WEBTOON (NASDAQ:WBTN) Reports Sales Below Analyst Estimates In Q1 Earnings, Stock Drops

Digital storytelling platform WEBTOON (NASDAQ: WBTN) fell short of the market’s revenue expectations in Q1 CY2025, with sales flat year on year at $325.7 million. On the other hand, the company expects next quarter’s revenue to be around $340 million, close to analysts’ estimates. Its GAAP loss of $0.17 per share was 7% below analysts’ consensus estimates.

Is now the time to buy WEBTOON? Find out by accessing our full research report, it’s free.

WEBTOON (WBTN) Q1 CY2025 Highlights:

- Revenue: $325.7 million vs analyst estimates of $328.8 million (flat year on year, 1% miss)

- EPS (GAAP): -$0.17 vs analyst expectations of -$0.16 (7% miss)

- Adjusted EBITDA: $4.08 million vs analyst estimates of $3.23 million (1.3% margin, relatively in line)

- Revenue Guidance for Q2 CY2025 is $340 million at the midpoint, roughly in line with what analysts were expecting

- EBITDA guidance for Q2 CY2025 is $3 million at the midpoint, below analyst estimates of $11.89 million

- Operating Margin: -8.2%, down from 4.3% in the same quarter last year

- Free Cash Flow was -$19.19 million, down from $20.79 million in the same quarter last year

- Monthly Active Users: 150 million

- Market Capitalization: $1.24 billion

Junkoo Kim, Founder and CEO, said, “We are pleased to report both revenue and Adjusted EBITDA above the midpoint of our guidance. Total revenue was up 5.3% on a constant currency basis, with all three revenue streams – Paid Content, Advertising, and IP Adaptations – contributing to growth.”

Company Overview

Pioneering a vertical-scrolling format optimized for mobile devices, WEBTOON Entertainment (NASDAQ: WBTN) operates a global platform where creators publish serialized web-comics and web-novels that users can read in bite-sized episodes.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $1.35 billion in revenue over the past 12 months, WEBTOON is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

