Olaplex (NASDAQ:OLPX) Reports Upbeat Q1 But Stock Drops

Hair care company Olaplex (NASDAQ: OLPX) reported Q1 CY2025 results topping the market’s revenue expectations, but sales fell by 1.9% year on year to $96.98 million. The company’s full-year revenue guidance of $420.5 million at the midpoint came in 0.6% above analysts’ estimates. Its GAAP loss of $0 per share was in line with analysts’ consensus estimates.

Is now the time to buy Olaplex? Find out by accessing our full research report, it’s free.

Olaplex (OLPX) Q1 CY2025 Highlights:

- Revenue: $96.98 million vs analyst estimates of $93.34 million (1.9% year-on-year decline, 3.9% beat)

- EPS (GAAP): $0 vs analyst estimates of $0 (in line)

- Adjusted EBITDA: $25.66 million vs analyst estimates of $22.62 million (26.5% margin, 13.4% beat)

- The company reconfirmed its revenue guidance for the full year of $420.5 million at the midpoint

- Operating Margin: 8.7%, down from 19.8% in the same quarter last year

- Market Capitalization: $885.5 million

Amanda Baldwin, OLAPLEX’s Chief Executive Officer, commented: "We had a solid start to the year as the quarter marked continued progress on our transformation and our Bonds and Beyond strategy, with first quarter sales coming in ahead of our expectations. As we look ahead, we believe in our ability to navigate the dynamic environment and will continue to invest behind our strategic priorities."

Company Overview

Rising to fame on TikTok because of its “bond building" hair products, Olaplex (NASDAQ: OLPX) offers products and treatments that repair the damage caused by traditional heat and chemical-based styling goods.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $420.7 million in revenue over the past 12 months, Olaplex is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

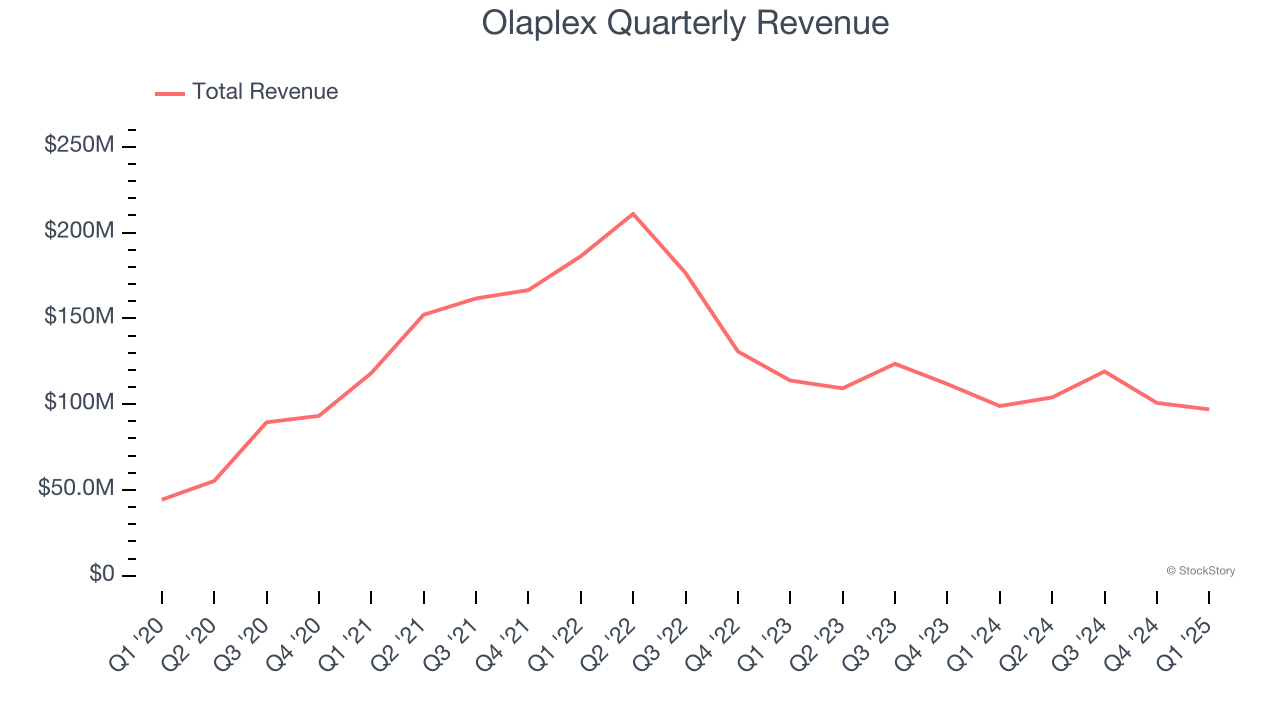

As you can see below, Olaplex’s demand was weak over the last three years. Its sales fell by 14.2% annually, a poor baseline for our analysis.

