Appian (NASDAQ:APPN) Beats Q1 Sales Targets, Stock Soars

Low code software development platform provider Appian (Nasdaq: APPN) reported Q1 CY2025 results exceeding the market’s revenue expectations, with sales up 11.1% year on year to $166.4 million. Revenue guidance for the full year exceeded analysts’ estimates, but next quarter’s guidance of $160 million was less impressive, coming in 0.8% below expectations. Its non-GAAP profit of $0.13 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Appian? Find out by accessing our full research report, it’s free.

Appian (APPN) Q1 CY2025 Highlights:

- Revenue: $166.4 million vs analyst estimates of $163.2 million (11.1% year-on-year growth, 2% beat)

- Adjusted EPS: $0.13 vs analyst estimates of $0.03 (significant beat)

- Adjusted EBITDA: $16.76 million vs analyst estimates of $9.19 million (10.1% margin, 82.5% beat)

- The company slightly lifted its revenue guidance for the full year to $684 million at the midpoint from $682 million

- Management raised its full-year Adjusted EPS guidance to $0.22 at the midpoint, a 12.8% increase

- EBITDA guidance for the full year is $43 million at the midpoint, above analyst estimates of $39.14 million

- Operating Margin: -0.5%, up from -13% in the same quarter last year

- Free Cash Flow Margin: 26.6%, up from 8% in the previous quarter

- Net Revenue Retention Rate: 112%, down from 116% in the previous quarter

- Market Capitalization: $2.26 billion

“In Q1, Appian continued to demonstrate our earnings potential, with narrowing net losses, our third straight quarter of positive adjusted EBITDA, and $45 million in operating cash flow,” said Matt Calkins, CEO & Founder.

Company Overview

Founded by Matt Calkins and his three friends out of an apartment in Northern Virginia, Appian (NASDAQ: APPN) sells a software platform that lets its users build applications without using much code, allowing them to create new software more quickly.

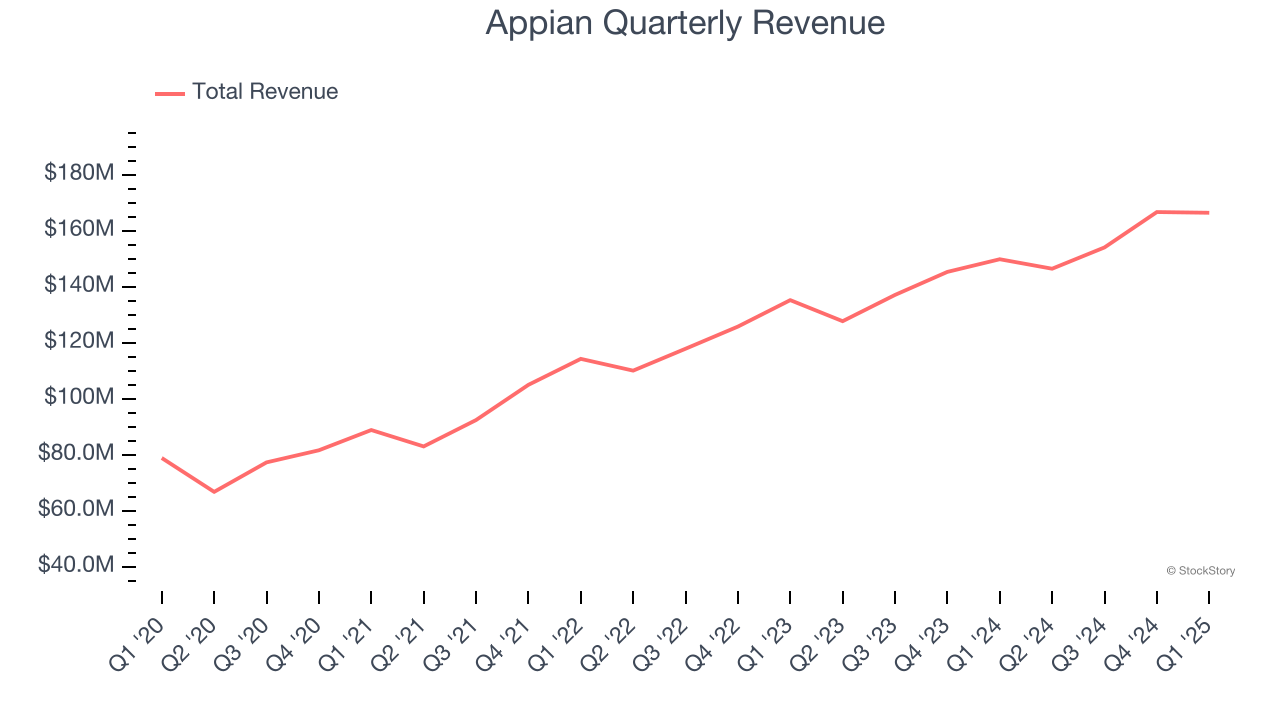

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, Appian grew its sales at a 17.1% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.