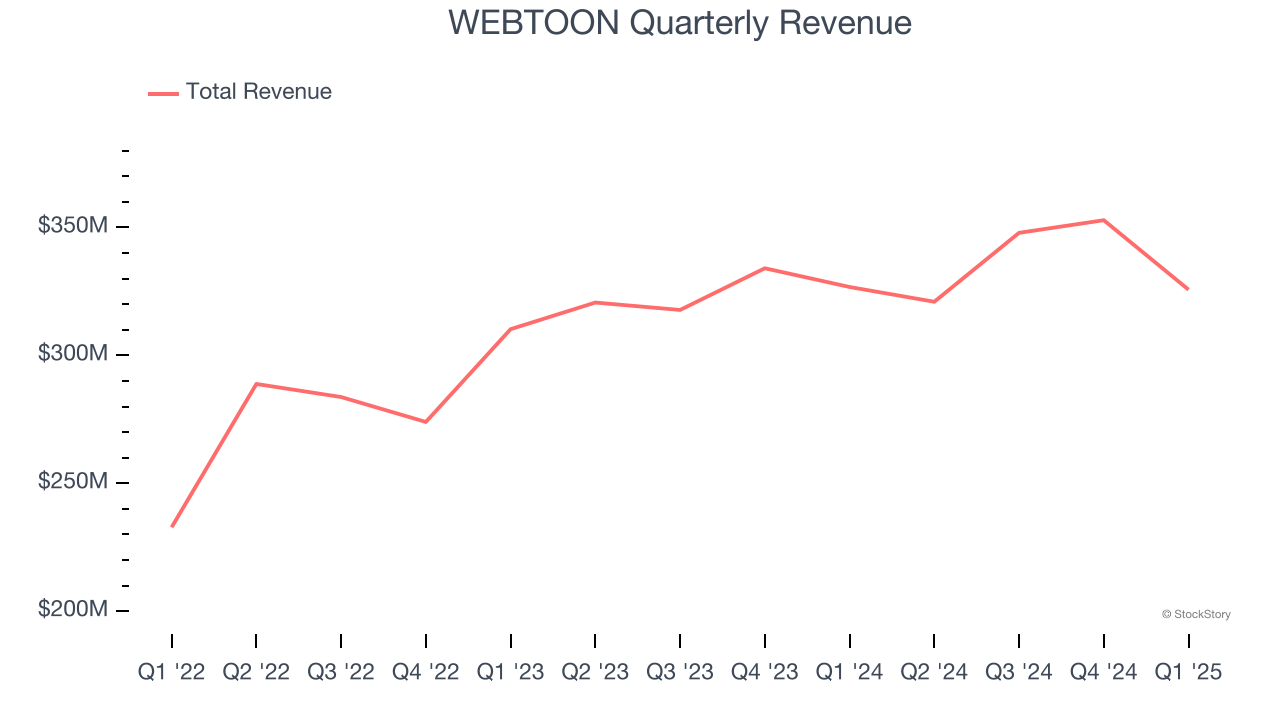

As you can see below, WEBTOON’s 7.9% annualized revenue growth over the last two years was solid. This is an encouraging starting point for our analysis because it shows WEBTOON’s demand was higher than many business services companies.

This quarter, WEBTOON missed Wall Street’s estimates and reported a rather uninspiring 0.3% year-on-year revenue decline, generating $325.7 million of revenue. Company management is currently guiding for a 5.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13% over the next 12 months, an improvement versus the last two years. This projection is admirable and indicates its newer products and services will spur better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

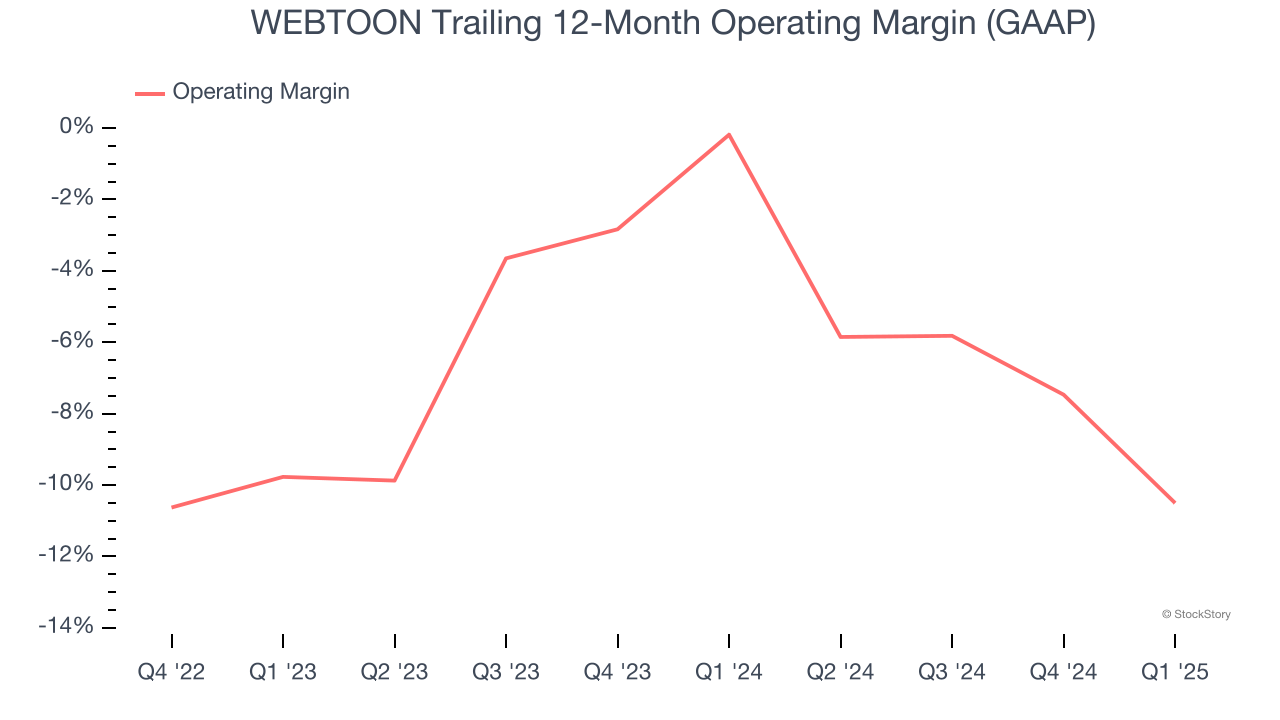

WEBTOON’s operating margin has been trending down over the last 12 months and averaged negative 6.9% over the last three years. Unprofitable, high-growth companies warrant extra scrutiny, especially if their margins fall because they’re spending loads of money to stay relevant, an unsustainable practice.

