Q1 Earnings Roundup: SPX Technologies (NYSE:SPXC) And The Rest Of The Gas and Liquid Handling Segment

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how gas and liquid handling stocks fared in Q1, starting with SPX Technologies (NYSE: SPXC).

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 11 gas and liquid handling stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 0.9% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 6.1% on average since the latest earnings results.

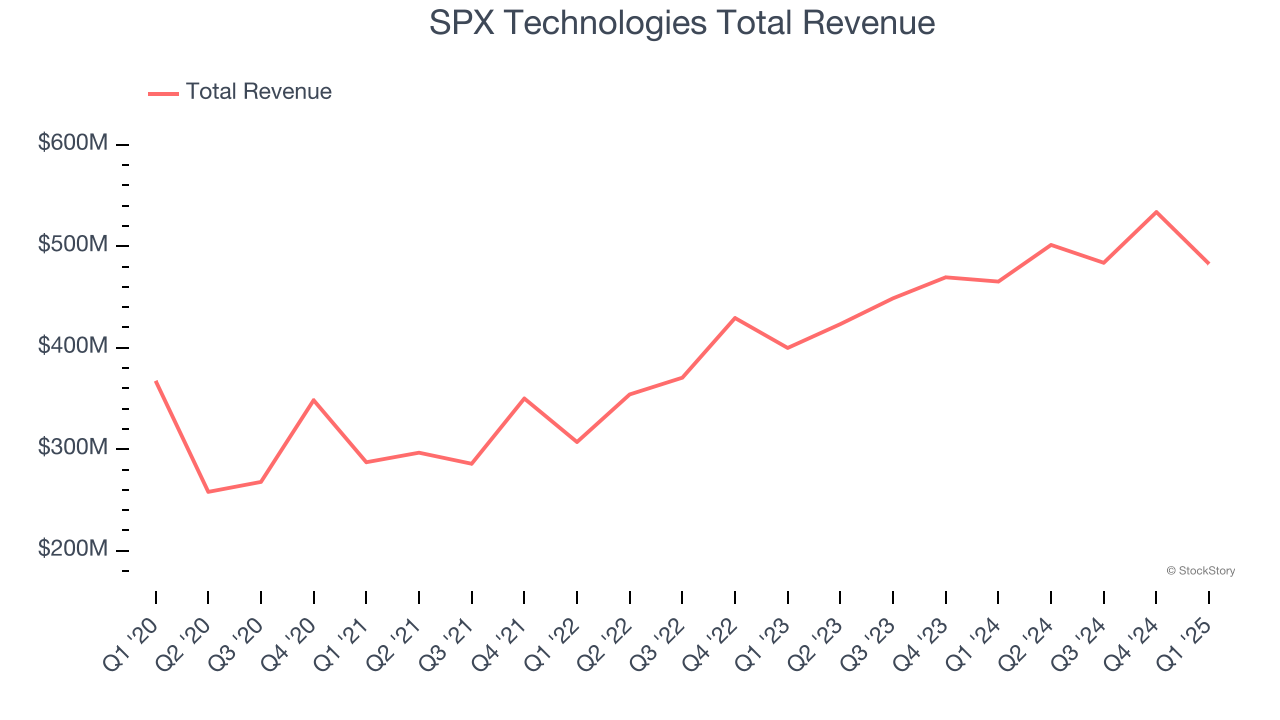

SPX Technologies (NYSE: SPXC)

SPX Technologies (NYSE: SPXC) is an industrial conglomerate catering to the energy, manufacturing, automotive, and aerospace sectors.

SPX Technologies reported revenues of $482.6 million, up 3.7% year on year. This print was in line with analysts’ expectations, and overall, it was an exceptional quarter for the company with an impressive beat of analysts’ EBITDA estimates.

SPX Technologies pulled off the highest full-year guidance raise of the whole group. Unsurprisingly, the stock is up 10.3% since reporting and currently trades at $150.53.

