3 Reasons MD is Risky and 1 Stock to Buy Instead

Pediatrix Medical Group has been on fire lately. In the past six months alone, the company’s stock price has rocketed 51.5%, reaching $16 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy Pediatrix Medical Group, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

We’re happy investors have made money, but we're cautious about Pediatrix Medical Group. Here are three reasons why MD doesn't excite us and a stock we'd rather own.

Why Do We Think Pediatrix Medical Group Will Underperform?

Founded in 1979, Pediatrix Medical Group (NYSE: MD) offers a wide range of pediatric care services, specializing in neonatal, pediatric, and maternal-fetal health.

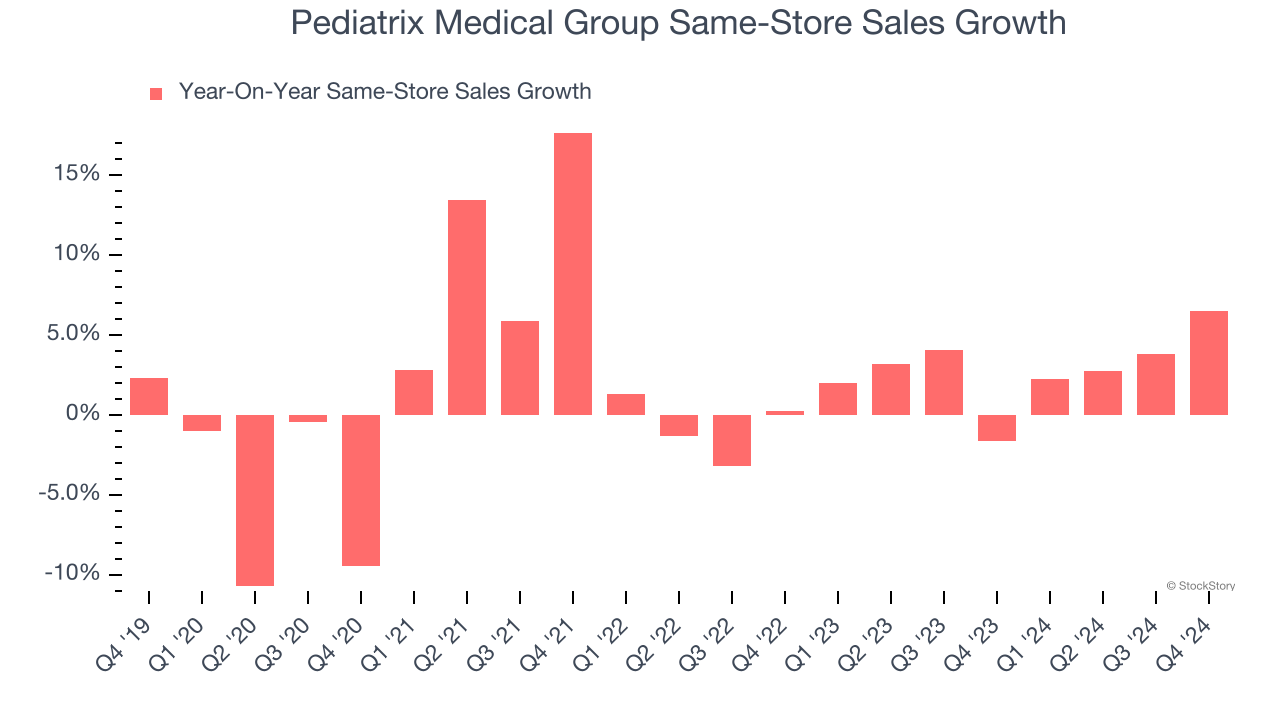

1. Same-Store Sales Falling Behind Peers

In addition to reported revenue, same-store sales are a useful data point for analyzing Specialized Medical & Nursing Services companies. This metric measures the change in sales at brick-and-mortar locations that have existed for at least a year, giving visibility into Pediatrix Medical Group’s underlying demand characteristics.

Over the last two years, Pediatrix Medical Group’s same-store sales averaged 2.9% year-on-year growth. This performance slightly lagged the sector and suggests it might have to change its strategy or pricing, which can disrupt operations.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Pediatrix Medical Group’s revenue to drop by 7.2%, a decrease from its 1% annualized growth for the past two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

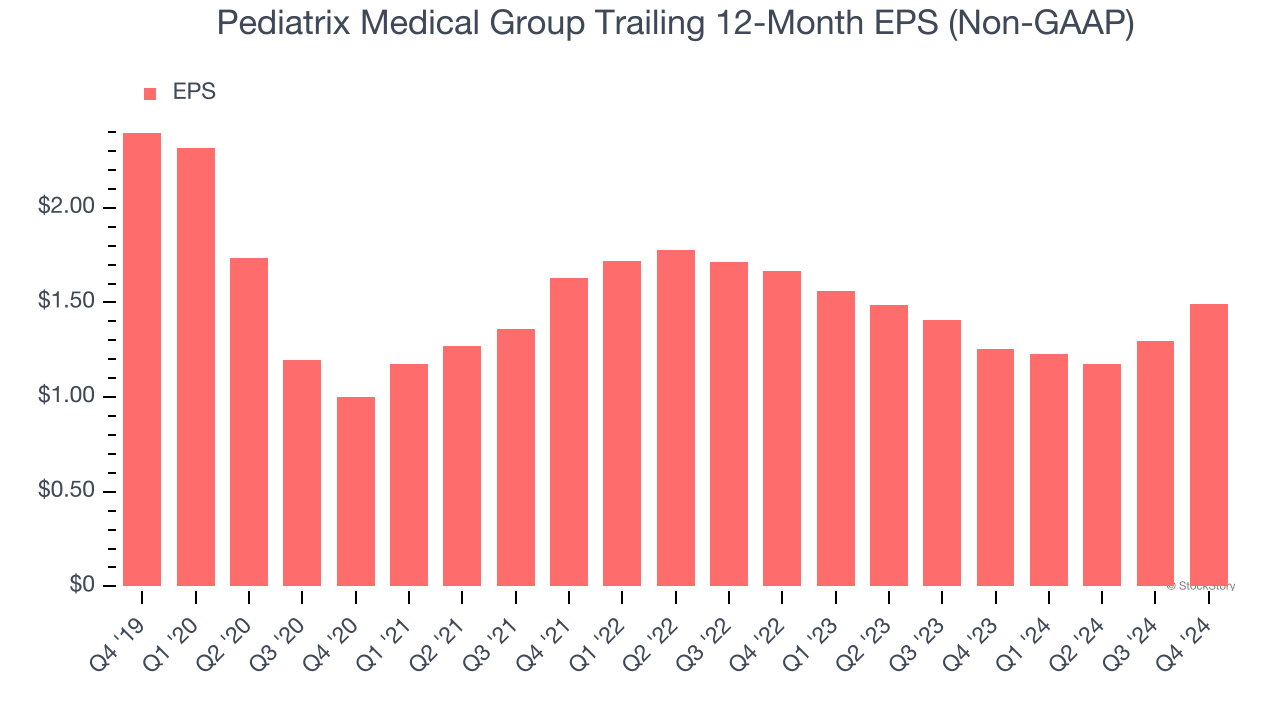

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Pediatrix Medical Group, its EPS declined by 9.1% annually over the last five years while its revenue grew by 2.5%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Pediatrix Medical Group falls short of our quality standards. After the recent rally, the stock trades at 9.3× forward price-to-earnings (or $16 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. Let us point you toward the most entrenched endpoint security platform on the market.

Stocks We Like More Than Pediatrix Medical Group

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.