Distribution Solutions (NASDAQ:DSGR) Exceeds Q4 Expectations

Industrial and safety product distributor Distribution Solutions (NASDAQ: DSGR) reported Q4 CY2024 results exceeding the market’s revenue expectations, with sales up 18.6% year on year to $480.5 million. Its non-GAAP profit of $0.42 per share was 26% above analysts’ consensus estimates.

Is now the time to buy Distribution Solutions? Find out by accessing our full research report, it’s free.

Distribution Solutions (DSGR) Q4 CY2024 Highlights:

- Revenue: $480.5 million vs analyst estimates of $463.8 million (18.6% year-on-year growth, 3.6% beat)

- Adjusted EPS: $0.42 vs analyst estimates of $0.33 (26% beat)

- Adjusted EBITDA: $44.9 million vs analyst estimates of $47.03 million (9.3% margin, 4.5% miss)

- Operating Margin: 4.2%, up from 0.7% in the same quarter last year

- Free Cash Flow Margin: 8.6%, up from 5.5% in the same quarter last year

- Market Capitalization: $1.3 billion

Company Overview

Founded in 1952, Distribution Solutions (NASDAQ: DSGR) provides supply chain solutions and distributes industrial, safety, and maintenance products to various industries.

Maintenance and Repair Distributors

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Maintenance and repair distributors that boast reliable selection and quickly deliver products to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is still a real threat, forcing investment in omnichannel capabilities to serve customers everywhere. Additionally, maintenance and repair distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

