Henry Schein (NASDAQ:HSIC) Reports Sales Below Analyst Estimates In Q1 Earnings

Dental and medical products company Henry Schein (NASDAQ: HSIC) missed Wall Street’s revenue expectations in Q1 CY2025, with sales flat year on year at $3.17 billion. Its non-GAAP profit of $1.15 per share was 3.6% above analysts’ consensus estimates.

Is now the time to buy Henry Schein? Find out by accessing our full research report, it’s free.

Henry Schein (HSIC) Q1 CY2025 Highlights:

- Revenue: $3.17 billion vs analyst estimates of $3.23 billion (flat year on year, 2% miss)

- Adjusted EPS: $1.15 vs analyst estimates of $1.11 (3.6% beat)

- Adjusted EBITDA: $259 million vs analyst estimates of $260.8 million (8.2% margin, 0.7% miss)

- Management reiterated its full-year Adjusted EPS guidance of $4.87 at the midpoint

- Operating Margin: 5.5%, in line with the same quarter last year

- Free Cash Flow Margin: 0.2%, down from 4.9% in the same quarter last year

- Market Capitalization: $8 billion

“We are pleased with our first quarter financial results as well as the momentum we are seeing heading into the second quarter and remain confident in the fundamentals of our business,” said Stanley M. Bergman, Chairman of the Board and Chief Executive Officer of Henry Schein.

Company Overview

With a vast inventory of over 300,000 products stocked in distribution centers spanning more than 5.3 million square feet worldwide, Henry Schein (NASDAQ: HSIC) is a global distributor of healthcare products and services primarily to dental practices, medical offices, and other healthcare facilities.

