3 Reasons to Avoid XRAY and 1 Stock to Buy Instead

Dentsply Sirona’s stock price has taken a beating over the past six months, shedding 46.9% of its value and falling to $12.92 per share. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Dentsply Sirona, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Even with the cheaper entry price, we're swiping left on Dentsply Sirona for now. Here are three reasons why you should be careful with XRAY and a stock we'd rather own.

Why Do We Think Dentsply Sirona Will Underperform?

With roots dating back to 1877 when it introduced the first dental electric drill, Dentsply Sirona (NASDAQ: XRAY) manufactures and sells professional dental equipment, technologies, and consumable products used by dentists and specialists worldwide.

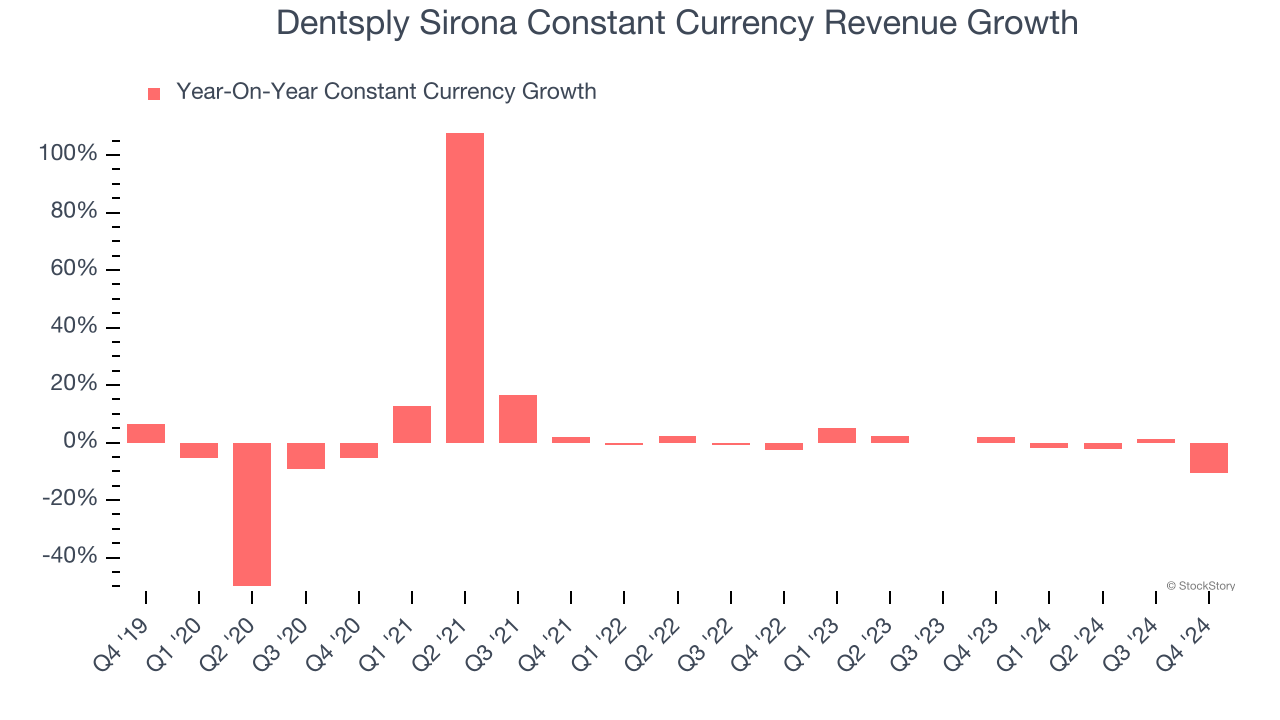

1. Constant Currency Revenue Hits a Standstill

We can better understand Dental Equipment & Technology companies by analyzing their constant currency revenue. This metric excludes currency movements, which are outside of Dentsply Sirona’s control and are not indicative of underlying demand.

Over the last two years, Dentsply Sirona failed to grow its constant currency revenue. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Dentsply Sirona might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. EPS Trending Down

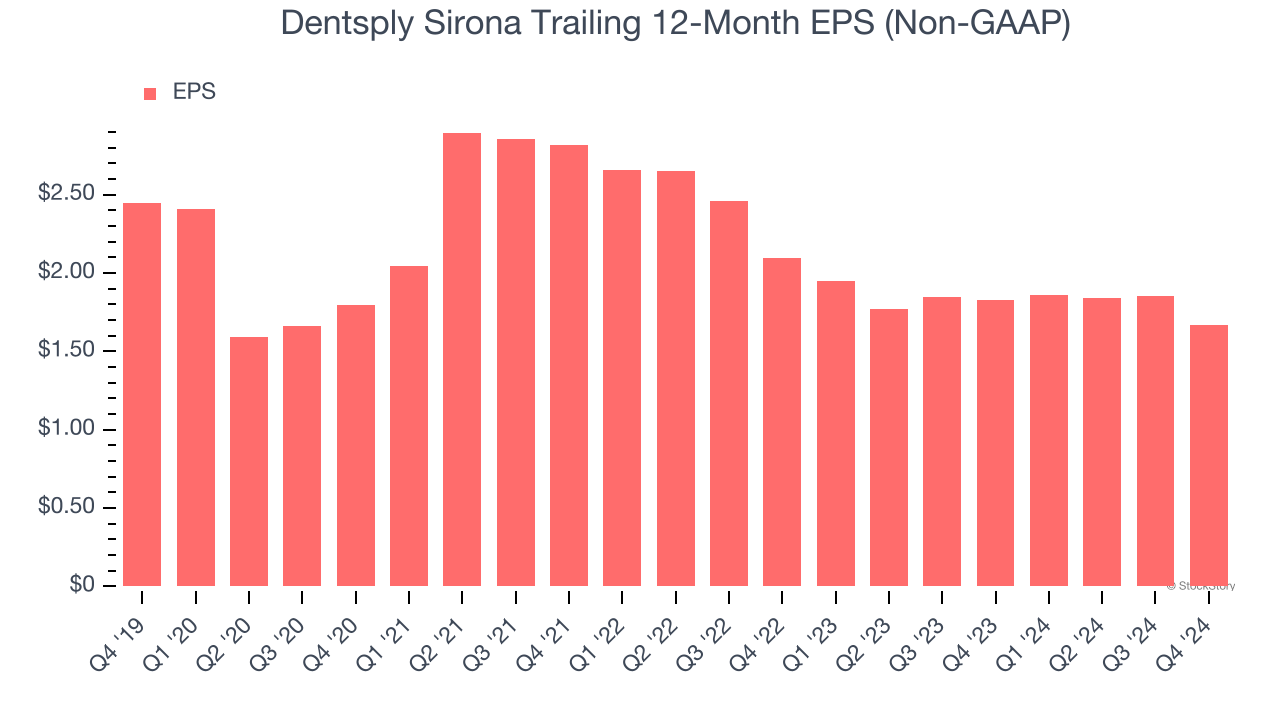

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Dentsply Sirona, its EPS declined by 7.4% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Dentsply Sirona’s five-year average ROIC was negative 7.8%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

Final Judgment

Dentsply Sirona doesn’t pass our quality test. After the recent drawdown, the stock trades at 6.8× forward price-to-earnings (or $12.92 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Dentsply Sirona

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.