Reflecting On Beverages, Alcohol, and Tobacco Stocks’ Q4 Earnings: Vita Coco (NASDAQ:COCO)

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at beverages, alcohol, and tobacco stocks, starting with Vita Coco (NASDAQ: COCO).

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

The 15 beverages, alcohol, and tobacco stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was 0.6% below.

While some beverages, alcohol, and tobacco stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.1% since the latest earnings results.

Vita Coco (NASDAQ: COCO)

Founded in 2004 followed by a 2021 IPO, The Vita Coco Company (NASDAQ: COCO) offers coconut water products that are a natural way to quench thirst.

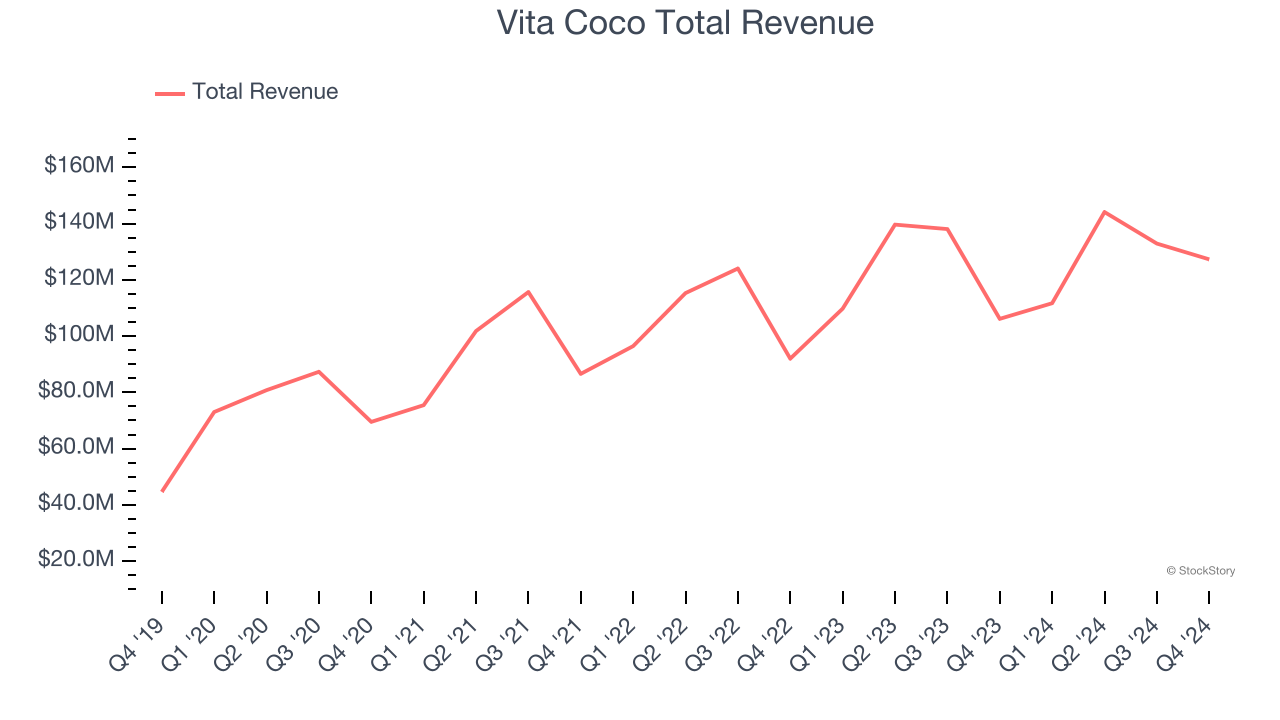

Vita Coco reported revenues of $127.3 million, up 19.9% year on year. This print exceeded analysts’ expectations by 4.4%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Martin Roper, the Company’s Chief Executive Officer, said, “Our exceptionally strong shipment performance in the fourth quarter benefited from retailer and distributor inventory levels rebuilding after the shortages of the prior quarter. We are pleased with our current inventory levels and excited by the current scan growth and indications from retailers of increased points of distribution in the coming resets. Collectively, we believe that this should help us deliver high teens branded growth in 2025."

Vita Coco pulled off the fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 13.8% since reporting and currently trades at $32.98.

We think Vita Coco is a good business, but is it a buy today? Read our full report here, it’s free.

