Caesars Entertainment (NASDAQ:CZR) Reports Q1 In Line With Expectations

Hotel and casino entertainment company Caesars Entertainment (NASDAQ: CZR) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 1.9% year on year to $2.79 billion. Its GAAP loss of $0.54 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Caesars Entertainment? Find out by accessing our full research report, it’s free.

Caesars Entertainment (CZR) Q1 CY2025 Highlights:

- Revenue: $2.79 billion vs analyst estimates of $2.79 billion (1.9% year-on-year growth, in line)

- EPS (GAAP): -$0.54 vs analyst estimates of -$0.17 (significant miss)

- Adjusted EBITDA: $884 million vs analyst estimates of $874.8 million (31.6% margin, 1.1% beat)

- Operating Margin: 17.5%, in line with the same quarter last year

- Market Capitalization: $5.95 billion

Tom Reeg, Chief Executive Officer of Caesars Entertainment, Inc., commented, “During the first quarter of 2025, consolidated Adjusted EBITDA grew 4% over prior year driven by significant gains in our Digital segment which delivered a new Q1 record, growth in our regional segment with strong contributions from recently opened properties and a solid quarter in Las Vegas against a tough Super Bowl compare last year.”

Company Overview

Formerly Eldorado Resorts, Caesars Entertainment (NASDAQ: CZR) is a global gaming and hospitality company operating numerous casinos, hotels, and resort properties.