Sales Growth

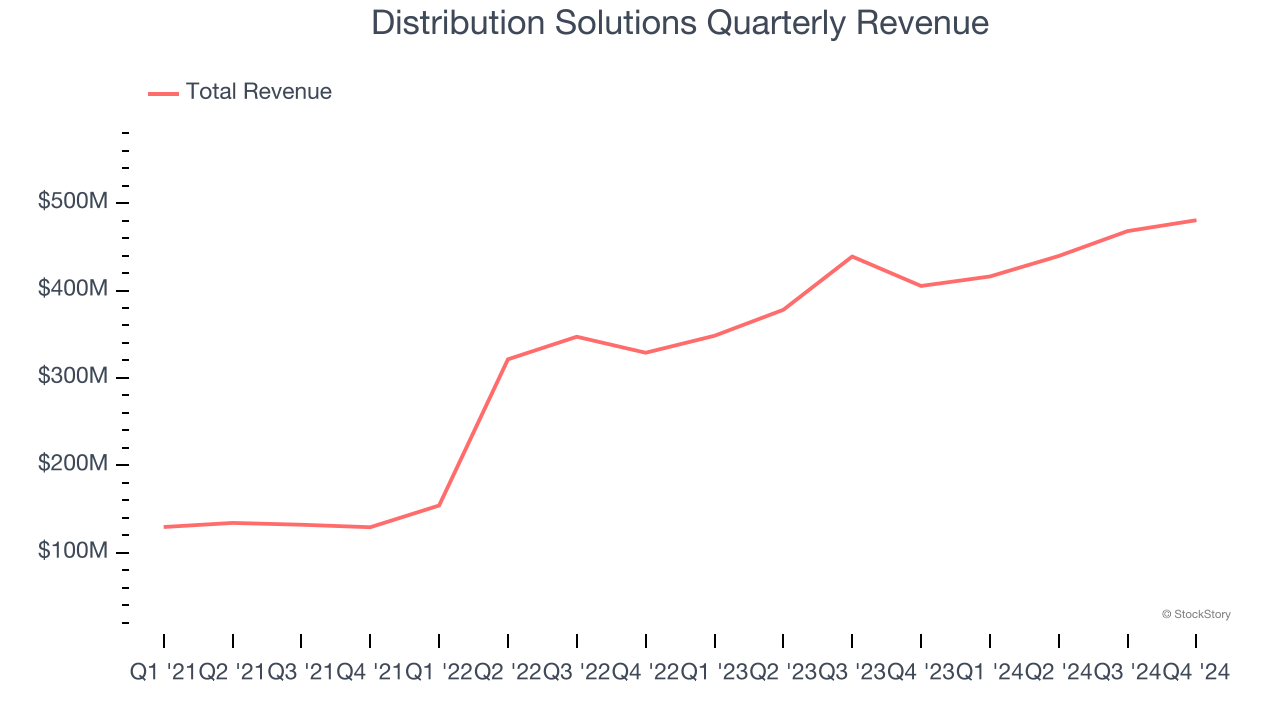

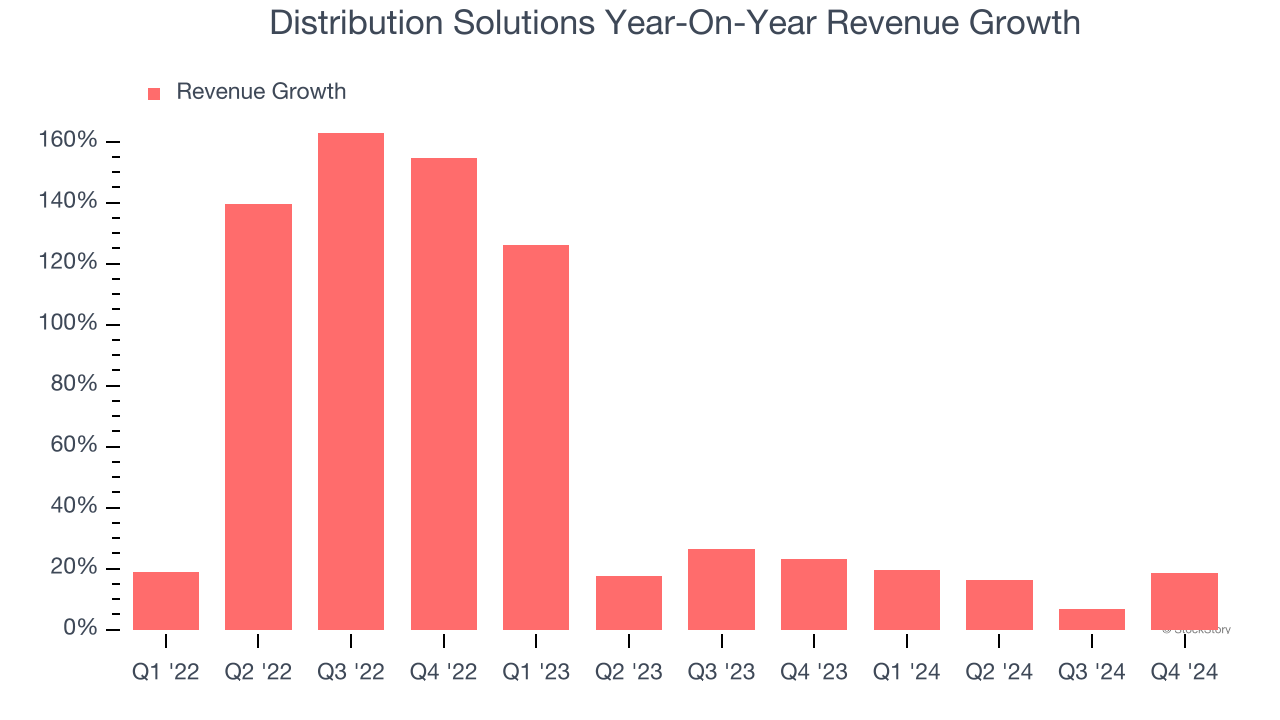

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Distribution Solutions’s sales grew at an incredible 50.9% compounded annual growth rate over the last three years. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Distribution Solutions’s annualized revenue growth of 25.2% over the last two years is below its three-year trend, but we still think the results were good and suggest demand was healthy.

This quarter, Distribution Solutions reported year-on-year revenue growth of 18.6%, and its $480.5 million of revenue exceeded Wall Street’s estimates by 3.6%.

