Q4 Rundown: VSE Corporation (NASDAQ:VSEC) Vs Other Maintenance and Repair Distributors Stocks

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at VSE Corporation (NASDAQ: VSEC) and the best and worst performers in the maintenance and repair distributors industry.

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Maintenance and repair distributors that boast reliable selection and quickly deliver products to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is still a real threat, forcing investment in omnichannel capabilities to serve customers everywhere. Additionally, maintenance and repair distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

The 9 maintenance and repair distributors stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 0.8%.

While some maintenance and repair distributors stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.8% since the latest earnings results.

VSE Corporation (NASDAQ: VSEC)

With roots dating back to 1959 and a strategic focus on extending the life of transportation assets, VSE Corporation (NASDAQ: VSEC) provides aftermarket parts distribution and maintenance, repair, and overhaul services for aircraft and vehicle fleets in commercial and government markets.

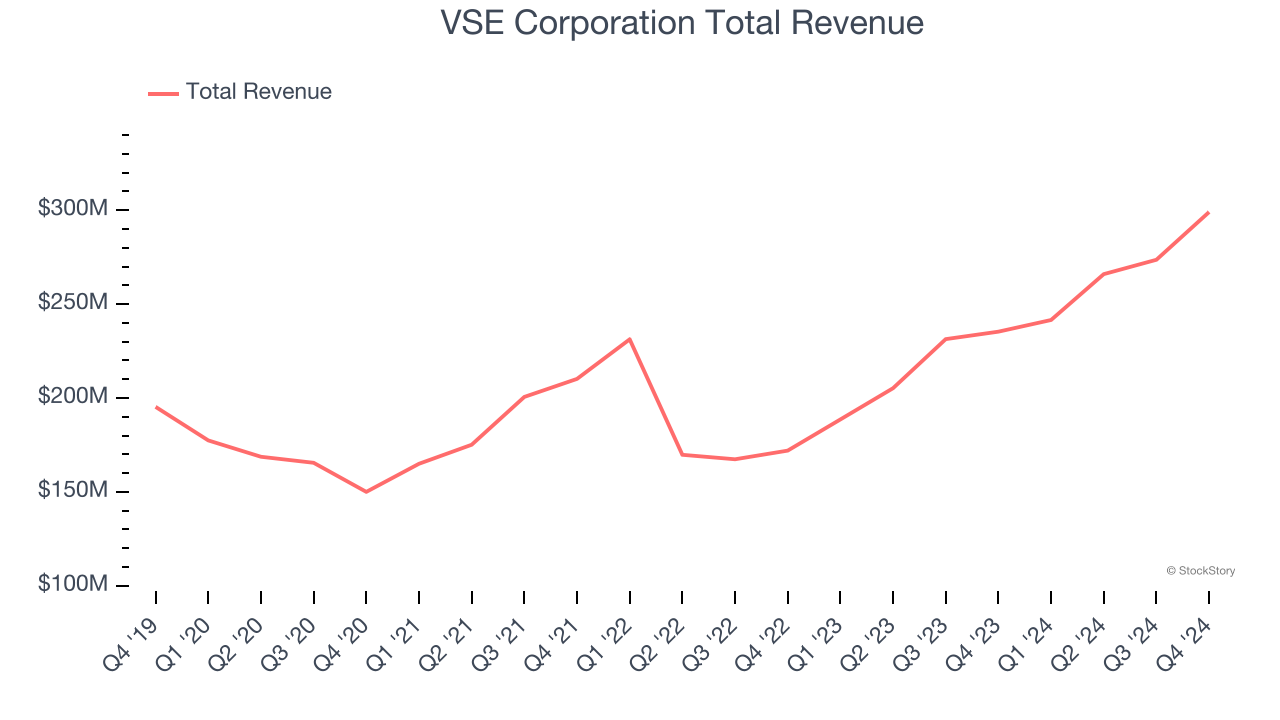

VSE Corporation reported revenues of $299 million, up 27.1% year on year. This print exceeded analysts’ expectations by 1.8%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

"2024 was a transformative year for VSE, marked by record revenue and profitability in our Aviation segment, the acquisition of two commercial aviation aftermarket businesses, and the divestiture of our Federal and Defense Services segment,” said John Cuomo, President and CEO of VSE Corporation.

VSE Corporation pulled off the fastest revenue growth of the whole group. The stock is up 13.9% since reporting and currently trades at $115.01.

Is now the time to buy VSE Corporation? Access our full analysis of the earnings results here, it’s free.

