Spotting Winners: Jamf (NASDAQ:JAMF) And Automation Software Stocks In Q1

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Jamf (NASDAQ: JAMF) and the best and worst performers in the automation software industry.

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

The 7 automation software stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 5.9% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 9.6% on average since the latest earnings results.

Jamf (NASDAQ: JAMF)

Founded in 2002 by Zach Halmstad and Chip Pearson, right around the time when Apple began to dominate the personal computing market, Jamf (NASDAQ: JAMF) provides software for companies to manage Apple devices such as Macs, iPads, and iPhones.

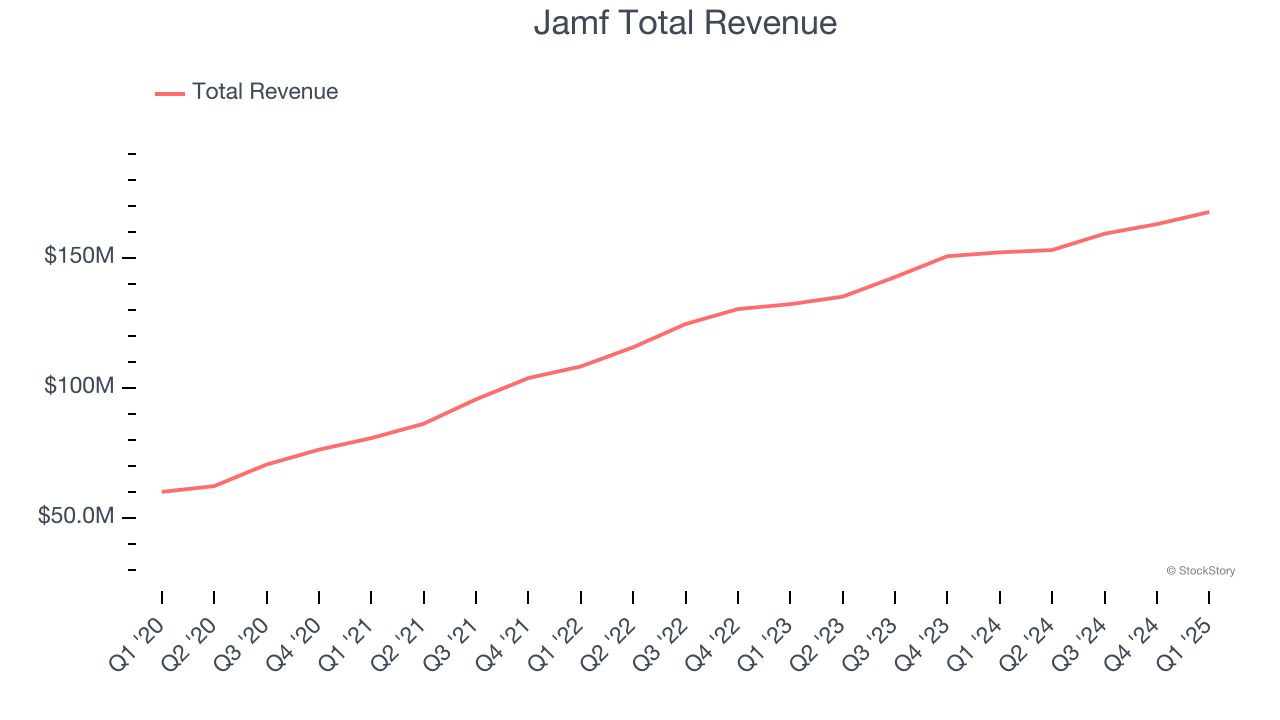

Jamf reported revenues of $167.6 million, up 10.2% year on year. This print exceeded analysts’ expectations by 0.8%. Despite the top-line beat, it was still a mixed quarter for the company with full-year revenue guidance topping analysts’ expectations but annual recurring revenue in line with analysts’ estimates.

Jamf pulled off the highest full-year guidance raise of the whole group. Still, the market seems discontent with the results. The stock is down 46.8% since reporting and currently trades at $9.73.

Is now the time to buy Jamf? Access our full analysis of the earnings results here, it’s free.

Best Q1: Pegasystems (NASDAQ: PEGA)

Founded by Alan Trefler in 1983, Pegasystems (NASDAQ: PEGA) offers a software-as-a-service platform to automate and optimize workflows in customer service and engagement.

