3 Reasons We’re Fans of Comfort Systems (FIX)

Although the S&P 500 is down 10% over the past six months, Comfort Systems’s stock price has fallen further to $347.95, losing shareholders 16.7% of their capital. This might have investors contemplating their next move.

Given the weaker price action, is now the time to buy FIX? Find out in our full research report, it’s free.

Why Are We Positive On Comfort Systems?

Formed through the merger of 12 companies, Comfort Systems (NYSE: FIX) provides mechanical and electrical contracting services.

1. Surging Backlog Locks In Future Sales

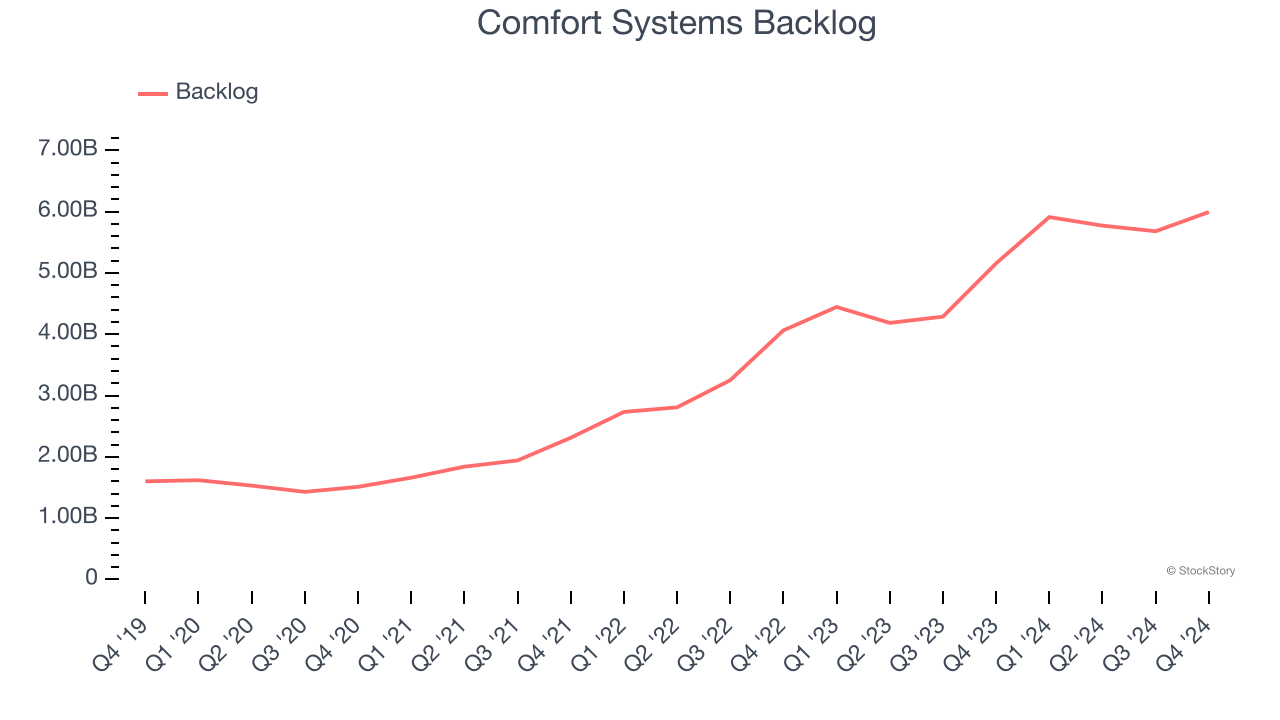

We can better understand Construction and Maintenance Services companies by analyzing their backlog. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Comfort Systems’s future revenue streams.

Comfort Systems’s backlog punched in at $5.99 billion in the latest quarter, and over the last two years, its year-on-year growth averaged 36.3%. This performance was fantastic and shows the company has a robust sales pipeline because it is accumulating more orders than it can fulfill. Its growth also suggests that customers are committing to Comfort Systems for the long term, enhancing the business’s predictability.

