Reflecting On Casino Operator Stocks’ Q1 Earnings: Caesars Entertainment (NASDAQ:CZR)

Wrapping up Q1 earnings, we look at the numbers and key takeaways for the casino operator stocks, including Caesars Entertainment (NASDAQ: CZR) and its peers.

Casino operators enjoy limited competition because gambling is a highly regulated industry. These companies can also enjoy healthy margins and profits. Have you ever heard the phrase ‘the house always wins’? Regulation cuts both ways, however, and casinos may face stroke-of-the-pen risk that suddenly limits what they can or can't do and where they can do it. Furthermore, digitization is changing the game, pun intended. Whether it’s online poker or sports betting on your smartphone, innovation is forcing these players to adapt to changing consumer preferences, such as being able to wager anywhere on demand.

The 9 casino operator stocks we track reported a slower Q1. As a group, revenues were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady as they are up 4.5% on average since the latest earnings results.

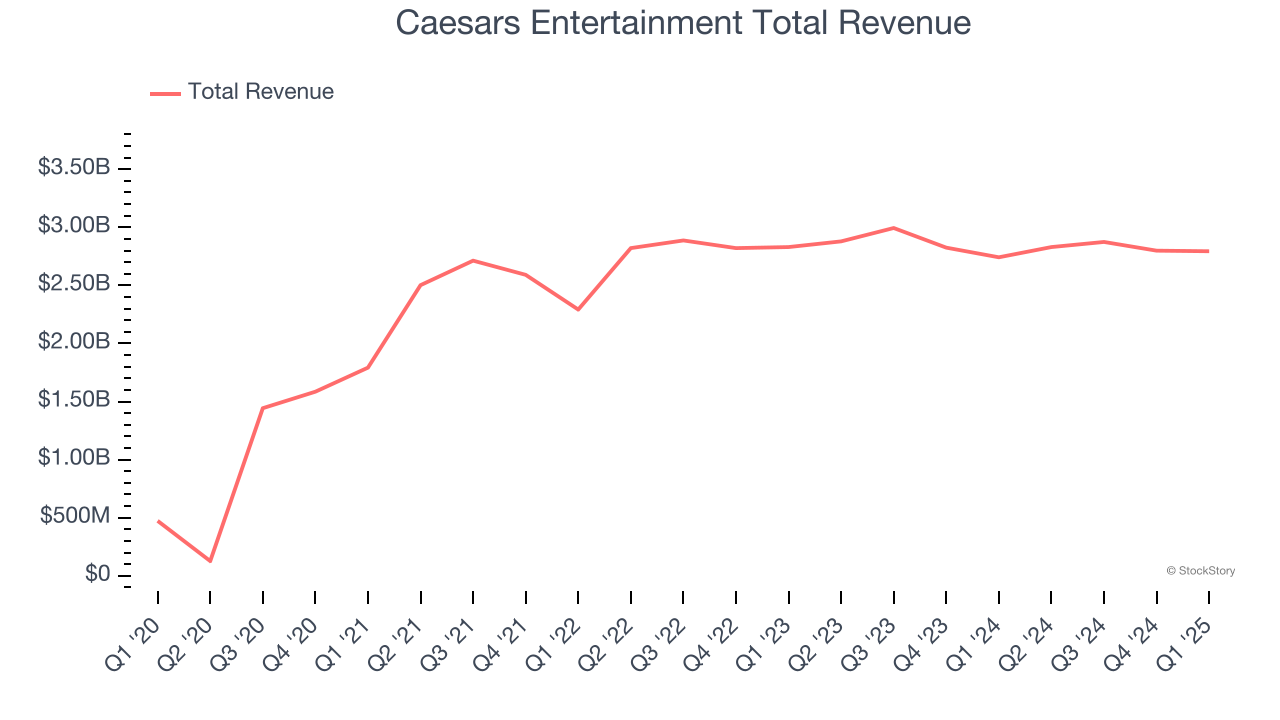

Caesars Entertainment (NASDAQ: CZR)

Formerly Eldorado Resorts, Caesars Entertainment (NASDAQ: CZR) is a global gaming and hospitality company operating numerous casinos, hotels, and resort properties.

Caesars Entertainment reported revenues of $2.79 billion, up 1.9% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with a significant miss of analysts’ EPS estimates and a miss of analysts’ adjusted operating income estimates.

Tom Reeg, Chief Executive Officer of Caesars Entertainment, Inc., commented, “During the first quarter of 2025, consolidated Adjusted EBITDA grew 4% over prior year driven by significant gains in our Digital segment which delivered a new Q1 record, growth in our regional segment with strong contributions from recently opened properties and a solid quarter in Las Vegas against a tough Super Bowl compare last year.”

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $27.88.

Read our full report on Caesars Entertainment here, it’s free.

