3 Reasons to Avoid TPC and 1 Stock to Buy Instead

Tutor Perini has gotten torched over the last six months - since October 2024, its stock price has dropped 23.4% to $20.26 per share. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Tutor Perini, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Even with the cheaper entry price, we're swiping left on Tutor Perini for now. Here are three reasons why we avoid TPC and a stock we'd rather own.

Why Do We Think Tutor Perini Will Underperform?

Known for constructing the Philadelphia Eagles’ Stadium, Tutor Perini (NYSE: TPC) is a civil and building construction company offering diversified general contracting and design-build services.

1. Long-Term Revenue Growth Flatter Than a Pancake

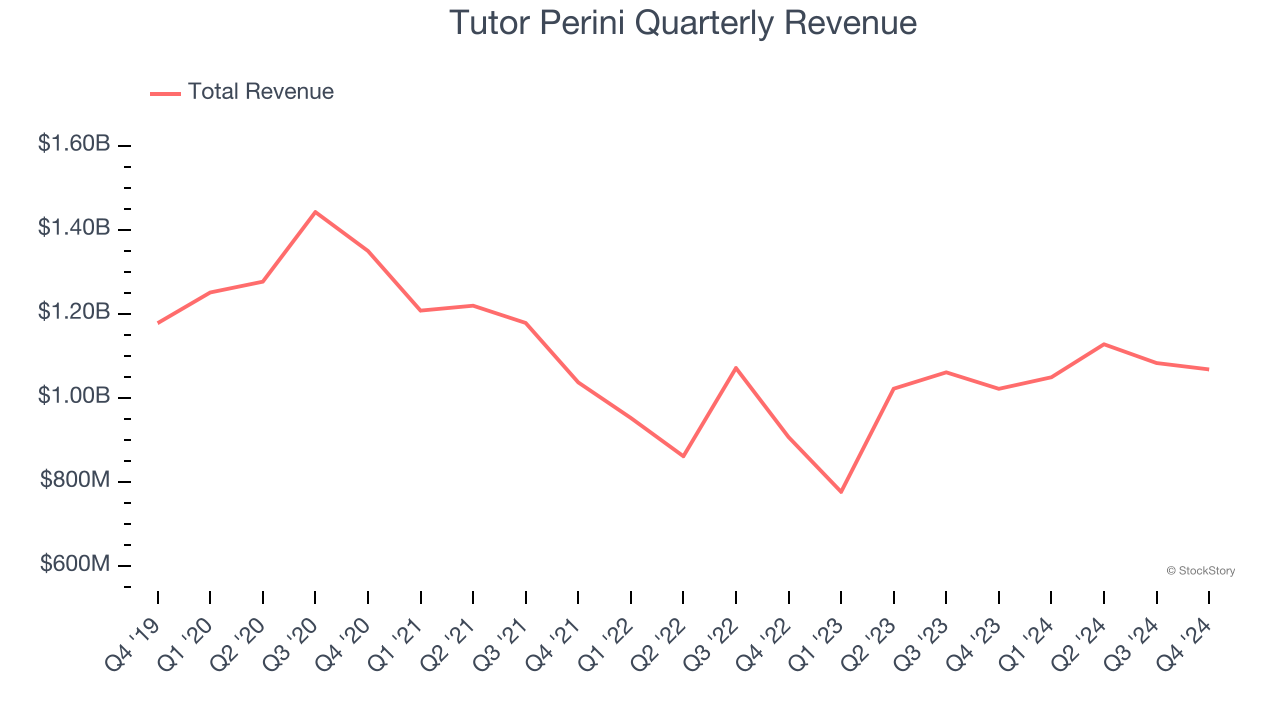

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Tutor Perini struggled to consistently increase demand as its $4.33 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and signals it’s a low quality business.

