3 Reasons HLT is Risky and 1 Stock to Buy Instead

Hilton currently trades at $231.61 per share and has shown little upside over the past six months, posting a middling return of 1.4%.

Is now the time to buy Hilton, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

We don't have much confidence in Hilton. Here are three reasons why HLT doesn't excite us and a stock we'd rather own.

Why Is Hilton Not Exciting?

Founded in 1919, Hilton Worldwide (NYSE: HLT) is a global hospitality company with a portfolio of hotel brands.

1. Long-Term Revenue Growth Disappoints

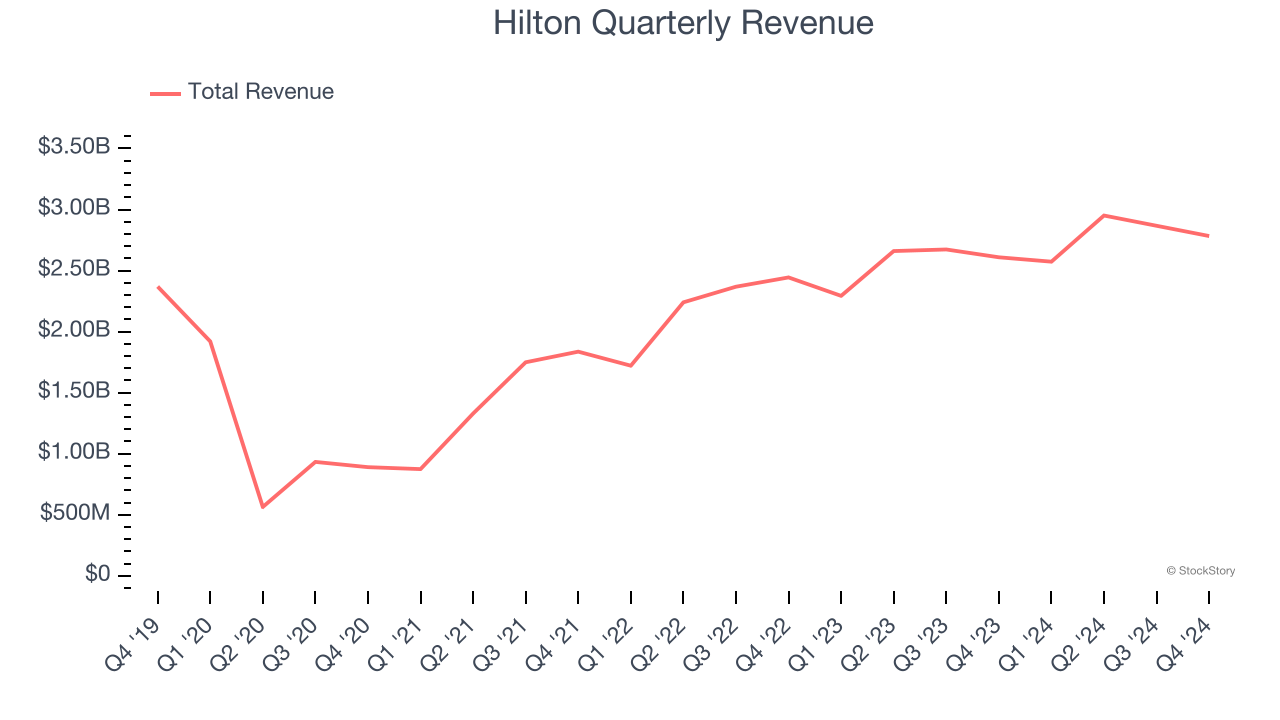

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Hilton grew its sales at a sluggish 3.4% compounded annual growth rate. This fell short of our benchmark for the consumer discretionary sector.

2. Weak RevPAR Growth Points to Soft Demand

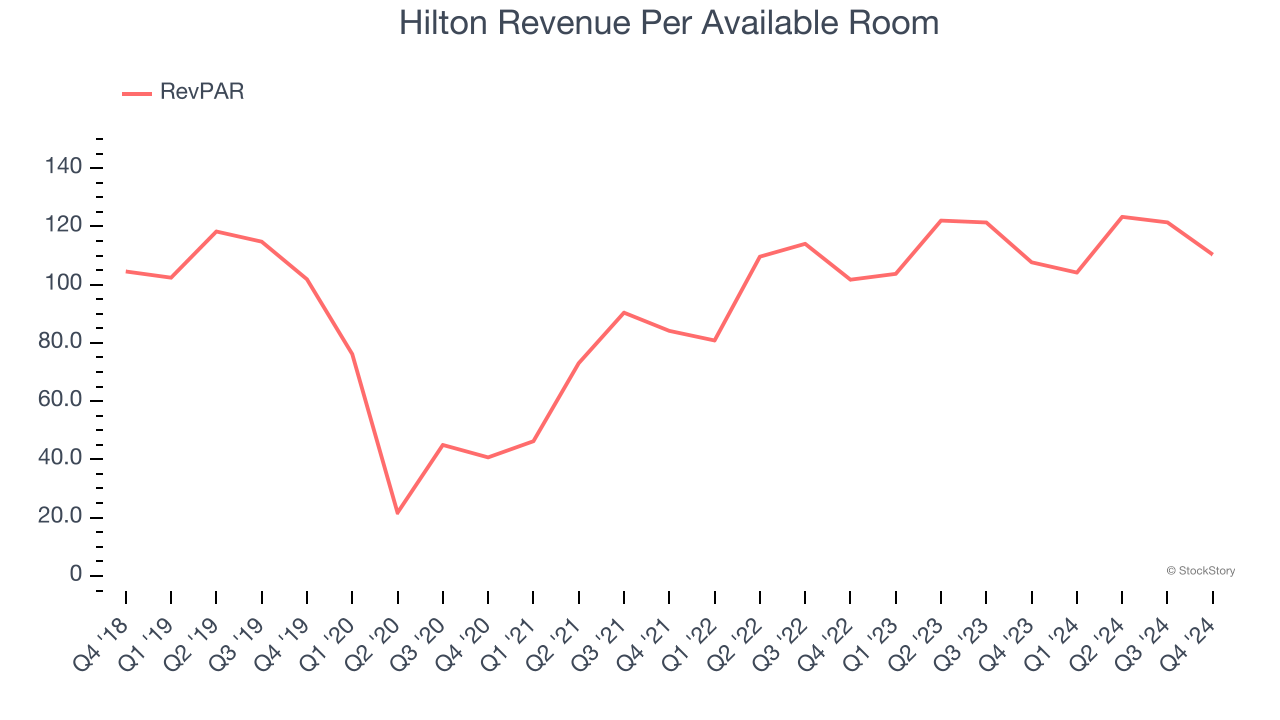

We can better understand Travel and Vacation Providers companies by analyzing their RevPAR, or revenue per available room. This metric accounts for daily rates and occupancy levels, painting a holistic picture of Hilton’s demand characteristics.

Hilton’s RevPAR came in at $110.33 in the latest quarter, and over the last two years, its year-on-year growth averaged 7%. This performance was underwhelming and suggests it might have to invest in new amenities such as restaurants and bars to attract customers - this isn’t ideal because expansions can complicate operations and be quite expensive (i.e., renovations and increased overhead).

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Hilton’s revenue to rise by 8.6%, a deceleration versus its 12.9% annualized growth for the past two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

Final Judgment

Hilton isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 28.7× forward price-to-earnings (or $231.61 per share). At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere. We’d suggest looking at one of our top digital advertising picks.

Stocks We Like More Than Hilton

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.