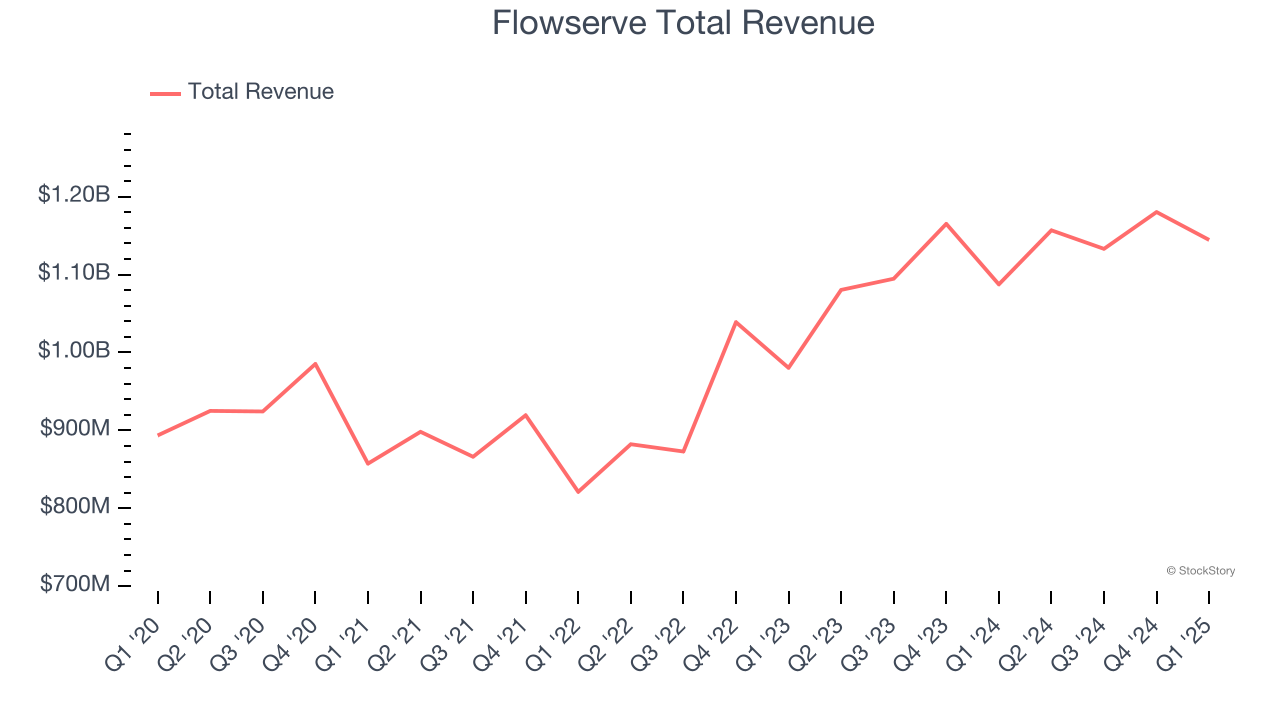

Best Q1: Flowserve (NYSE: FLS)

Manufacturing the largest pump ever built for nuclear power generation, Flowserve (NYSE: FLS) manufactures and sells flow control equipment for various industries.

Flowserve reported revenues of $1.14 billion, up 5.2% year on year, outperforming analysts’ expectations by 3.6%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates.

The market seems content with the results as the stock is up 4% since reporting. It currently trades at $46.69.

Is now the time to buy Flowserve? Access our full analysis of the earnings results here, it’s free.

Slowest Q1: ITT (NYSE: ITT)

Playing a crucial role in the development of the first transatlantic television transmission in 1956, ITT (NYSE: ITT) provides motion and fluid handling equipment for various industries

ITT reported revenues of $913 million, flat year on year, exceeding analysts’ expectations by 0.6%. Still, it was a mixed quarter as it posted full-year EPS guidance meeting analysts’ expectations.

Interestingly, the stock is up 3.2% since the results and currently trades at $141.43.

Read our full analysis of ITT’s results here.

Chart (NYSE: GTLS)

Installing the first bulk Co2 tank for McDonalds’s sodas, Chart (NYSE: GTLS) provides equipment to store and transport gasses.

Chart reported revenues of $1.00 billion, up 5.3% year on year. This result was in line with analysts’ expectations. Overall, it was a very strong quarter as it also produced an impressive beat of analysts’ adjusted operating income estimates.

Chart had the weakest full-year guidance update among its peers. The stock is up 11.8% since reporting and currently trades at $150.74.

Read our full, actionable report on Chart here, it’s free.

Ingersoll Rand (NYSE: IR)

Started with the invention of the steam drill, Ingersoll Rand (NYSE: IR) provides mission-critical air, gas, liquid, and solid flow creation solutions.

Ingersoll Rand reported revenues of $1.72 billion, up 2.8% year on year. This number met analysts’ expectations. More broadly, it was a slower quarter as it logged full-year EBITDA guidance missing analysts’ expectations.

The stock is up 2.1% since reporting and currently trades at $77.80.

Read our full, actionable report on Ingersoll Rand here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View MoreRecent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.