Automation Software Stocks Q4 Recap: Benchmarking Microsoft (NASDAQ:MSFT)

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Microsoft (NASDAQ: MSFT) and the rest of the automation software stocks fared in Q4.

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

The 7 automation software stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 11.2% since the latest earnings results.

Microsoft (NASDAQ: MSFT)

Short for microcomputer software, Microsoft (NASDAQ: MSFT) is the largest software vendor in the world with its Windows operating system, Office suite, and cloud computing services.

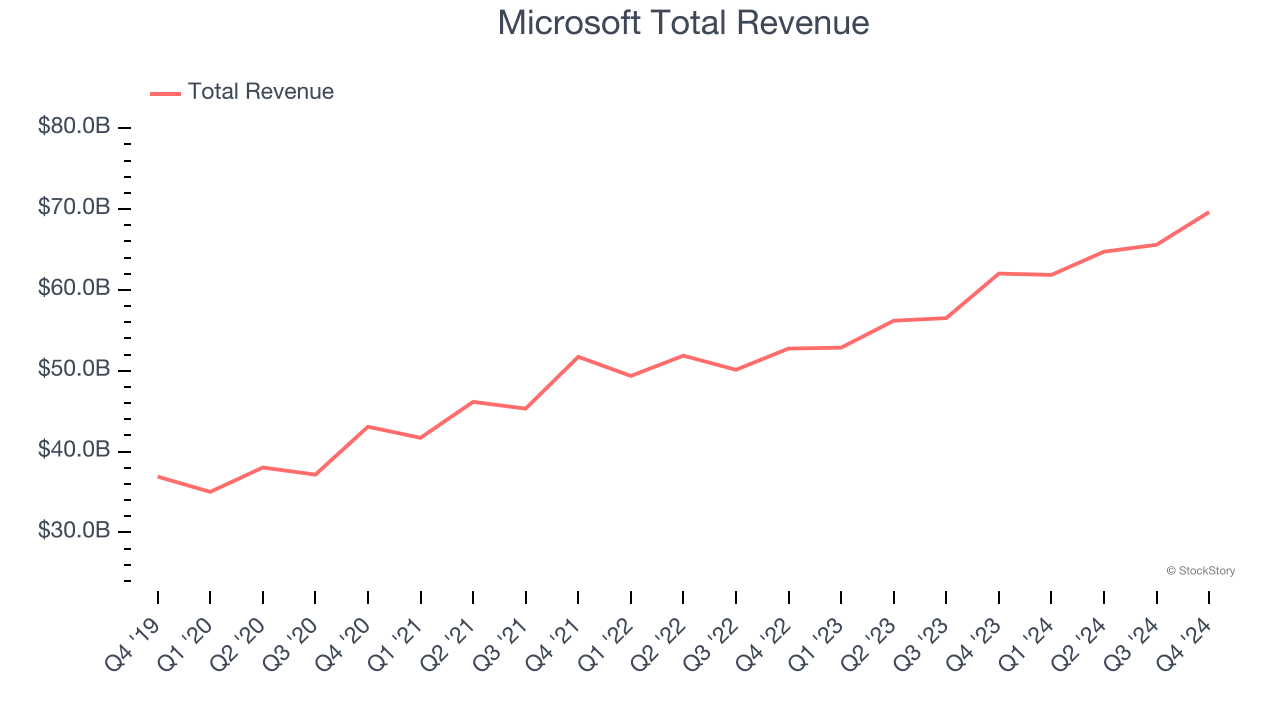

Microsoft reported revenues of $69.63 billion, up 12.3% year on year. This print exceeded analysts’ expectations by 1.1%. Overall, it was a decent quarter: Microsoft narrowly topped analysts’ revenue expectations, as Personal Computing and Business Services beat while Intelligent Cloud was in line. Within Intelligent Cloud, the all-important Azure constant-currency revenue growth came in at 31%, missing investor expectations of 32-33%.

The stock is down 10.5% since reporting and currently trades at $395.20.

We think Microsoft is a good business, but is it a buy today? Read our full report here, it’s free.

Best Q4: SoundHound AI (NASDAQ: SOUN)

Founded in 2005, SoundHound AI (NASDAQ: SOUN) develops independent voice artificial intelligence solutions that enable businesses across various industries to offer customized conversational experiences to consumers.