This quarter, Appian reported year-on-year revenue growth of 11.1%, and its $166.4 million of revenue exceeded Wall Street’s estimates by 2%. Company management is currently guiding for a 9.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.1% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

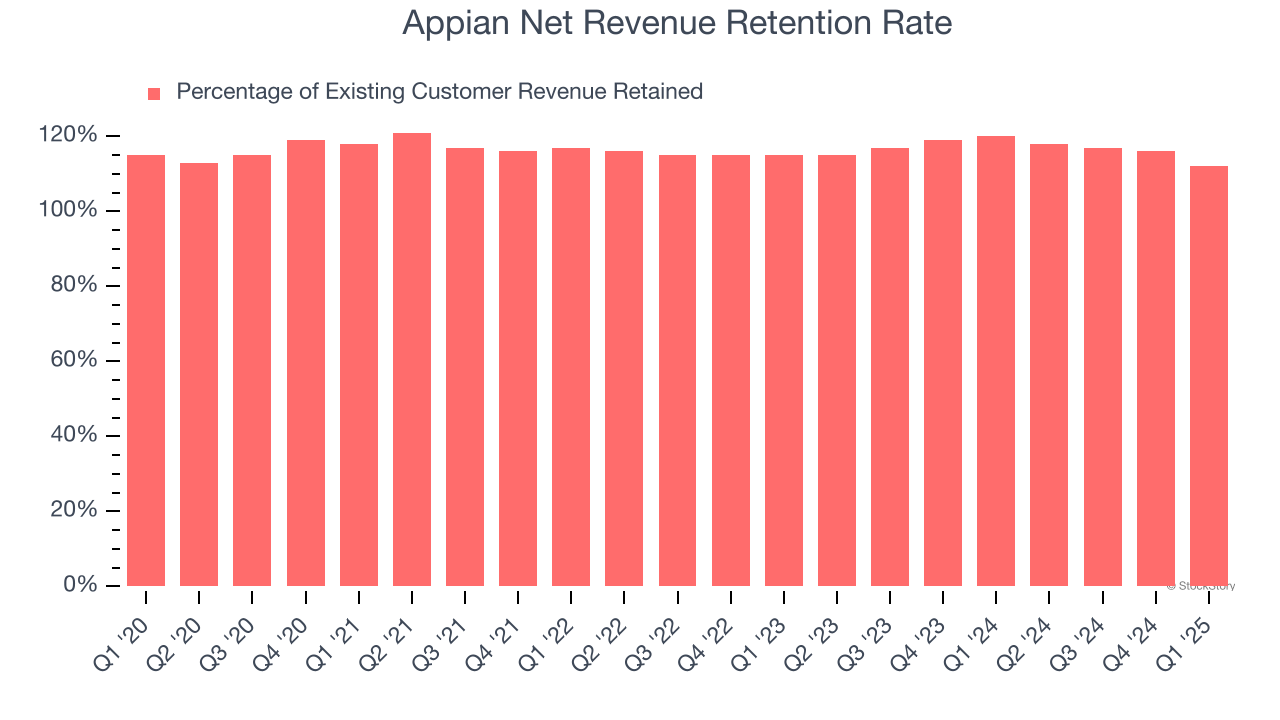

Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Appian’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 116% in Q1. This means Appian would’ve grown its revenue by 15.7% even if it didn’t win any new customers over the last 12 months.

Despite falling over the last year, Appian still has a good net retention rate, proving that customers are satisfied with its software and getting more value from it over time, which is always great to see.

Key Takeaways from Appian’s Q1 Results

We liked that revenue beat and were impressed by how significantly Appian blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance trumped Wall Street’s estimates. On the other hand, its revenue guidance for next quarter fell slightly short of Wall Street’s estimates. Zooming out, we think this was still a decent quarter. The stock traded up 7.1% to $32.55 immediately following the results.

So do we think Appian is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.