Q4 Earnings Outperformers: Hillman (NASDAQ:HLMN) And The Rest Of The Professional Tools and Equipment Stocks

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how professional tools and equipment stocks fared in Q4, starting with Hillman (NASDAQ: HLMN).

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand. Some professional tools and equipment companies also provide software to accompany measurement or automated machinery, adding a stream of recurring revenues to their businesses. On the other hand, professional tools and equipment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 10 professional tools and equipment stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 9.7% since the latest earnings results.

Hillman (NASDAQ: HLMN)

Established when Max Hillman purchased a franchise operation, Hillman (NASDAQ: HLMN) designs, manufactures, and sells industrial equipment and systems for various sectors.

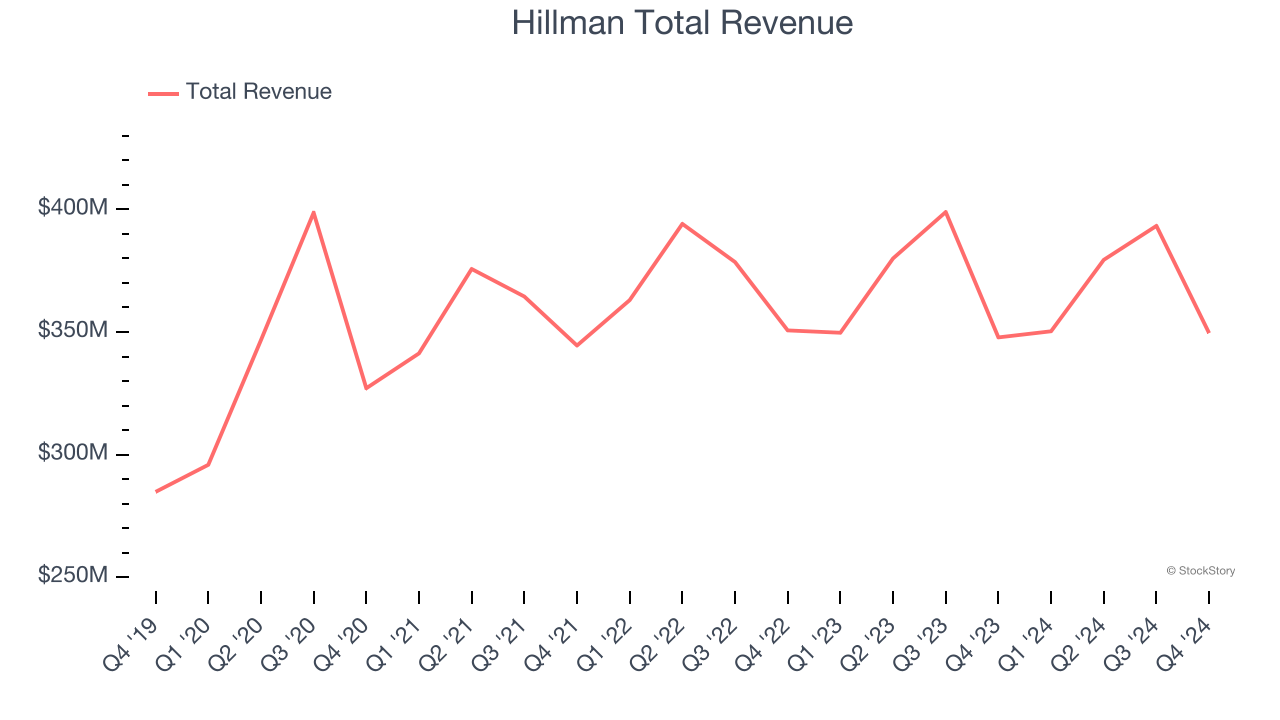

Hillman reported revenues of $349.6 million, flat year on year. This print fell short of analysts’ expectations by 0.6%. Overall, it was a mixed quarter for the company with an impressive beat of analysts’ adjusted operating income estimates but a significant miss of analysts’ EPS estimates.

Doug Cahill, Hillman's executive chairman commented: “During 2024, Hillman delivered record bottom line results despite the soft macro environment. Our focus on disciplined execution and taking care of our customers added to Hillman's 60-year legacy of service, which resulted in us winning vendor of the year awards at our two biggest customers: Home Depot and Lowe's."

Hillman pulled off the highest full-year guidance raise of the whole group. Still, the market seems discontent with the results. The stock is down 20.2% since reporting and currently trades at $8.79.

Read our full report on Hillman here, it’s free.

Best Q4: Hyster-Yale Materials Handling (NYSE: HY)

Playing a significant role in the development of the hydraulic lift truck, Hyster-Yale (NYSE: HY) designs, manufactures, and sells materials handling equipment to various sectors.