2. Outstanding Long-Term EPS Growth

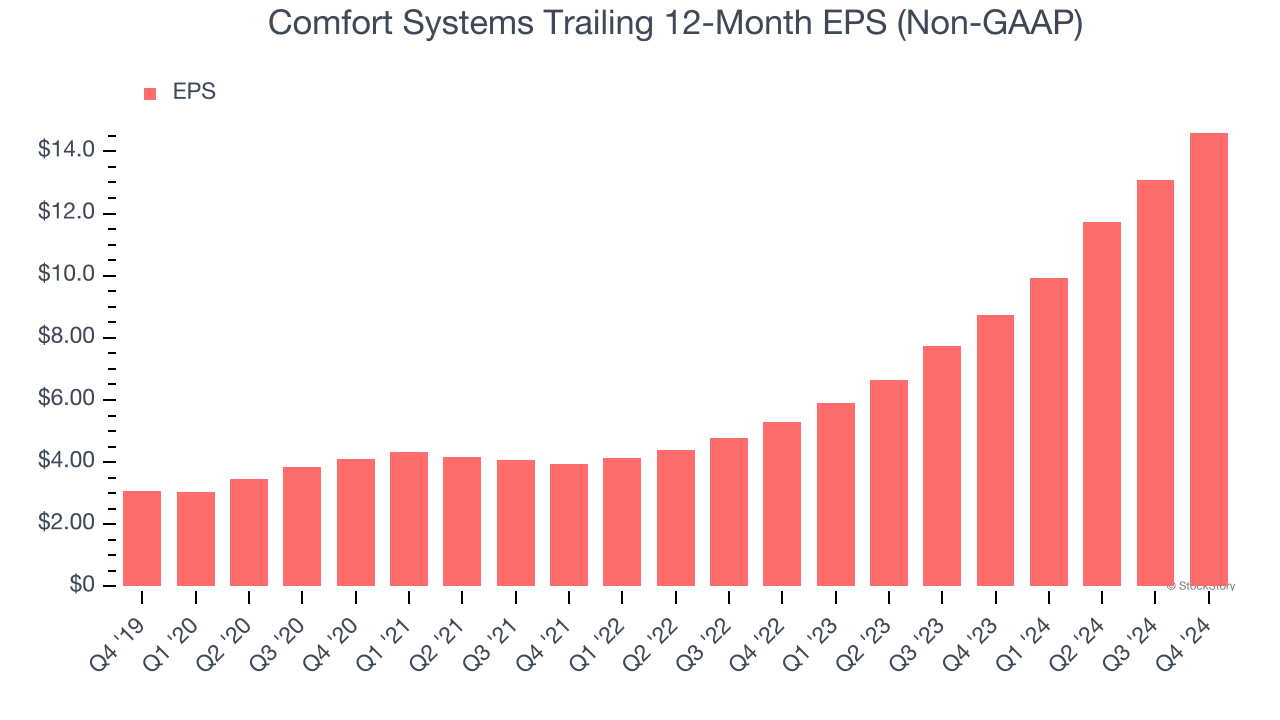

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Comfort Systems’s EPS grew at an astounding 36.5% compounded annual growth rate over the last five years, higher than its 21.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

3. New Investments Bear Fruit as ROIC Jumps

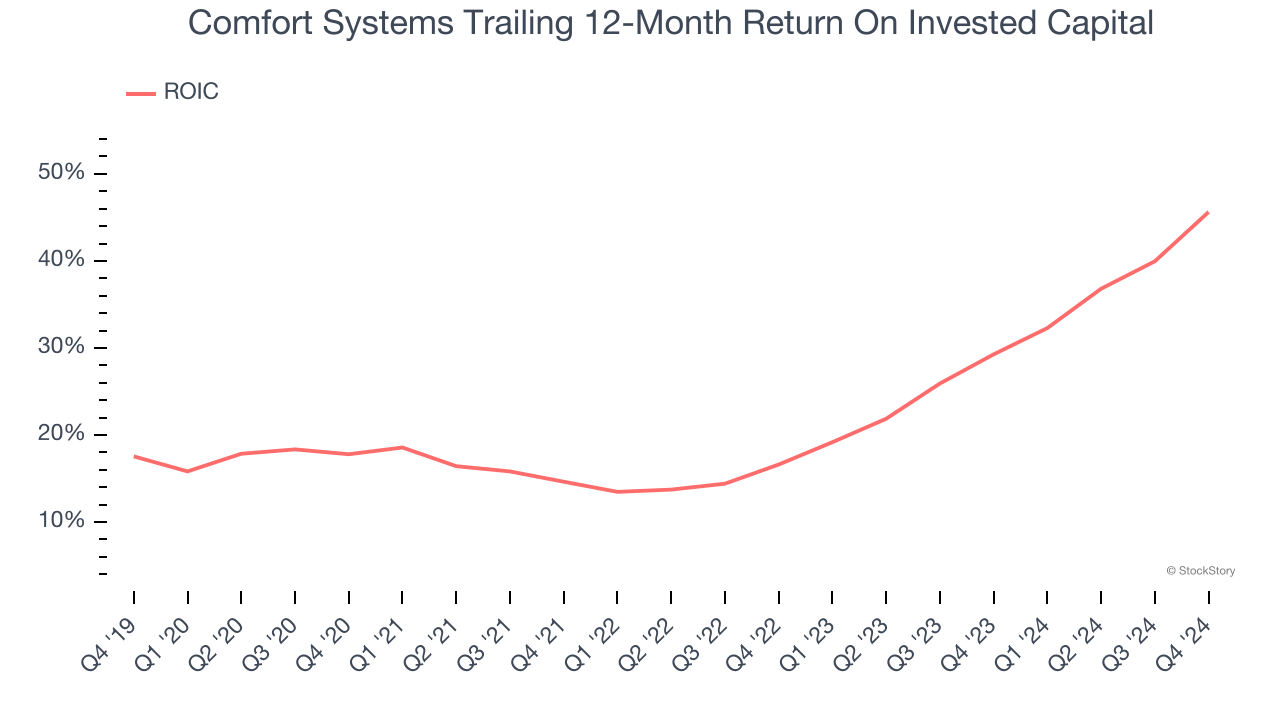

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Comfort Systems’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

Final Judgment

These are just a few reasons why Comfort Systems ranks near the top of our list. With the recent decline, the stock trades at 20.7× forward price-to-earnings (or $347.95 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Comfort Systems

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.