2 Reasons to Like IRDM (and 1 Not So Much)

Although the S&P 500 is down 7.2% over the past six months, Iridium’s stock price has fallen further to $24.70, losing shareholders 17.7% of their capital. This might have investors contemplating their next move.

Following the pullback, is now an opportune time to buy IRDM? Find out in our full research report, it’s free.

Why Does Iridium Spark Debate?

With a constellation of 66 low-earth orbit satellites providing coverage to every inch of the planet, Iridium Communications (NASDAQ: IRDM) operates a global satellite network that provides voice and data services to customers in remote areas where traditional telecommunications are unavailable.

Two Positive Attributes:

1. Growth in Commercial Subscribers Shows Increasing Demand

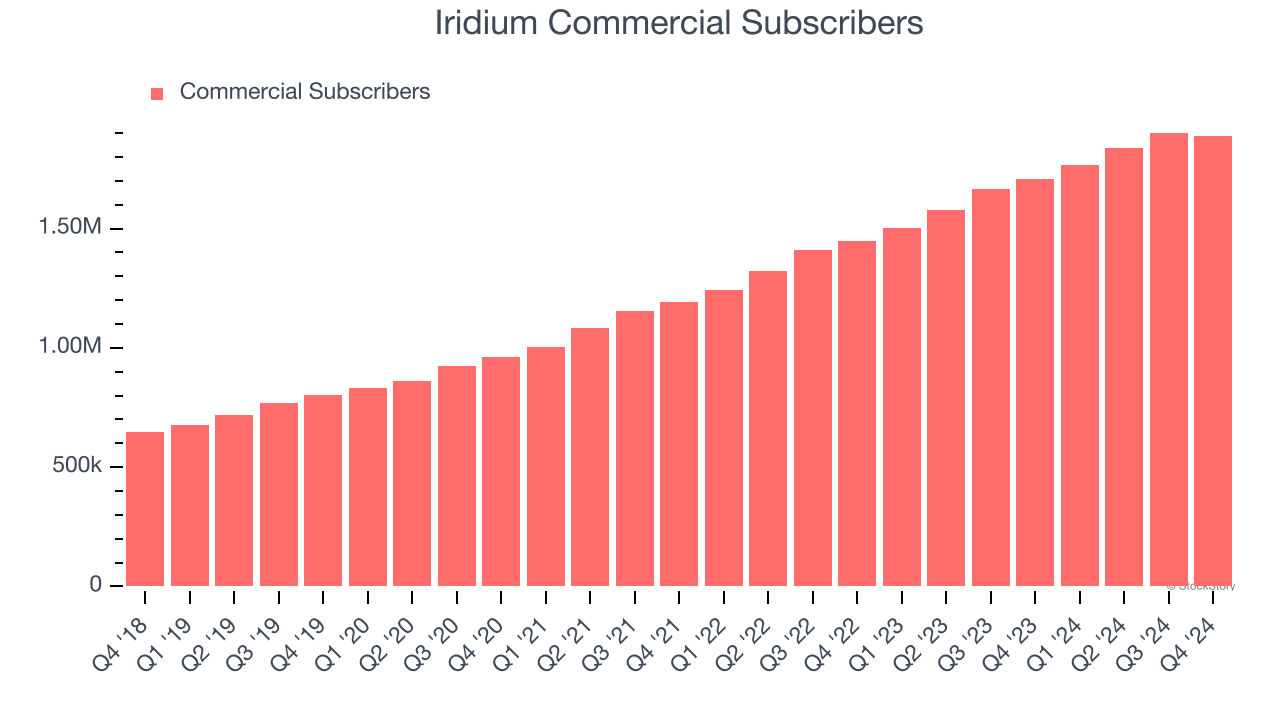

Revenue growth can be broken down into changes in price and volume (for companies like Iridium, our preferred volume metric is commercial subscribers). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Iridium’s commercial subscribers punched in at 1.89 million in the latest quarter, and over the last two years, averaged 16.8% year-on-year growth. This performance was fantastic and shows its services have a unique value proposition.

