Unpacking Q4 Earnings: Marqeta (NASDAQ:MQ) In The Context Of Other Finance and HR Software Stocks

Wrapping up Q4 earnings, we look at the numbers and key takeaways for the finance and hr software stocks, including Marqeta (NASDAQ: MQ) and its peers.

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 14 finance and hr software stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.1% while next quarter’s revenue guidance was 1.4% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 11.6% since the latest earnings results.

Marqeta (NASDAQ: MQ)

Founded by CEO Jason Gardner in 2009, Marqeta (NASDAQ: MQ) is an innovative card issuer that provides companies with the ability to issue and process virtual, physical, and tokenized credit and debit cards.

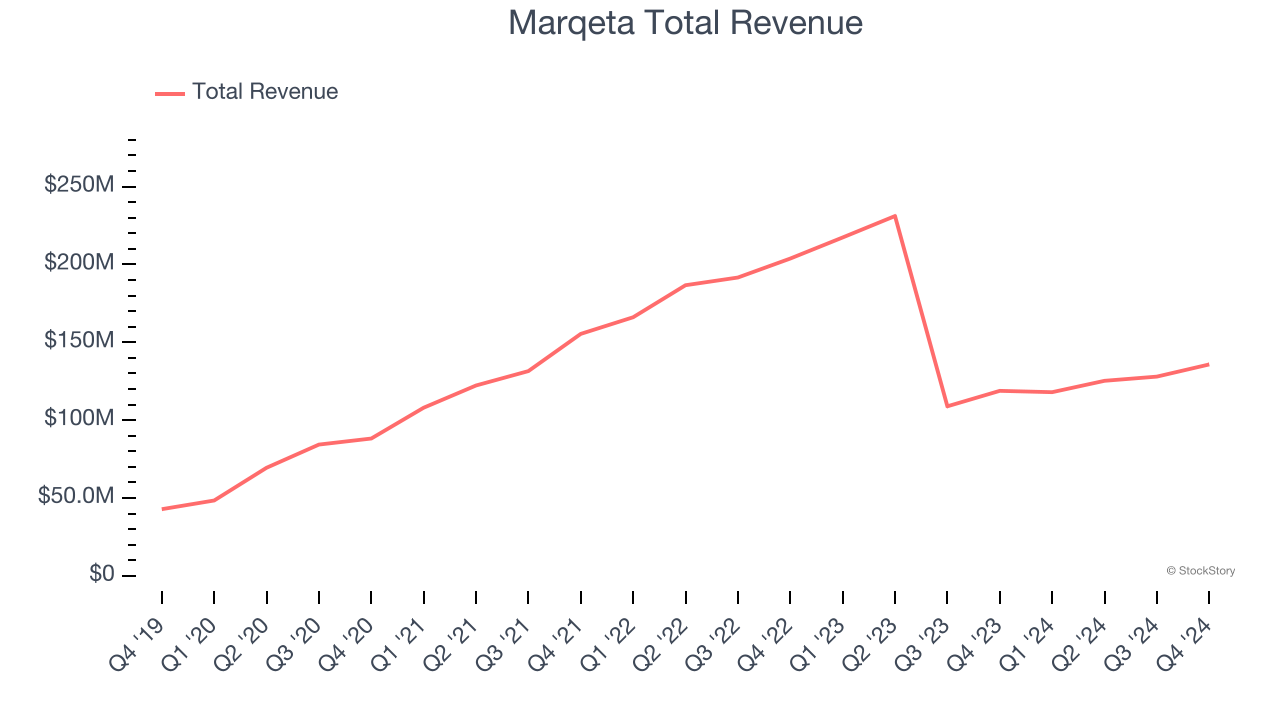

Marqeta reported revenues of $135.8 million, up 14.3% year on year. This print exceeded analysts’ expectations by 3%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ total payment volume estimates.

"In 2024, we empowered our customers to achieve significant growth and scale, maintaining both stability and compliance," said Mike Milotich, Interim CEO at Marqeta.

Interestingly, the stock is up 13.9% since reporting and currently trades at $3.97.

Is now the time to buy Marqeta? Access our full analysis of the earnings results here, it’s free.

Best Q4: Workday (NASDAQ: WDAY)

Founded by industry veterans Aneel Bushri and Dave Duffield after their former company PeopleSoft was acquired by Oracle in a hostile takeover, Workday (NASDAQ: WDAY) provides cloud-based software for organizations to manage and plan finance and human resources.

