Teladoc’s (NYSE:TDOC) Q1 Sales Beat Estimates

Digital medical services platform Teladoc Health (NYSE: TDOC) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, but sales fell by 2.6% year on year to $629.4 million. The company expects next quarter’s revenue to be around $623.5 million, close to analysts’ estimates. Its GAAP loss of $0.53 per share was 57.8% below analysts’ consensus estimates.

Is now the time to buy Teladoc? Find out by accessing our full research report, it’s free.

Teladoc (TDOC) Q1 CY2025 Highlights:

- Revenue: $629.4 million vs analyst estimates of $618.9 million (2.6% year-on-year decline, 1.7% beat)

- EPS (GAAP): -$0.53 vs analyst expectations of -$0.34 (57.8% miss)

- Adjusted EBITDA: $58.09 million vs analyst estimates of $53.54 million (9.2% margin, 8.5% beat)

- The company reconfirmed its revenue guidance for the full year of $2.52 billion at the midpoint

- EBITDA guidance for the full year is $283.5 million at the midpoint, below analyst estimates of $293.2 million

- Operating Margin: -19.2%, down from -13.5% in the same quarter last year

- Free Cash Flow was -$15.67 million, down from $79.77 million in the previous quarter

- U.S. Integrated Care Members: 102.5 million, up 10.7 million year on year

- Market Capitalization: $1.28 billion

“We are pleased with the solid start to 2025. Consolidated revenue and adjusted EBITDA were towards the higher end of our first quarter guidance ranges, including our Integrated Care segment being above our ranges for both measures and BetterHelp segment results in the upper half of our ranges as well. We also continue to make progress towards strategic priorities aimed at driving sustainable performance, including advancing our position in virtual mental health. We are excited about the UpLift acquisition announced today, which will further the BetterHelp segment's ability to support consumers seeking to use their covered benefits for virtual mental health services,” said Chuck Divita, Chief Executive Officer of Teladoc Health.

Company Overview

Founded to help people in rural areas get online medical consultations, Teladoc Health (NYSE: TDOC) is a telemedicine platform that facilitates remote doctor’s visits.

