EchoStar (NASDAQ:SATS) Posts Q1 Sales In Line With Estimates

Satellite communications company EchoStar (NASDAQGS:SATS) met Wall Street’s revenue expectations in Q1 CY2025, but sales fell by 3.6% year on year to $3.87 billion. Its GAAP loss of $0.71 per share was 11.4% above analysts’ consensus estimates.

Is now the time to buy EchoStar? Find out by accessing our full research report, it’s free.

EchoStar (SATS) Q1 CY2025 Highlights:

- Revenue: $3.87 billion vs analyst estimates of $3.86 billion (3.6% year-on-year decline, in line)

- EPS (GAAP): -$0.71 vs analyst estimates of -$0.80 (11.4% beat)

- Adjusted EBITDA: $400.2 million vs analyst estimates of $416.4 million (10.3% margin, 3.9% miss)

- Operating Margin: -2.3%, down from -0.4% in the same quarter last year

- Free Cash Flow was $465.2 million, up from -$68.35 million in the same quarter last year

- Market Capitalization: $6.83 billion

"The EchoStar team performed well against our plan in the first quarter," said Hamid Akhavan, president and CEO, EchoStar Corporation.

Company Overview

Following its 2023 acquisition of DISH Network, EchoStar (NASDAQ: SATS) provides satellite communications, pay-TV services, wireless networks, and broadband solutions across consumer and enterprise markets.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $15.68 billion in revenue over the past 12 months, EchoStar is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices.

