MSA Safety (NYSE:MSA) Beats Expectations in Strong Q1

Safety equipment manufacturer MSA Safety (NYSE: MSA) reported Q1 CY2025 results exceeding the market’s revenue expectations, with sales up 1.9% year on year to $421.3 million. Its non-GAAP profit of $1.68 per share was 6.3% above analysts’ consensus estimates.

Is now the time to buy MSA Safety? Find out by accessing our full research report, it’s free.

MSA Safety (MSA) Q1 CY2025 Highlights:

- Revenue: $421.3 million vs analyst estimates of $401.3 million (1.9% year-on-year growth, 5% beat)

- Adjusted EPS: $1.68 vs analyst estimates of $1.58 (6.3% beat)

- Adjusted EBITDA: $101.5 million vs analyst estimates of $96.52 million (24.1% margin, 5.1% beat)

- Operating Margin: 18.5%, down from 21.7% in the same quarter last year

- Free Cash Flow Margin: 12.1%, up from 9.6% in the same quarter last year

- Market Capitalization: $5.99 billion

"Our solid first quarter results demonstrate the team's continued dedication to executing our Accelerate strategy. Within our diversified portfolio, revenue growth was fueled by robust performance in detection and partnering with our customers to accelerate some shipments in consideration of tariffs," said Steve Blanco, MSA Safety President and CEO.

Company Overview

Founded in 1914 as Mine Safety Appliances to protect coal miners from dangerous gases, MSA Safety (NYSE: MSA) designs and manufactures advanced safety products that protect workers and facilities across industries including fire service, energy, construction, and manufacturing.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $1.82 billion in revenue over the past 12 months, MSA Safety is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

