3 Reasons ARLO is Risky and 1 Stock to Buy Instead

What a brutal six months it’s been for Arlo Technologies. The stock has dropped 20.3% and now trades at $8.85, rattling many shareholders. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Arlo Technologies, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Even with the cheaper entry price, we're swiping left on Arlo Technologies for now. Here are three reasons why you should be careful with ARLO and a stock we'd rather own.

Why Is Arlo Technologies Not Exciting?

Originally spun off from networking equipment maker Netgear in 2018, Arlo Technologies (NYSE: ARLO) provides cloud-based smart security devices and subscription services that help consumers and businesses monitor and protect their homes, properties, and loved ones.

1. Lackluster Revenue Growth

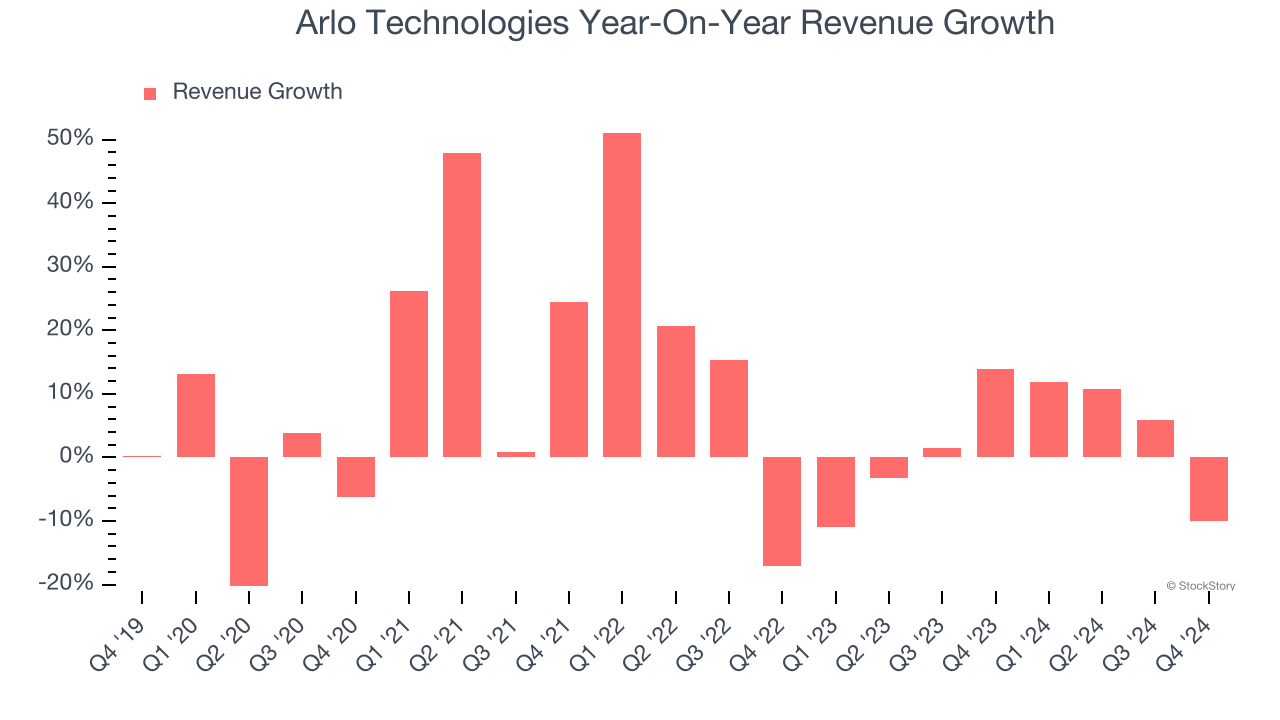

Long-term growth is the most important, but within business services, a stretched historical view may miss new innovations or demand cycles. Arlo Technologies’s recent performance shows its demand has slowed as its annualized revenue growth of 2.1% over the last two years was below its five-year trend.

2. Fewer Distribution Channels Limit its Ceiling

With $510.9 million in revenue over the past 12 months, Arlo Technologies is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

3. Cash Burn Ignites Concerns

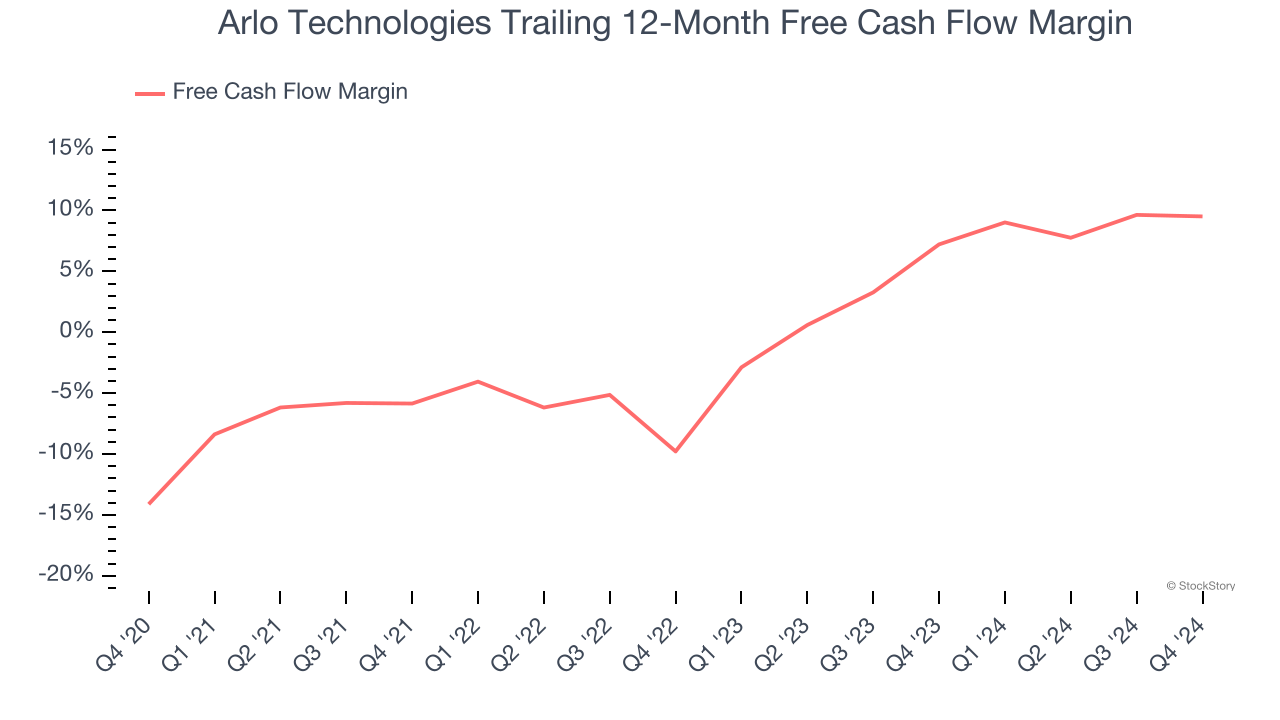

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

While Arlo Technologies posted positive free cash flow this quarter, the broader story hasn’t been so clean. Arlo Technologies’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1.7%, meaning it lit $1.74 of cash on fire for every $100 in revenue.

Final Judgment

Arlo Technologies’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 16.4× forward price-to-earnings (or $8.85 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d suggest looking at one of our top digital advertising picks.

Stocks We Like More Than Arlo Technologies

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.