3 Reasons to Sell HTLD and 1 Stock to Buy Instead

What a brutal six months it’s been for Heartland Express. The stock has dropped 29.4% and now trades at $8.28, rattling many shareholders. This might have investors contemplating their next move.

Is now the time to buy Heartland Express, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Even with the cheaper entry price, we're swiping left on Heartland Express for now. Here are three reasons why there are better opportunities than HTLD and a stock we'd rather own.

Why Do We Think Heartland Express Will Underperform?

Founded by the son of a trucker, Heartland Express (NASDAQ: HTLD) offers full-truckload deliveries across the United States and Mexico.

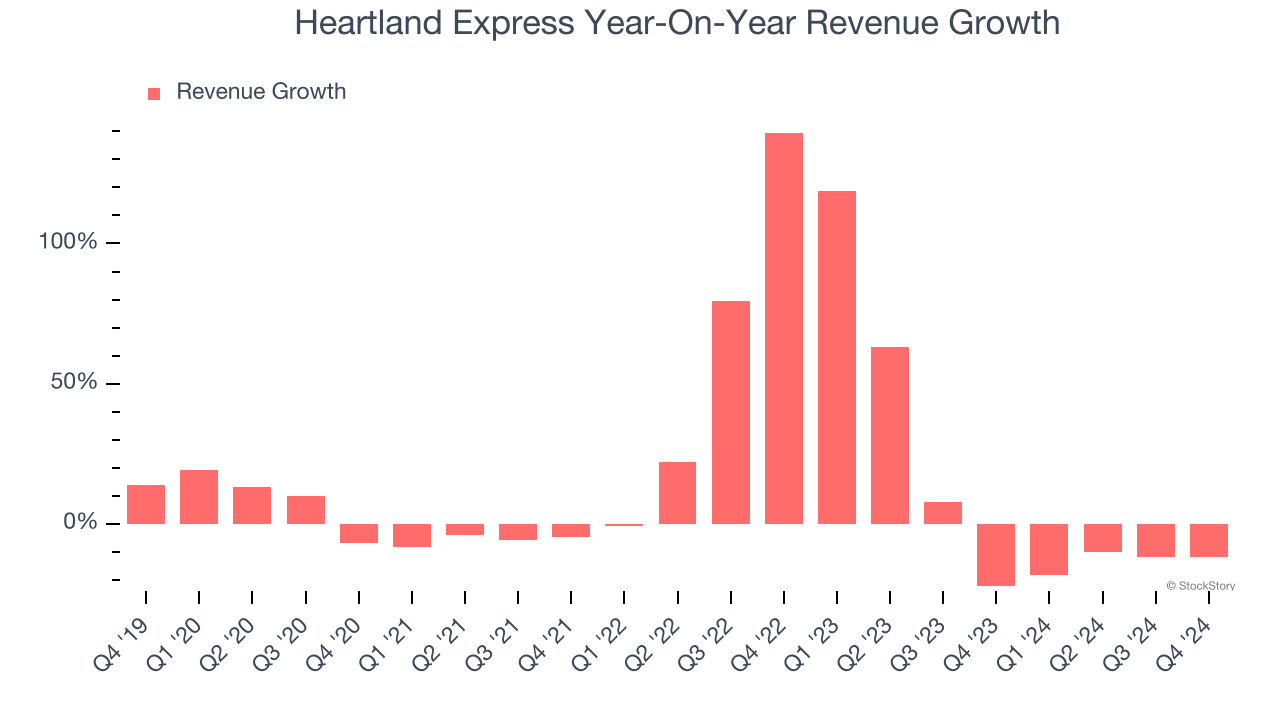

1. Lackluster Revenue Growth

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Heartland Express’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 4% over the last two years was well below its five-year trend. We also note many other Ground Transportation businesses have faced declining sales because of cyclical headwinds. While Heartland Express grew slower than we’d like, it did do better than its peers.

