Perdoceo Education (NASDAQ:PRDO) Posts Better-Than-Expected Sales In Q1

Higher education company Perdoceo Education (NASDAQ: PRDO) reported Q1 CY2025 results exceeding the market’s revenue expectations, with sales up 26.6% year on year to $213 million. Its non-GAAP profit of $0.70 per share was 6.1% above analysts’ consensus estimates.

Is now the time to buy Perdoceo Education? Find out by accessing our full research report, it’s free.

Perdoceo Education (PRDO) Q1 CY2025 Highlights:

- Revenue: $213 million vs analyst estimates of $208 million (26.6% year-on-year growth, 2.4% beat)

- Adjusted EPS: $0.70 vs analyst estimates of $0.66 (6.1% beat)

- Adjusted EBITDA: $63.53 million vs analyst estimates of $64.3 million (29.8% margin, 1.2% miss)

- Management raised its full-year Adjusted EPS guidance to $2.48 at the midpoint, a 2.9% increase

- Operating Margin: 24.3%, down from 28.5% in the same quarter last year

- Free Cash Flow Margin: 29.8%, down from 31.7% in the same quarter last year

- Market Capitalization: $1.65 billion

"First quarter results exceeded our expectations as CTU and AIUS continued to operate at historically high levels of student retention and engagement, and experienced increased levels of prospective student interest, a trend we expect to continue this year,” said Todd Nelson, President and Chief Executive Officer.

Company Overview

Formerly known as Career Education Corporation, Perdoceo Education (NASDAQ: PRDO) is an educational services company that specializes in postsecondary education.