This quarter, WEBTOON generated a negative 8.2% operating margin.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

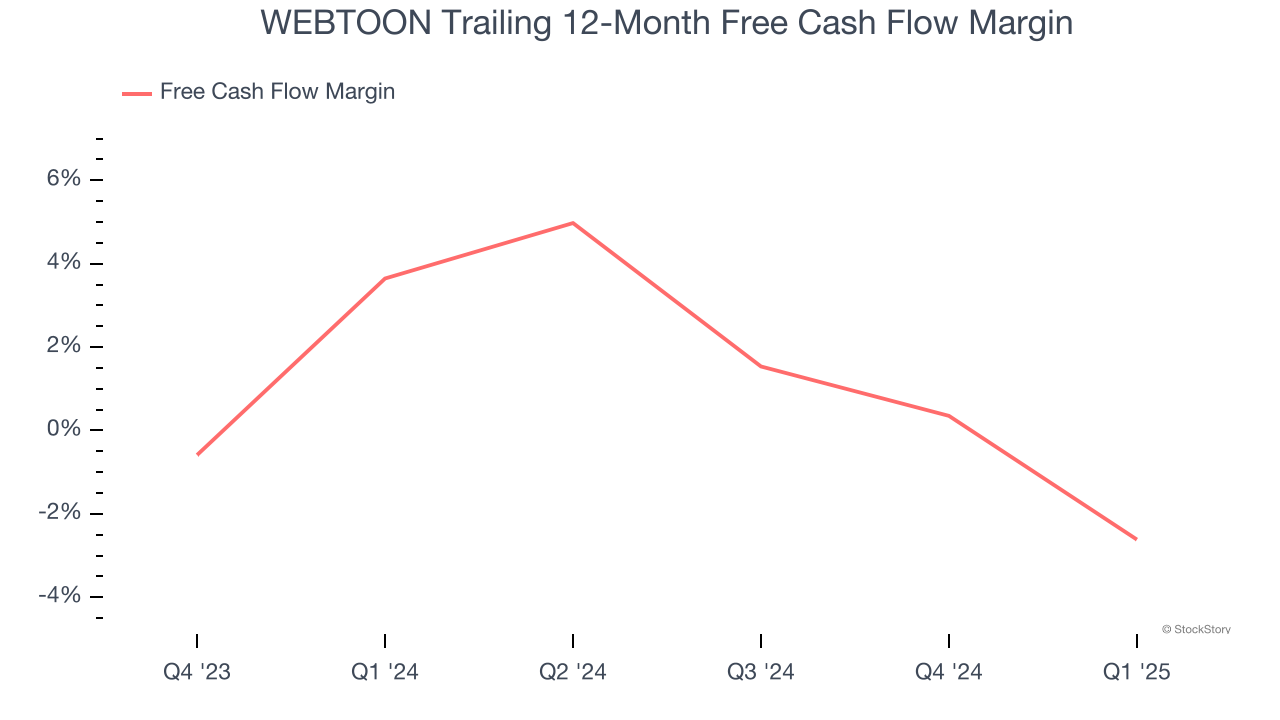

WEBTOON broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

WEBTOON burned through $19.19 million of cash in Q1, equivalent to a negative 5.9% margin. The company’s cash flow turned negative after being positive in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Key Takeaways from WEBTOON’s Q1 Results

We struggled to find many positives in these results as its revenue and EPS missed. Next quarter's EBITDA guidance also fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 6.6% to $9.22 immediately after reporting.

WEBTOON underperformed this quarter, but does that create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.