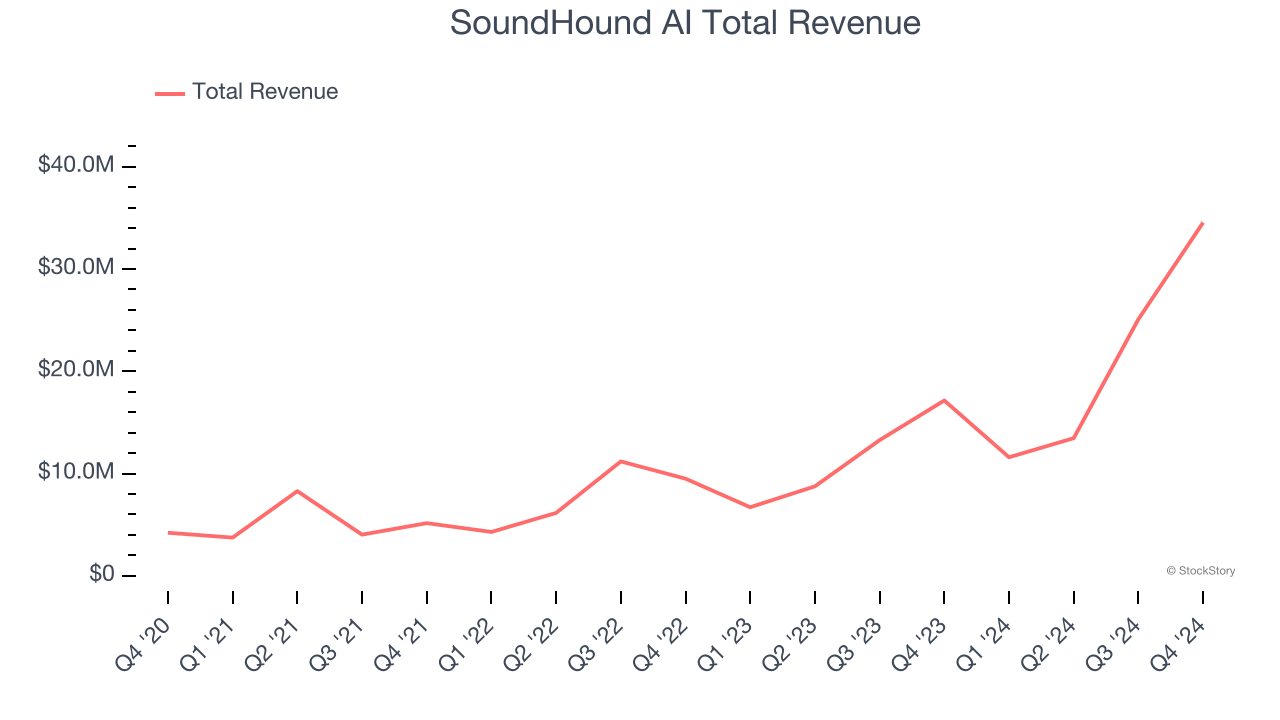

SoundHound AI reported revenues of $34.54 million, up 101% year on year, outperforming analysts’ expectations by 2.3%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ billings estimates.

SoundHound AI scored the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 9.1% since reporting. It currently trades at $10.05.

Is now the time to buy SoundHound AI? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: UiPath (NYSE: PATH)

Started in 2005 in Romania as a tech outsourcing company, UiPath (NYSE: PATH) makes software that helps companies automate repetitive computer tasks.

UiPath reported revenues of $423.6 million, up 4.5% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a significant miss of analysts’ billings estimates and full-year guidance of slowing revenue growth.

UiPath delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 6.9% since the results and currently trades at $11.05.

Read our full analysis of UiPath’s results here.

Appian (NASDAQ: APPN)

Founded by Matt Calkins and his three friends out of an apartment in Northern Virginia, Appian (NASDAQ: APPN) sells a software platform that lets its users build applications without using much code, allowing them to create new software more quickly.

Appian reported revenues of $166.7 million, up 14.7% year on year. This number surpassed analysts’ expectations by 1.5%. Aside from that, it was a satisfactory quarter as it also logged an impressive beat of analysts’ billings estimates but EBITDA guidance for next quarter missing analysts’ expectations significantly.

The stock is down 3.1% since reporting and currently trades at $31.11.

Read our full, actionable report on Appian here, it’s free.

Jamf (NASDAQ: JAMF)

Founded in 2002 by Zach Halmstad and Chip Pearson, right around the time when Apple began to dominate the personal computing market, Jamf (NASDAQ: JAMF) provides software for companies to manage Apple devices such as Macs, iPads, and iPhones.

Jamf reported revenues of $163 million, up 8.2% year on year. This result met analysts’ expectations. Aside from that, it was a slower quarter as it recorded full-year guidance of slowing revenue growth and a miss of analysts’ billings estimates.

The stock is down 10% since reporting and currently trades at $13.26.

Read our full, actionable report on Jamf here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.