This quarter, Olaplex’s revenue fell by 1.9% year on year to $96.98 million but beat Wall Street’s estimates by 3.9%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection suggests its newer products will fuel better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

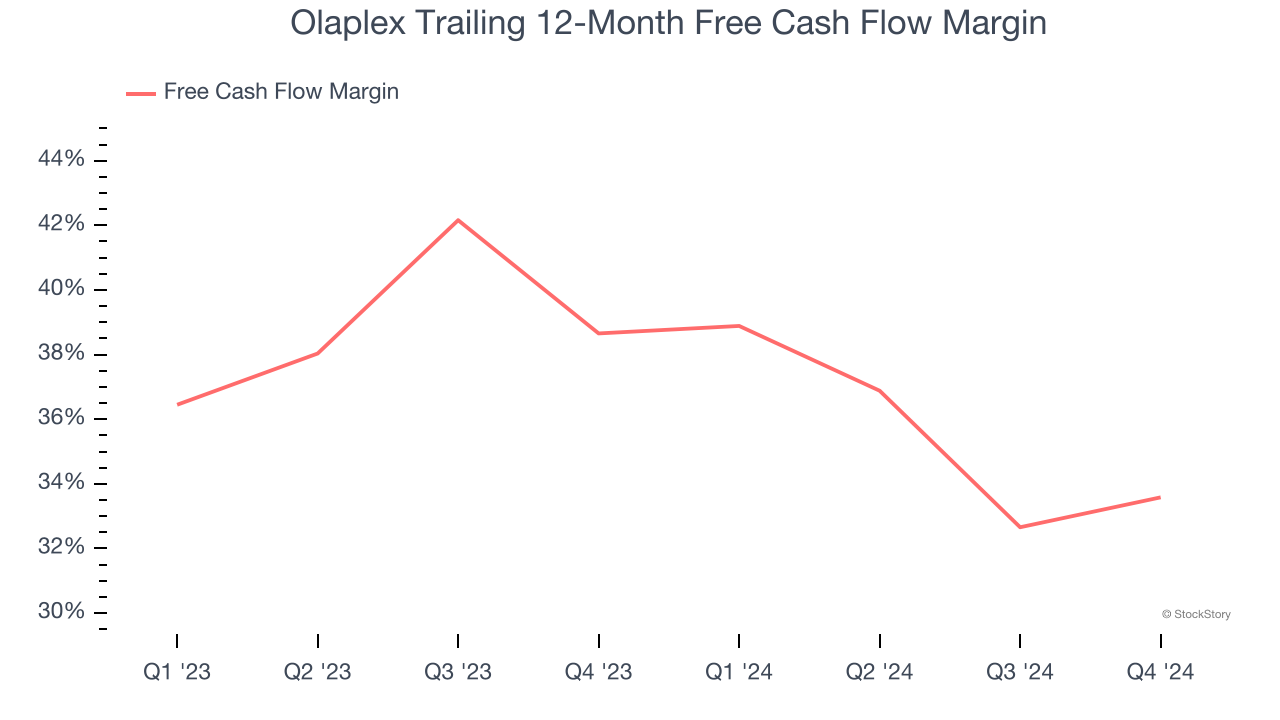

Olaplex has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging an eye-popping 35.3% over the last two years.

Key Takeaways from Olaplex’s Q1 Results

We were impressed by how Olaplex beat analysts’ revenue and EBITDA expectations this quarter. On the other hand, its gross margin missed. Zooming out, we think this was a solid print. The market seemed to be hoping for more, and the stock traded down 6.8% to $1.23 immediately following the results.

Big picture, is Olaplex a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.