Hospital Chains Stocks Q4 Earnings: Universal Health Services (NYSE:UHS) Firing on All Cylinders

As the Q4 earnings season wraps, let’s dig into this quarter’s best and worst performers in the hospital chains industry, including Universal Health Services (NYSE: UHS) and its peers.

Hospital chains operate scale-driven businesses that rely on patient volumes, efficient operations, and favorable payer contracts to drive revenue and profitability. These organizations benefit from the essential nature of their services, which ensures consistent demand, particularly as populations age and chronic diseases become more prevalent. However, profitability can be pressured by rising labor costs, regulatory requirements, and the challenges of balancing care quality with cost efficiency. Dependence on government and private insurance reimbursements also introduces financial uncertainty. Looking ahead, hospital chains stand to benefit from tailwinds such as increasing healthcare utilization driven by an aging population that generally has higher incidents of disease. AI can also be a tailwind in areas such as predictive analytics for more personalized treatment and efficiency (intake, staffing, resourcing allocation). However, the sector faces potential headwinds such as labor shortages that could push up wages as well as substantial investments needs for digital infrastructure to support telehealth and electronic health records. Regulatory scrutiny, and reimbursement cuts are also looming topics that could further strain margins.

The 4 hospital chains stocks we track reported a mixed Q4. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 10.3% since the latest earnings results.

Best Q4: Universal Health Services (NYSE: UHS)

With a network spanning 39 states and three countries, Universal Health Services (NYSE: UHS) operates acute care hospitals and behavioral health facilities across the United States, United Kingdom, and Puerto Rico.

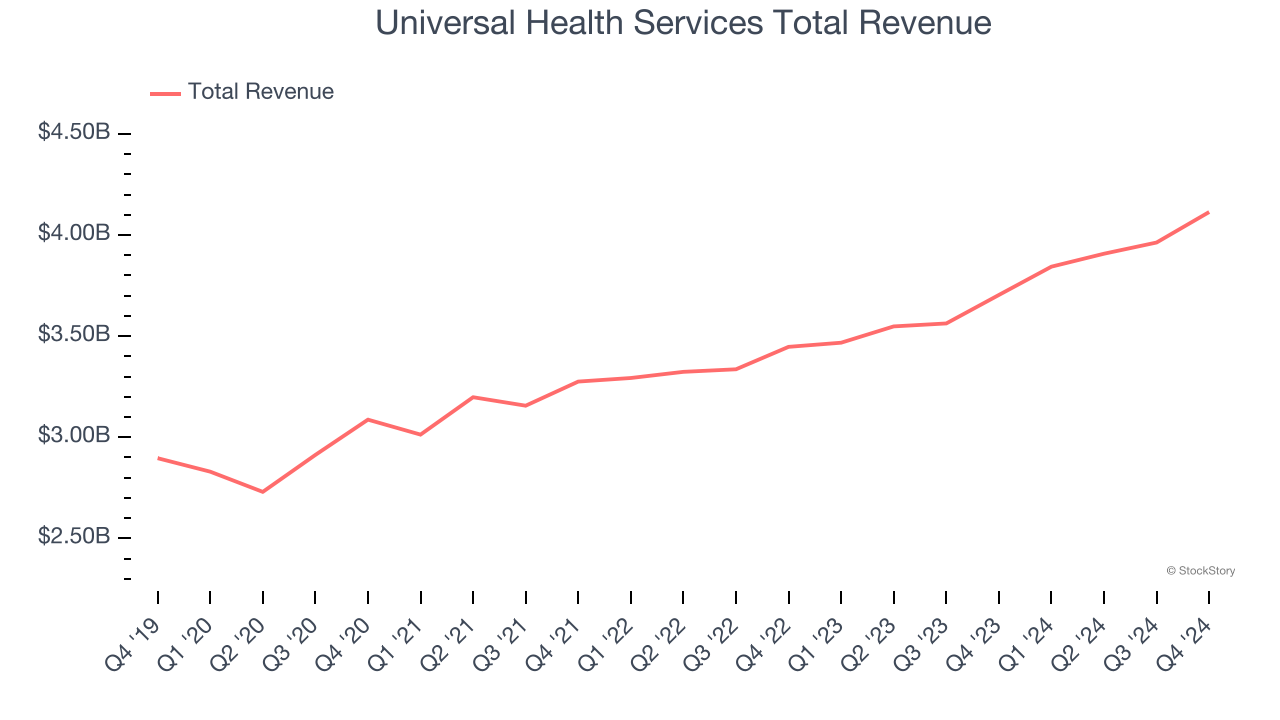

Universal Health Services reported revenues of $4.11 billion, up 11.1% year on year. This print exceeded analysts’ expectations by 2.6%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ full-year EPS guidance estimates.

Universal Health Services scored the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 2.1% since reporting and currently trades at $175.55.

Is now the time to buy Universal Health Services? Access our full analysis of the earnings results here, it’s free.