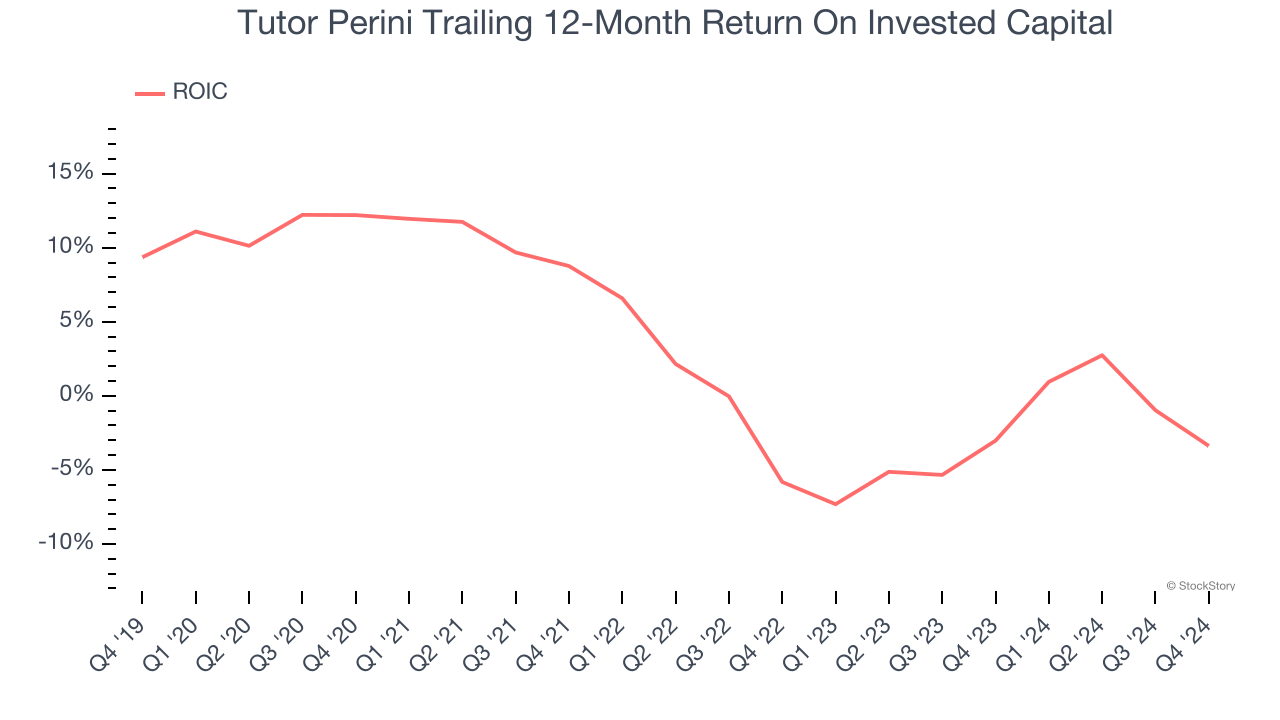

2. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Tutor Perini’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

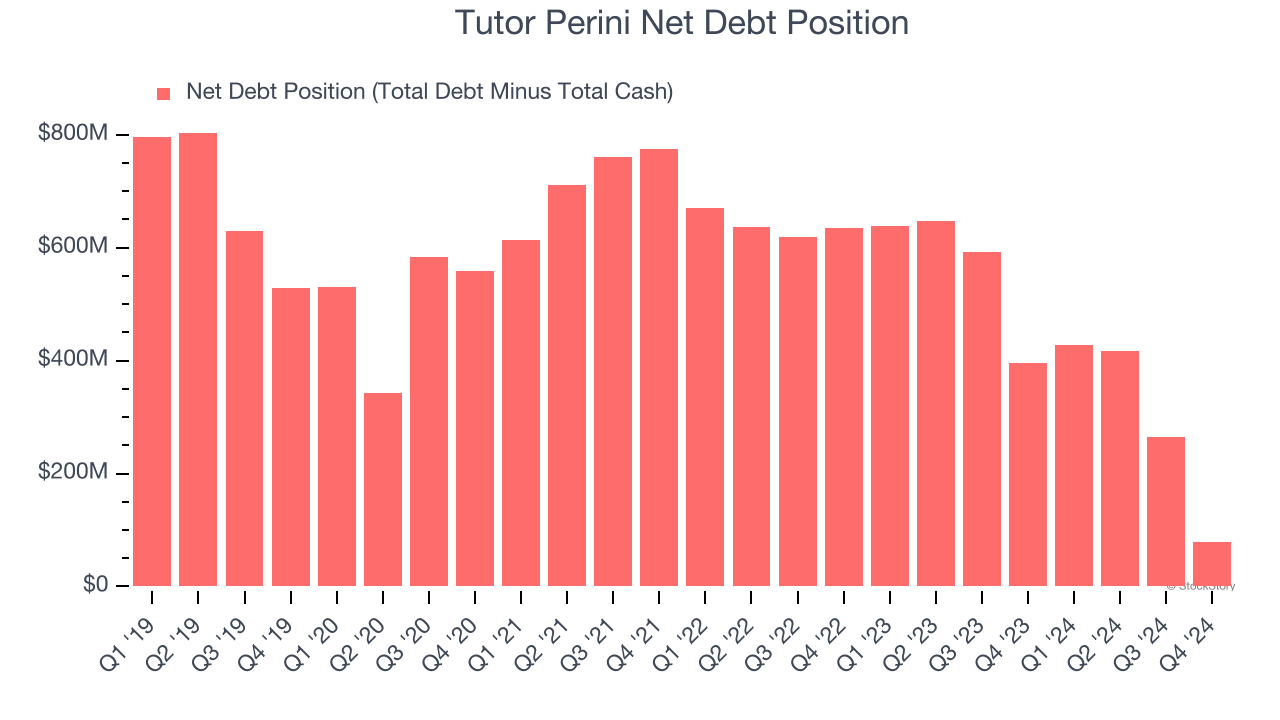

3. Restricted Access to Capital Increases Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Tutor Perini posted negative $12.12 million of EBITDA over the last 12 months, and its $534.1 million of debt exceeds the $455.1 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

We implore our readers to tread carefully because credit agencies could downgrade Tutor Perini if its unprofitable ways continue, making incremental borrowing more expensive and restricting growth prospects. The company could also be backed into a corner if the market turns unexpectedly. We hope Tutor Perini can improve its profitability and remain cautious until then.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of Tutor Perini, we’ll be cheering from the sidelines. After the recent drawdown, the stock trades at 12.6× forward price-to-earnings (or $20.26 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are superior stocks to buy right now. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Tutor Perini

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.