Q1 Business Process Outsourcing & Consulting Earnings: CRA (NASDAQ:CRAI) Impresses

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how CRA (NASDAQ: CRAI) and the rest of the business process outsourcing & consulting stocks fared in Q1.

The sector stands to benefit from ongoing digital transformation, increasing corporate demand for cost efficiencies, and the growing complexity of regulatory and cybersecurity landscapes. For those that invest wisely, AI and automation capabilities could emerge as competitive advantages, enhancing process efficiencies for the companies themselves as well as their clients. On the flip side, AI could be a headwind as well as the technology could lower the barrier to entry in the space and give rise to more self-service solutions. Additional challenges in the years ahead could include wage inflation for highly skilled consultants and potential regulatory scrutiny on outsourcing practices—especially in industries like finance and healthcare where who has access to certain data matters greatly.

The 7 business process outsourcing & consulting stocks we track reported a satisfactory Q1. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady as they are up 3.2% on average since the latest earnings results.

Best Q1: CRA (NASDAQ: CRAI)

Often retained for high-stakes matters with multibillion-dollar implications, CRA International (NASDAQ: CRAI) provides economic, financial, and management consulting services to corporations, law firms, and government agencies for litigation, regulatory proceedings, and business strategy.

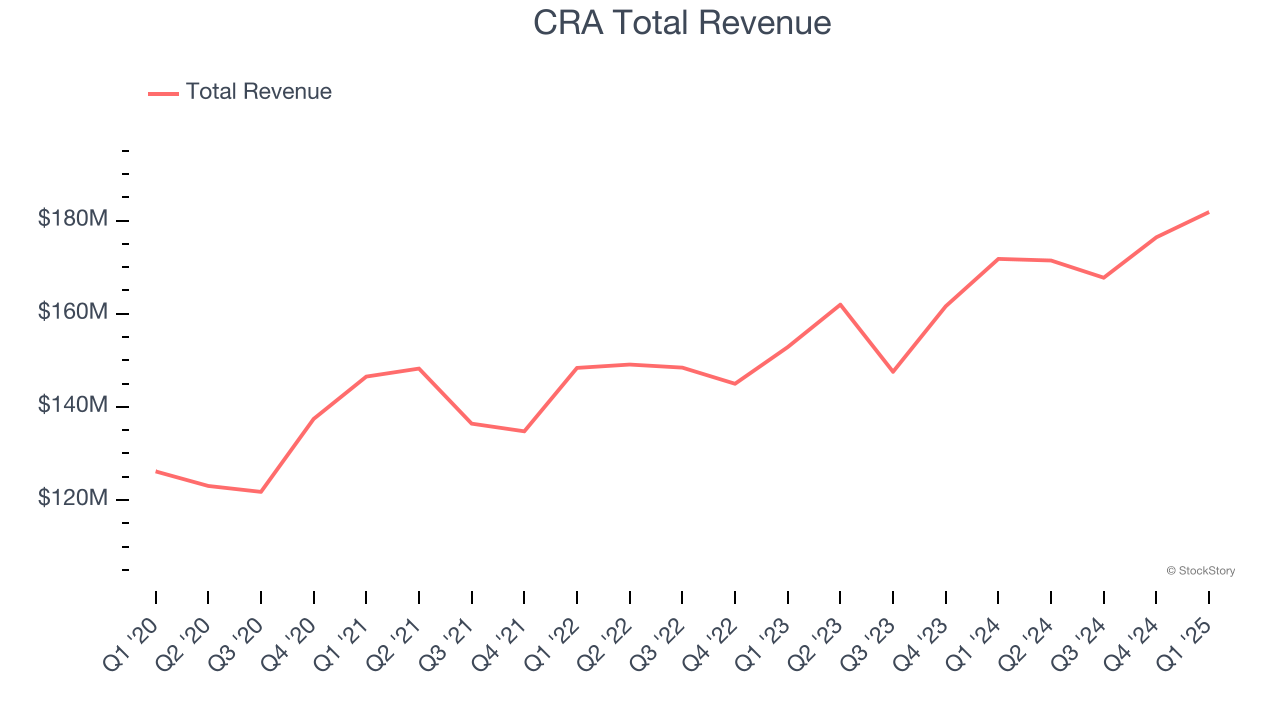

CRA reported revenues of $181.9 million, up 5.9% year on year. This print exceeded analysts’ expectations by 3%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ EPS estimates and full-year revenue guidance slightly topping analysts’ expectations.

“Building on the momentum of an exceptional fiscal 2024, CRA continued its strong performance into the first quarter, setting new records for financial results,” said Paul Maleh, CRA’s President and Chief Executive Officer.

CRA achieved the biggest analyst estimates beat and highest full-year guidance raise of the whole group. Unsurprisingly, the stock is up 16% since reporting and currently trades at $187.07.

Is now the time to buy CRA? Access our full analysis of the earnings results here, it’s free.

