3 Reasons to Sell ELAN and 1 Stock to Buy Instead

Elanco has gotten torched over the last six months - since September 2024, its stock price has dropped 28.5% to $10.39 per share. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Elanco, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Despite the more favorable entry price, we don't have much confidence in Elanco. Here are three reasons why there are better opportunities than ELAN and a stock we'd rather own.

Why Is Elanco Not Exciting?

Founded in 1954 as part of Eli Lilly, Elanco (NYSE: ELAN) develops, manufactures, and markets products for both pets and livestock, focusing on medicines that prevent and treat disease, improve productivity, and ensure animal welfare.

1. Weak Constant Currency Growth Points to Soft Demand

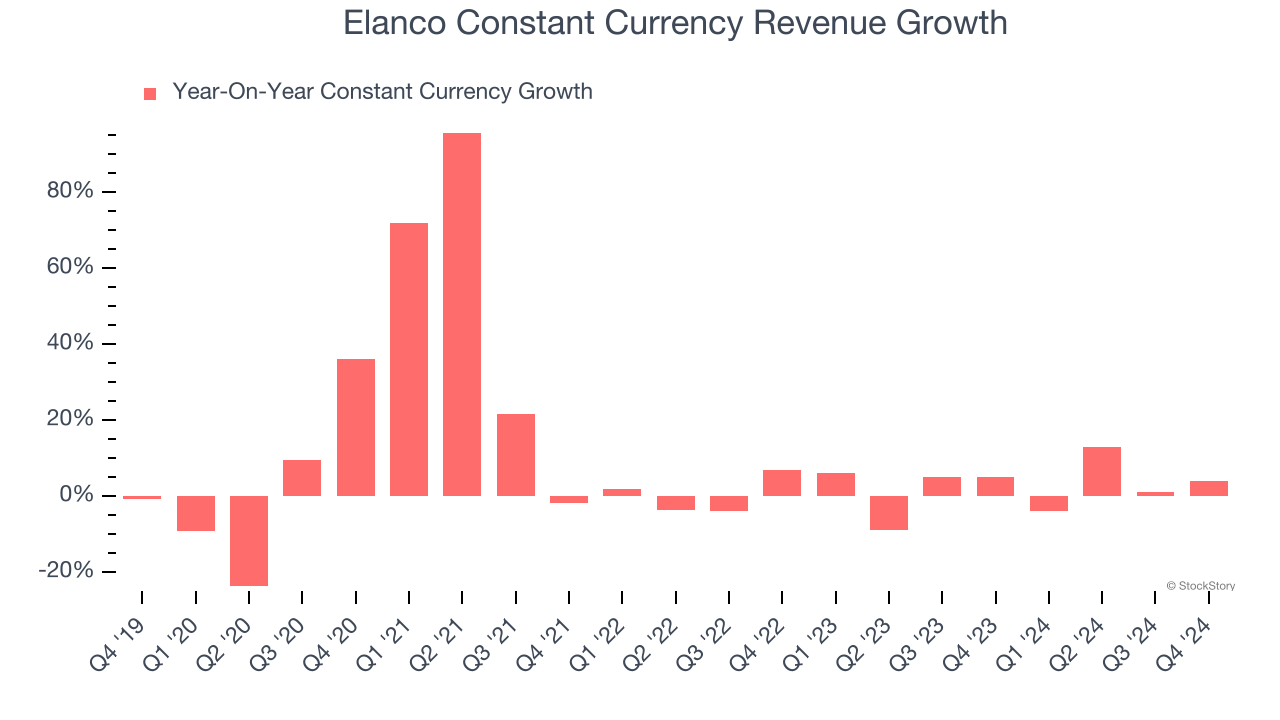

In addition to reported revenue, constant currency revenue is a useful data point for analyzing Specialty Pharmaceuticals companies. This metric excludes currency movements, which are outside of Elanco’s control and are not indicative of underlying demand.

Over the last two years, Elanco’s constant currency revenue averaged 2.6% year-on-year growth. This performance slightly lagged the sector and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. EPS Trending Down

