Hilton (NYSE:HLT) Reports Sales Below Analyst Estimates In Q1 Earnings

Hotel company Hilton (NYSE: HLT) fell short of the market’s revenue expectations in Q1 CY2025 as sales rose 4.7% year on year to $2.70 billion. Its non-GAAP profit of $1.72 per share was 7% above analysts’ consensus estimates.

Is now the time to buy Hilton? Find out by accessing our full research report, it’s free.

Hilton (HLT) Q1 CY2025 Highlights:

- Revenue: $2.70 billion vs analyst estimates of $2.72 billion (4.7% year-on-year growth, 0.9% miss)

- Adjusted EPS: $1.72 vs analyst estimates of $1.61 (7% beat)

- Adjusted EBITDA: $795 million vs analyst estimates of $784.1 million (29.5% margin, 1.4% beat)

- Management raised its full-year Adjusted EPS guidance to $7.85 at the midpoint, a 1.1% increase

- EBITDA guidance for the full year is $3.68 billion at the midpoint, in line with analyst expectations

- Operating Margin: 19.9%, in line with the same quarter last year

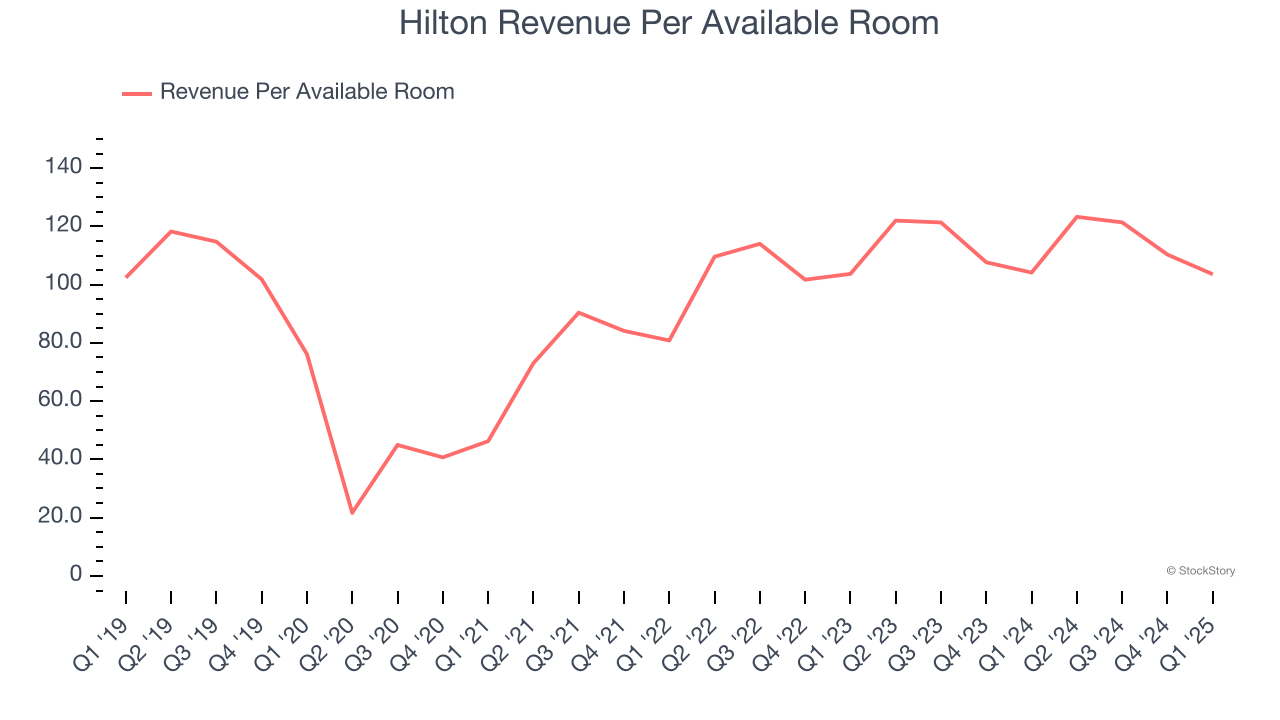

- RevPAR: $103.59 at quarter end, in line with the same quarter last year

- Market Capitalization: $53.1 billion

Christopher J. Nassetta, President & Chief Executive Officer of Hilton, said, "We are pleased with our first quarter results, with strong bottom line performance, even with somewhat weaker macroeconomic conditions. Additionally, we expect our industry-leading brands and powerful commercial engines to continue to drive strong net unit growth. Overall, we remain optimistic about our growth opportunities and are well positioned to continue creating value for our stakeholders in 2025 and beyond. "

Company Overview

Founded in 1919, Hilton Worldwide (NYSE: HLT) is a global hospitality company with a portfolio of hotel brands.