Best Q4: Anheuser-Busch (NYSE: BUD)

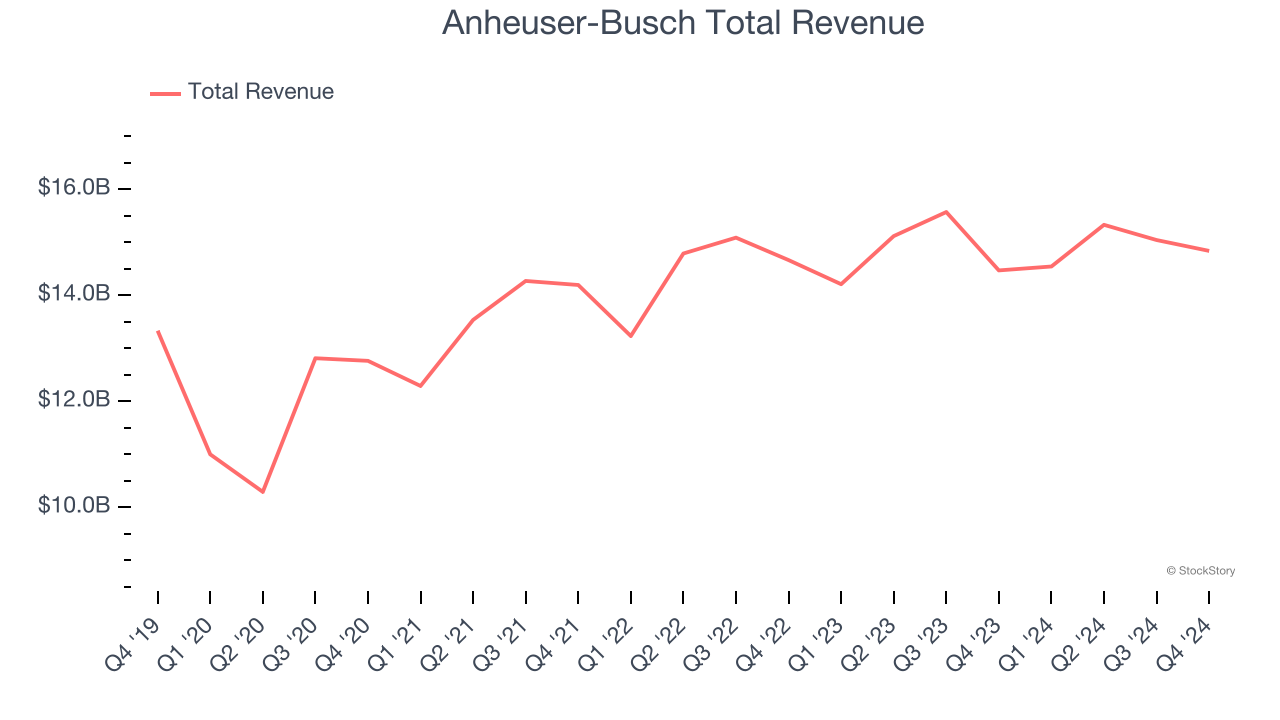

Born out of a complicated web of mergers and acquisitions, Anheuser-Busch InBev (NYSE: BUD) boasts a powerhouse beer portfolio of Budweiser, Stella Artois, Corona, and local favorites around the world.

Anheuser-Busch reported revenues of $14.84 billion, up 2.5% year on year, outperforming analysts’ expectations by 5.5%. The business had a stunning quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 14.6% since reporting. It currently trades at $62.74.

Is now the time to buy Anheuser-Busch? Access our full analysis of the earnings results here, it’s free.

Slowest Q4: Boston Beer (NYSE: SAM)

Known for its flavorful beverages challenging the status quo, Boston Beer (NYSE: SAM) is a pioneer in craft brewing and a symbol of American innovation in the alcoholic beverage industry.

Boston Beer reported revenues of $402.3 million, up 2.2% year on year, exceeding analysts’ expectations by 2.4%. Still, it was a disappointing quarter as it posted full-year EPS guidance missing analysts’ expectations.

Interestingly, the stock is up 2.4% since the results and currently trades at $239.99.

Read our full analysis of Boston Beer’s results here.

Keurig Dr Pepper (NASDAQ: KDP)

Born out of a 2018 merger between Keurig Green Mountain and Dr Pepper Snapple, Keurig Dr Pepper (NASDAQ: KDP) is a consumer staples powerhouse boasting a portfolio of beverages including sodas, coffees, and juices.

Keurig Dr Pepper reported revenues of $4.07 billion, up 5.2% year on year. This result topped analysts’ expectations by 1.4%. Zooming out, it was a mixed quarter as it also logged a narrow beat of analysts’ EBITDA estimates but a slight miss of analysts’ gross margin estimates.

The stock is down 2.4% since reporting and currently trades at $33.29.

Read our full, actionable report on Keurig Dr Pepper here, it’s free.

Zevia (NYSE: ZVIA)

With a primary focus on soda but also a presence in energy drinks and teas, Zevia (NYSE: ZVIA) is a better-for-you beverage company.

Zevia reported revenues of $39.46 million, up 4.4% year on year. This print was in line with analysts’ expectations. Zooming out, it was a softer quarter as it recorded full-year EBITDA guidance missing analysts’ expectations.

The stock is down 34.5% since reporting and currently trades at $2.13.

Read our full, actionable report on Zevia here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.