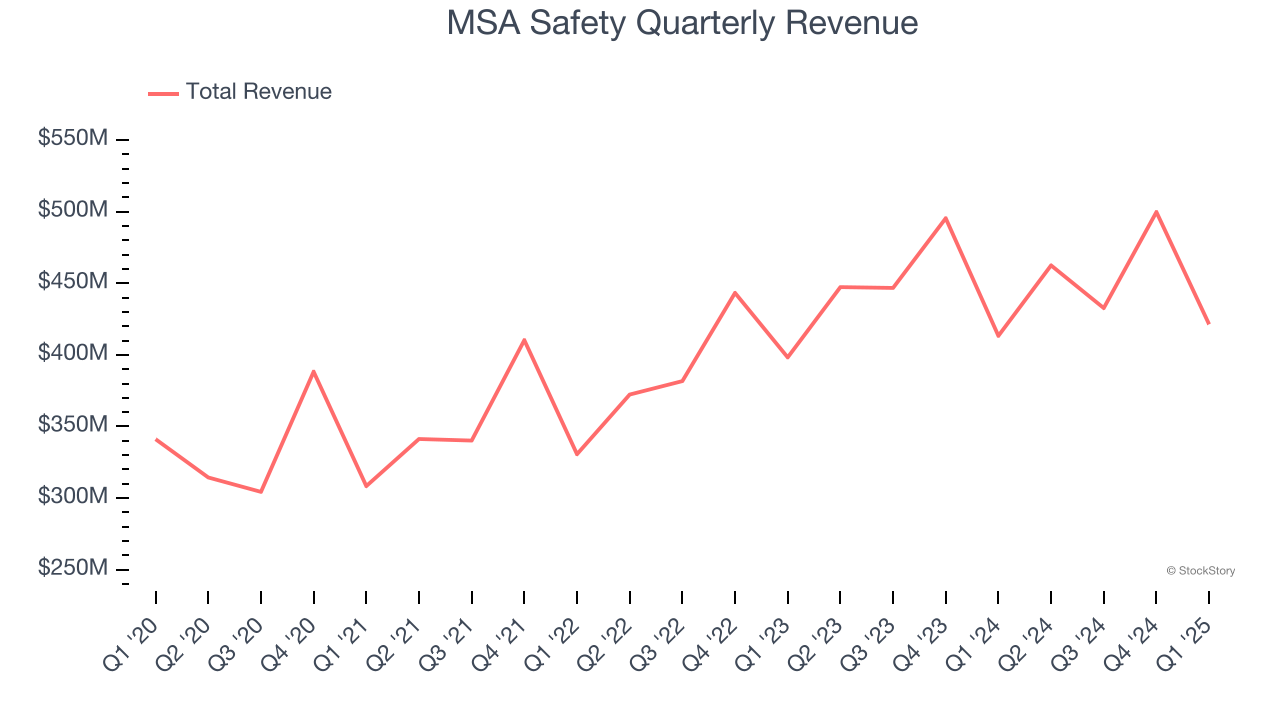

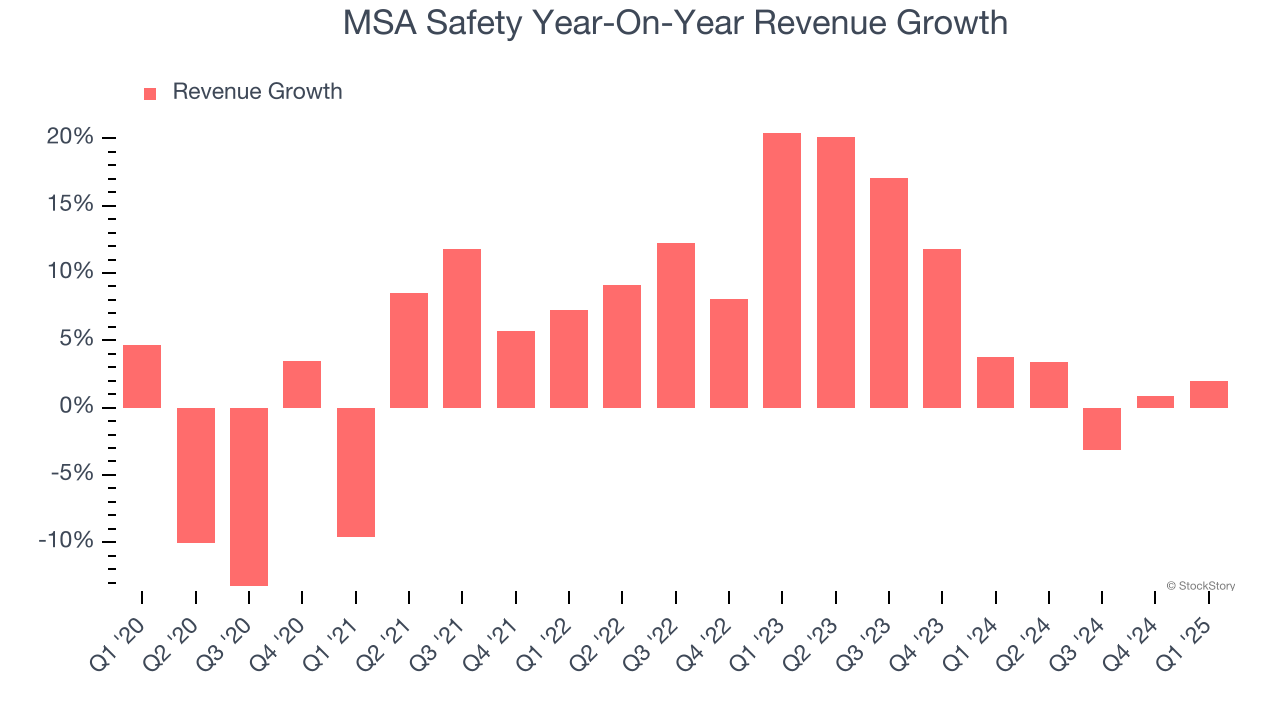

As you can see below, MSA Safety’s 5.1% annualized revenue growth over the last five years was decent. This shows its offerings generated slightly more demand than the average business services company, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. MSA Safety’s annualized revenue growth of 6.7% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, MSA Safety reported modest year-on-year revenue growth of 1.9% but beat Wall Street’s estimates by 5%.

