Amtech (NASDAQ:ASYS) Misses Q1 Analysts’ Revenue Estimates

Semiconductor production equipment provider Amtech Systems (NASDAQ: ASYS) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 38.7% year on year to $15.6 million. Next quarter’s revenue guidance of $17.5 million underwhelmed, coming in 28.9% below analysts’ estimates. Its non-GAAP loss of $0.16 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Amtech? Find out by accessing our full research report, it’s free.

Amtech (ASYS) Q1 CY2025 Highlights:

- Revenue: $15.6 million vs analyst estimates of $18.5 million (38.7% year-on-year decline, 15.7% miss)

- Adjusted EPS: -$0.16 vs analyst estimates of $0.01 (significant miss)

- Adjusted EBITDA: -$1.36 million vs analyst estimates of $300,000 (-8.7% margin, significant miss)

- Revenue Guidance for Q2 CY2025 is $17.5 million at the midpoint, below analyst estimates of $24.6 million

- Operating Margin: -202%, down from -2.8% in the same quarter last year

- Free Cash Flow was $2.93 million, up from -$884,000 in the same quarter last year

- Inventory Days Outstanding: 119, down from 155 in the previous quarter

- Market Capitalization: $49.01 million

I continue to be very encouraged by the strong demand we’re experiencing for semiconductor packaging equipment that supports AI infrastructure builds and by the meaningful progress we’ve made in improving our cost structure. With strong long-term growth drivers, including AI infrastructure investments and our initiatives to grow our consumables, parts and services revenue, we are well positioned to deliver profitable growth and create meaningful long-term value for our shareholders,” commented Mr. Bob Daigle, Chief Executive Officer of Amtech.

Company Overview

Focusing on the silicon carbide and power semiconductor sectors, Amtech Systems (NASDAQ: ASYS) produces the machinery and related chemicals needed for manufacturing semiconductors.

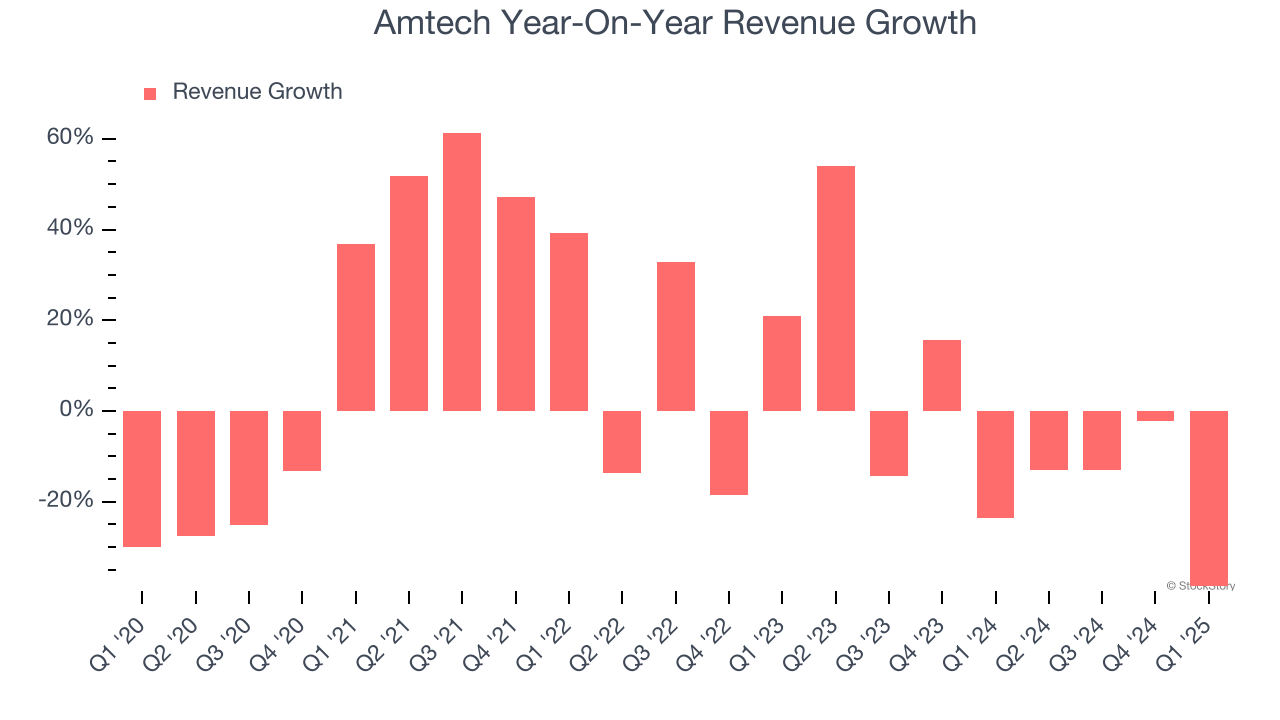

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Amtech’s 3.5% annualized revenue growth over the last five years was sluggish. This was below our standard for the semiconductor sector and is a rough starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Amtech’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 7.9% annually.

This quarter, Amtech missed Wall Street’s estimates and reported a rather uninspiring 38.7% year-on-year revenue decline, generating $15.6 million of revenue. Adding to the miss, the drop in sales could mean that the current downcycle is deepening. Company management is currently guiding for a 34.6% year-on-year decline in sales next quarter.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Amtech’s DIO came in at 119, which is 35 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

Key Takeaways from Amtech’s Q1 Results

We were impressed by Amtech’s strong improvement in inventory levels. On the other hand, its revenue guidance for next quarter missed significantly and its revenue fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 3.3% to $3.25 immediately following the results.

The latest quarter from Amtech’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.