Sales Growth

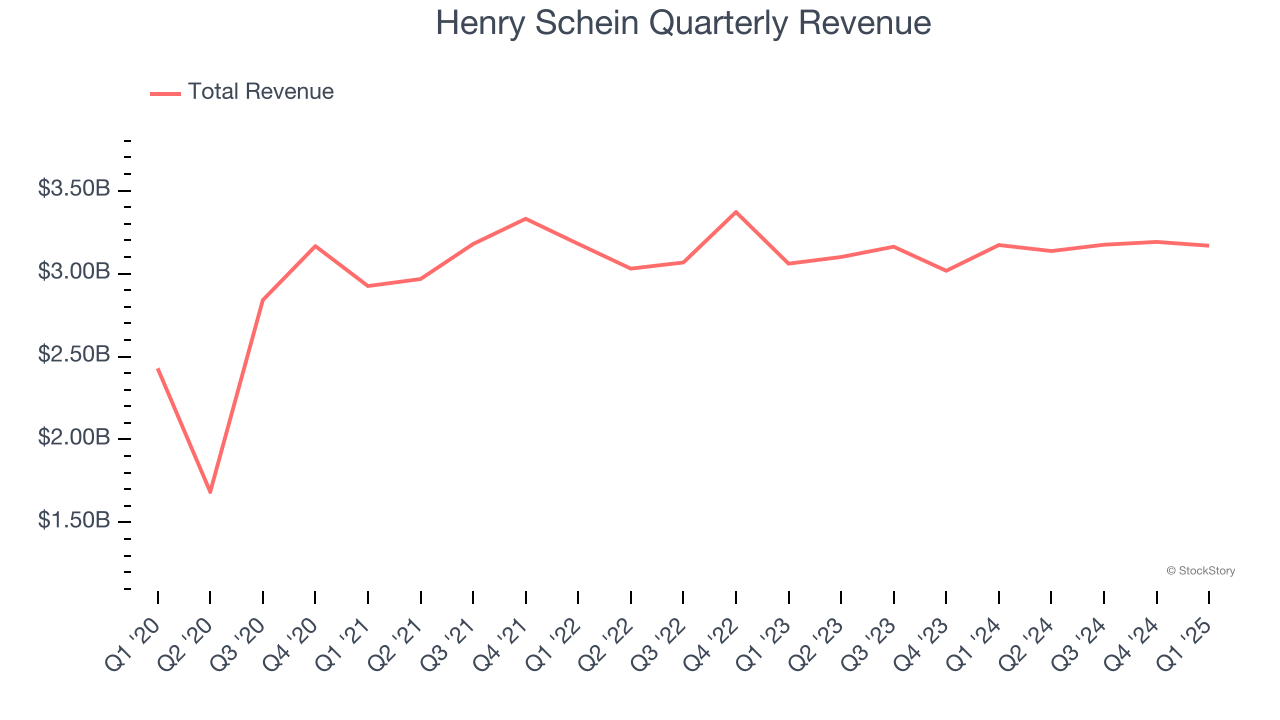

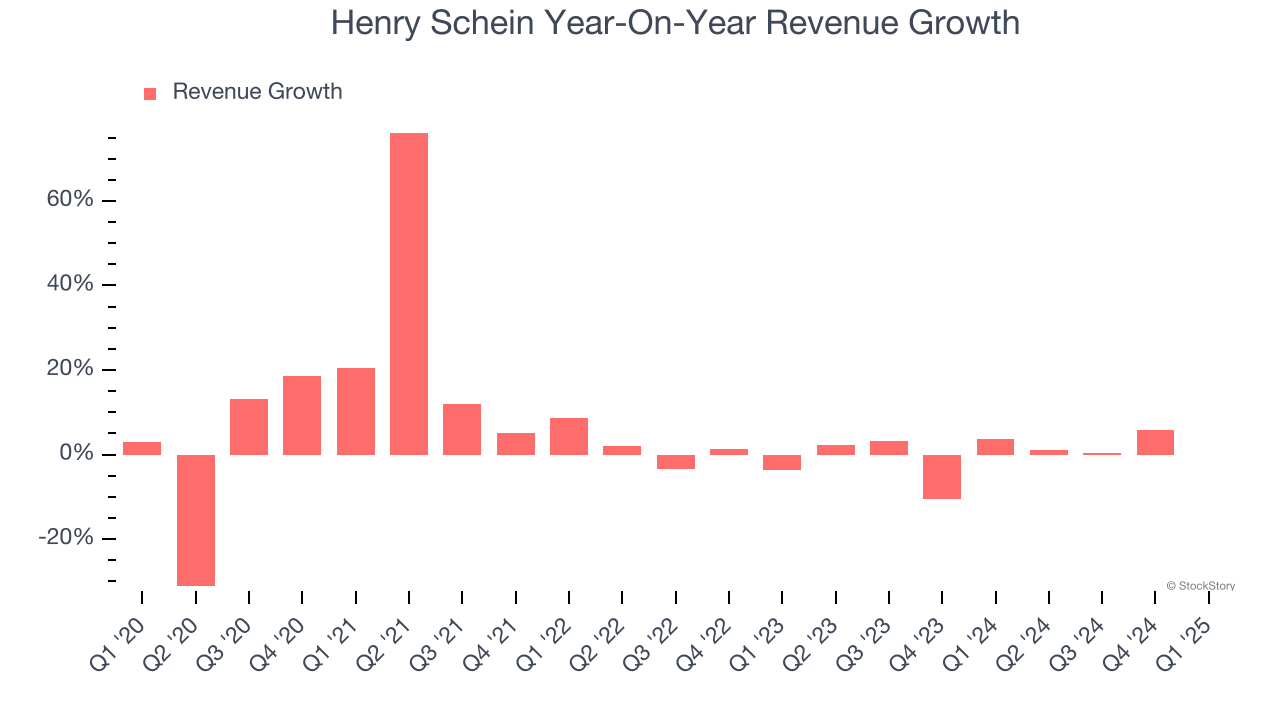

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Henry Schein’s 4.7% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the healthcare sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Henry Schein’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

This quarter, Henry Schein missed Wall Street’s estimates and reported a rather uninspiring 0.1% year-on-year revenue decline, generating $3.17 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.4% over the next 12 months. Although this projection suggests its newer products and services will spur better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

