Q1 Earnings Highs And Lows: Western Digital (NASDAQ:WDC) Vs The Rest Of The Semiconductors Stocks

Wrapping up Q1 earnings, we look at the numbers and key takeaways for the semiconductors stocks, including Western Digital (NASDAQ: WDC) and its peers.

The semiconductor industry is driven by cyclical demand for advanced electronic products like smartphones, PCs, servers, and data storage. While analog chips serve as the building blocks of most electronic goods and equipment, processors (CPUs) and graphics chips serve as their brains. The growth of data and technologies like artificial intelligence, 5G, the Internet of Things, and smart cars are creating the next wave of secular growth for the industry.

The 41 semiconductors stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was 0.8% below.

Luckily, semiconductors stocks have performed well with share prices up 16.9% on average since the latest earnings results.

Western Digital (NASDAQ: WDC)

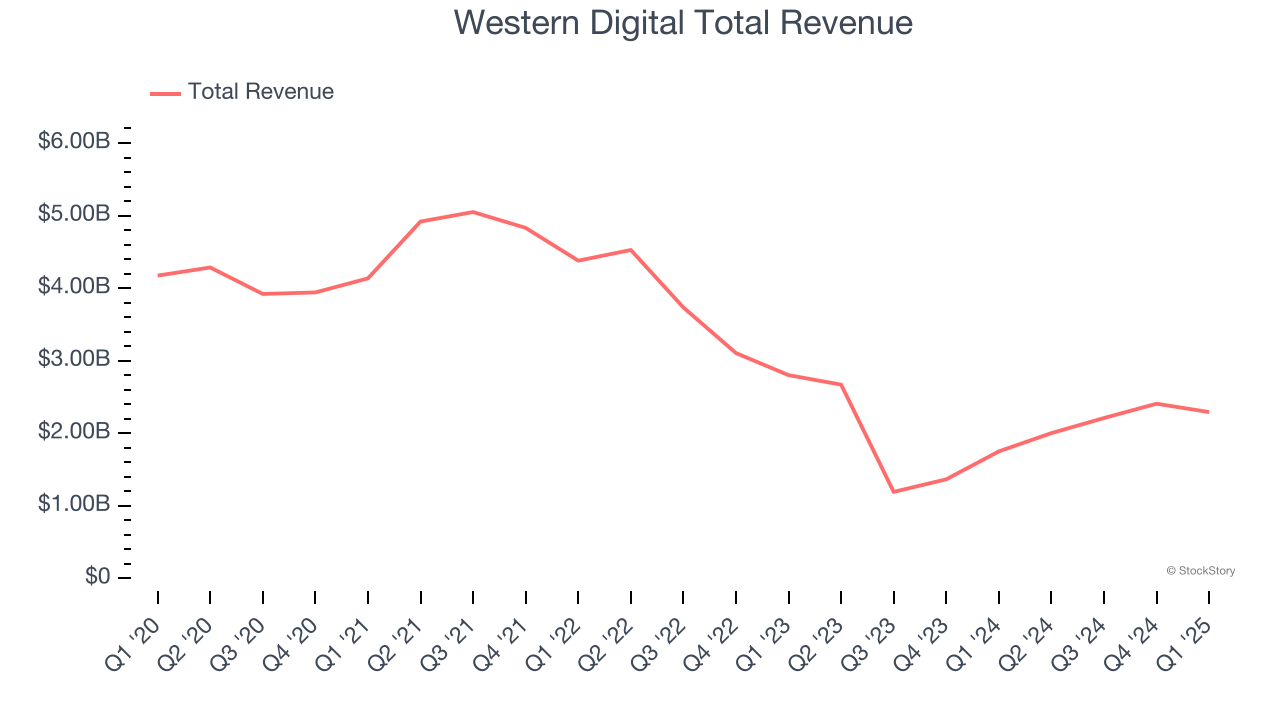

Founded in 1970 by a Motorola employee, Western Digital (NASDAQ: WDC) is a leading producer of hard disk drives, SSDs and flash memory.

Western Digital reported revenues of $2.29 billion, up 30.9% year on year. This print exceeded analysts’ expectations by 1.9%. Overall, it was a very strong quarter for the company with a significant improvement in its inventory levels and a solid beat of analysts’ EPS estimates.

“Western Digital executed well in its fiscal third quarter achieving revenue at the high end of our guidance range and gross margin over 40%,” said Irving Tan, CEO of Western Digital.

The stock is up 39.7% since reporting and currently trades at $56.75.

Is now the time to buy Western Digital? Access our full analysis of the earnings results here, it’s free.

