Q4 Earnings Roundup: Salesforce (NYSE:CRM) And The Rest Of The Sales Software Segment

Let’s dig into the relative performance of Salesforce (NYSE: CRM) and its peers as we unravel the now-completed Q4 sales software earnings season.

Companies need to be able to interact with and sell to their customers as efficiently as possible. This reality coupled with the ongoing migration of enterprises to the cloud drives demand for cloud-based customer relationship management (CRM) software that integrates data analytics with sales and marketing functions.

The 4 sales software stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 2.6% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 27% since the latest earnings results.

Weakest Q4: Salesforce (NYSE: CRM)

Launched in 1999 from a rented one-bedroom apartment in San Francisco by Marc Benioff and his three co-founders, Salesforce (NYSE: CRM) is a software-as-a-service platform that helps companies access, manage, and share sales information such as leads.

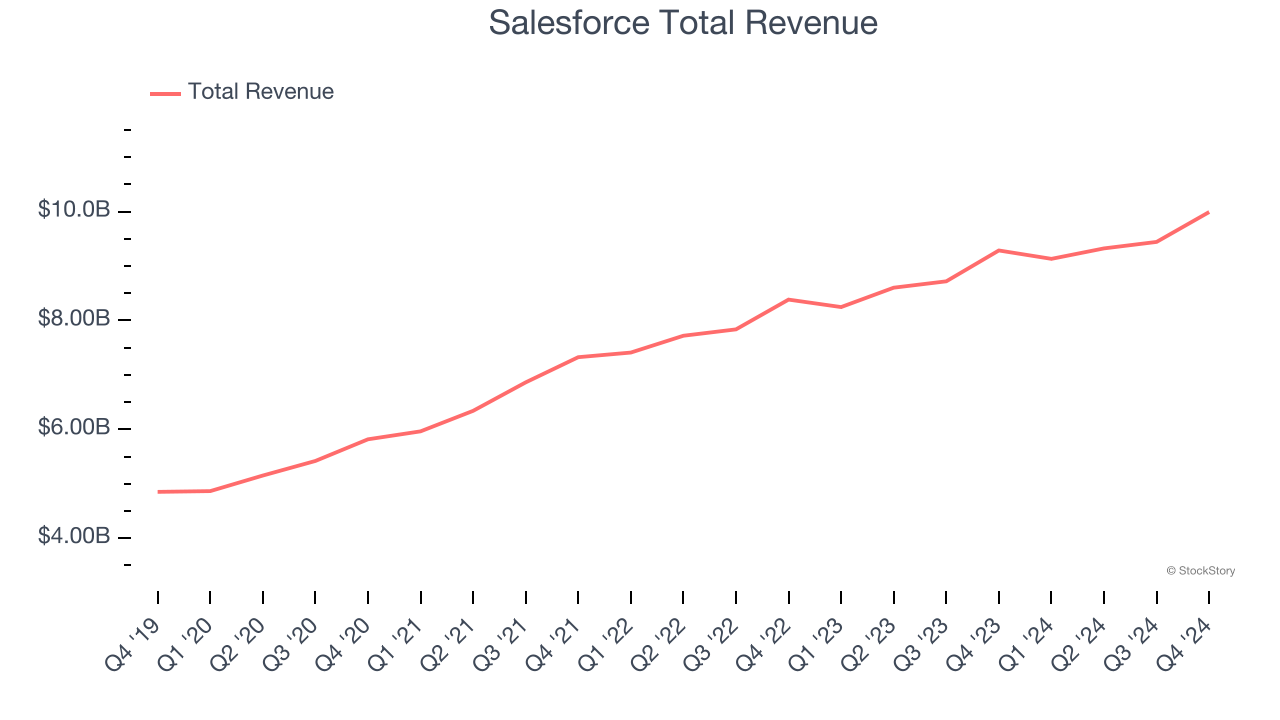

Salesforce reported revenues of $9.99 billion, up 7.6% year on year. This print fell short of analysts’ expectations by 0.5%. Overall, it was a slower quarter for the company with EPS guidance for next quarter missing analysts’ expectations and a slight miss of analysts’ annual recurring revenue estimates.

“We had an incredible quarter and year, with strong performance across all our key metrics, including the highest cash flow in our company’s history and more than $60 billion in RPO,” said Marc Benioff, Chair and CEO, Salesforce.

Salesforce delivered the weakest performance against analyst estimates and weakest full-year guidance update of the whole group. The stock is down 20% since reporting and currently trades at $245.99.

Read our full report on Salesforce here, it’s free.

Best Q4: ZoomInfo (NASDAQ: ZI)

Founded in 2007 as DiscoveryOrg and renamed after a merger in 2019, ZoomInfo (NASDAQ: ZI) is a software as a service product that provides sales departments with access to a database of prospective clients.