HCA Healthcare (NYSE: HCA)

With roots dating back to 1968 and a network spanning 20 states, HCA Healthcare (NYSE: HCA) operates a network of 190 hospitals and 150+ outpatient facilities providing a full range of medical services across the US and England.

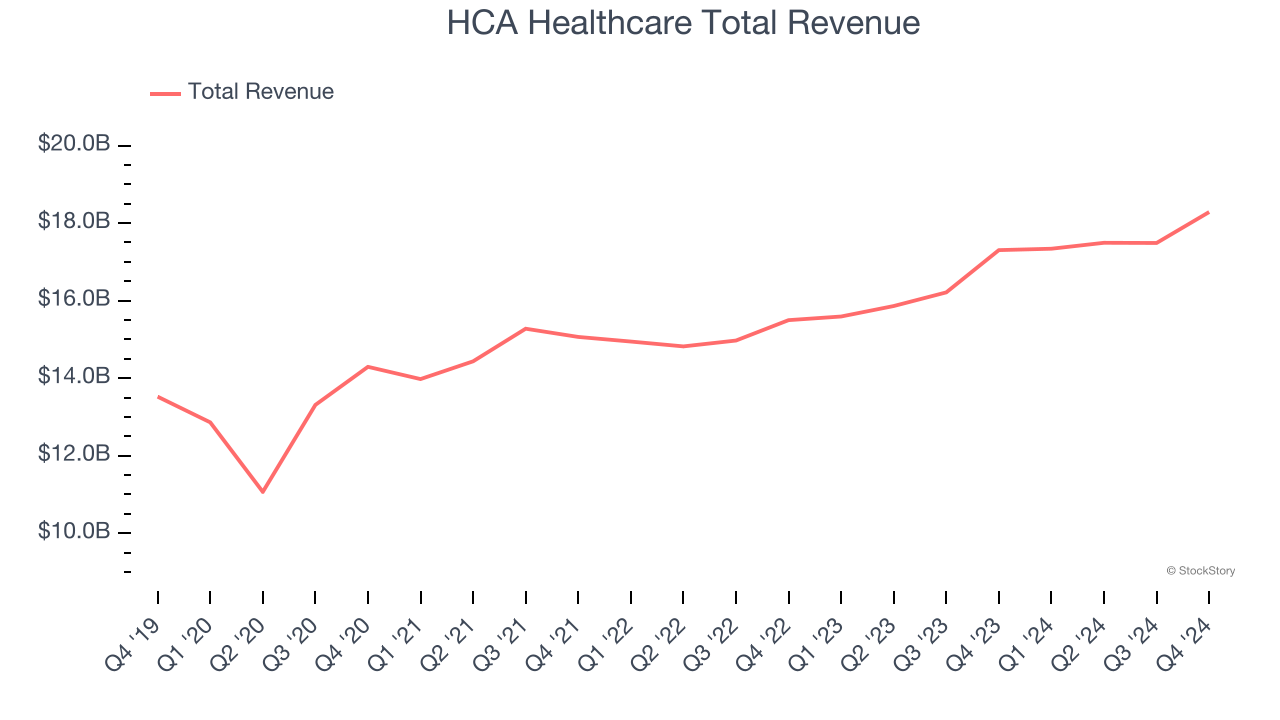

HCA Healthcare reported revenues of $18.29 billion, up 5.7% year on year, outperforming analysts’ expectations by 0.7%. The business performed better than its peers, but it was unfortunately a mixed quarter with a narrow beat of analysts’ EPS estimates but same-store sales in line with analysts’ estimates.

The market seems content with the results as the stock is up 1.6% since reporting. It currently trades at $330.50.

Is now the time to buy HCA Healthcare? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Acadia Healthcare (NASDAQ: ACHC)

With a network of over 250 facilities serving patients in 38 states and Puerto Rico, Acadia Healthcare (NASDAQ: ACHC) operates facilities providing mental health and substance use disorder treatment services across the United States.

Acadia Healthcare reported revenues of $774.2 million, up 4.2% year on year, falling short of analysts’ expectations by 0.6%. It was a softer quarter as it posted a significant miss of analysts’ EPS estimates and EBITDA guidance for next quarter missing analysts’ expectations.

As expected, the stock is down 29.8% since the results and currently trades at $28.25.

Read our full analysis of Acadia Healthcare’s results here.

Tenet Healthcare (NYSE: THC)

With a network spanning nine states and serving primarily urban and suburban communities, Tenet Healthcare (NYSE: THC) operates a nationwide network of hospitals, ambulatory surgery centers, and outpatient facilities providing acute care and specialty healthcare services.

Tenet Healthcare reported revenues of $5.07 billion, down 5.7% year on year. This number came in 2% below analysts' expectations. Aside from that, it was a mixed quarter as it also logged an impressive beat of analysts’ full-year EPS guidance estimates.

Tenet Healthcare had the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update among its peers. The stock is down 10.8% since reporting and currently trades at $123.84.

Read our full, actionable report on Tenet Healthcare here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.