Best Q1: Penguin Solutions (NASDAQ: PENG)

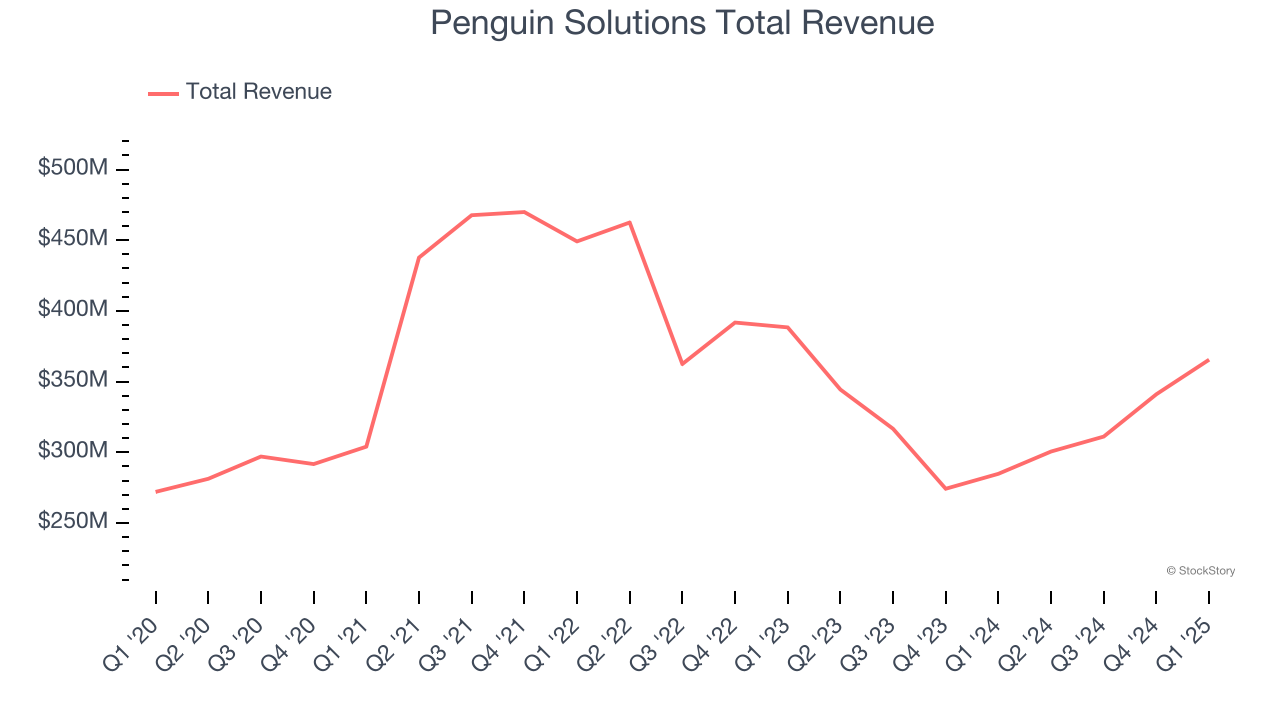

Based in the US, Penguin Solutions (NASDAQ: PENG) is a diversified semiconductor company offering memory, digital, and LED products.

Penguin Solutions reported revenues of $365.5 million, up 28.3% year on year, outperforming analysts’ expectations by 6.1%. The business had a stunning quarter with a significant improvement in its inventory levels and a solid beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 7.3% since reporting. It currently trades at $19.37.

Is now the time to buy Penguin Solutions? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Photronics (NASDAQ: PLAB)

Sporting a global footprint of facilities, Photronics (NASDAQ: PLAB) is a manufacturer of photomasks, templates used to transfer patterns onto semiconductor wafers.

Photronics reported revenues of $211 million, down 2.8% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted revenue guidance for next quarter missing analysts’ expectations and a significant miss of analysts’ EPS estimates.

As expected, the stock is down 5.6% since the results and currently trades at $18.95.

Read our full analysis of Photronics’s results here.

Himax (NASDAQ: HIMX)

Taiwan-based Himax Technologies (NASDAQ: HIMX) is a leading manufacturer of display driver chips and timing controllers used in TVs, laptops, and mobile phones.

Himax reported revenues of $215.1 million, up 3.7% year on year. This result topped analysts’ expectations by 2.4%. It was an exceptional quarter as it also logged a solid beat of analysts’ EPS estimates and revenue guidance for next quarter exceeding analysts’ expectations.

The stock is up 22.1% since reporting and currently trades at $9.11.

Read our full, actionable report on Himax here, it’s free.

Intel (NASDAQ: INTC)

Inventor of the x86 processor that powered decades of technological innovation in PCs, data centers, and numerous other markets, Intel (NASDAQ: INTC) is a leading manufacturer of computer processors and graphics chips.

Intel reported revenues of $12.67 billion, flat year on year. This number surpassed analysts’ expectations by 2.6%. Aside from that, it was a satisfactory quarter as it also logged an impressive beat of analysts’ EPS estimates.

The stock is down 4.5% since reporting and currently trades at $20.51.

Read our full, actionable report on Intel here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.