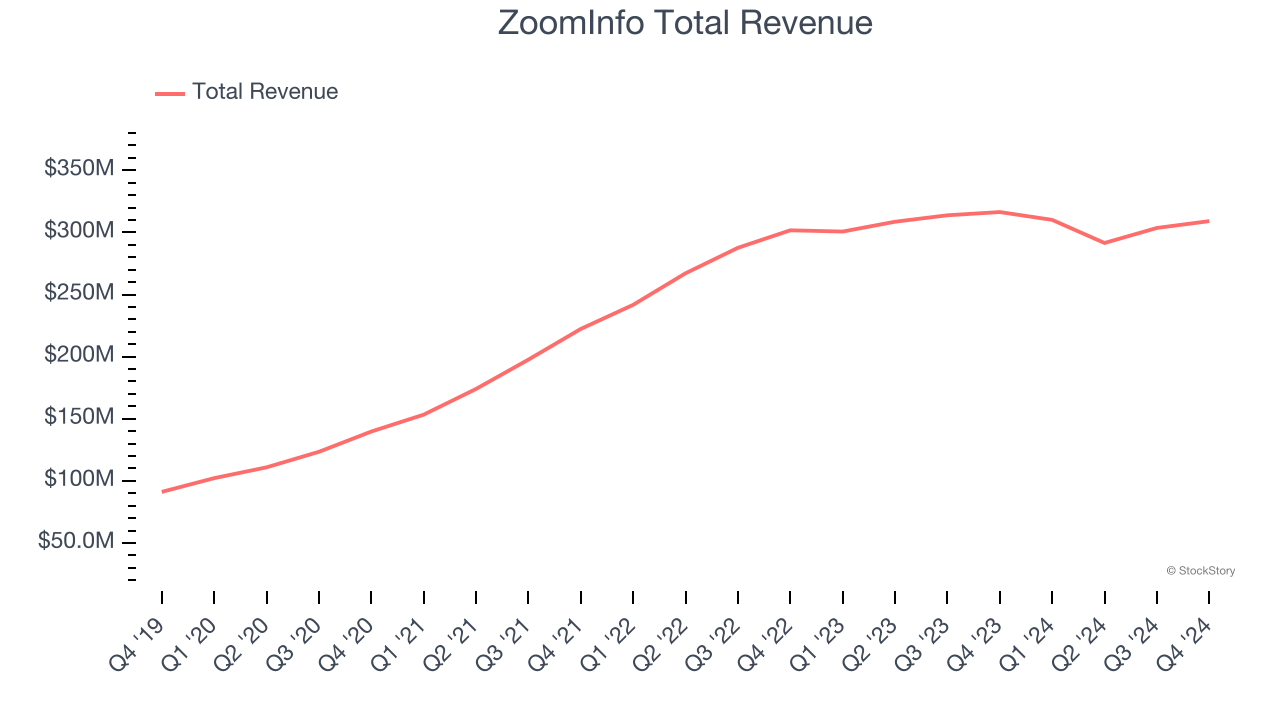

ZoomInfo reported revenues of $309.1 million, down 2.3% year on year, outperforming analysts’ expectations by 3.8%. The business had an exceptional quarter with a solid beat of analysts’ billings estimates and accelerating growth in large customers.

ZoomInfo scored the highest full-year guidance raise among its peers. The company added 58 enterprise customers paying more than $100,000 annually to reach a total of 1,867. The stock is down 23% since reporting. It currently trades at $7.35.

Is now the time to buy ZoomInfo? Access our full analysis of the earnings results here, it’s free.

HubSpot (NYSE: HUBS)

Started in 2006 by two MIT grad students, HubSpot (NYSE: HUBS) is a software-as-a-service platform that helps small and medium-sized businesses market themselves, sell, and get found on the internet.

HubSpot reported revenues of $703.2 million, up 20.8% year on year, exceeding analysts’ expectations by 4.4%. Still, it was a mixed quarter as it posted EPS guidance for next quarter missing analysts’ expectations significantly.

As expected, the stock is down 38.1% since the results and currently trades at $486.07.

Read our full analysis of HubSpot’s results here.

Freshworks (NASDAQ: FRSH)

Founded in Chennai, India in 2010 with the idea of creating a “fresh” helpdesk product, Freshworks (NASDAQ: FRSH) offers a broad range of software targeted at small and medium-sized businesses.

Freshworks reported revenues of $194.6 million, up 21.5% year on year. This number topped analysts’ expectations by 2.7%. Overall, it was a strong quarter as it also recorded a solid beat of analysts’ billings estimates and EPS guidance for next quarter exceeding analysts’ expectations.

Freshworks pulled off the fastest revenue growth among its peers. The company added 199 enterprise customers paying more than $5,000 annually to reach a total of 22,558. The stock is down 27% since reporting and currently trades at $13.04.

Read our full, actionable report on Freshworks here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.