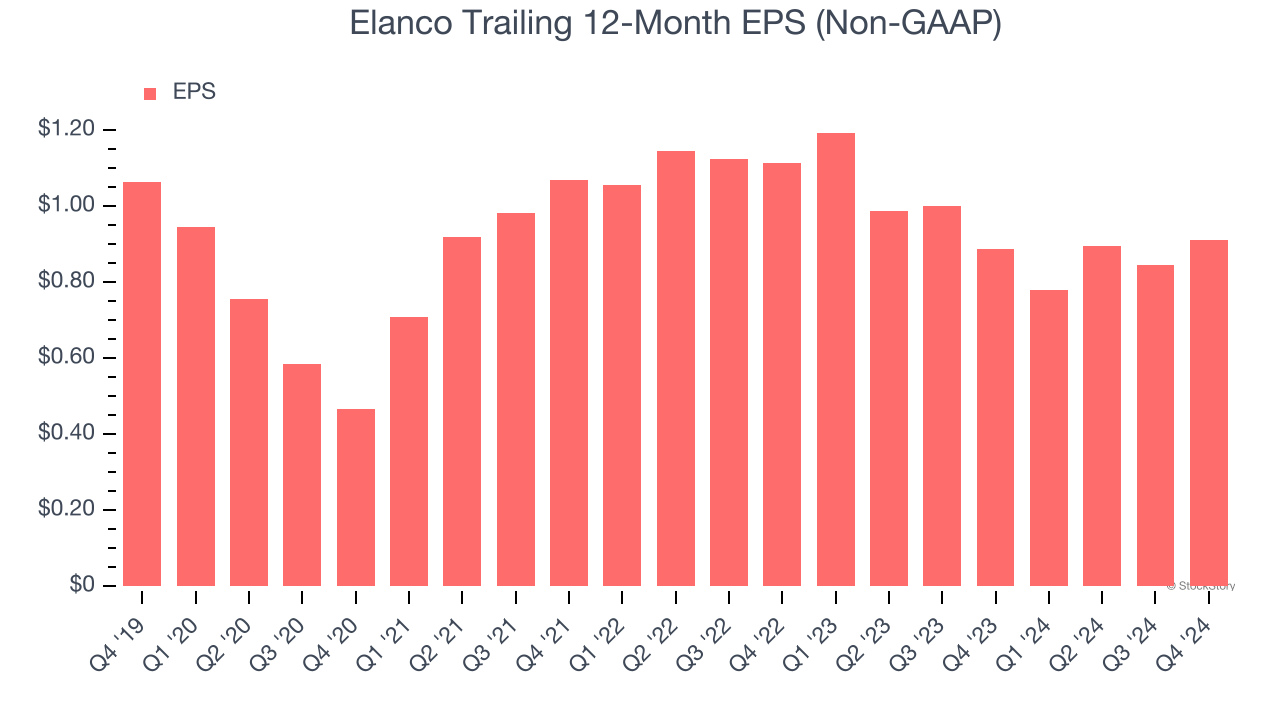

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Elanco, its EPS declined by 3.1% annually over the last five years while its revenue grew by 7.6%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Previous Growth Initiatives Have Lost Money

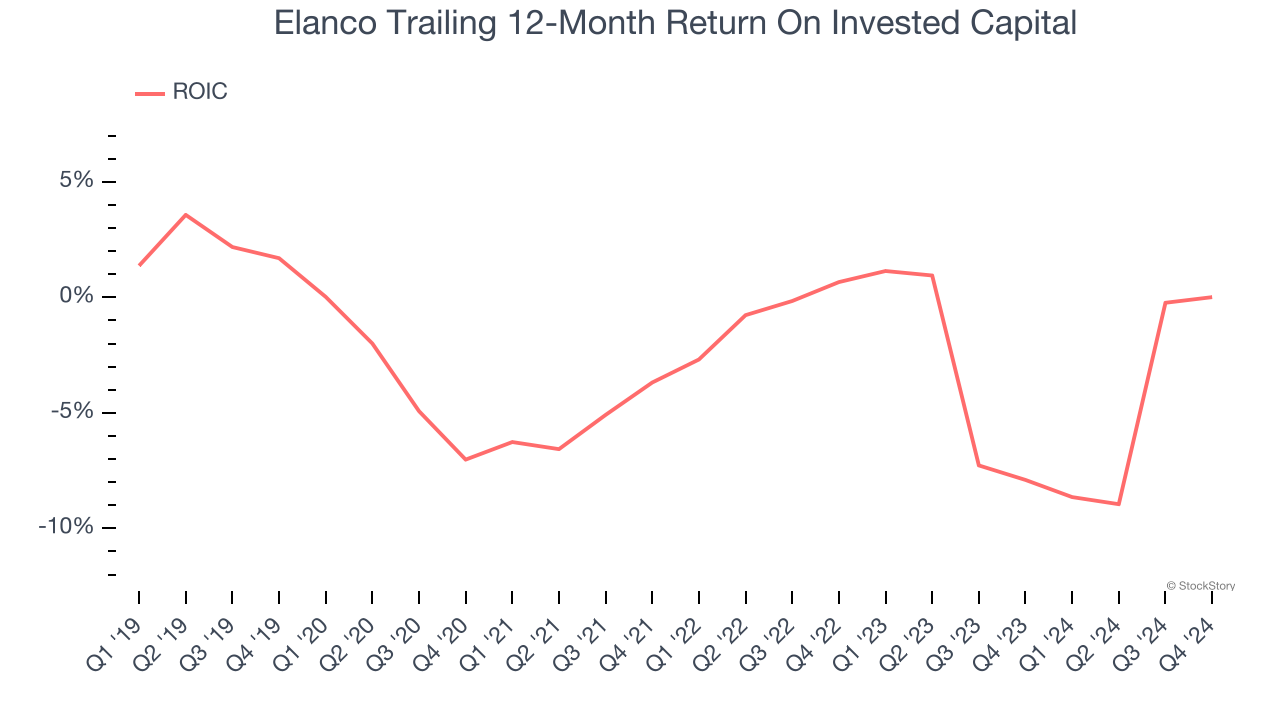

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Elanco’s five-year average ROIC was negative 3.6%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

Final Judgment

Elanco isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 11.7× forward price-to-earnings (or $10.39 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're fairly confident there are better stocks to buy right now. Let us point you toward a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than Elanco

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.