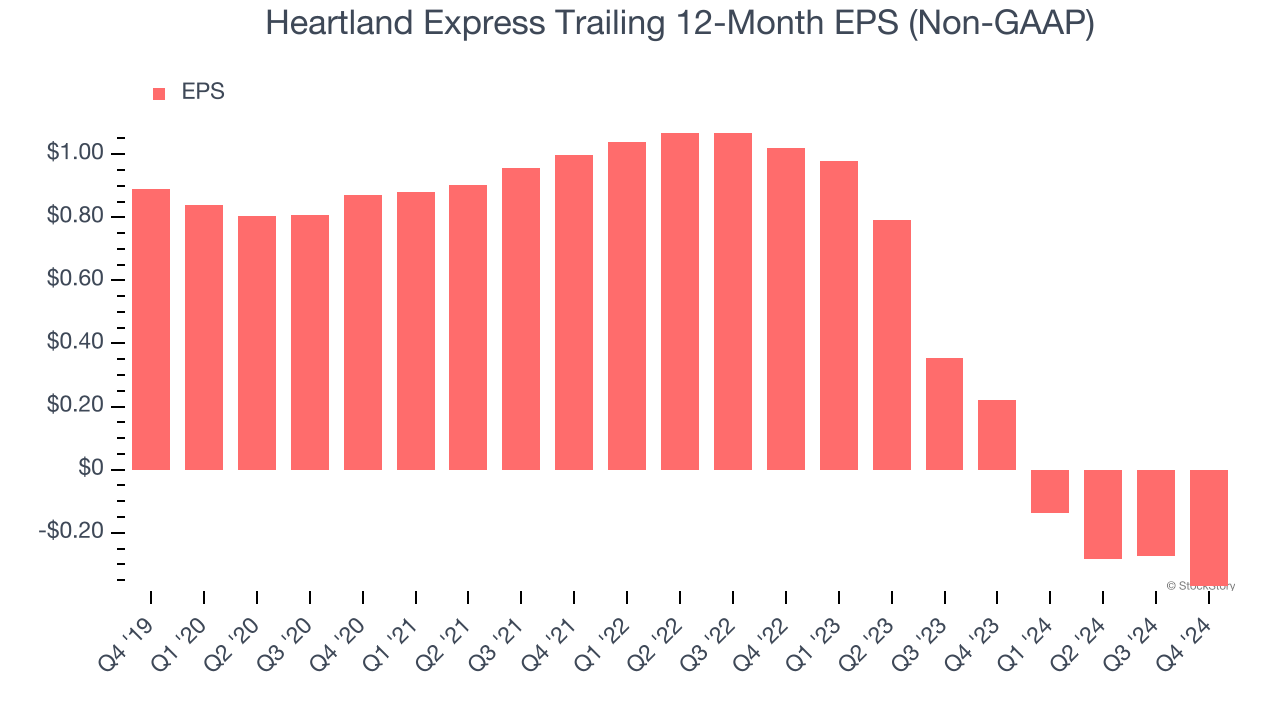

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Heartland Express, its EPS declined by 19.3% annually over the last five years while its revenue grew by 11.9%. This tells us the company became less profitable on a per-share basis as it expanded.

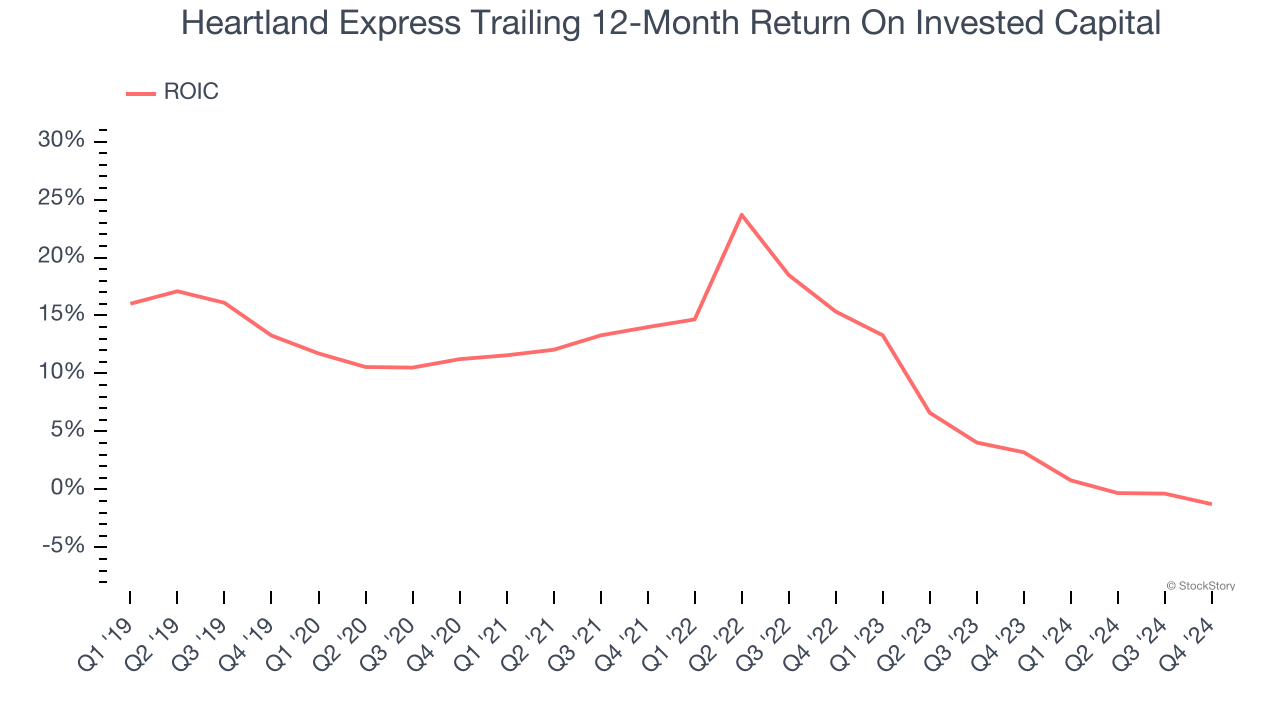

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Heartland Express’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

Heartland Express doesn’t pass our quality test. Following the recent decline, the stock trades at $8.28 per share (or 0.6× forward price-to-sales). The market typically values companies like Heartland Express based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Heartland Express

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.