Sales Growth

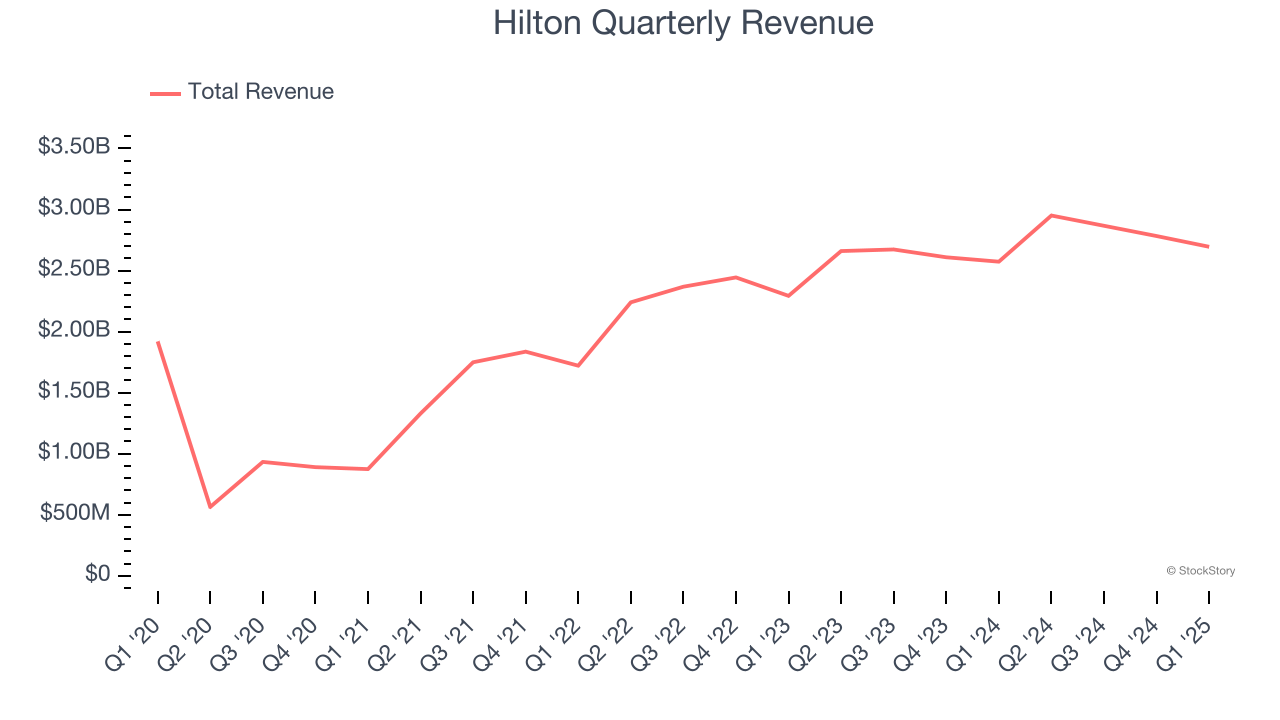

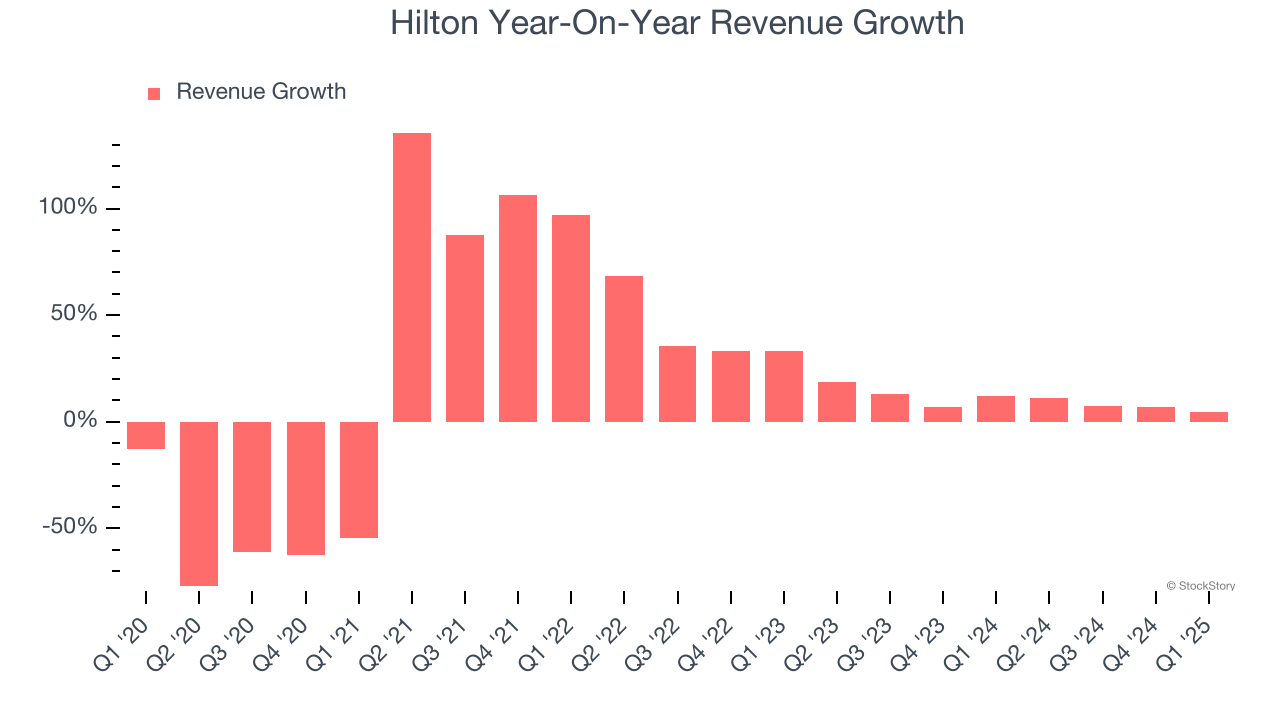

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Hilton’s sales grew at a sluggish 4.3% compounded annual growth rate over the last five years. This was below our standard for the consumer discretionary sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Hilton’s annualized revenue growth of 9.9% over the last two years is above its five-year trend, but we were still disappointed by the results.

We can dig further into the company’s revenue dynamics by analyzing its revenue per available room, which clocked in at $103.59 this quarter and is a key metric accounting for daily rates and occupancy levels. Over the last two years, Hilton’s revenue per room averaged 3.4% year-on-year growth. Because this number is lower than its revenue growth, we can see its sales from other areas like restaurants, bars, and amenities outperformed its room bookings.

This quarter, Hilton’s revenue grew by 4.7% year on year to $2.70 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 8.6% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

