3 Reasons LFST is Risky and 1 Stock to Buy Instead

LifeStance Health Group trades at $6.79 per share and has moved almost in lockstep with the market over the last six months. The stock has lost 7.1% while the S&P 500 is down 8.3%. This may have investors wondering how to approach the situation.

Is there a buying opportunity in LifeStance Health Group, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Despite the more favorable entry price, we're swiping left on LifeStance Health Group for now. Here are three reasons why we avoid LFST and a stock we'd rather own.

Why Is LifeStance Health Group Not Exciting?

With over 6,600 licensed mental health professionals treating more than 880,000 patients annually, LifeStance Health (NASDAQ: LFST) provides outpatient mental health services through a network of clinicians offering psychiatric evaluations, psychological testing, and therapy across 33 states.

1. Fewer Distribution Channels Limit its Ceiling

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.25 billion in revenue over the past 12 months, LifeStance Health Group is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

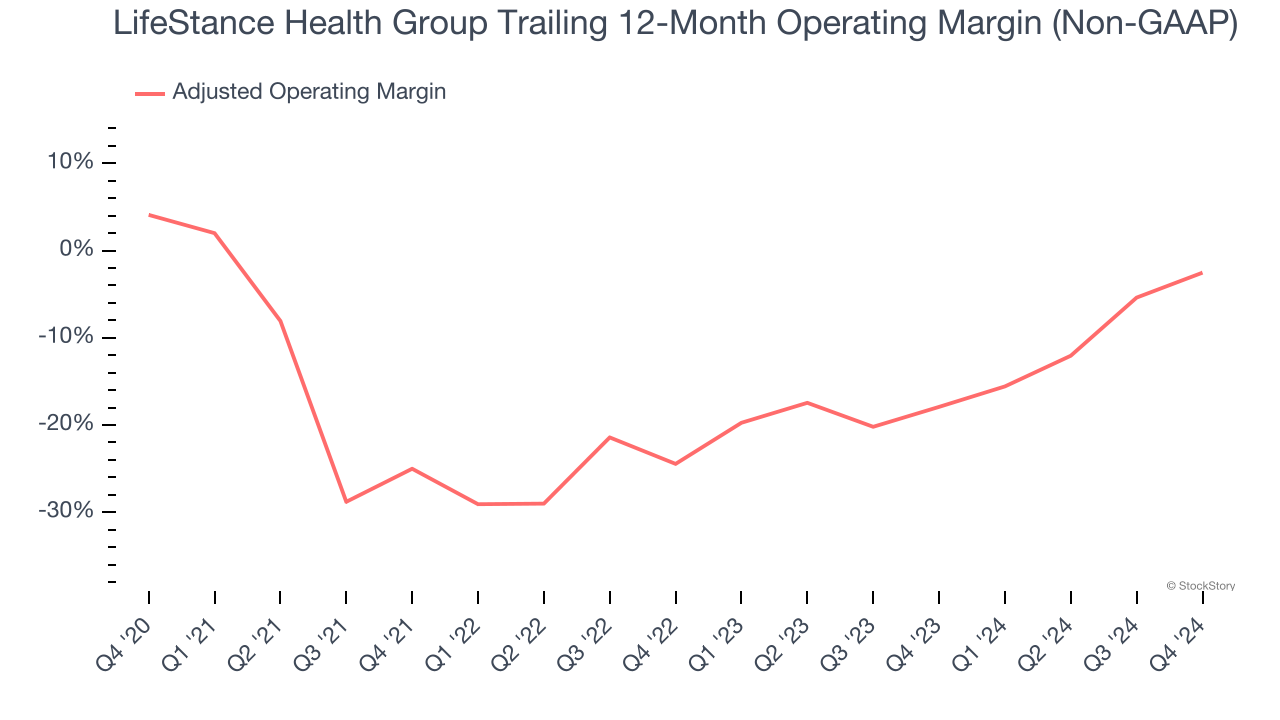

2. Shrinking Adjusted Operating Margin

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

Analyzing the trend in its profitability, LifeStance Health Group’s adjusted operating margin decreased by 6.6 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. LifeStance Health Group’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its adjusted operating margin for the trailing 12 months was negative 2.5%.

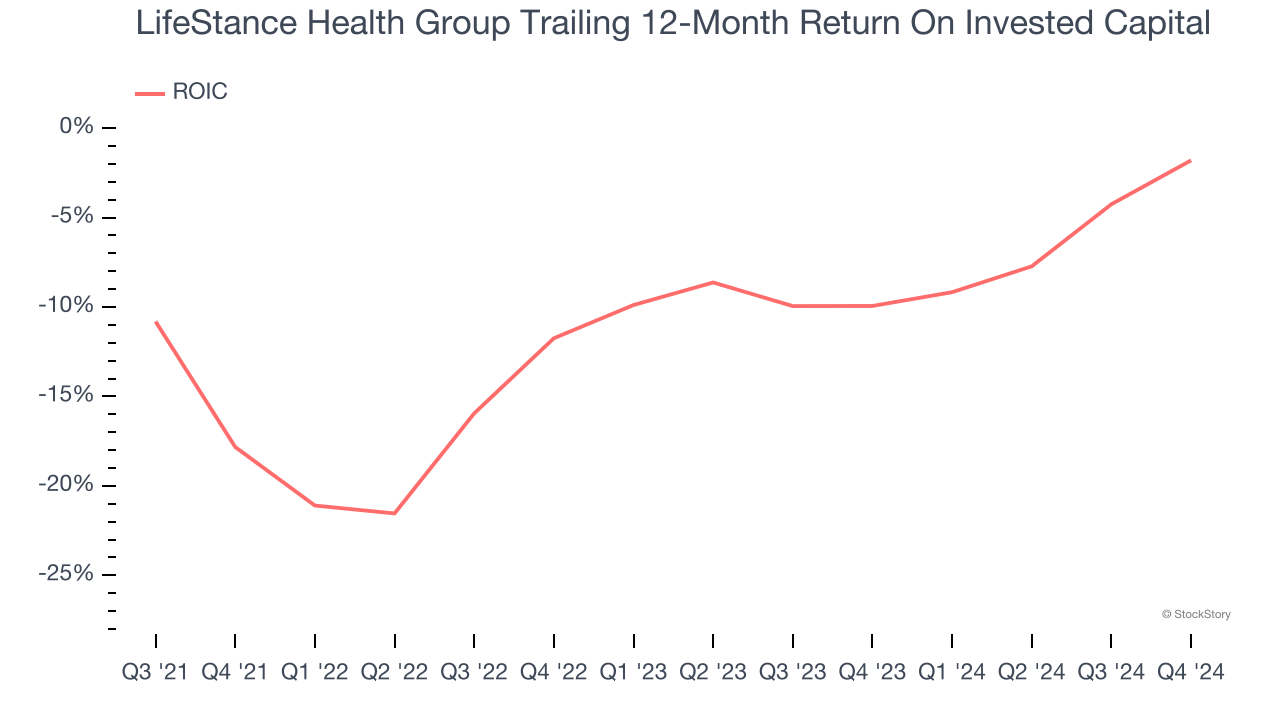

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

LifeStance Health Group’s five-year average ROIC was negative 10.3%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

Final Judgment

LifeStance Health Group isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 222.3× forward price-to-earnings (or $6.79 per share). At this valuation, there’s a lot of good news priced in - you can find better investment opportunities elsewhere. We’d recommend looking at the most dominant software business in the world.

Stocks We Like More Than LifeStance Health Group

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.