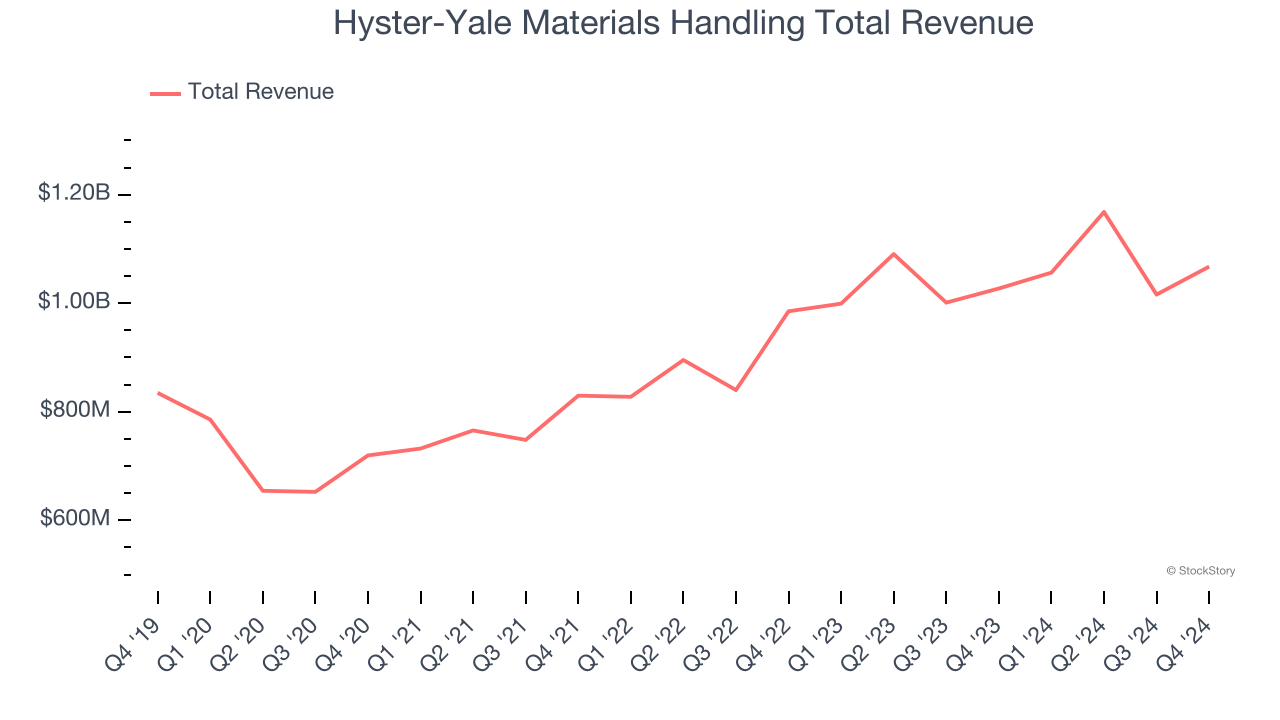

Hyster-Yale Materials Handling reported revenues of $1.07 billion, up 3.9% year on year, outperforming analysts’ expectations by 4.4%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates and a decent beat of analysts’ EPS estimates.

Hyster-Yale Materials Handling delivered the biggest analyst estimates beat and fastest revenue growth among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 20.2% since reporting. It currently trades at $41.34.

Is now the time to buy Hyster-Yale Materials Handling? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Kennametal (NYSE: KMT)

Involved in manufacturing hard tips of anti-tank projectiles in World War II, Kennametal (NYSE: KMT) is a provider of industrial materials and tools for various sectors.

Kennametal reported revenues of $482.1 million, down 2.7% year on year, falling short of analysts’ expectations by 1%. It was a disappointing quarter as it posted full-year EPS guidance missing analysts’ expectations and a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 8.7% since the results and currently trades at $21.40.

Read our full analysis of Kennametal’s results here.

Fortive (NYSE: FTV)

Taking its name from the Latin root of "strong", Fortive (NYSE: FTV) manufactures products and develops industrial software for numerous industries.

Fortive reported revenues of $1.62 billion, up 2.3% year on year. This print lagged analysts' expectations by 0.5%. Overall, it was a slower quarter as it also recorded EPS guidance for next quarter missing analysts’ expectations.

Fortive had the weakest full-year guidance update among its peers. The stock is down 9.6% since reporting and currently trades at $72.21.

Read our full, actionable report on Fortive here, it’s free.

Stanley Black & Decker (NYSE: SWK)

With an iconic “STANLEY” logo which has remained virtually unchanged for over a century, Stanley Black & Decker (NYSE: SWK) is a manufacturer primarily catering to the tool and outdoor equipment industry.

Stanley Black & Decker reported revenues of $3.72 billion, flat year on year. This number surpassed analysts’ expectations by 3.8%. Overall, it was a strong quarter as it also recorded an impressive beat of analysts’ organic revenue and EPS estimates.

The stock is down 11.4% since reporting and currently trades at $76.87.

Read our full, actionable report on Stanley Black & Decker here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.