Construction Machinery Q4 Earnings: Astec (NASDAQ:ASTE) is the Best in the Biz

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Astec (NASDAQ: ASTE) and the rest of the construction machinery stocks fared in Q4.

Automation that increases efficiencies and connected equipment that collects analyzable data have been trending, creating new sales opportunities for construction machinery companies. On the other hand, construction machinery companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the commercial and residential construction that drives demand for these companies’ offerings.

The 4 construction machinery stocks we track reported a slower Q4. As a group, revenues missed analysts’ consensus estimates by 1.4%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 16.1% since the latest earnings results.

Best Q4: Astec (NASDAQ: ASTE)

Inventing the first ever double-barrel hot-mix asphalt plant, Astec (NASDAQ: ASTE) provides machines and equipment for building roads, processing raw materials, and producing concrete.

Astec reported revenues of $359 million, up 6.5% year on year. This print fell short of analysts’ expectations by 4%, but it was still a strong quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Astec pulled off the fastest revenue growth but had the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is up 9.3% since reporting and currently trades at $34.11.

Is now the time to buy Astec? Access our full analysis of the earnings results here, it’s free.

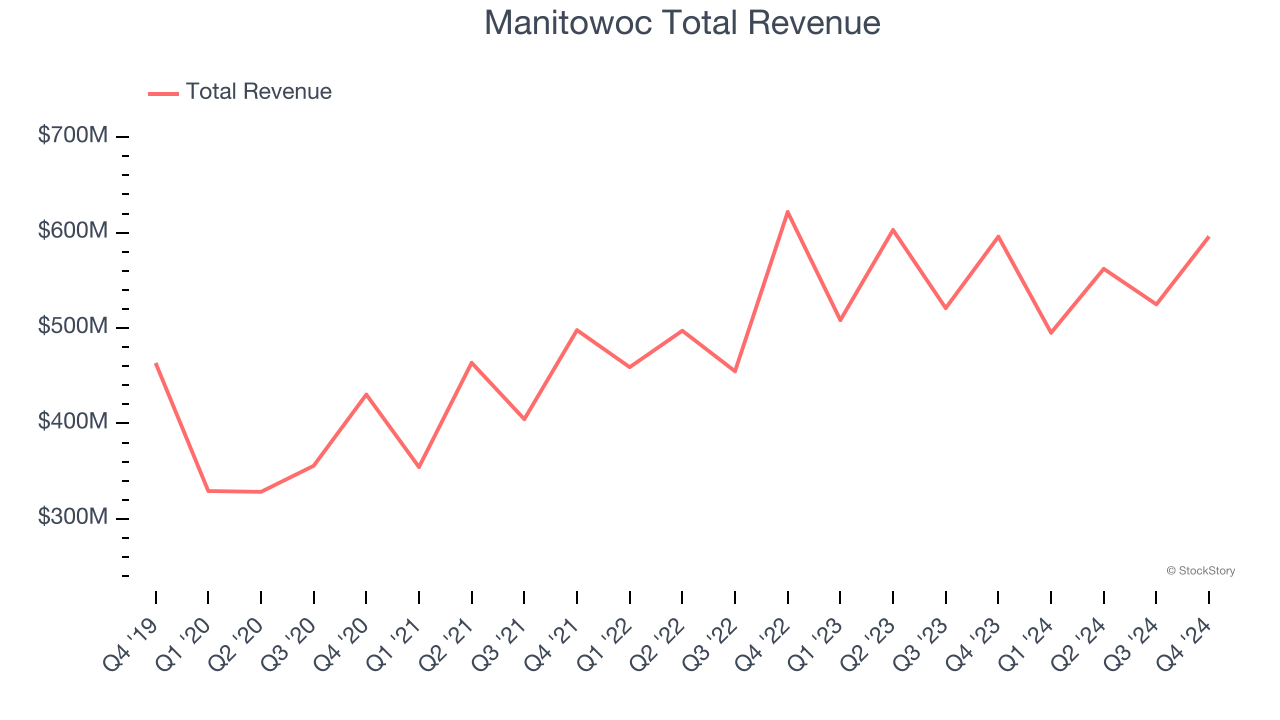

Manitowoc (NYSE: MTW)

Contracted by the United States Navy during WWII, Manitowoc (NYSE: MTW) provides cranes and lifting equipment.

Manitowoc reported revenues of $596 million, flat year on year, in line with analysts’ expectations. The business performed better than its peers, with a significant beat of analysts' EPS estimates.

The stock is down 23.2% since reporting. It currently trades at $7.53.

Is now the time to buy Manitowoc? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Caterpillar (NYSE: CAT)

With its iconic yellow machinery working on construction sites, Caterpillar (NYSE: CAT) manufactures construction equipment like bulldozers, excavators, and parts and maintenance services.

Caterpillar reported revenues of $16.22 billion, down 5% year on year, falling short of analysts’ expectations by 2%. It was a softer quarter as it posted a significant miss of analysts’ adjusted operating income estimates and a miss of analysts’ organic revenue estimates.

Caterpillar delivered the slowest revenue growth in the group. As expected, the stock is down 23.7% since the results and currently trades at $299.92.

Read our full analysis of Caterpillar’s results here.

Terex (NYSE: TEX)

With humble beginnings as a dump truck company, Terex (NYSE: TEX) today manufactures lifting and material handling equipment designed to move and hoist heavy goods and materials.

Terex reported revenues of $1.24 billion, up 1.5% year on year. This number beat analysts’ expectations by 0.8%. Aside from that, it was a slower quarter as it recorded full-year EBITDA guidance missing analysts’ expectations.

Terex achieved the biggest analyst estimates beat among its peers. The stock is down 26.8% since reporting and currently trades at $35.13.

Read our full, actionable report on Terex here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.