Sales Growth

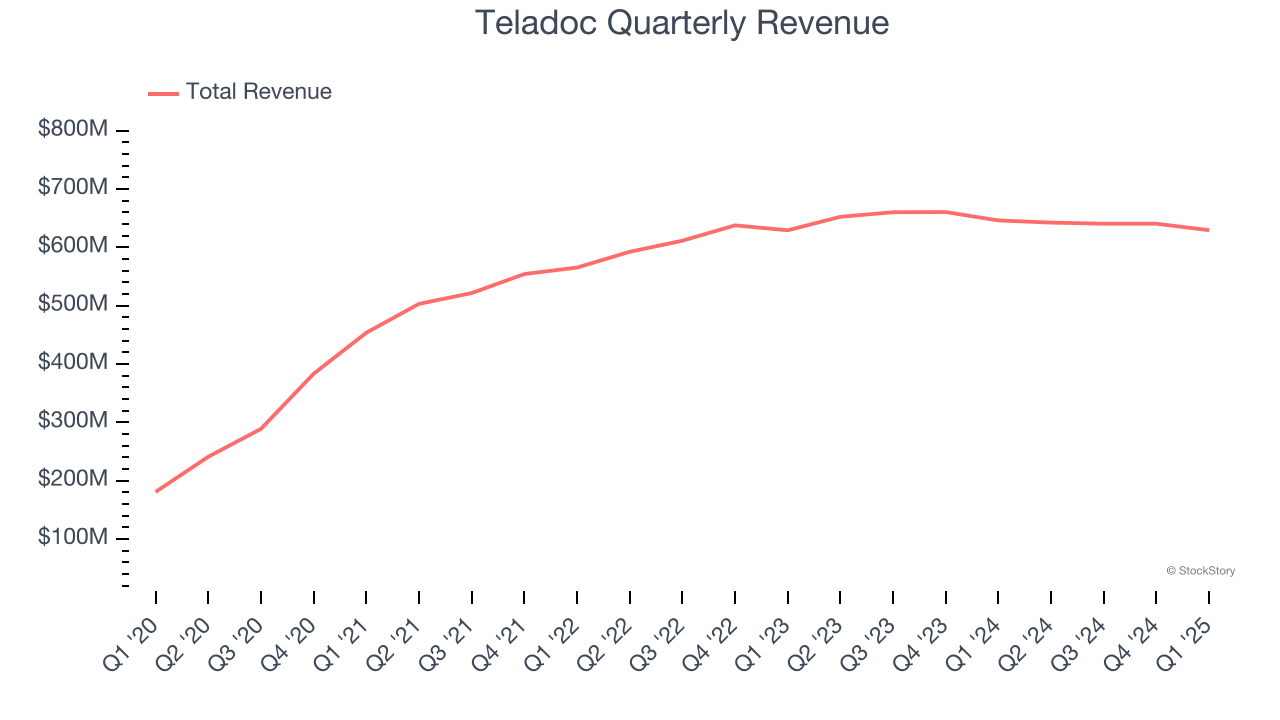

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Teladoc’s sales grew at a sluggish 6% compounded annual growth rate over the last three years. This was below our standard for the consumer internet sector and is a rough starting point for our analysis.

This quarter, Teladoc’s revenue fell by 2.6% year on year to $629.4 million but beat Wall Street’s estimates by 1.7%. Company management is currently guiding for a 2.9% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

U.S. Integrated Care Members

User Growth

As an online marketplace, Teladoc generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

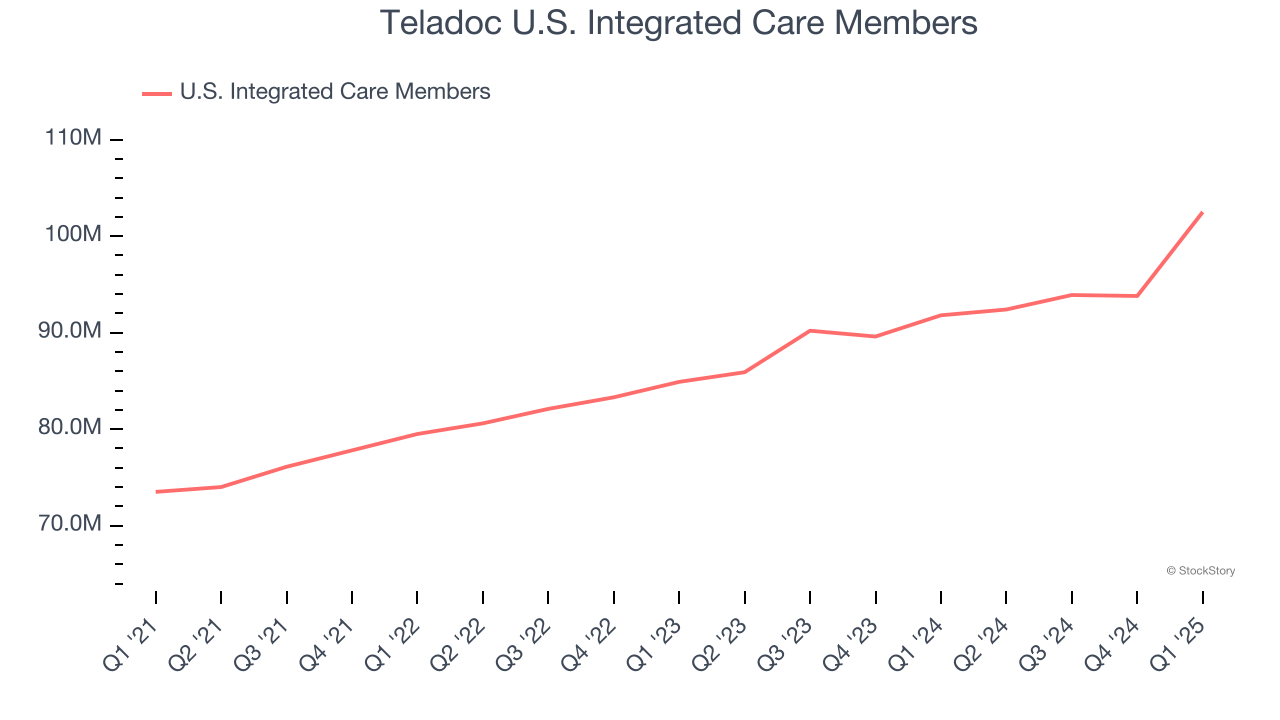

Over the last two years, Teladoc’s u.s. integrated care members, a key performance metric for the company, increased by 7.5% annually to 102.5 million in the latest quarter. This growth rate is decent for a consumer internet business and indicates people enjoy using its offerings.