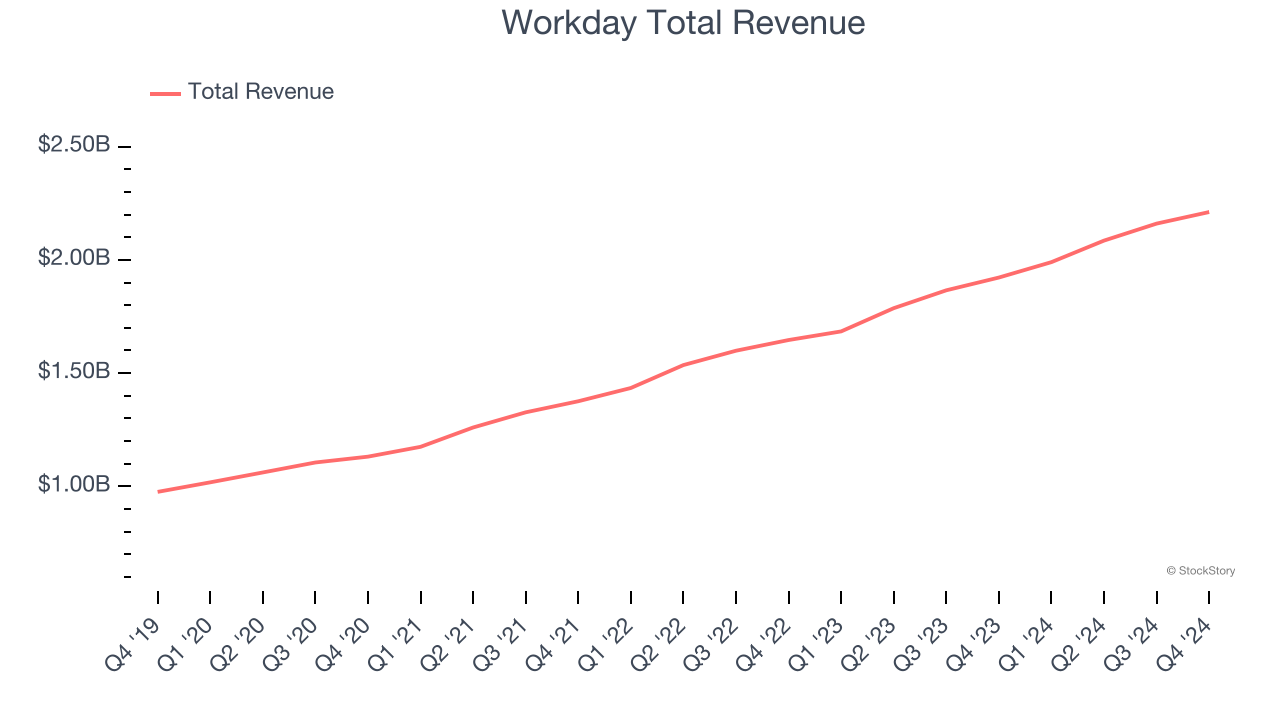

Workday reported revenues of $2.21 billion, up 15% year on year, outperforming analysts’ expectations by 1.3%. The business had a very strong quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ billings estimates.

The stock is down 5.8% since reporting. It currently trades at $240.40.

Is now the time to buy Workday? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Flywire (NASDAQ: FLYW)

Originally created to process international tuition payments for universities, Flywire (NASDAQ: FLYW) is a cross border payments processor and software platform focusing on complex, high-value transactions like education, healthcare and B2B payments.

Flywire reported revenues of $117.6 million, up 22.4% year on year, falling short of analysts’ expectations by 4.9%. It was a softer quarter as it posted revenue guidance for next quarter slightly missing analysts’ expectations.

Flywire delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. As expected, the stock is down 49.4% since the results and currently trades at $8.92.

Read our full analysis of Flywire’s results here.

Workiva (NYSE: WK)

Founded in 2010, Workiva (NYSE: WK) offers software as a service product that makes financial and compliance reporting easier, especially for publicly traded corporations.

Workiva reported revenues of $199.9 million, up 19.9% year on year. This result topped analysts’ expectations by 2.4%. Taking a step back, it was a mixed quarter as it also logged an impressive beat of analysts’ EBITDA estimates but full-year EPS guidance missing analysts’ expectations significantly.

Workiva scored the highest full-year guidance raise among its peers. The company added 129 enterprise customers paying more than $100,000 annually to reach a total of 2,055. The stock is down 12.4% since reporting and currently trades at $73.32.

Read our full, actionable report on Workiva here, it’s free.

Paychex (NASDAQ: PAYX)

One of the oldest service providers in the industry, Paychex (NASDAQ: PAYX) offers its customers payroll and HR software solutions.

Paychex reported revenues of $1.51 billion, up 4.8% year on year. This print met analysts’ expectations. More broadly, it was a mixed quarter as it underperformed in some other aspects of the business.

Paychex had the slowest revenue growth among its peers. The stock is flat since reporting and currently trades at $144.73.

Read our full, actionable report on Paychex here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.