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

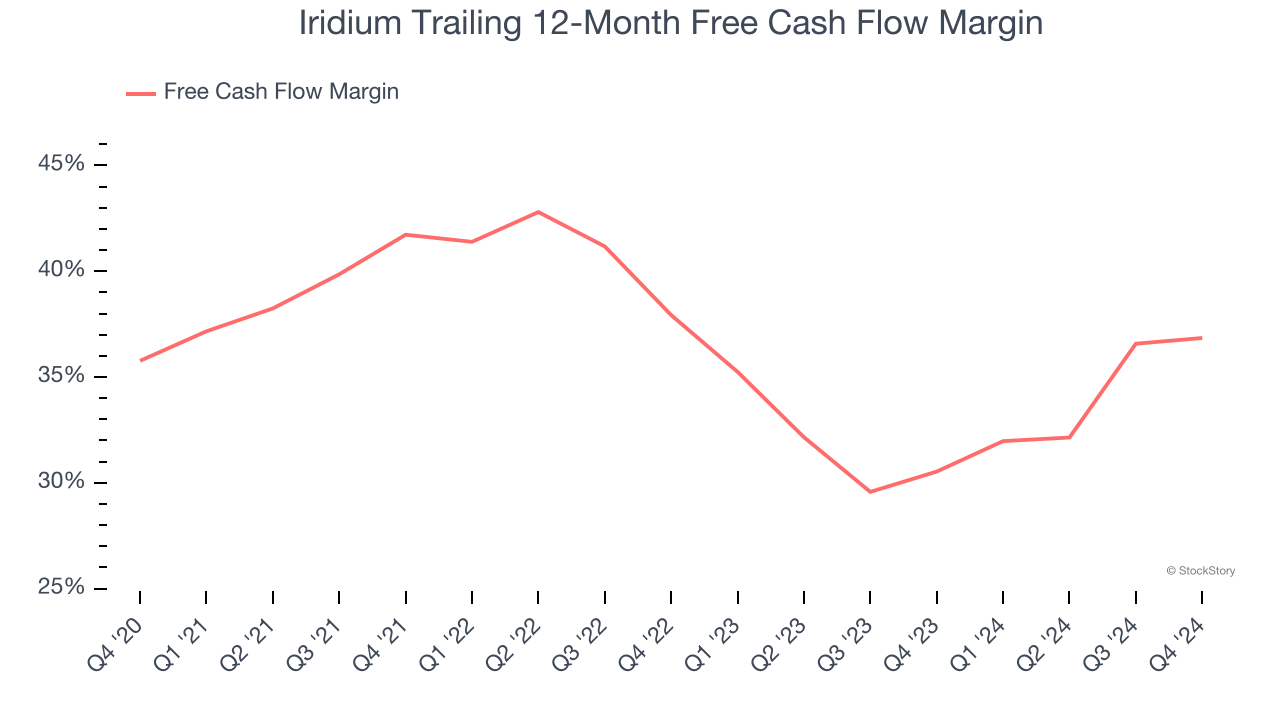

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Iridium has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging an eye-popping 36.3% over the last five years.

One Reason to be Careful:

Previous Growth Initiatives Haven’t Impressed

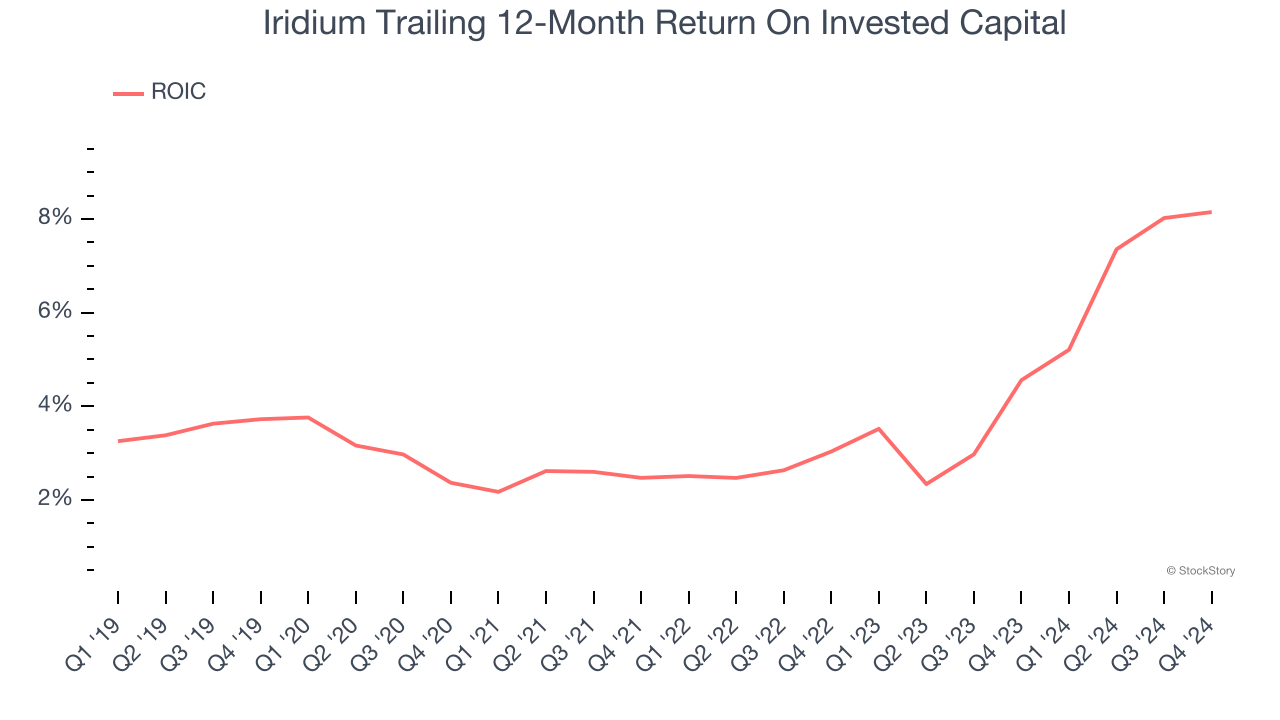

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Iridium has shown solid business quality lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4.1%, lower than the typical cost of capital (how much it costs to raise money) for business services companies.

Final Judgment

Iridium’s merits more than compensate for its flaws. With the recent decline, the stock trades at 20.7× forward price-to-earnings (or $24.70 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Iridium

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.