3 Reasons MSA is Risky and 1 Stock to Buy Instead

Over the past six months, MSA Safety’s shares (currently trading at $152.66) have posted a disappointing 13.7% loss while the S&P 500 was flat. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy MSA Safety, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Despite the more favorable entry price, we're cautious about MSA Safety. Here are three reasons why we avoid MSA and a stock we'd rather own.

Why Is MSA Safety Not Exciting?

Founded in 1914 as Mine Safety Appliances to protect coal miners from dangerous gases, MSA Safety (NYSE: MSA) designs and manufactures advanced safety products that protect workers and facilities across industries including fire service, energy, construction, and manufacturing.

1. Fewer Distribution Channels than Larger Competitors

With $1.81 billion in revenue over the past 12 months, MSA Safety is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect MSA Safety’s revenue to stall, a deceleration versus its 8.8% annualized growth for the past two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

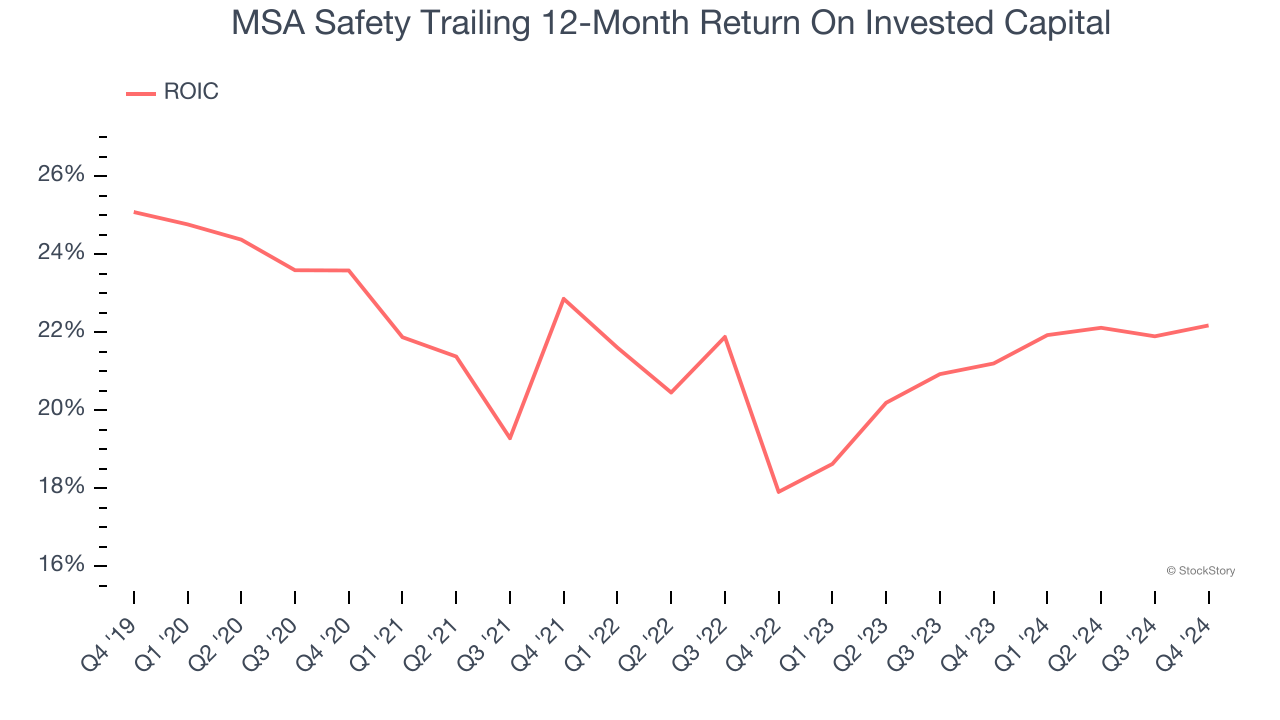

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, MSA Safety’s ROIC averaged 1.5 percentage point decreases each year. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

MSA Safety’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 18.8× forward price-to-earnings (or $152.66 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than MSA Safety

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.