Q1 Earnings Highlights: Upstart (NASDAQ:UPST) Vs The Rest Of The Vertical Software Stocks

As the Q1 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the vertical software industry, including Upstart (NASDAQ: UPST) and its peers.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 14 vertical software stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 2.8% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 7.4% on average since the latest earnings results.

Upstart (NASDAQ: UPST)

Founded by the former head of Google's enterprise business, Upstart (NASDAQ: UPST) is an AI-powered lending platform facilitating loans for banks and consumers.

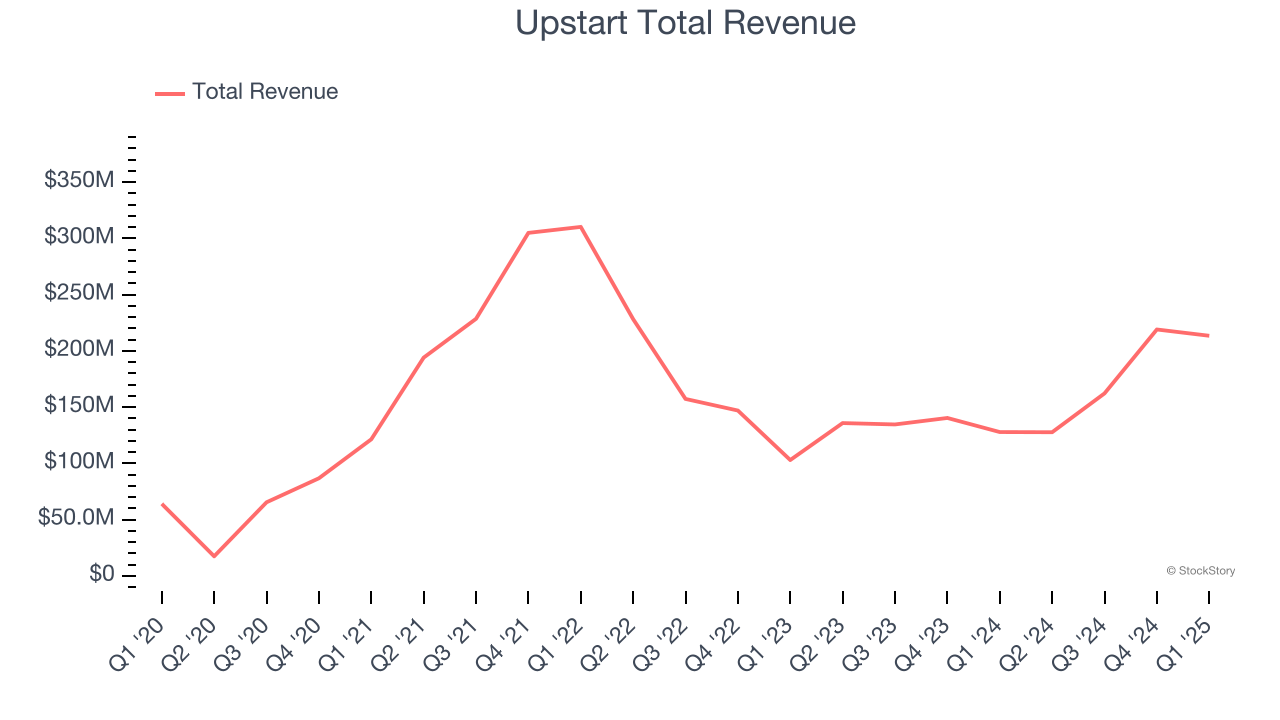

Upstart reported revenues of $213.4 million, up 67% year on year. This print exceeded analysts’ expectations by 5.2%. Overall, it was a very strong quarter for the company with EBITDA guidance for next quarter exceeding analysts’ expectations.

Upstart achieved the biggest analyst estimates beat and fastest revenue growth of the whole group. Unsurprisingly, the stock is up 3.2% since reporting and currently trades at $53.05.

We think Upstart is a good business, but is it a buy today? Read our full report here, it’s free.

Best Q1: Veeva Systems (NYSE: VEEV)

Built on top of Salesforce as one of the first vertical-focused cloud platforms, Veeva (NYSE: VEEV) provides data and customer relationship management (CRM) software for organizations in the life sciences industry.

