3 Reasons to Sell ESAB and 1 Stock to Buy Instead

Over the past six months, ESAB has been a great trade. While the S&P 500 was flat, the stock price has climbed by 14.4% to $118.76 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy ESAB, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

We’re glad investors have benefited from the price increase, but we're sitting this one out for now. Here are three reasons why we avoid ESAB and a stock we'd rather own.

Why Is ESAB Not Exciting?

Having played a significant role in the construction of the iconic Sydney Opera House, ESAB (NYSE: ESAB) manufactures and sells welding and cutting equipment for numerous industries.

1. Slow Organic Growth Suggests Waning Demand In Core Business

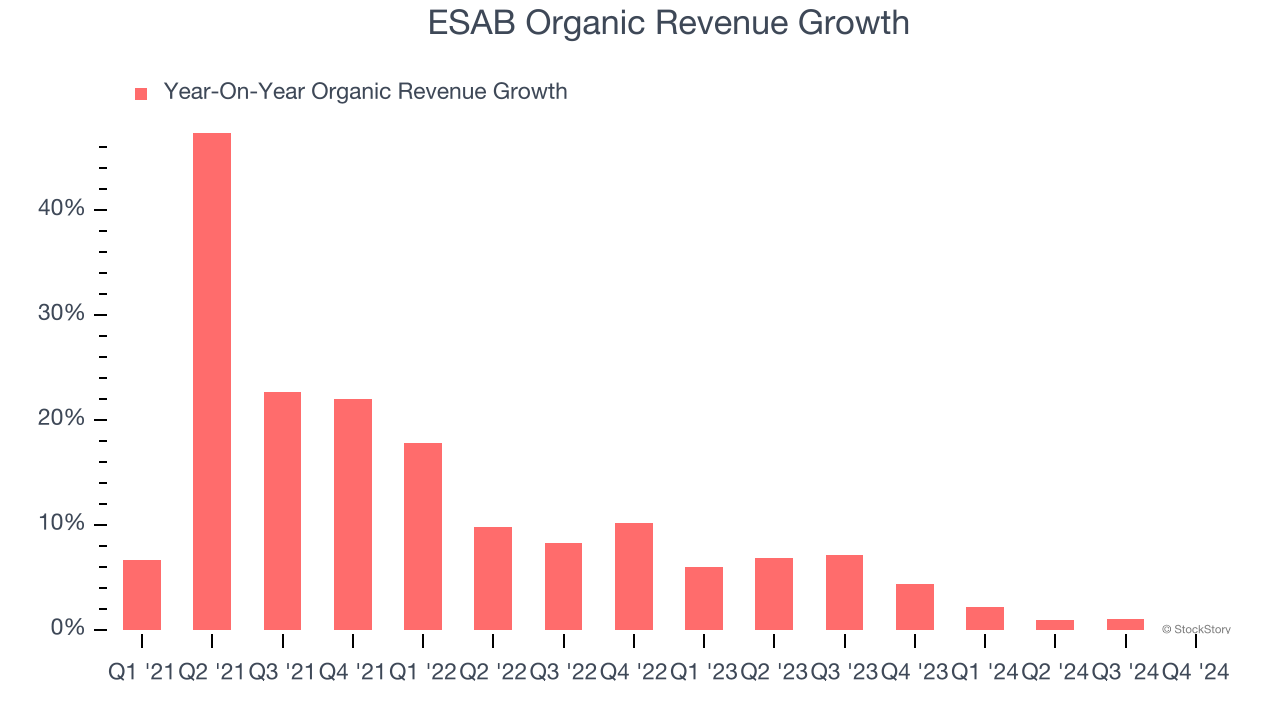

In addition to reported revenue, organic revenue is a useful data point for analyzing Professional Tools and Equipment companies. This metric gives visibility into ESAB’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, ESAB’s organic revenue averaged 3.5% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect ESAB’s revenue to stall, a deceleration versus its 2.8% annualized growth for the past two years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

3. EPS Barely Growing

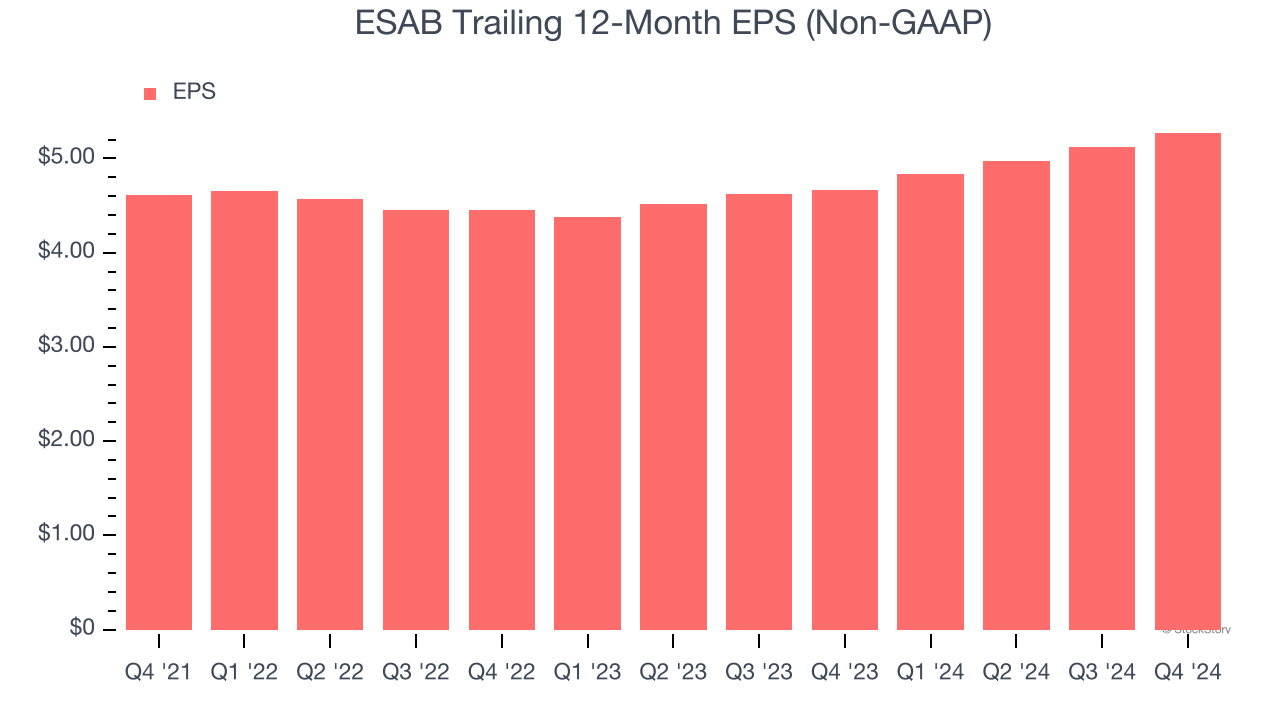

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

ESAB’s unimpressive 4.6% annual EPS growth over the last three years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

Final Judgment

ESAB isn’t a terrible business, but it doesn’t pass our quality test. With its shares outperforming the market lately, the stock trades at 22.2× forward price-to-earnings (or $118.76 per share). At this valuation, there’s a lot of good news priced in - we think there are better investment opportunities out there. Let us point you toward the most dominant software business in the world.

Stocks We Like More Than ESAB

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.