FTI Consulting (NYSE: FCN)

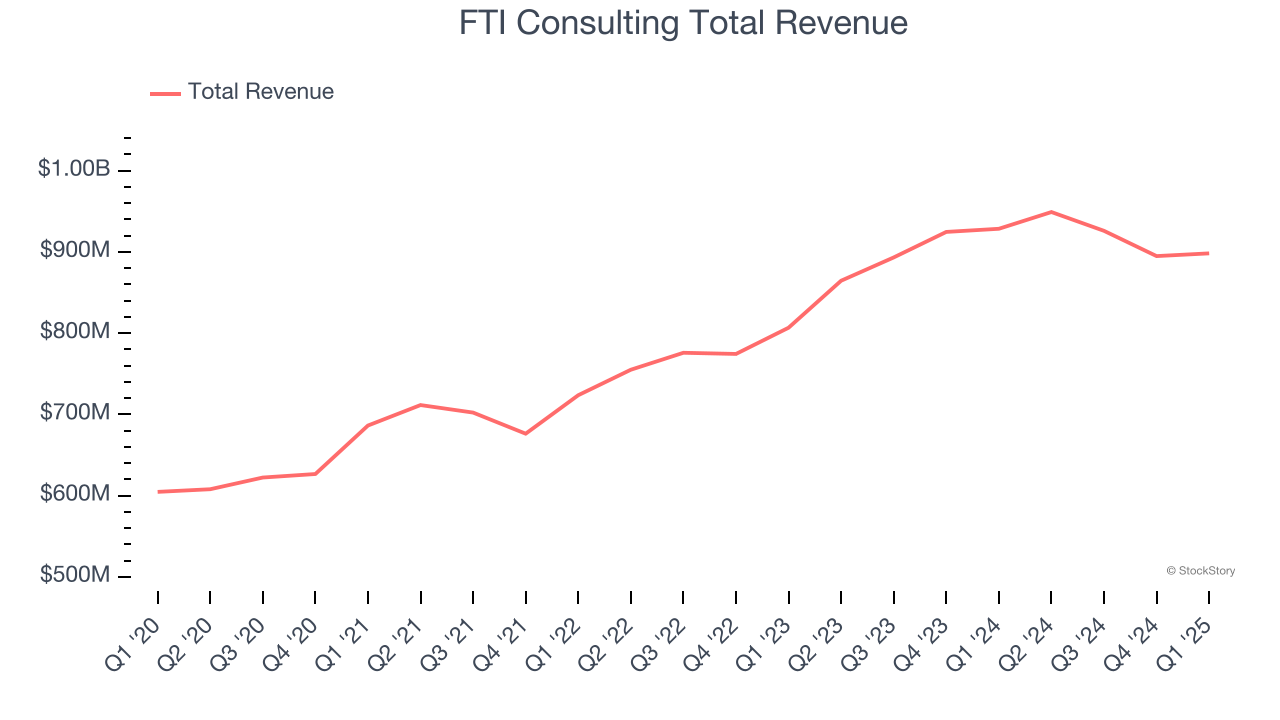

With a team of experts deployed across 30+ countries to tackle complex business challenges, FTI Consulting (NYSE: FCN) is a global business advisory firm that helps organizations manage change, mitigate risk, and resolve disputes across financial, legal, operational, and regulatory matters.

FTI Consulting reported revenues of $898.3 million, down 3.3% year on year, falling short of analysts’ expectations by 0.9%. However, the business still had a strong quarter with an impressive beat of analysts’ EPS estimates.

The stock is down 3.9% since reporting. It currently trades at $161.75.

Is now the time to buy FTI Consulting? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Genpact (NYSE: G)

Originally spun off from General Electric in 2005 to provide business process services, Genpact (NYSE: G) is a global professional services firm that helps businesses transform their operations through digital technology, AI, and data analytics solutions.

Genpact reported revenues of $1.21 billion, up 7.4% year on year, in line with analysts’ expectations. It was a slower quarter as it posted EPS guidance for next quarter missing analysts' estimates.

Genpact delivered the weakest full-year guidance update in the group. As expected, the stock is down 12.8% since the results and currently trades at $43.23.

Read our full analysis of Genpact’s results here.

CBIZ (NYSE: CBZ)

With over 120 offices across 33 states and a team of more than 6,700 professionals, CBIZ (NYSE: CBZ) provides accounting, tax, benefits, insurance brokerage, and advisory services to help small and mid-sized businesses manage their finances and operations.

CBIZ reported revenues of $838 million, up 69.5% year on year. This print lagged analysts' expectations by 2.6%. Overall, it was a slower quarter as it also logged full-year revenue guidance missing analysts’ expectations.

CBIZ delivered the fastest revenue growth but had the weakest performance against analyst estimates among its peers. The stock is down 6% since reporting and currently trades at $72.60.

Read our full, actionable report on CBIZ here, it’s free.

Concentrix (NASDAQ: CNXC)

With a team of approximately 450,000 employees across 75 countries, Concentrix (NASDAQ: CNXC) designs and delivers customer experience solutions that help global brands manage their customer interactions across digital channels and contact centers.

Concentrix reported revenues of $2.37 billion, down 1.3% year on year. This result met analysts’ expectations. It was a satisfactory quarter as it also recorded a solid beat of analysts’ EPS estimates.

The stock is up 21.4% since reporting and currently trades at $55.50.

Read our full, actionable report on Concentrix here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.