Apogee (NASDAQ:APOG) Beats Expectations in Strong Q2, Stock Soars

Architectural products company Apogee (NASDAQ: APOG) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 4.6% year on year to $346.6 million. The company’s full-year revenue guidance of $1.42 billion at the midpoint came in 2.4% above analysts’ estimates. Its non-GAAP profit of $0.56 per share was 23.5% above analysts’ consensus estimates.

Is now the time to buy Apogee? Find out by accessing our full research report, it’s free.

Apogee (APOG) Q2 CY2025 Highlights:

- Revenue: $346.6 million vs analyst estimates of $326.1 million (4.6% year-on-year growth, 6.3% beat)

- Adjusted EPS: $0.56 vs analyst estimates of $0.45 (23.5% beat)

- Adjusted EBITDA: $34.38 million vs analyst estimates of $30.65 million (9.9% margin, 12.2% beat)

- The company lifted its revenue guidance for the full year to $1.42 billion at the midpoint from $1.4 billion, a 1.4% increase

- Management raised its full-year Adjusted EPS guidance to $4 at the midpoint, a 4.5% increase

- Operating Margin: 2%, down from 12.5% in the same quarter last year

- Free Cash Flow was -$26.95 million compared to -$1.78 million in the same quarter last year

- Market Capitalization: $855.8 million

Company Overview

Involved in the design of the Apple Store on Fifth Avenue in New York City, Apogee (NASDAQ: APOG) sells architectural products and services such as high-performance glass for commercial buildings.

