American Superconductor (NASDAQ:AMSC) Delivers Impressive Q4, Stock Soars

American Superconductor Corporation (AMSC) is a leading provider of megawatt-scale power resiliency solutions for the electrical grid and critical naval systems. beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 56% year on year to $61.4 million. On top of that, next quarter’s revenue guidance ($61 million at the midpoint) was surprisingly good and 3.1% above what analysts were expecting. Its non-GAAP profit of $0.16 per share was significantly above analysts’ consensus estimates.

Is now the time to buy American Superconductor? Find out by accessing our full research report, it’s free.

American Superconductor (AMSC) Q4 CY2024 Highlights:

- Revenue: $61.4 million vs analyst estimates of $56.67 million (56% year-on-year growth, 8.4% beat)

- Adjusted EPS: $0.16 vs analyst estimates of $0.07 (significant beat)

- Adjusted EBITDA: $7.84 million vs analyst estimates of $1.8 million (12.8% margin, significant beat)

- Revenue Guidance for Q1 CY2025 is $61 million at the midpoint, above analyst estimates of $59.17 million

- Adjusted EPS guidance for Q1 CY2025 is $0.07 at the midpoint, below analyst estimates of $0.08

- Operating Margin: 2.1%, up from -1.5% in the same quarter last year

- Free Cash Flow Margin: 8.7%, up from 2.7% in the same quarter last year

- Market Capitalization: $999 million

"AMSC delivered the best quarterly results in years. Fiscal third quarter revenue surpassed $60 million, that’s revenue growth of 56% when compared to the same period last year, and net income exceeded $2 million, making it our second consecutive quarter of reporting net income,” said Daniel P. McGahn, Chairman, President and CEO, AMSC.

Company Overview

Founded in 1987, American Superconductor (NASDAQ: AMSC) has shifted from superconductor research to developing power systems, adapting to changing energy grid needs and naval technology requirements.

Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

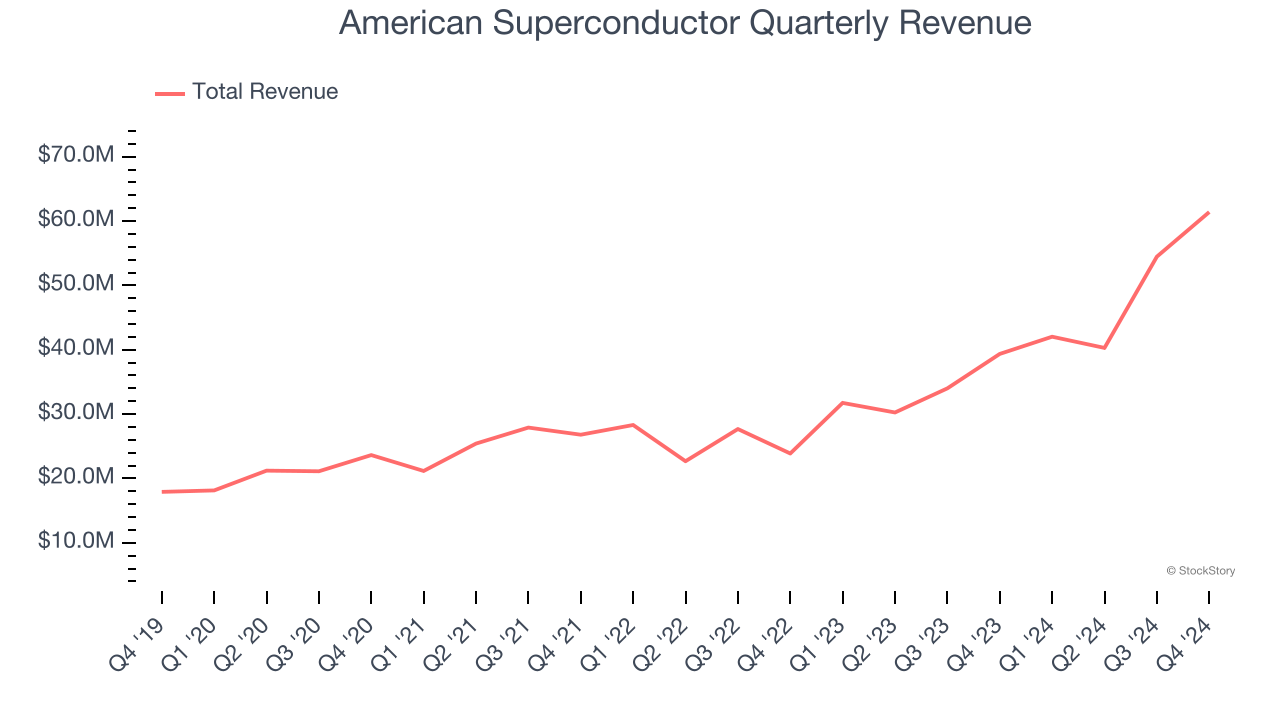

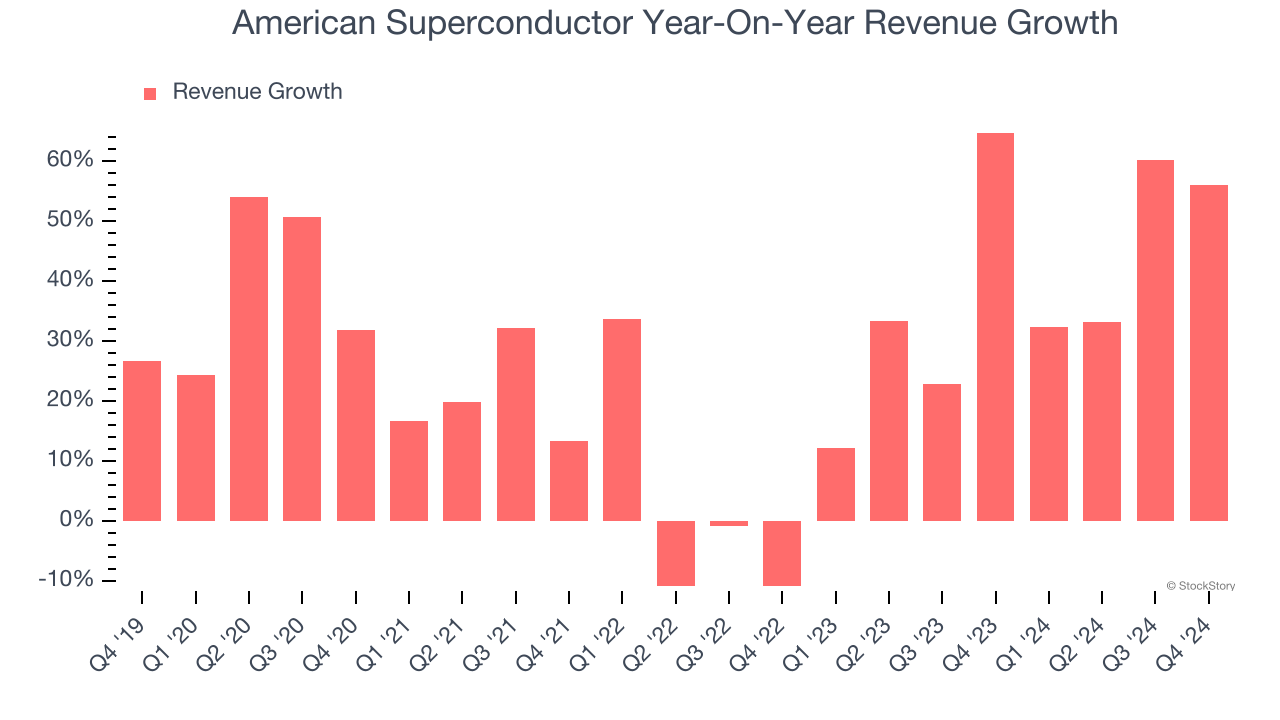

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, American Superconductor grew its sales at an incredible 26.9% compounded annual growth rate. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. American Superconductor’s annualized revenue growth of 39% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, American Superconductor reported magnificent year-on-year revenue growth of 56%, and its $61.4 million of revenue beat Wall Street’s estimates by 8.4%. Company management is currently guiding for a 45.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 22.6% over the next 12 months, a deceleration versus the last two years. Still, this projection is commendable and implies the market is baking in success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Although American Superconductor was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 13.7% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, American Superconductor’s operating margin rose by 25.1 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to show consistent profitability.

