3 Reasons PLUS is Risky and 1 Stock to Buy Instead

ePlus has gotten torched over the last six months - since October 2024, its stock price has dropped 41.2% to $58.24 per share. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy ePlus, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Even though the stock has become cheaper, we're swiping left on ePlus for now. Here are three reasons why there are better opportunities than PLUS and a stock we'd rather own.

Why Is ePlus Not Exciting?

Starting as a financing company in 1990 before evolving into a full-service technology provider, ePlus (NASDAQ: PLUS) provides comprehensive IT solutions, professional services, and financing options to help organizations optimize their technology infrastructure and supply chain processes.

1. Lackluster Revenue Growth

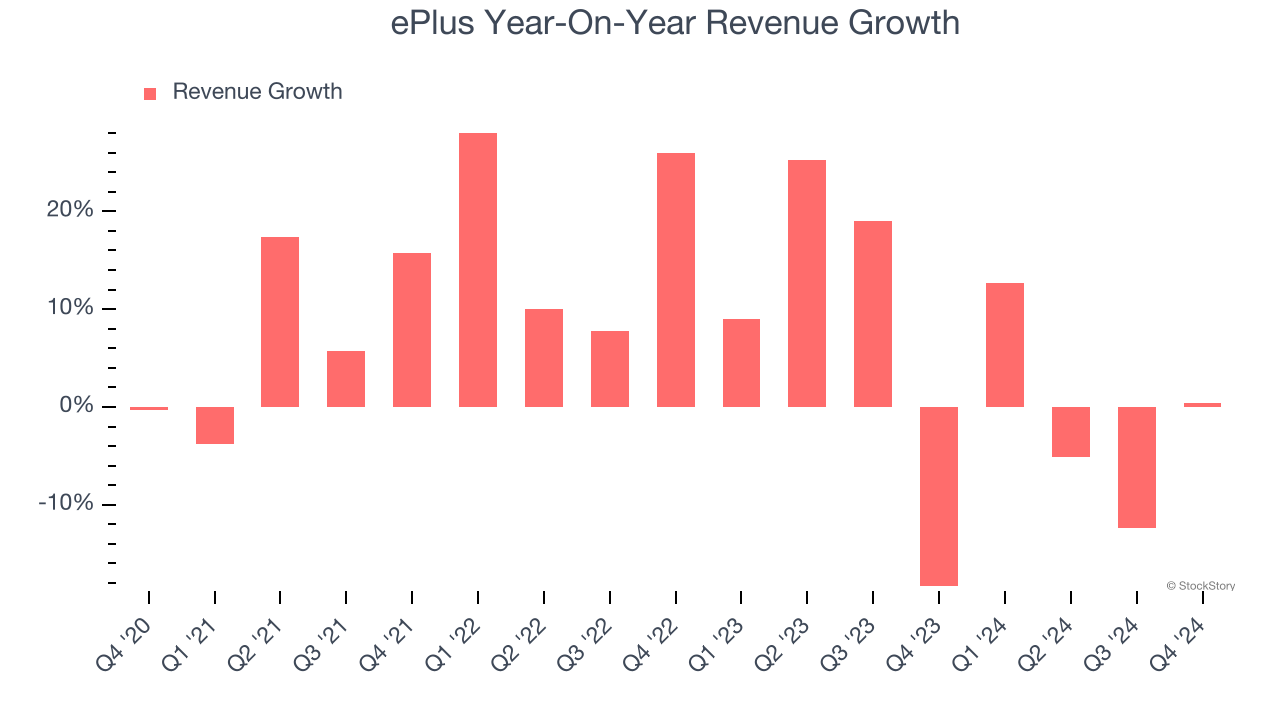

Long-term growth is the most important, but within business services, a stretched historical view may miss new innovations or demand cycles. ePlus’s recent performance shows its demand has slowed as its annualized revenue growth of 2.4% over the last two years was below its four-year trend.