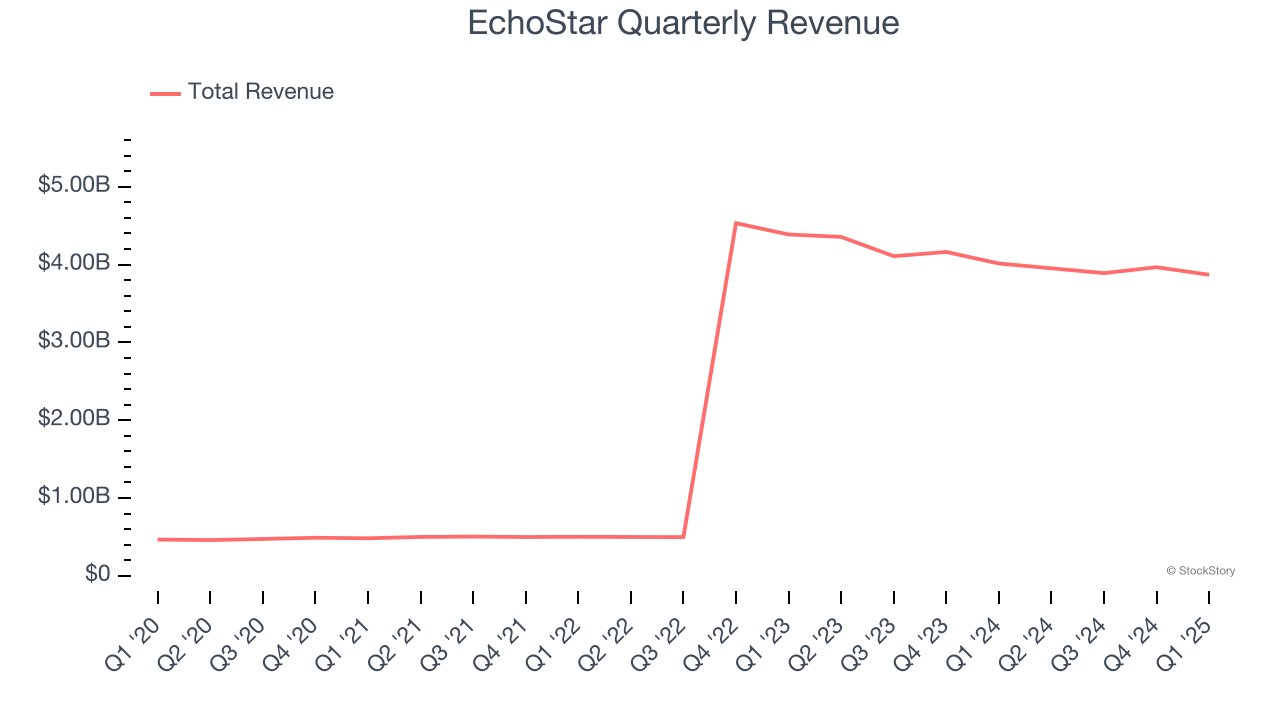

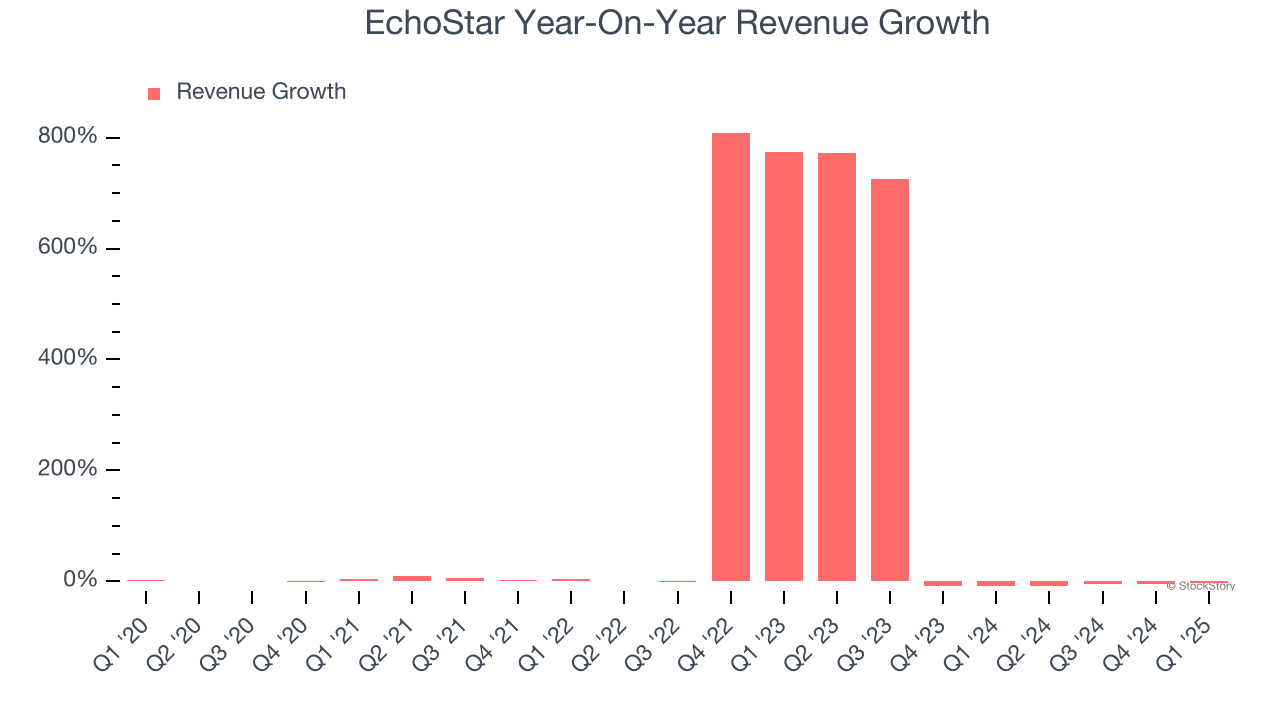

As you can see below, EchoStar’s 52.6% annualized revenue growth over the last five years was incredible. This shows it had high demand, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. EchoStar’s annualized revenue growth of 25.7% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

We can dig further into the company’s revenue dynamics by analyzing its most important segment, DISH PayTV. Over the last two years, EchoStar’s DISH PayTV revenue averaged 7.6% year-on-year declines. This segment has lagged the company’s overall sales.

This quarter, EchoStar reported a rather uninspiring 3.6% year-on-year revenue decline to $3.87 billion of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to decline by 2.9% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