In Q1, Teladoc added 10.7 million u.s. integrated care members, leading to 11.7% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating user growth.

Revenue Per User

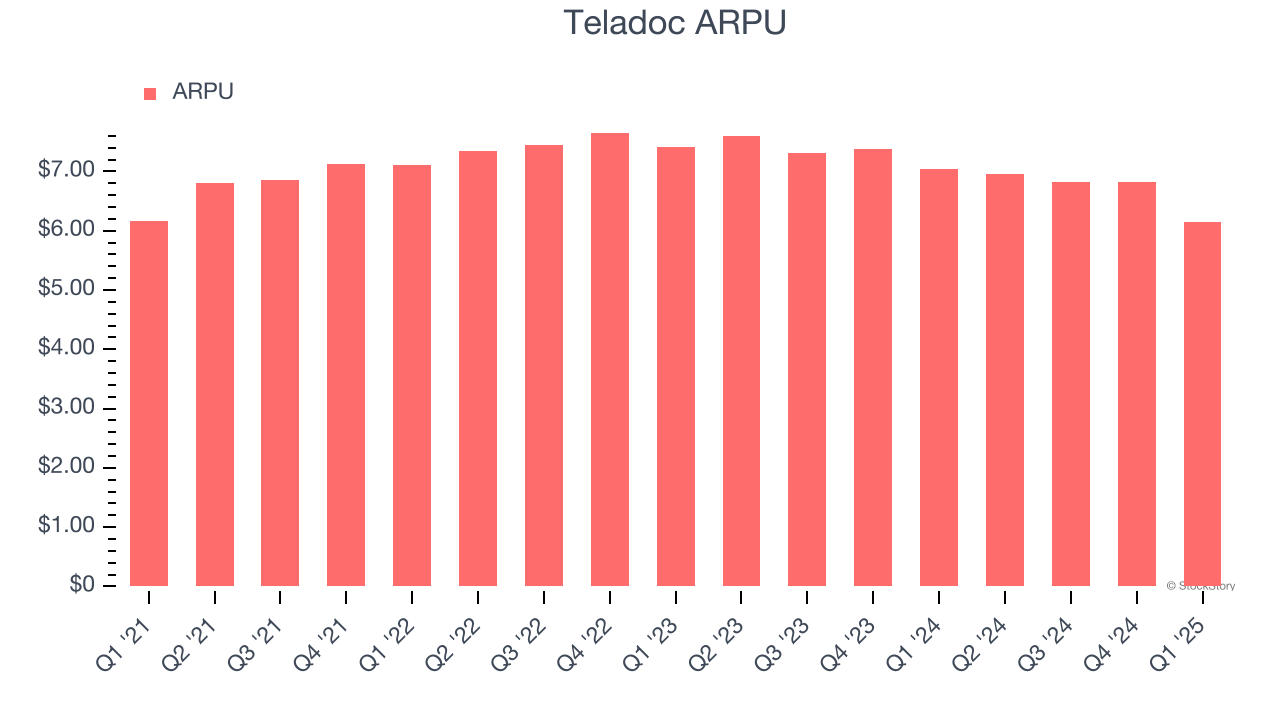

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns in transaction fees from each user. ARPU also gives us unique insights into a user’s average order size and Teladoc’s take rate, or "cut", on each order.

Teladoc’s ARPU fell over the last two years, averaging 5.3% annual declines. This isn’t great, but the increase in u.s. integrated care members is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Teladoc tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

This quarter, Teladoc’s ARPU clocked in at $6.14. It declined 12.8% year on year, worse than the change in its u.s. integrated care members.

Key Takeaways from Teladoc’s Q1 Results

We liked that Teladoc beat analysts’ revenue and EBITDA expectations this quarter. We were also glad it expanded its number of users. On the other hand, its full-year EBITDA guidance missed significantly and its EBITDA guidance for next quarter also fell short of Wall Street’s estimates. The outlook is weighing on shares. The stock traded down 4.4% to $6.85 immediately after reporting.

The latest quarter from Teladoc’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.