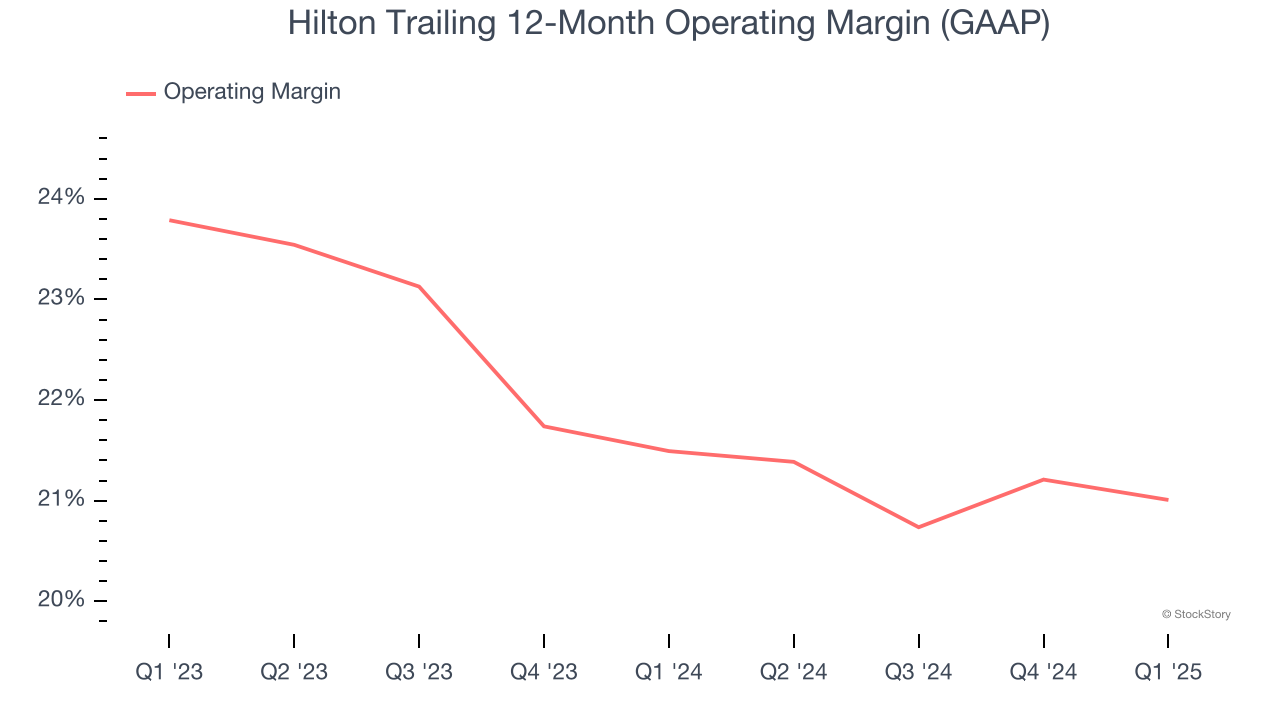

Operating Margin

Hilton’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 21.2% over the last two years. This profitability was top-notch for a consumer discretionary business, showing it’s an well-run company with an efficient cost structure.

This quarter, Hilton generated an operating profit margin of 19.9%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

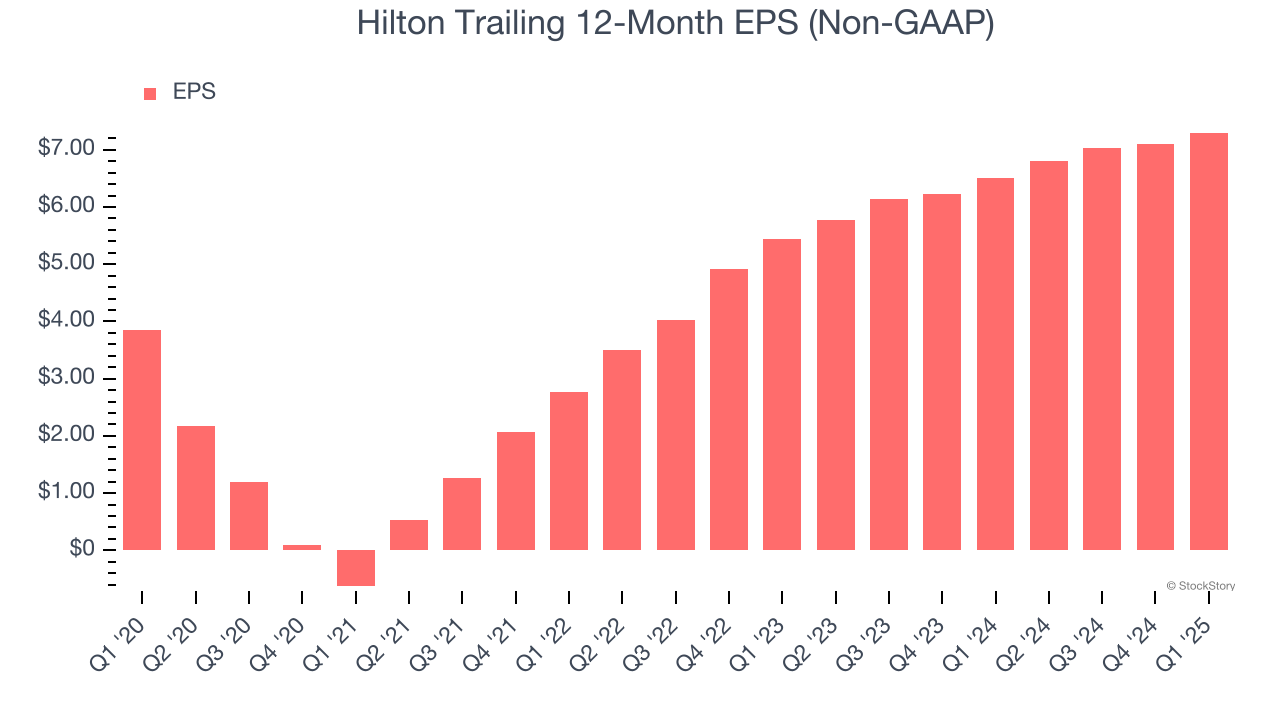

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Hilton’s EPS grew at a solid 13.7% compounded annual growth rate over the last five years, higher than its 4.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q1, Hilton reported EPS at $1.72, up from $1.53 in the same quarter last year. This print beat analysts’ estimates by 7%. Over the next 12 months, Wall Street expects Hilton’s full-year EPS of $7.30 to grow 11.8%.

Key Takeaways from Hilton’s Q1 Results

It was encouraging to see Hilton beat analysts’ EPS expectations this quarter. On the other hand, its revenue slightly missed and its EBITDA guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 2.3% to $216.73 immediately after reporting.

Is Hilton an attractive investment opportunity at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.