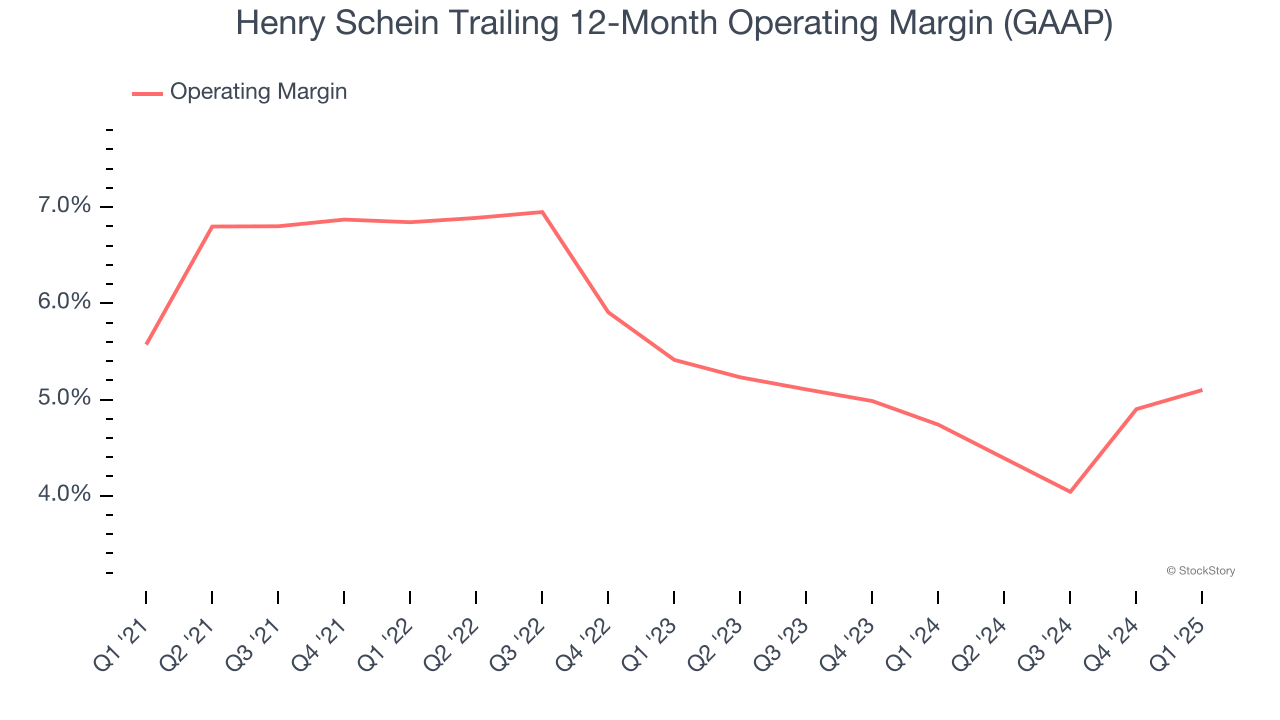

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Henry Schein was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.5% was weak for a healthcare business.

Analyzing the trend in its profitability, Henry Schein’s operating margin might fluctuated slightly but has generally stayed the same over the last five years, meaning it will take a fundamental shift in the business model to change.

In Q1, Henry Schein generated an operating profit margin of 5.5%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

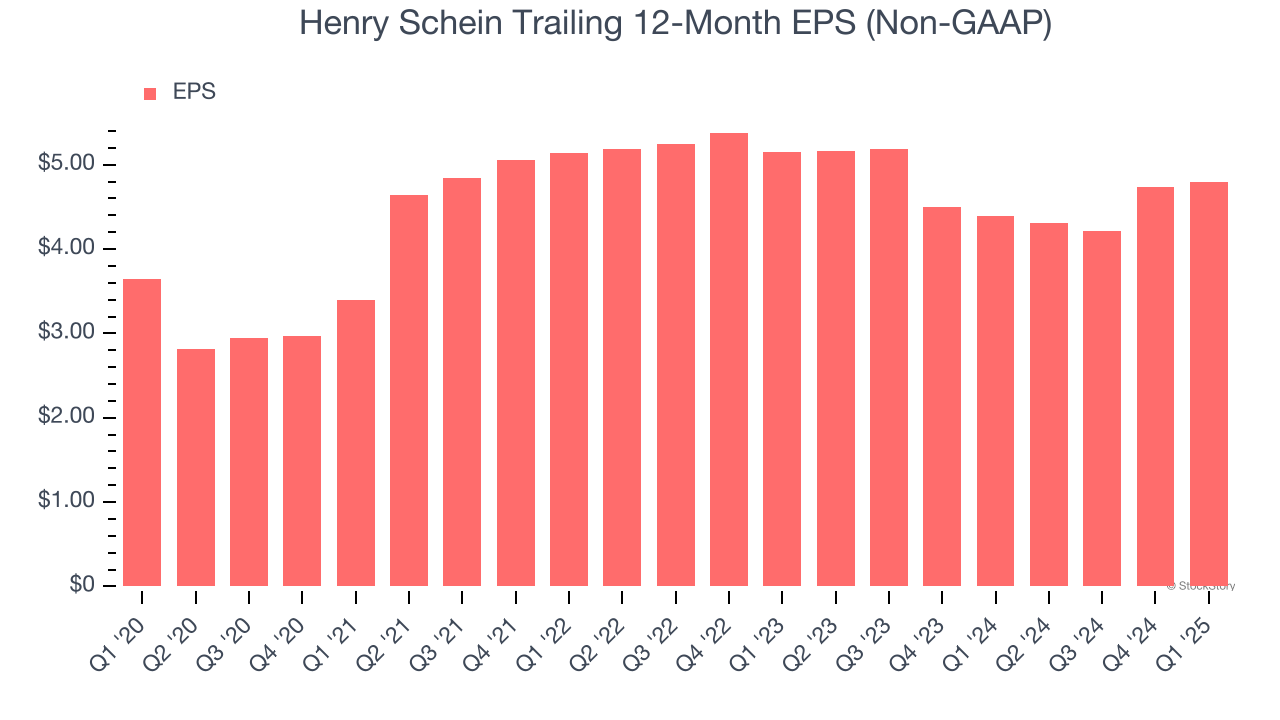

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Henry Schein’s decent 5.6% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q1, Henry Schein reported EPS at $1.15, up from $1.10 in the same quarter last year. This print beat analysts’ estimates by 3.6%. Over the next 12 months, Wall Street expects Henry Schein’s full-year EPS of $4.79 to grow 3.2%.

Key Takeaways from Henry Schein’s Q1 Results

It was encouraging to see Henry Schein beat analysts’ EPS expectations this quarter. We were also happy its full-year EPS guidance narrowly outperformed Wall Street’s estimates. On the other hand, its revenue missed significantly. Overall, this was a weaker quarter. The stock remained flat at $65.49 immediately after reporting.

Is Henry Schein an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.