Sales Growth

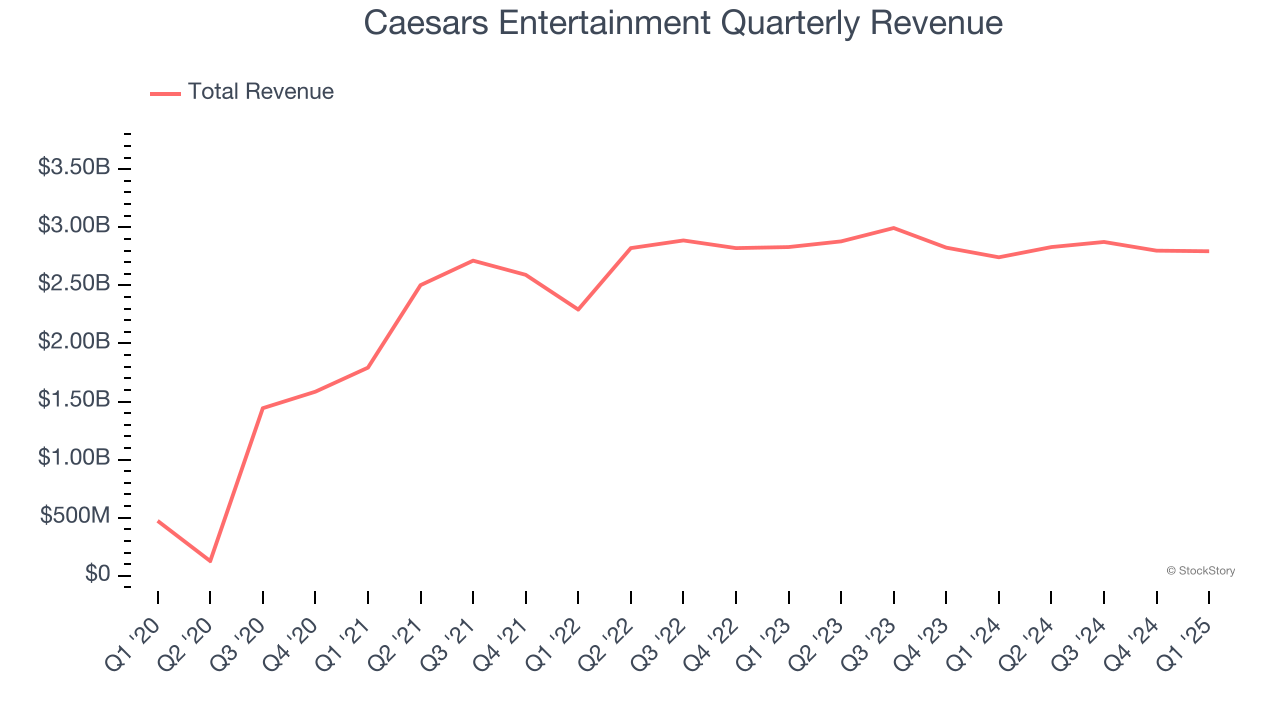

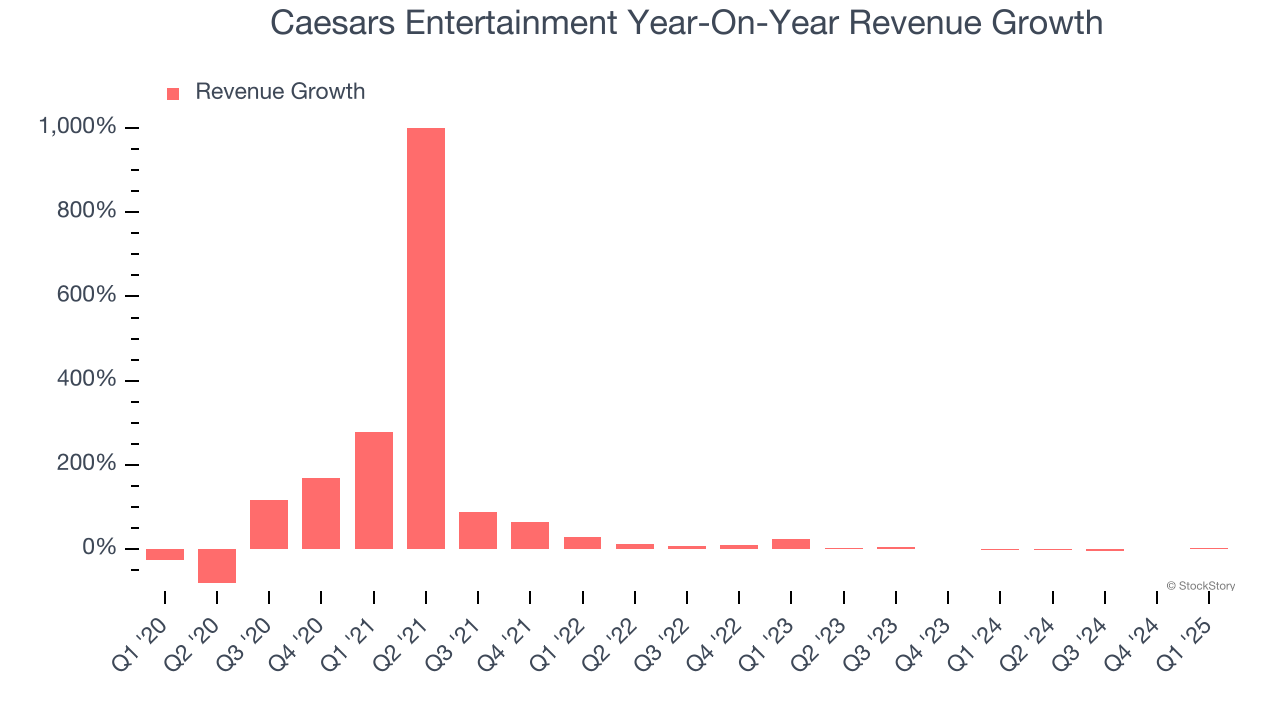

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Caesars Entertainment’s sales grew at an incredible 36.7% compounded annual growth rate over the last five years. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Caesars Entertainment’s recent performance shows its demand has slowed significantly as its revenue was flat over the last two years. Note that COVID hurt Caesars Entertainment’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

Caesars Entertainment also breaks out the revenue for its three most important segments: Casino, Hotel, and Dining, which are 57.1%, 15.6%, and 17.3% of revenue. Over the last two years, Caesars Entertainment’s Casino (Poker, Blackjack) and Dining (food and beverage) revenues averaged year-on-year growth of 30.4% and 14.2%. On the other hand, its Hotel revenue (overnight bookings) averaged 47.5% declines.

This quarter, Caesars Entertainment grew its revenue by 1.9% year on year, and its $2.79 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.9% over the next 12 months. Although this projection implies its newer products and services will spur better top-line performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