Revenue Growth

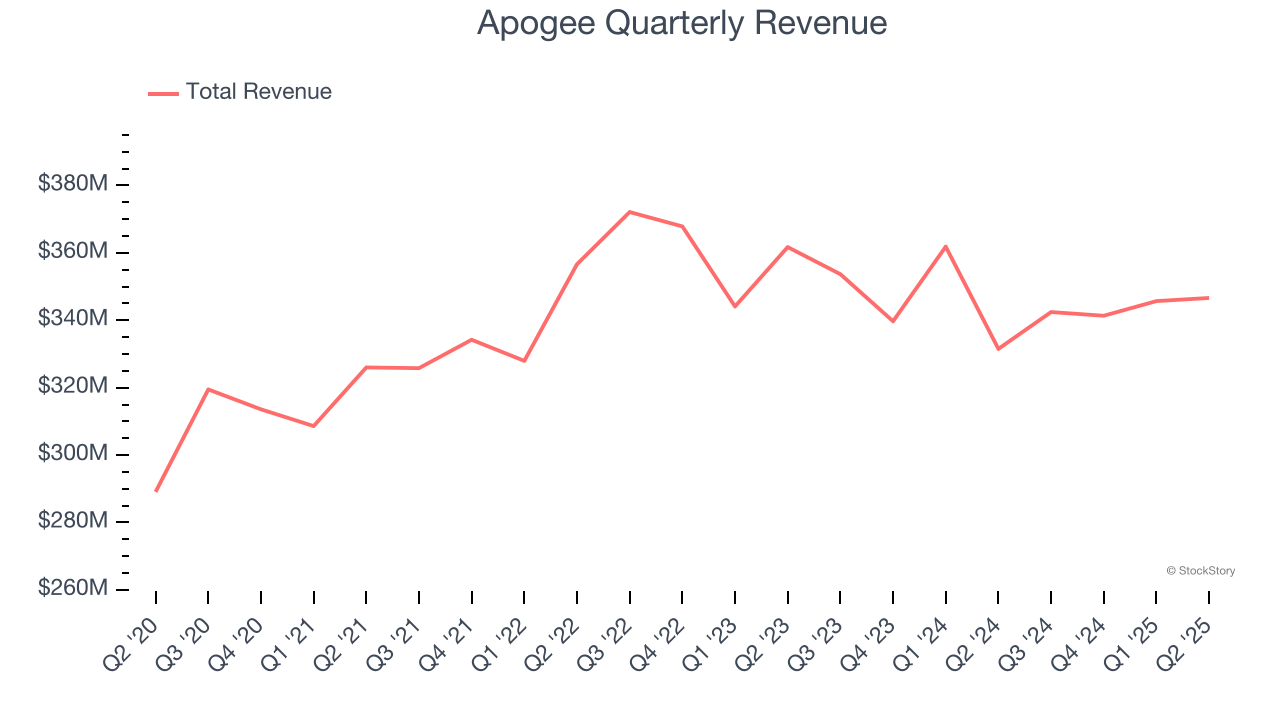

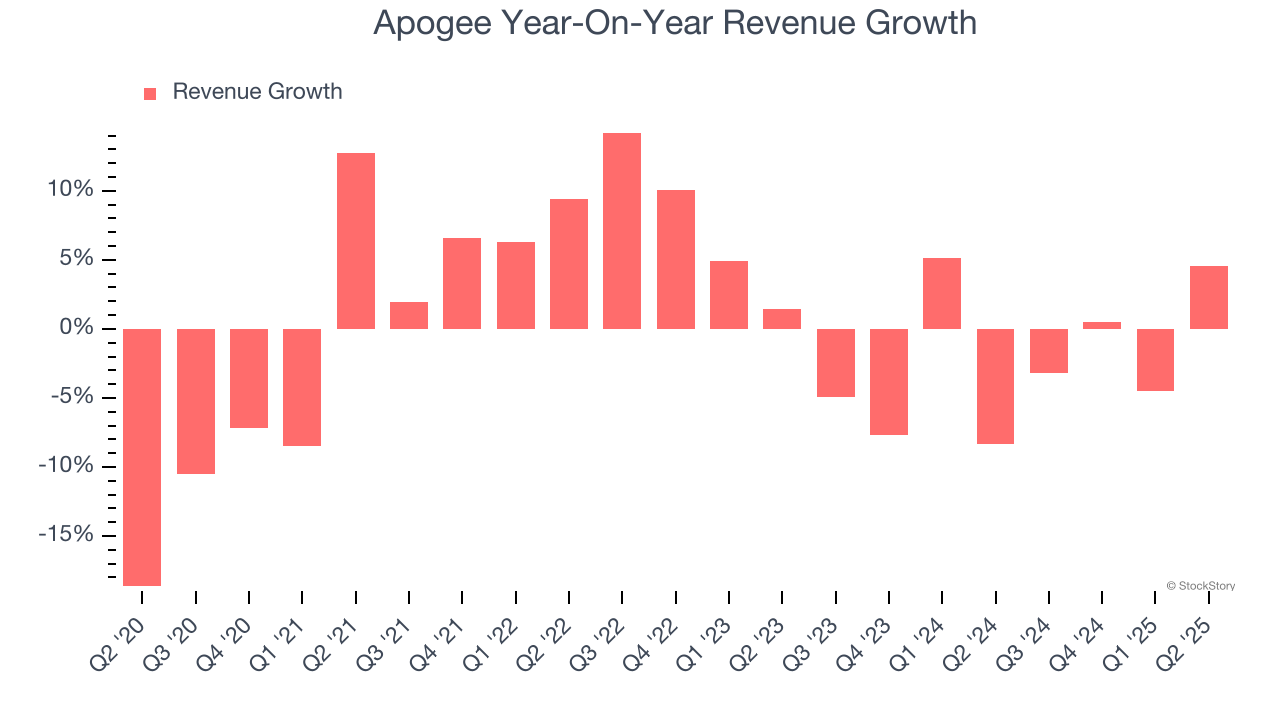

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Apogee struggled to consistently increase demand as its $1.38 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of poor business quality.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Apogee’s recent performance shows its demand remained suppressed as its revenue has declined by 2.4% annually over the last two years. Apogee isn’t alone in its struggles as the Commercial Building Products industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Apogee reported modest year-on-year revenue growth of 4.6% but beat Wall Street’s estimates by 6.3%.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