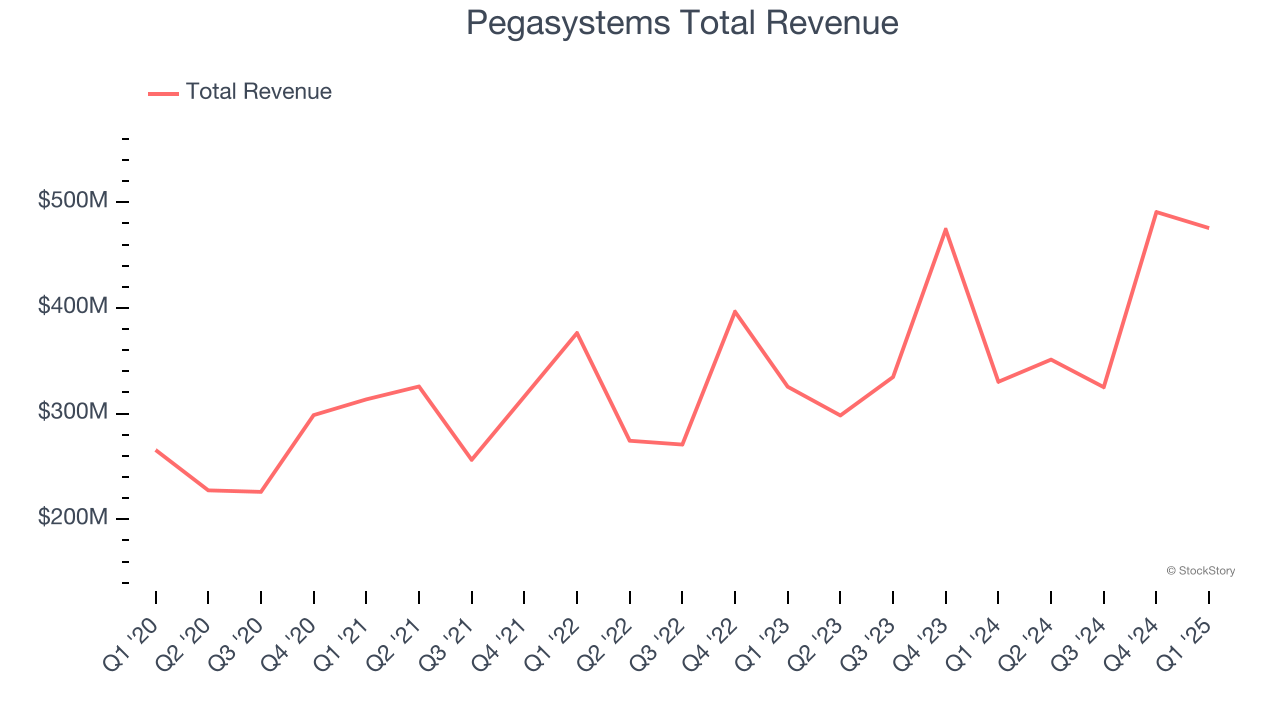

Pegasystems reported revenues of $475.6 million, up 44.1% year on year, outperforming analysts’ expectations by 33.1%. The business had an incredible quarter with an impressive beat of analysts’ billings estimates and a solid beat of analysts’ EBITDA estimates.

Pegasystems pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 46.8% since reporting. It currently trades at $101.

Is now the time to buy Pegasystems? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: SoundHound AI (NASDAQ: SOUN)

Founded in 2005, SoundHound AI (NASDAQ: SOUN) develops independent voice artificial intelligence solutions that enable businesses across various industries to offer customized conversational experiences to consumers.

SoundHound AI reported revenues of $29.13 million, up 151% year on year, falling short of analysts’ expectations by 4.4%. It was a softer quarter as it posted a significant miss of analysts’ EBITDA estimates.

SoundHound AI delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. As expected, the stock is down 3.1% since the results and currently trades at $9.43.

Read our full analysis of SoundHound AI’s results here.

UiPath (NYSE: PATH)

Started in 2005 in Romania as a tech outsourcing company, UiPath (NYSE: PATH) makes software that helps companies automate repetitive computer tasks.

UiPath reported revenues of $356.6 million, up 6.4% year on year. This result topped analysts’ expectations by 7.4%. It was a very strong quarter as it also put up a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

UiPath had the slowest revenue growth among its peers. The stock is down 5% since reporting and currently trades at $12.31.

Read our full, actionable report on UiPath here, it’s free.

Microsoft (NASDAQ: MSFT)

Short for microcomputer software, Microsoft (NASDAQ: MSFT) is the largest software vendor in the world with its Windows operating system, Office suite, and cloud computing services.

Microsoft reported revenues of $70.07 billion, up 13.3% year on year. This number beat analysts’ expectations by 2.3%. Overall, it was a very strong quarter as it also produced a solid beat of analysts’ operating income estimates and a narrow beat of analysts’ revenue estimates, as Personal Computing, Intelligent Cloud, and Business Services all beat.

The stock is up 22.6% since reporting and currently trades at $480.83.

Read our full, actionable report on Microsoft here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.