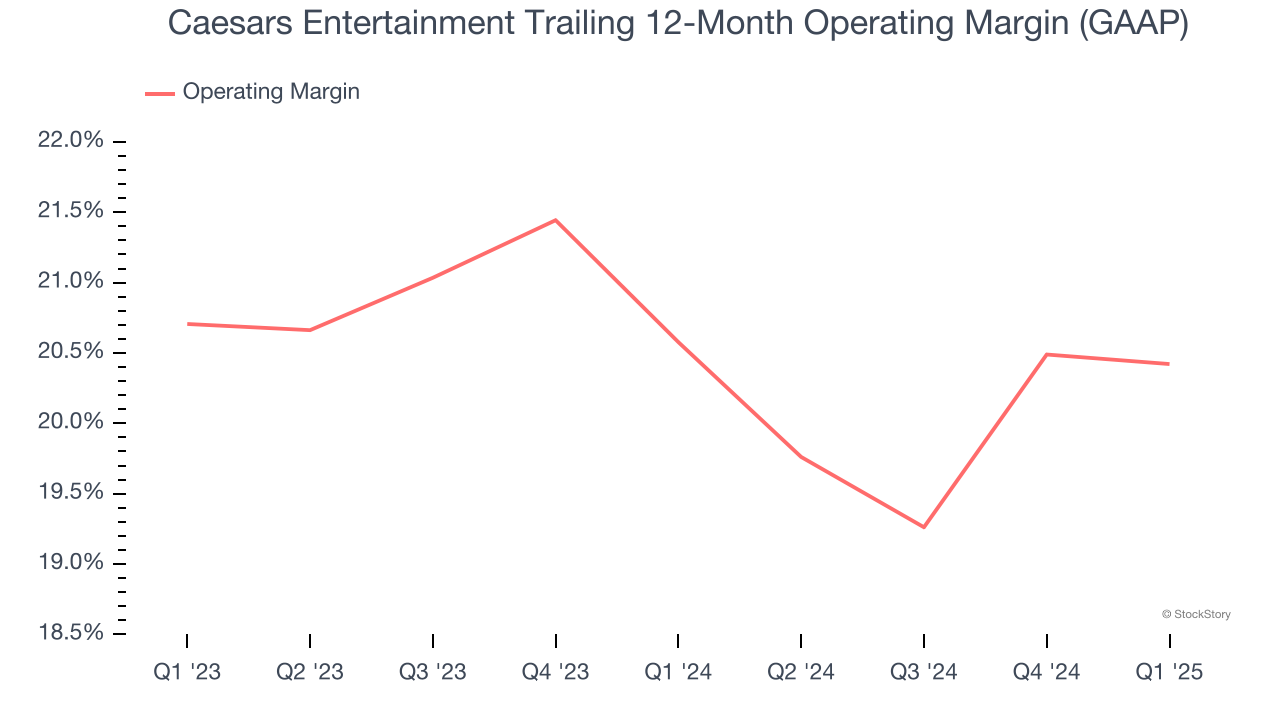

Caesars Entertainment’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 20.5% over the last two years. This profitability was top-notch for a consumer discretionary business, showing it’s an well-run company with an efficient cost structure.

This quarter, Caesars Entertainment generated an operating profit margin of 17.5%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

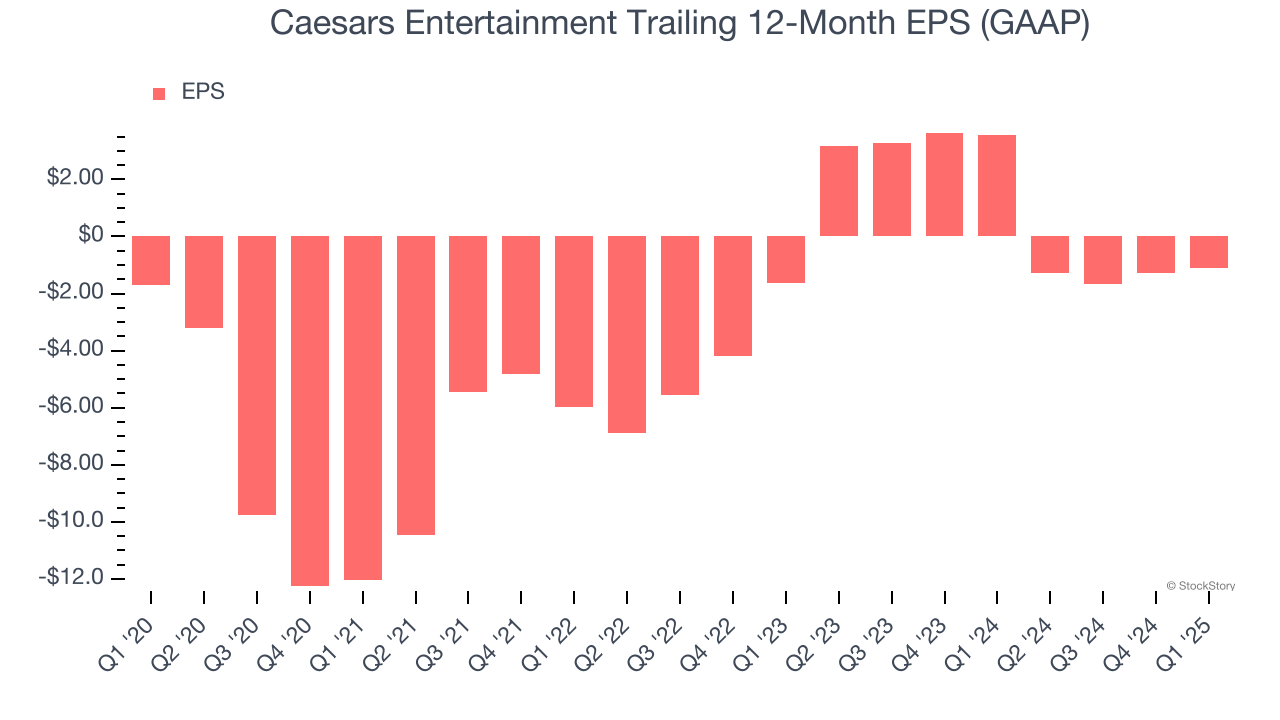

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Caesars Entertainment’s full-year earnings are still negative, it reduced its losses and improved its EPS by 8.6% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q1, Caesars Entertainment reported EPS at negative $0.54, up from negative $0.73 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Caesars Entertainment’s full-year EPS of negative $1.09 will flip to positive $1.18.

Key Takeaways from Caesars Entertainment’s Q1 Results

While revenue was in line, adjusted EBITDA beat. The stock traded up 1.5% to $28.36 immediately after reporting.

Big picture, is Caesars Entertainment a buy here and now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.