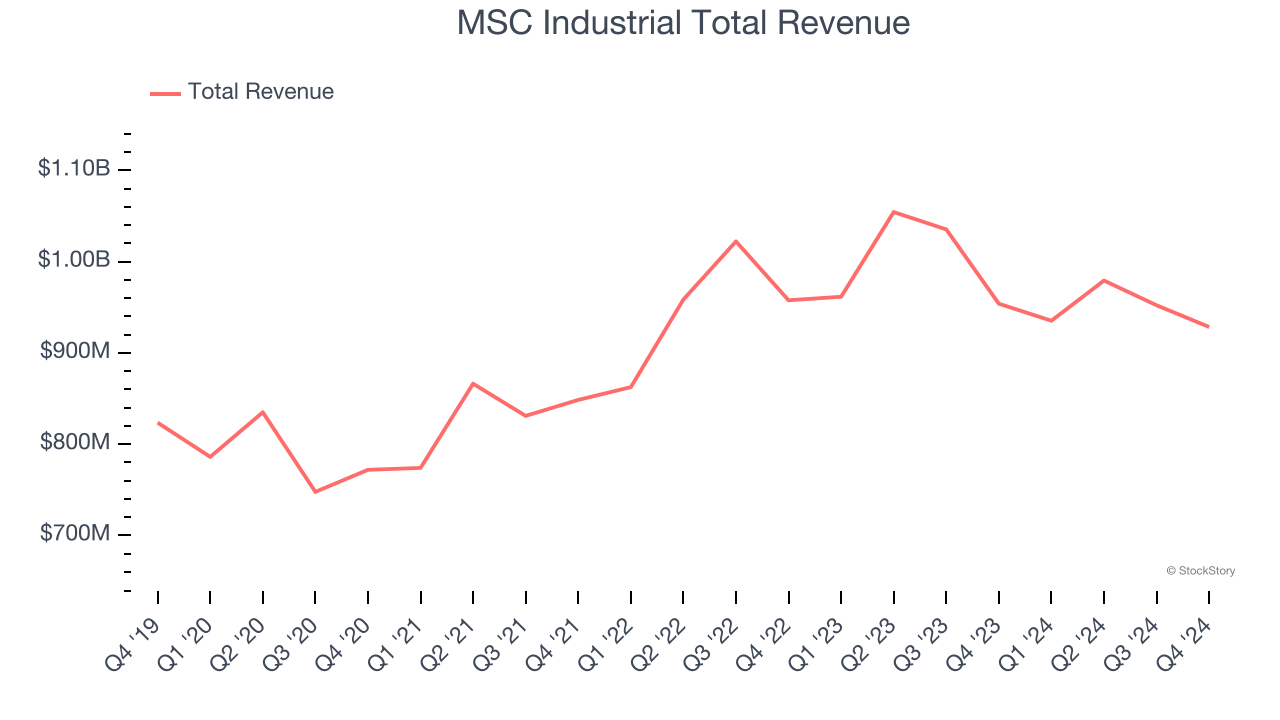

Best Q4: MSC Industrial (NYSE: MSM)

Founded in NYC’s Little Italy, MSC Industrial Direct (NYSE: MSM) provides industrial supplies and equipment, offering vast and reliable selection for customers such as contractors

MSC Industrial reported revenues of $928.5 million, down 2.7% year on year, outperforming analysts’ expectations by 2.7%. The business had a stunning quarter with an impressive beat of analysts’ EBITDA estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 2.9% since reporting. It currently trades at $77.61.

Is now the time to buy MSC Industrial? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Transcat (NASDAQ: TRNS)

Serving the pharmaceutical, industrial manufacturing, energy, and chemical process industries, Transcat (NASDAQ: TRNS) provides measurement instruments and supplies.

Transcat reported revenues of $66.75 million, up 2.4% year on year, falling short of analysts’ expectations by 5%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

Transcat delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 27.9% since the results and currently trades at $71.76.

Read our full analysis of Transcat’s results here.

Distribution Solutions (NASDAQ: DSGR)

Founded in 1952, Distribution Solutions (NASDAQ: DSGR) provides supply chain solutions and distributes industrial, safety, and maintenance products to various industries.

Distribution Solutions reported revenues of $480.5 million, up 18.6% year on year. This print topped analysts’ expectations by 3.6%. Overall, it was a strong quarter as it also recorded a solid beat of analysts’ EPS estimates.

The stock is up 5.8% since reporting and currently trades at $29.40.

Read our full, actionable report on Distribution Solutions here, it’s free.

W.W. Grainger (NYSE: GWW)

Founded as a supplier of motors, W.W. Grainger (NYSE: GWW) provides maintenance, repair, and operating (MRO) supplies and services to businesses and institutions.

W.W. Grainger reported revenues of $4.23 billion, up 5.9% year on year. This number was in line with analysts’ expectations. Aside from that, it was a slower quarter as it produced full-year EPS guidance missing analysts’ expectations.

The stock is down 13.2% since reporting and currently trades at $977.

Read our full, actionable report on W.W. Grainger here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.