2. EPS Took a Dip Over the Last Two Years

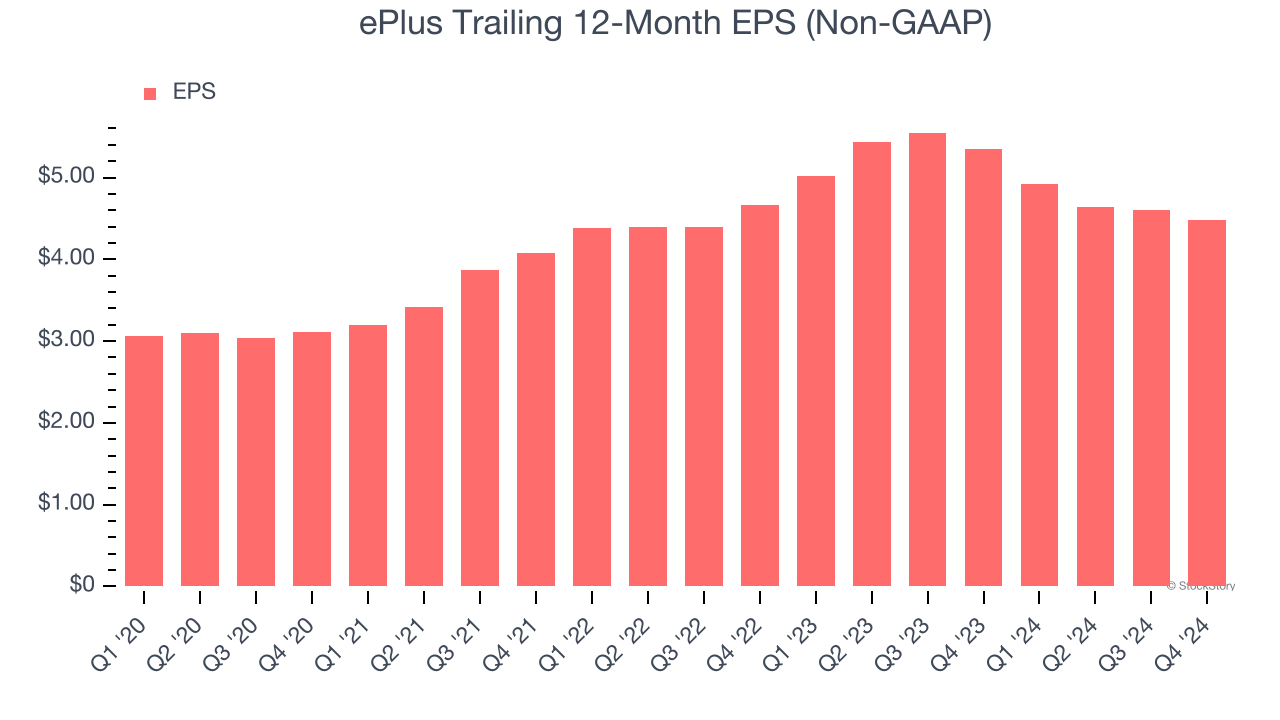

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for ePlus, its EPS declined by 2.1% annually over the last two years while its revenue grew by 2.4%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

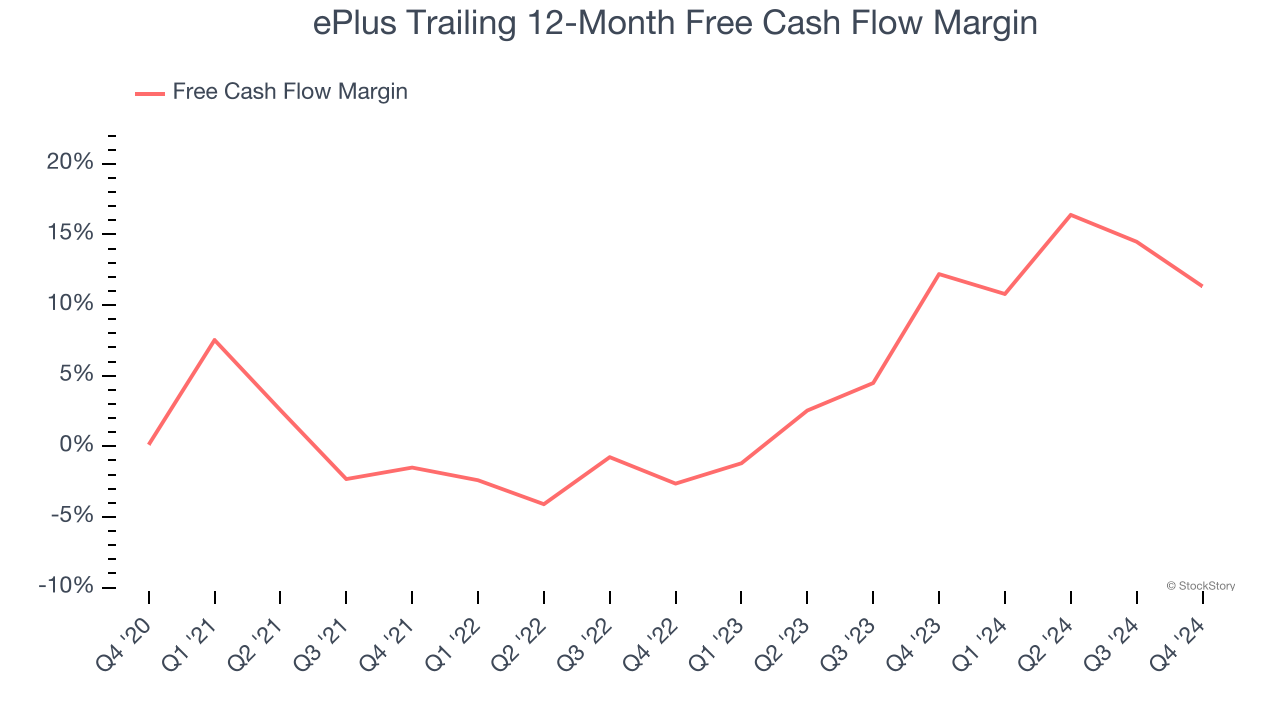

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

ePlus has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.4%, subpar for a business services business.

Final Judgment

ePlus isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 11× forward price-to-earnings (or $58.24 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now. We’d suggest looking at the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of ePlus

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.