Looking ahead, sell-side analysts expect revenue to grow 1.1% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

MSA Safety has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 20.6%.

Looking at the trend in its profitability, MSA Safety’s operating margin rose by 4.8 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q1, MSA Safety generated an operating profit margin of 18.5%, down 3.2 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

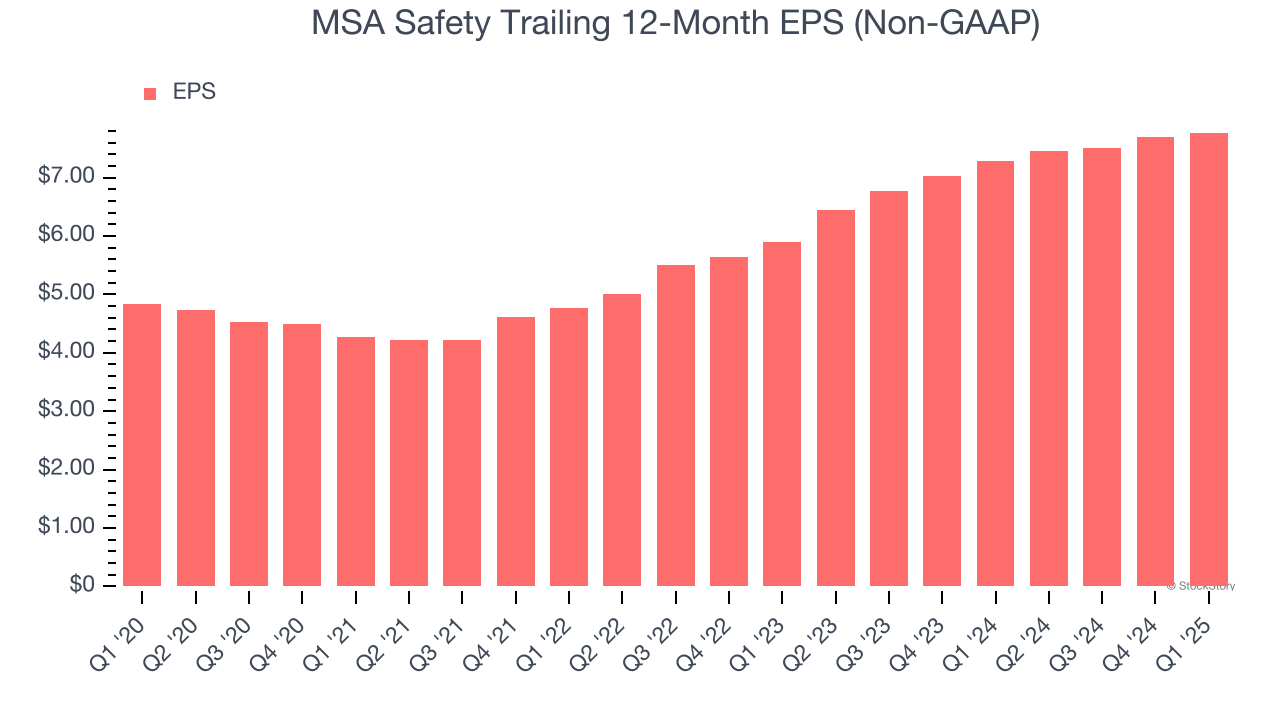

MSA Safety’s EPS grew at a solid 9.9% compounded annual growth rate over the last five years, higher than its 5.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into MSA Safety’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, MSA Safety’s operating margin declined this quarter but expanded by 4.8 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, MSA Safety reported EPS at $1.68, up from $1.61 in the same quarter last year. This print beat analysts’ estimates by 6.3%. Over the next 12 months, Wall Street expects MSA Safety’s full-year EPS of $7.77 to grow 6.6%.

Key Takeaways from MSA Safety’s Q1 Results

We enjoyed seeing MSA Safety beat analysts’ revenue expectations this quarter. We were also happy its EPS and EBITDA outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The market seemed to be hoping for more, and the stock traded down 2.2% to $150.50 immediately following the results.

Is MSA Safety an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.