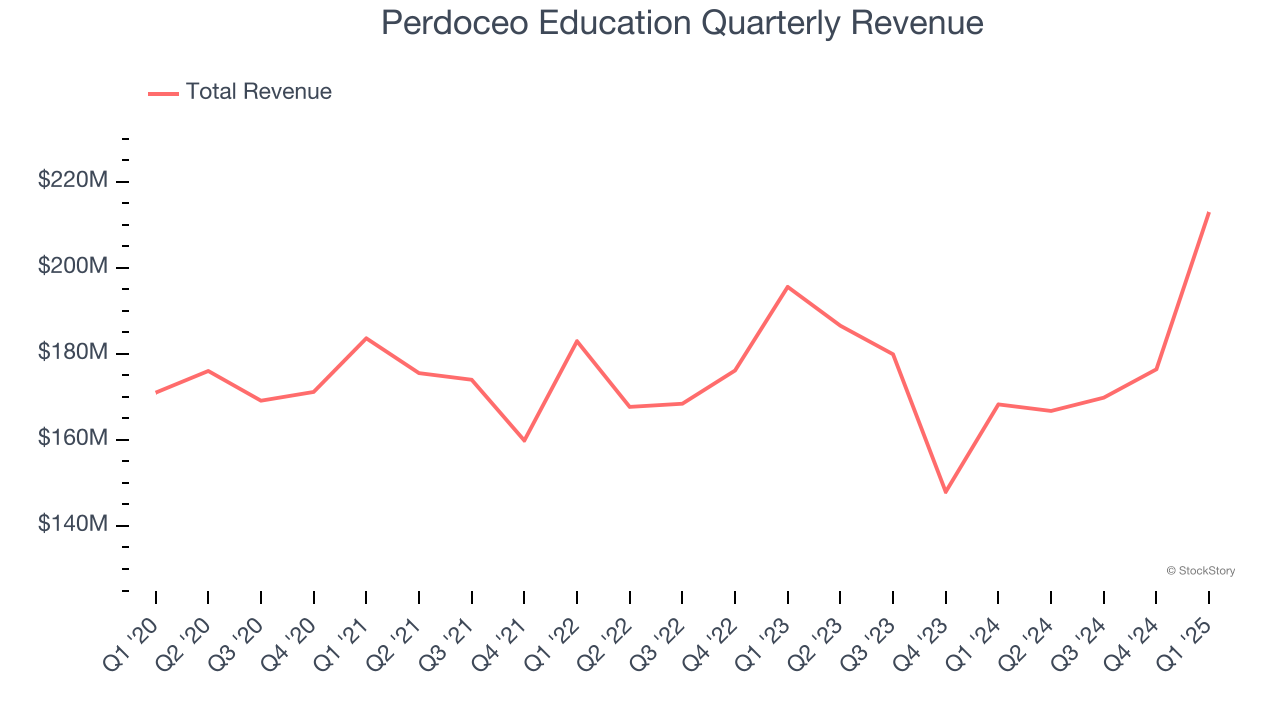

Sales Growth

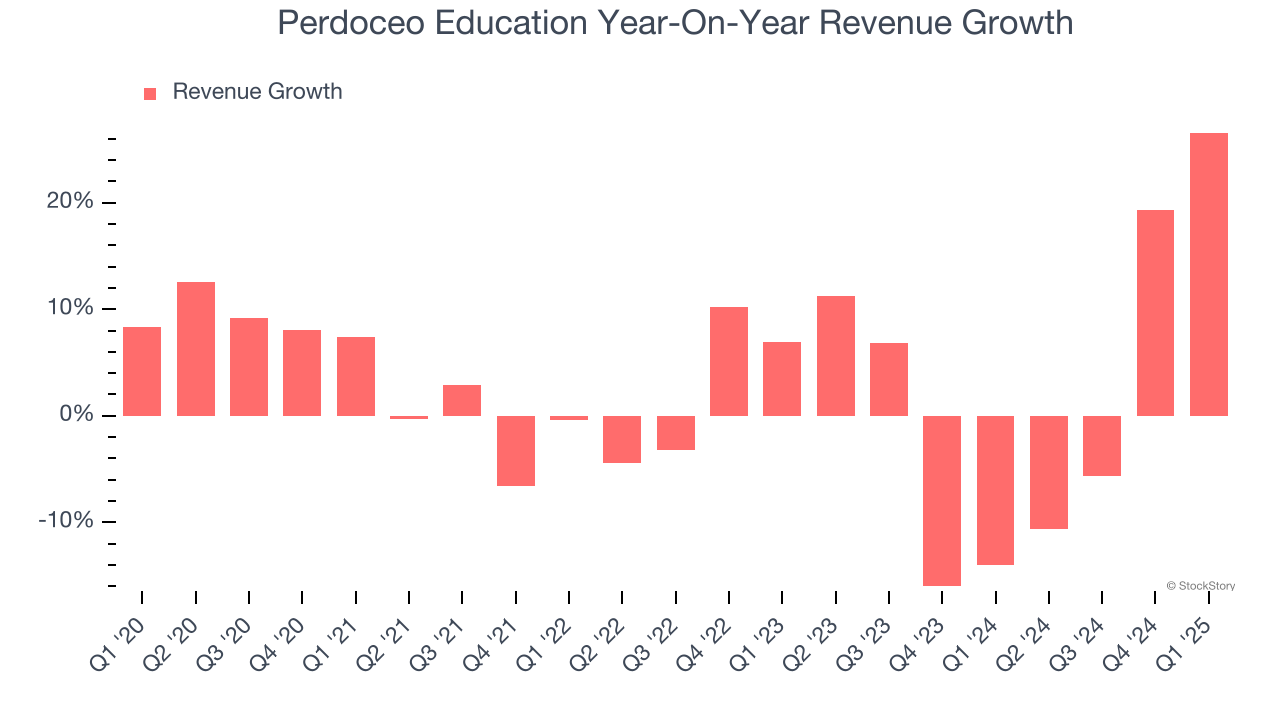

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Perdoceo Education grew its sales at a weak 2.5% compounded annual growth rate. This fell short of our benchmarks and is a poor baseline for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Perdoceo Education’s recent performance shows its demand has slowed as its annualized revenue growth of 1.3% over the last two years was below its five-year trend.

This quarter, Perdoceo Education reported robust year-on-year revenue growth of 26.6%, and its $213 million of revenue topped Wall Street estimates by 2.4%.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