In Q4, American Superconductor generated an operating profit margin of 2.1%, up 3.6 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

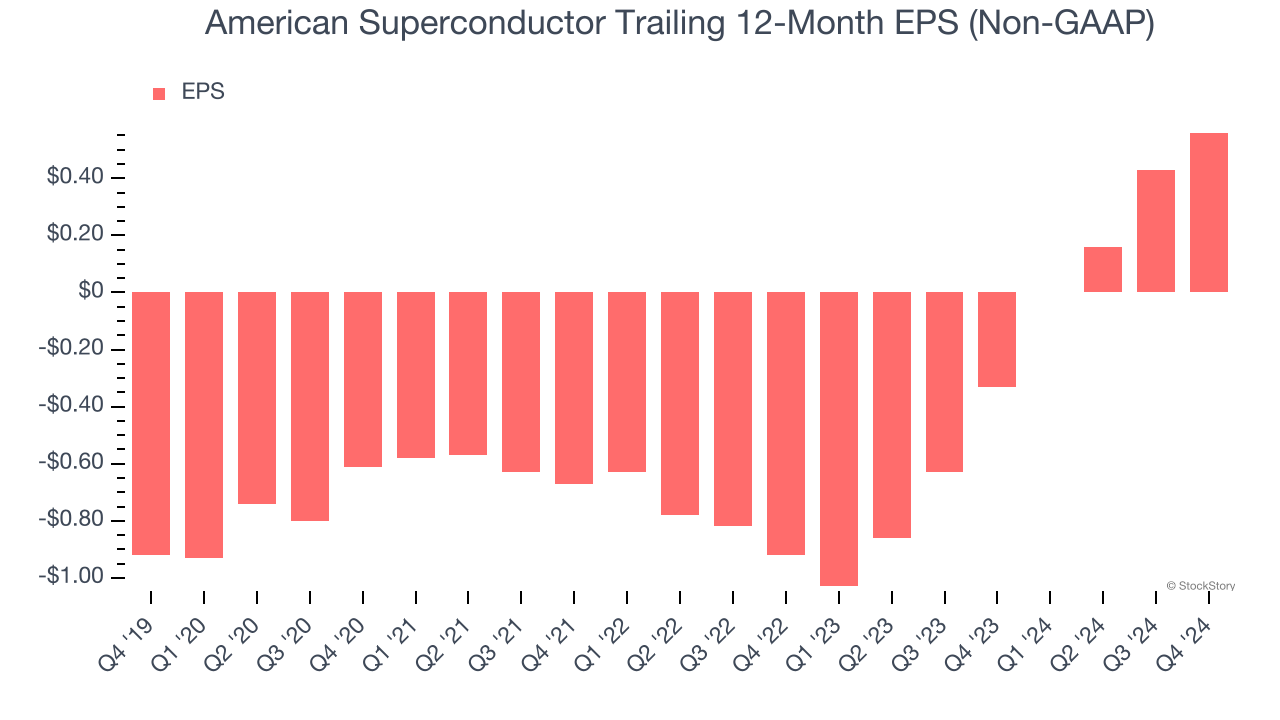

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

American Superconductor’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For American Superconductor, its two-year annual EPS growth of 61.5% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, American Superconductor reported EPS at $0.16, up from $0.03 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects American Superconductor to perform poorly. Analysts forecast its full-year EPS of $0.56 will hit $0.41.

Key Takeaways from American Superconductor’s Q4 Results

We were impressed by how significantly American Superconductor blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its EPS guidance for next quarter missed significantly. Zooming out, we think this was a solid quarter. The stock traded up 8.1% to $27.67 immediately after reporting.

Sure, American Superconductor had a solid quarter, but if we look at the bigger picture, is this stock a buy? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.