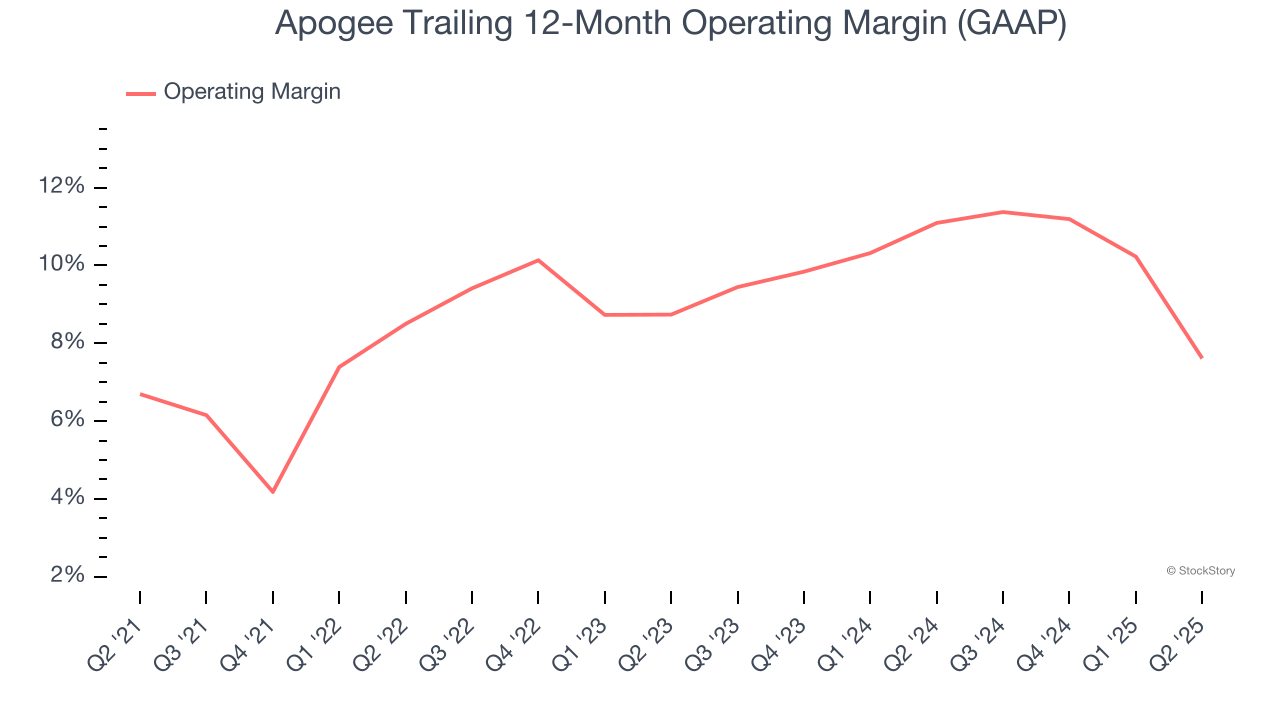

Apogee’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 8.6% over the last five years. This profitability was higher than the broader industrials sector, showing it did a decent job managing its expenses.

Analyzing the trend in its profitability, Apogee’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. Shareholders will want to see Apogee grow its margin in the future.

In Q2, Apogee generated an operating margin profit margin of 2%, down 10.5 percentage points year on year. Since Apogee’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