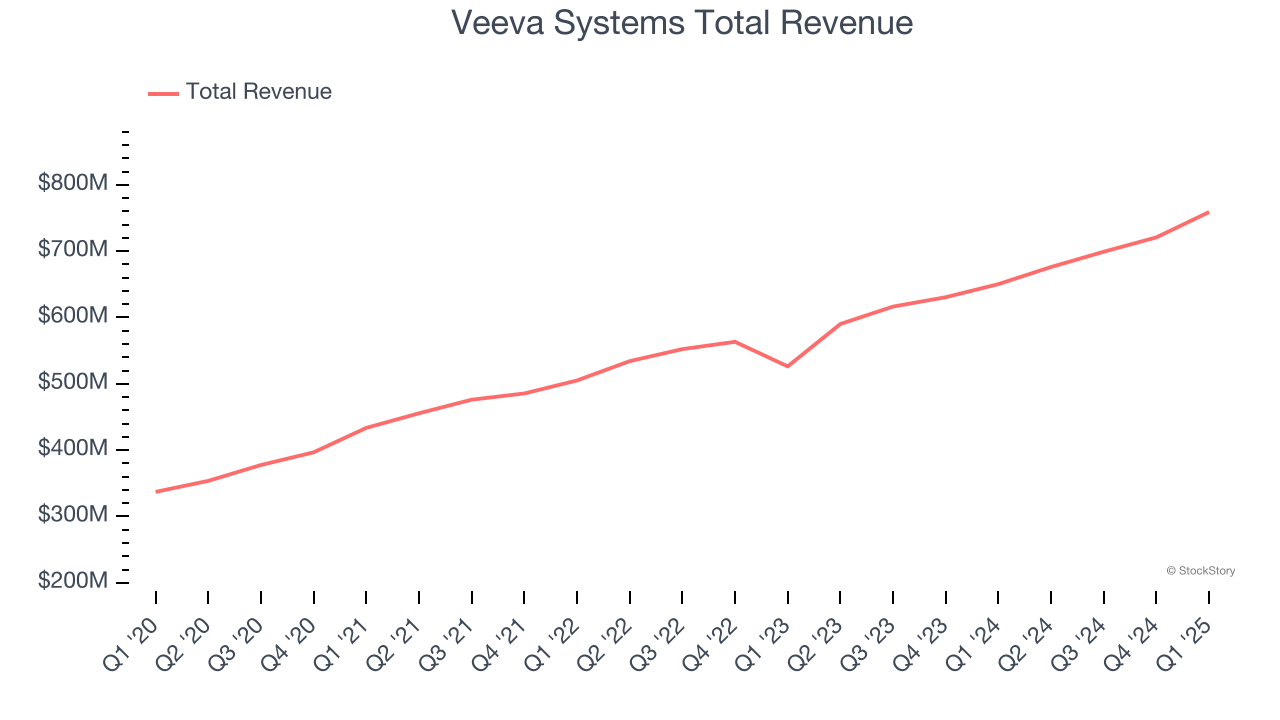

Veeva Systems reported revenues of $759 million, up 16.7% year on year, outperforming analysts’ expectations by 4.2%. The business had an exceptional quarter with a solid beat of analysts’ billings estimates and EPS guidance for next quarter exceeding analysts’ expectations.

Veeva Systems scored the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 19.8% since reporting. It currently trades at $281.60.

Is now the time to buy Veeva Systems? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Doximity (NYSE: DOCS)

Founded in 2010 and named for a combination of “docs” and “proximity”, Doximity (NYSE: DOCS) is the leading social network for U.S. medical professionals.

Doximity reported revenues of $138.3 million, up 17.1% year on year, exceeding analysts’ expectations by 3.5%. Still, it was a weaker quarter as it posted full-year guidance of slowing revenue growth.

The stock is flat since the results and currently trades at $58.50.

Read our full analysis of Doximity’s results here.

Olo (NYSE: OLO)

Founded by Noah Glass, who wanted to get a cup of coffee faster on his way to work, Olo (NYSE: OLO) provides restaurants and food retailers with software to manage food orders and delivery.

Olo reported revenues of $80.68 million, up 21.3% year on year. This print topped analysts’ expectations by 4.1%. Overall, it was a very strong quarter as it also produced a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is up 5.3% since reporting and currently trades at $8.47.

Read our full, actionable report on Olo here, it’s free.

Autodesk (NASDAQ: ADSK)

Founded in 1982 by John Walker and growing into one of the industry's behemoths, Autodesk (NASDAQ: ADSK) makes computer-aided design (CAD) software for engineering, construction, and architecture companies.

Autodesk reported revenues of $1.63 billion, up 15.2% year on year. This number beat analysts’ expectations by 1.7%. It was a very strong quarter as it also logged EPS guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

The stock is flat since reporting and currently trades at $296.30.

Read our full, actionable report on Autodesk here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.