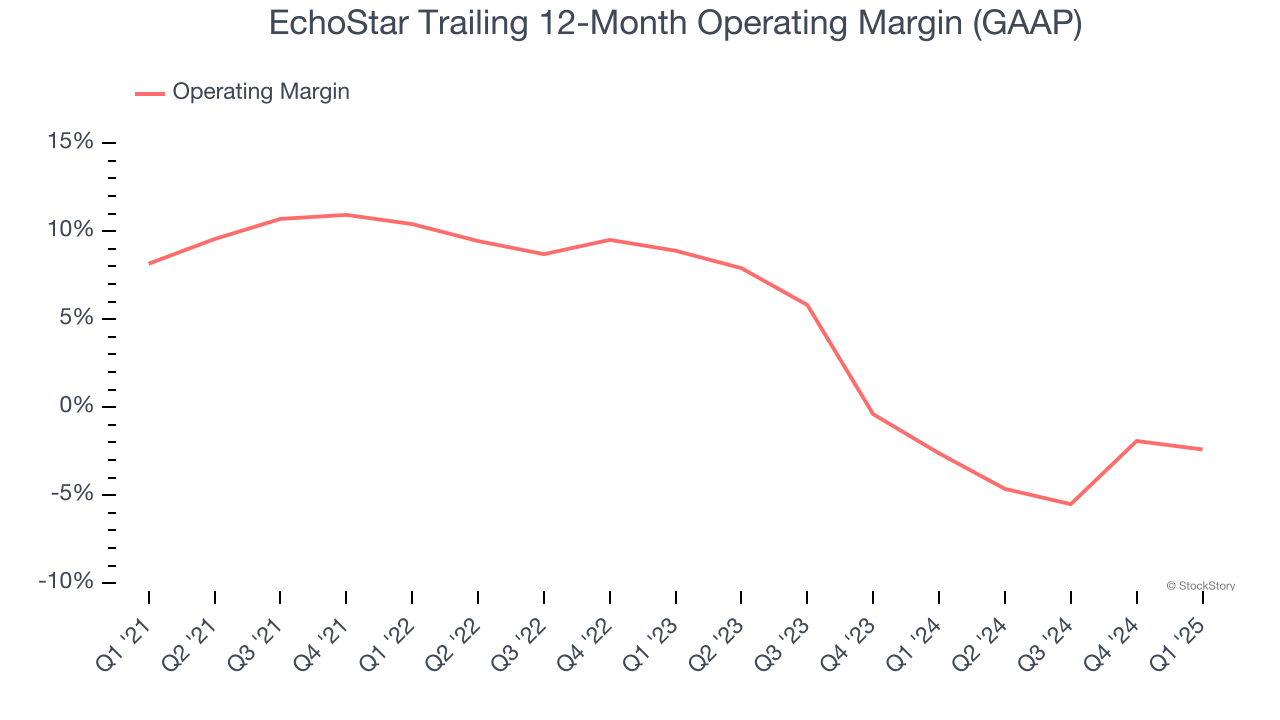

EchoStar was roughly breakeven when averaging the last five years of quarterly operating profits, inadequate for a business services business.

Analyzing the trend in its profitability, EchoStar’s operating margin decreased by 10.6 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. EchoStar’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, EchoStar generated an operating profit margin of negative 2.3%, down 1.9 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

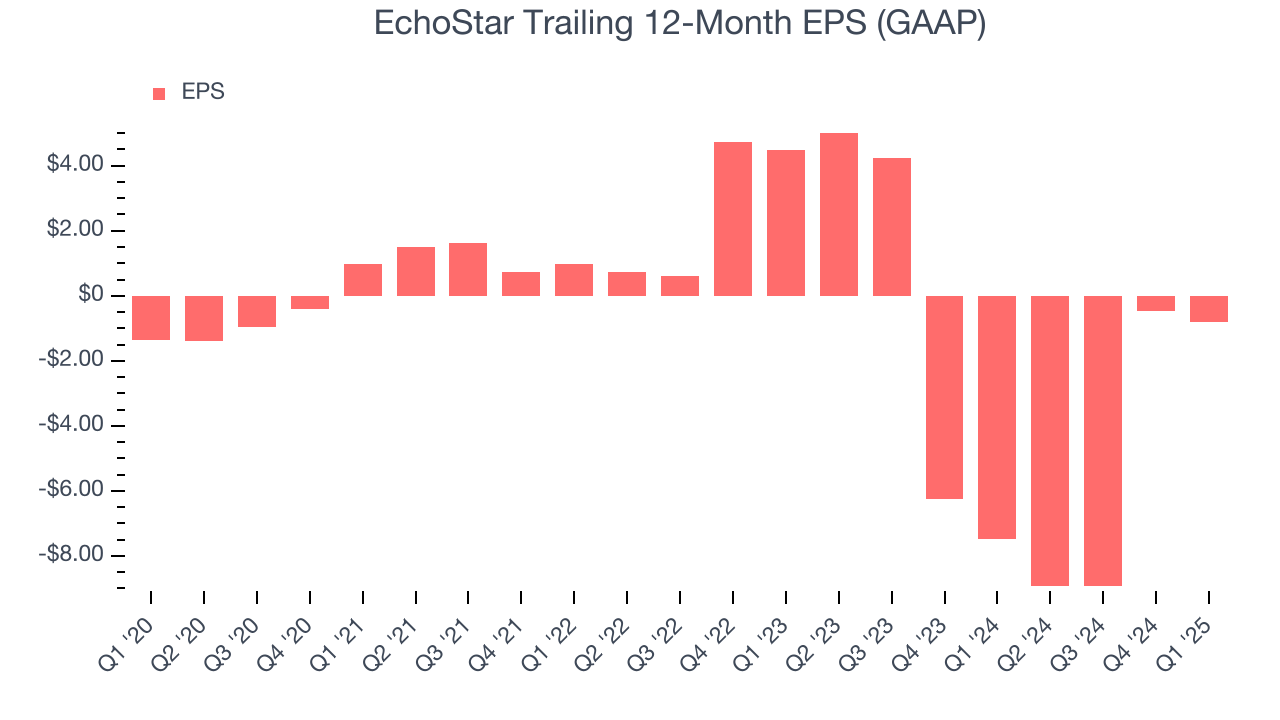

Although EchoStar’s full-year earnings are still negative, it reduced its losses and improved its EPS by 9.9% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q1, EchoStar reported EPS at negative $0.71, down from negative $0.40 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects EchoStar to perform poorly. Analysts forecast its full-year EPS of negative $0.80 will tumble to negative $3.75.

Key Takeaways from EchoStar’s Q1 Results

We enjoyed seeing EchoStar beat analysts’ EPS expectations this quarter. On the other hand, its revenue was in line and its EBITDA missed. Overall, we think this was a mixed quarter. Investors were likely hoping for more, and shares traded down 3.5% to $23.02 immediately following the results.

Is EchoStar an attractive investment opportunity at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.