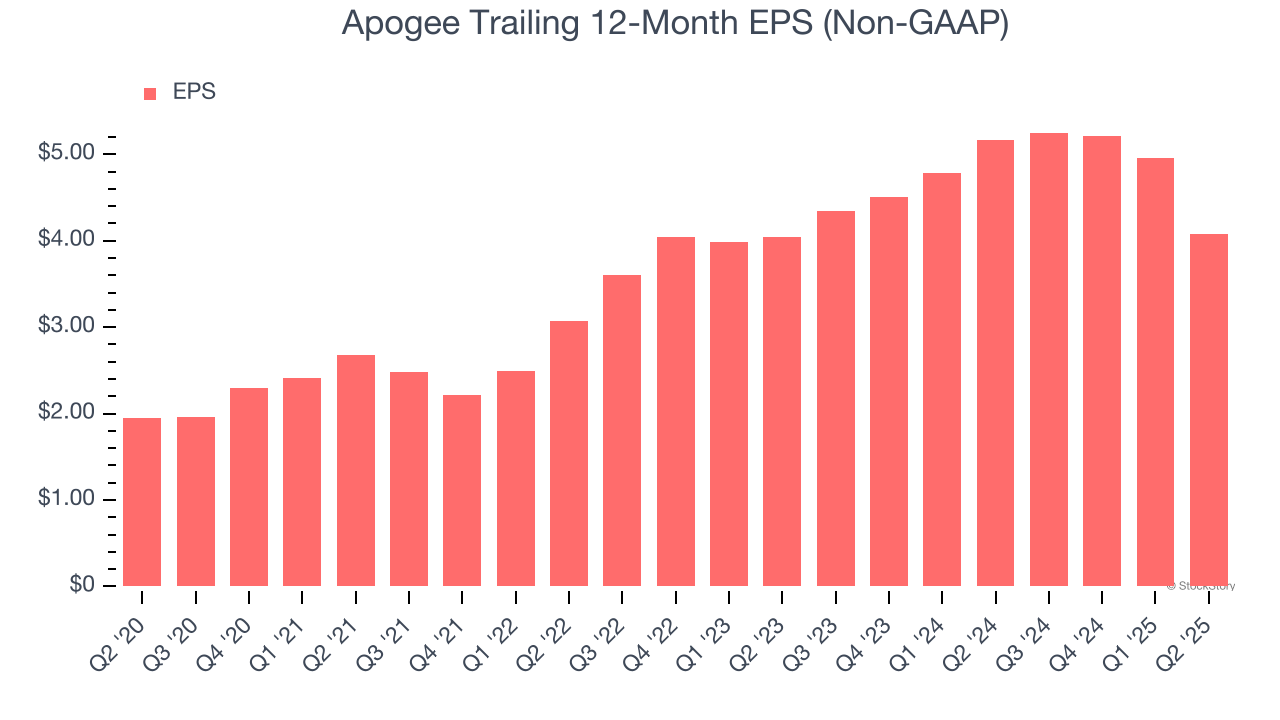

Apogee’s EPS grew at a spectacular 15.9% compounded annual growth rate over the last five years, higher than its flat revenue. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

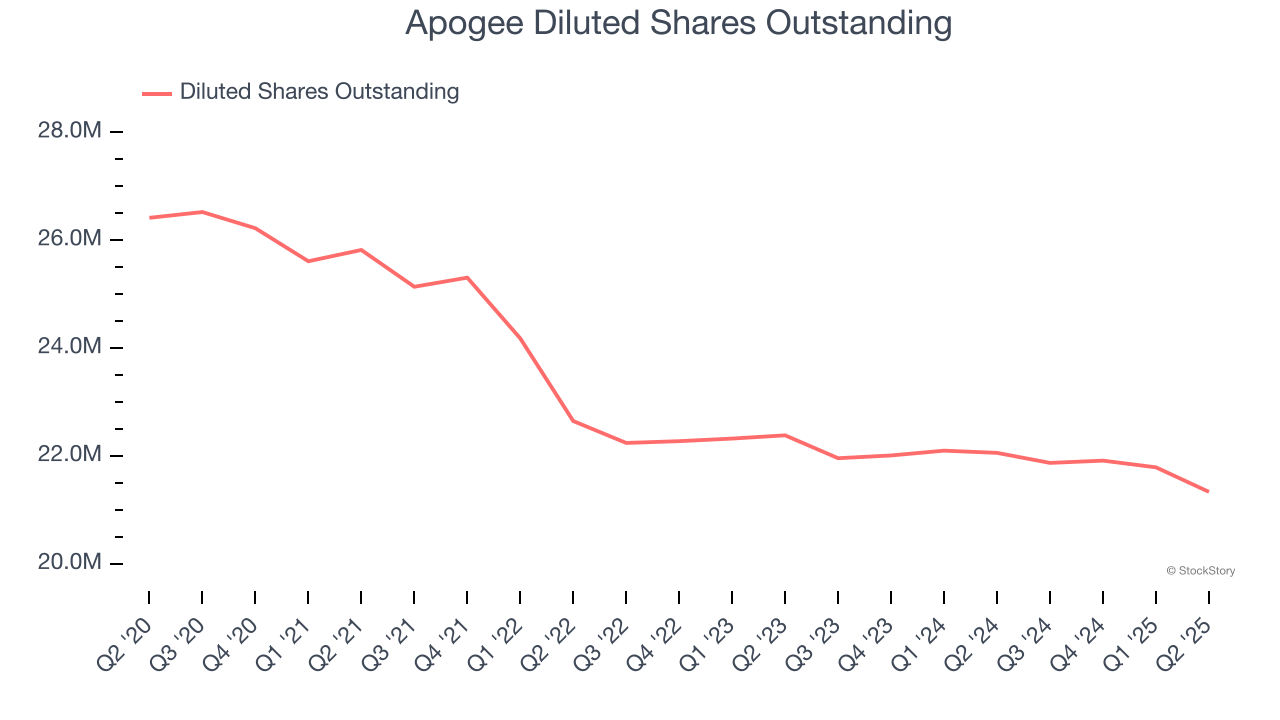

We can take a deeper look into Apogee’s earnings to better understand the drivers of its performance. A five-year view shows that Apogee has repurchased its stock, shrinking its share count by 19.2%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Apogee, EPS didn’t budge over the last two years, a regression from its five-year trend. We hope it can revert to earnings growth in the coming years.

In Q2, Apogee reported EPS at $0.56, down from $1.44 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Apogee’s full-year EPS of $4.08 to grow 2.5%.

Key Takeaways from Apogee’s Q2 Results

We were impressed by how significantly Apogee blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 6.9% to $42.39 immediately after reporting.

Apogee may have had a good quarter, but does that mean you should invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.