3 Reasons to Sell ASLE and 1 Stock to Buy Instead

The past six months have been a windfall for AerSale’s shareholders. The company’s stock price has jumped 70.9%, setting a new 52-week high of $8.70 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy AerSale, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

We’re happy investors have made money, but we're sitting this one out for now. Here are three reasons why we avoid ASLE and a stock we'd rather own.

Why Do We Think AerSale Will Underperform?

Providing a one-stop shop that integrates multiple services and product offerings, AerSale (NASDAQ: ASLE) delivers full-service support to mid-life commercial aircraft.

1. Revenue Tumbling Downwards

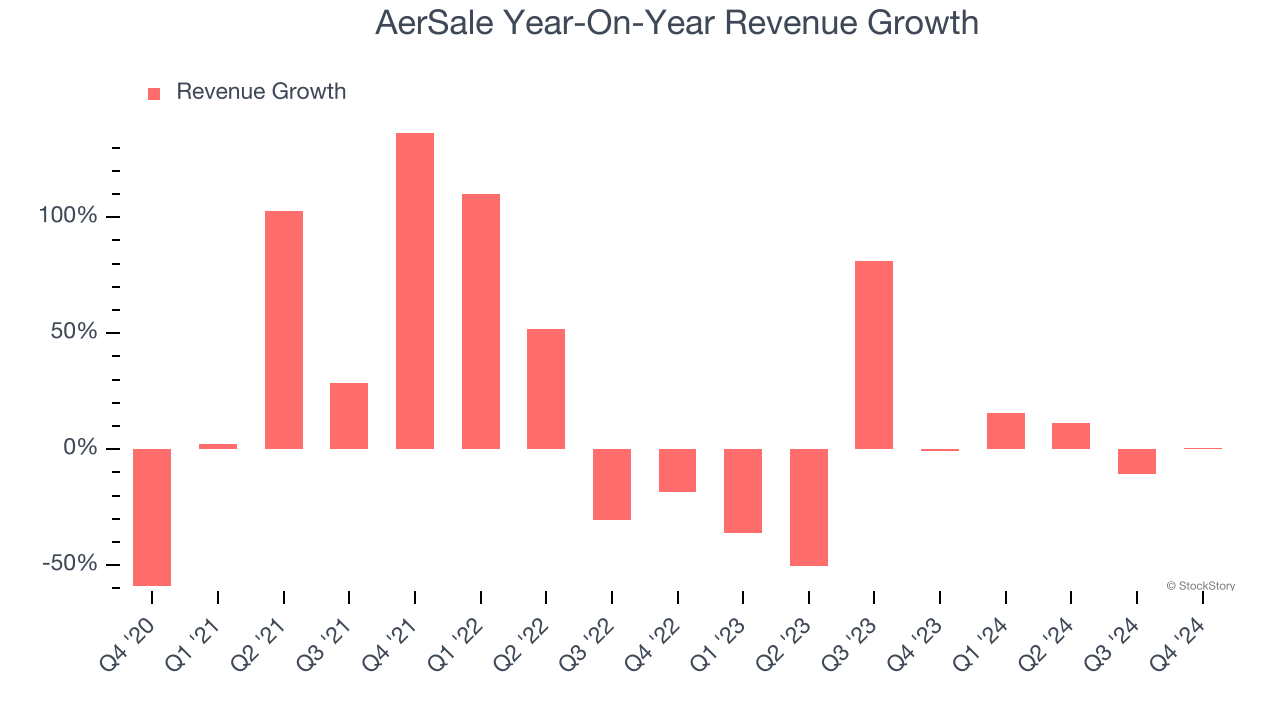

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. AerSale’s recent performance marks a sharp pivot from its four-year trend as its revenue has shown annualized declines of 8.1% over the last two years.

2. Cash Burn Ignites Concerns

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

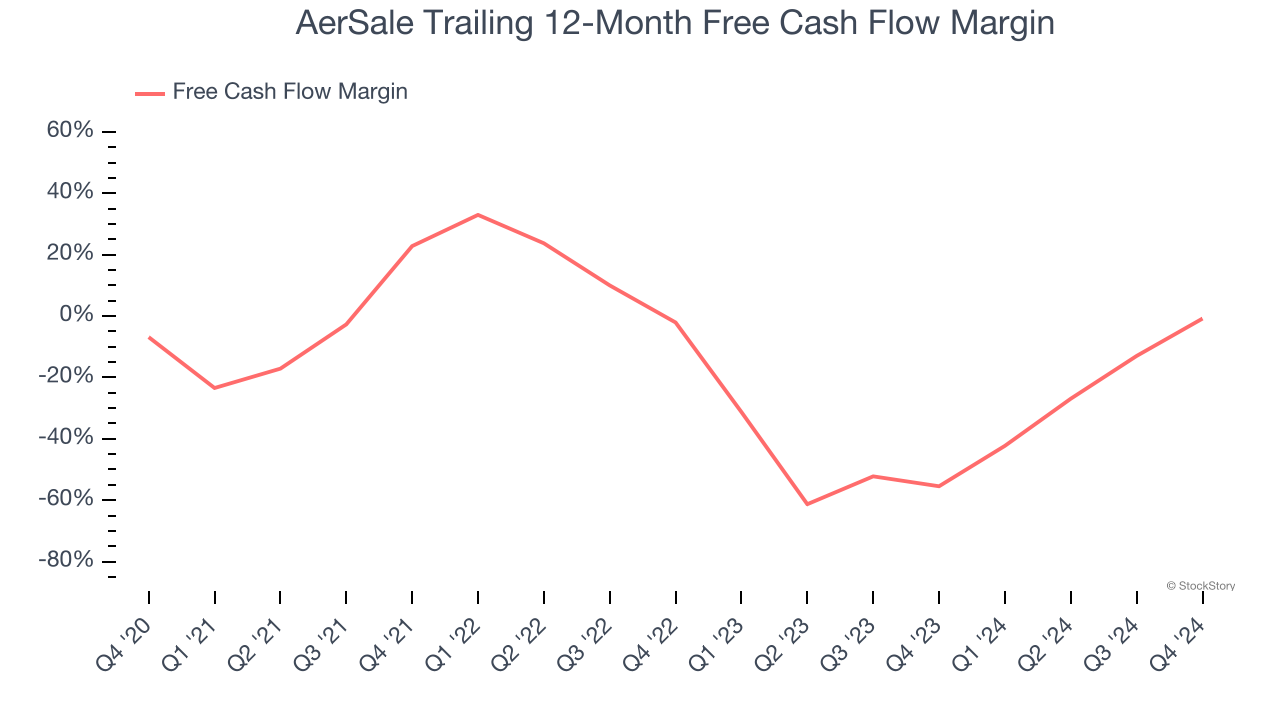

While AerSale posted positive free cash flow this quarter, the broader story hasn’t been so clean. AerSale’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 8.2%, meaning it lit $8.17 of cash on fire for every $100 in revenue.

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, AerSale’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

AerSale falls short of our quality standards. Following the recent surge, the stock trades at 17.7× forward price-to-earnings (or $8.70 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. Let us point you toward our favorite semiconductor picks and shovels play.

Stocks We Would Buy Instead of AerSale

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.