Looking ahead, sell-side analysts expect revenue to grow 11.8% over the next 12 months, a deceleration versus the last two years. Still, this projection is admirable and implies the market is forecasting success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Distribution Solutions was profitable over the last four years but held back by its large cost base. Its average operating margin of 4.3% was weak for an industrials business. This result is surprising given its high gross margin as a starting point.

On the plus side, Distribution Solutions’s operating margin rose by 1.6 percentage points over the last four years, as its sales growth gave it operating leverage.

This quarter, Distribution Solutions generated an operating profit margin of 4.2%, up 3.5 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

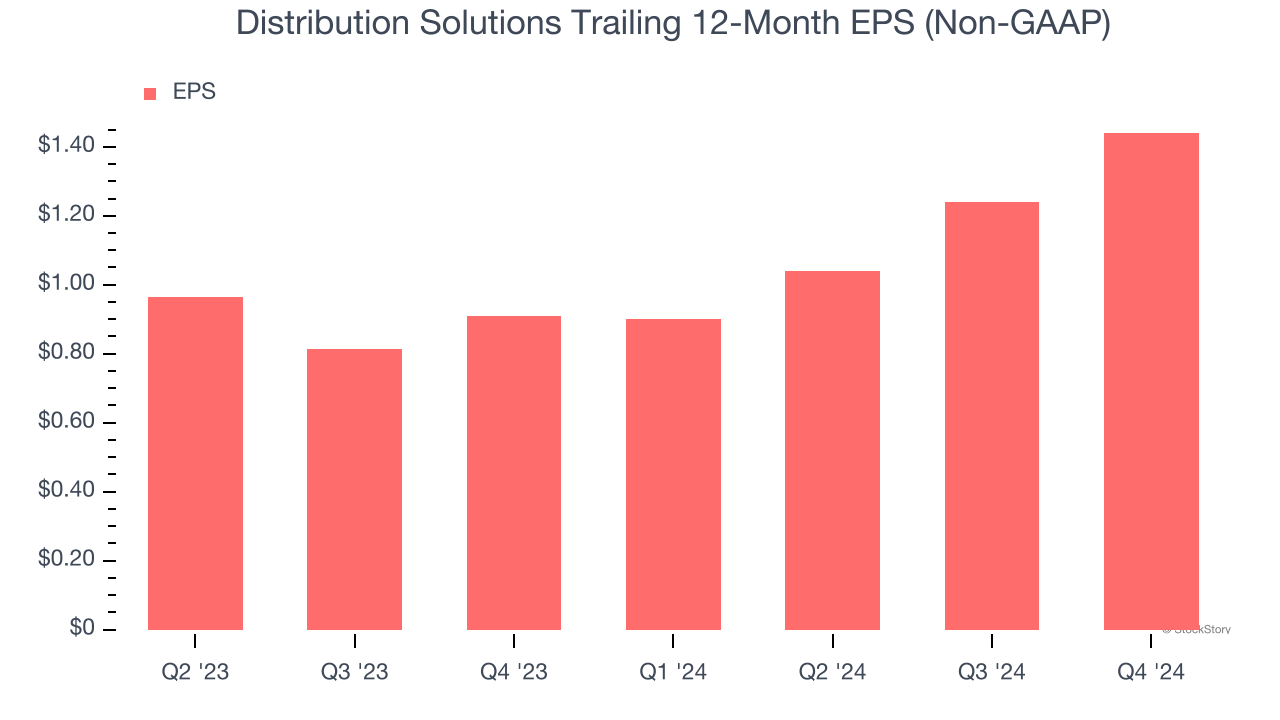

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Distribution Solutions’s EPS grew at an astounding 33.2% compounded annual growth rate over the last two years, higher than its 25.2% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand during this time.

In Q4, Distribution Solutions reported EPS at $0.42, up from $0.22 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Distribution Solutions’s full-year EPS of $1.44 to grow 14.9%.

Key Takeaways from Distribution Solutions’s Q4 Results

We liked that Distribution Solutions beat analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed. This was a mixed quarter, and the stock traded down 1.1% to $27.50 immediately after reporting.

So should you invest in Distribution Solutions right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.