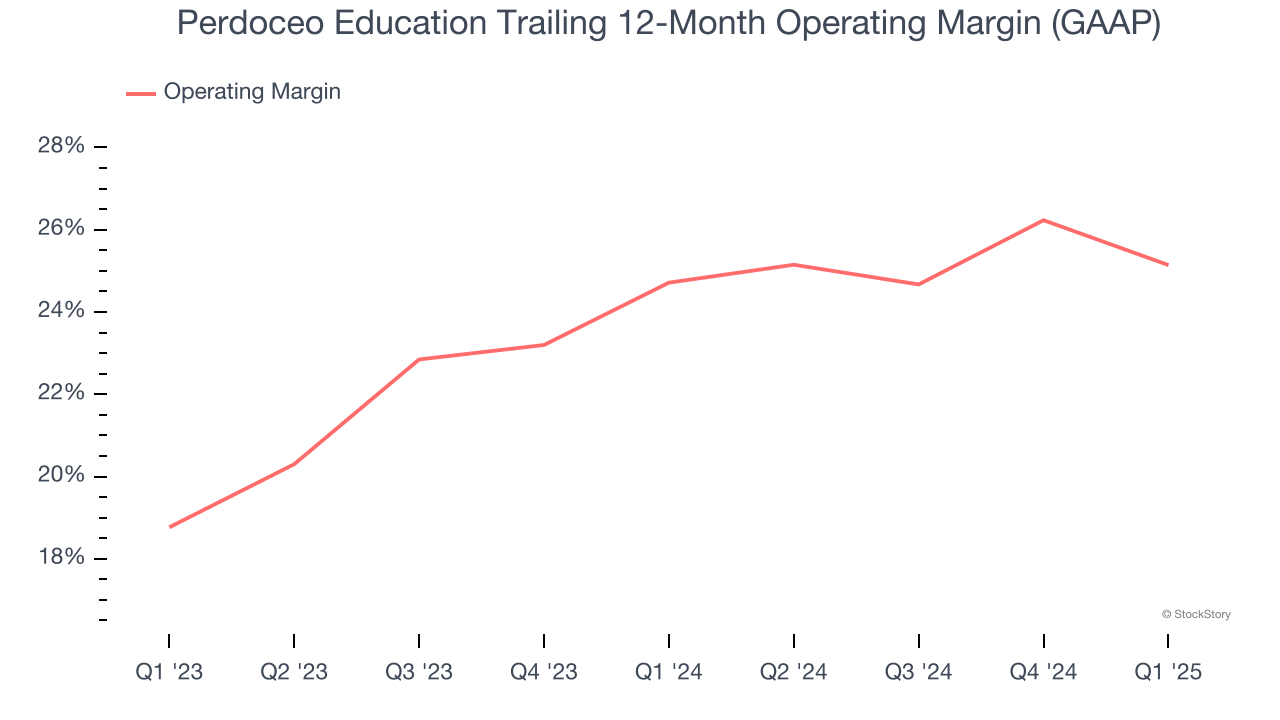

Operating Margin

Perdoceo Education’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 24.9% over the last two years. This profitability was elite for a consumer discretionary business thanks to its efficient cost structure and economies of scale.

This quarter, Perdoceo Education generated an operating profit margin of 24.3%, down 4.2 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

Earnings Per Share

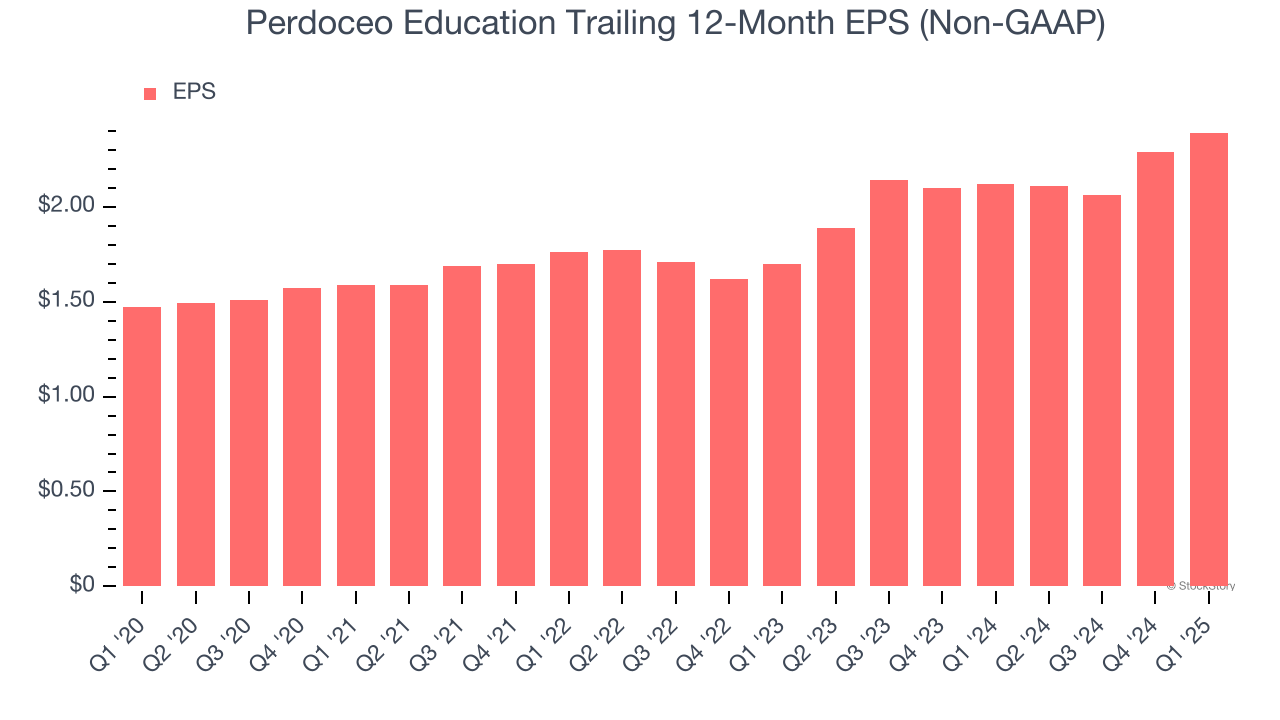

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Perdoceo Education’s EPS grew at a decent 10.2% compounded annual growth rate over the last five years, higher than its 2.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q1, Perdoceo Education reported EPS at $0.70, up from $0.60 in the same quarter last year. This print beat analysts’ estimates by 6.1%. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Perdoceo Education’s Q1 Results

It was great to see Perdoceo Education’s EPS guidance for next quarter top analysts’ expectations. We were also happy its revenue outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 2.5% to $25.78 immediately after reporting.

Perdoceo Education had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.