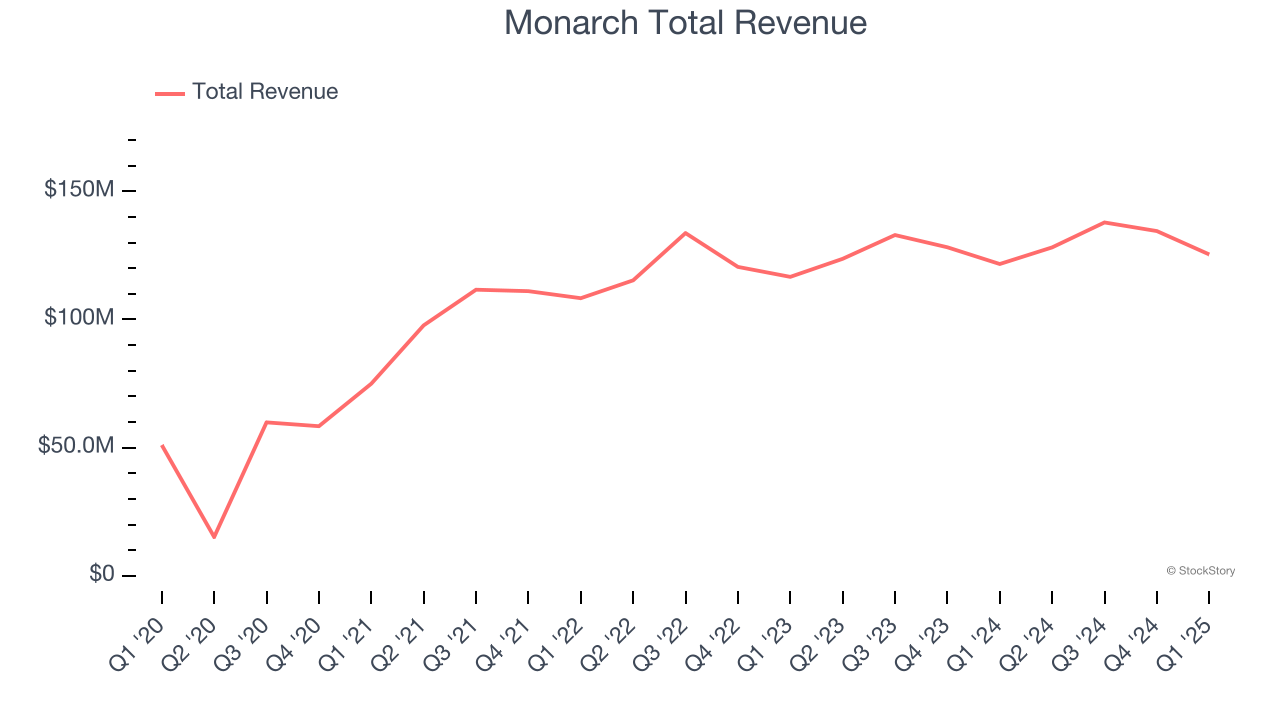

Best Q1: Monarch (NASDAQ: MCRI)

Established in 1993, Monarch (NASDAQ: MCRI) operates luxury casinos and resorts, offering high-end gaming, dining, and hospitality experiences.

Monarch reported revenues of $125.4 million, up 3.1% year on year, outperforming analysts’ expectations by 2.1%. The business had a strong quarter with a decent beat of analysts’ EPS and EBITDA estimates.

Monarch delivered the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 7.9% since reporting. It currently trades at $81.92.

Is now the time to buy Monarch? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: PENN Entertainment (NASDAQ: PENN)

Established in 1982, PENN Entertainment (NASDAQ: PENN) is a diversified American operator of casinos, sports betting, and entertainment venues.

PENN Entertainment reported revenues of $1.67 billion, up 4.1% year on year, falling short of analysts’ expectations by 1.6%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

As expected, the stock is down 2.9% since the results and currently trades at $15.25.

Read our full analysis of PENN Entertainment’s results here.

Wynn Resorts (NASDAQ: WYNN)

Founded by the former Mirage Resorts CEO, Wynn Resorts (NASDAQ: WYNN) is a global developer and operator of high-end hotels and casinos, known for its luxurious properties and premium guest services.

Wynn Resorts reported revenues of $1.7 billion, down 8.7% year on year. This print missed analysts’ expectations by 1.8%. It was a disappointing quarter as it also produced a significant miss of analysts’ EPS estimates and a miss of analysts’ EBITDA estimates.

Wynn Resorts had the slowest revenue growth among its peers. The stock is up 8% since reporting and currently trades at $90.21.

Read our full, actionable report on Wynn Resorts here, it’s free.

Golden Entertainment (NASDAQ: GDEN)

Founded in 2001, Golden Entertainment (NASDAQ: GDEN) is a gaming company operating casinos, taverns, and distributed gaming platforms.

Golden Entertainment reported revenues of $160.8 million, down 7.6% year on year. This number lagged analysts' expectations by 2.1%. Overall, it was a softer quarter as it also recorded a significant miss of analysts’ EPS and adjusted operating income estimates.

Golden Entertainment had the weakest performance against analyst estimates among its peers. The stock is up 8.4% since reporting and currently trades at $28.10.

Read our full, actionable report on Golden Entertainment here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.