2 Reasons to Watch CINF and 1 to Stay Cautious

Cincinnati Financial currently trades at $146.26 per share and has shown little upside over the past six months, posting a middling return of 2.2%.

Given the underwhelming price action, is now a good time to buy CINF? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free.

Why Does CINF Stock Spark Debate?

Founded in 1950 by independent insurance agents seeking stable market options for their clients, Cincinnati Financial (NASDAQ: CINF) provides property casualty insurance, life insurance, and related financial services through independent agencies across 46 states.

Two Things to Like:

1. Net Premiums Earned Skyrockets, Fueling Growth Opportunities

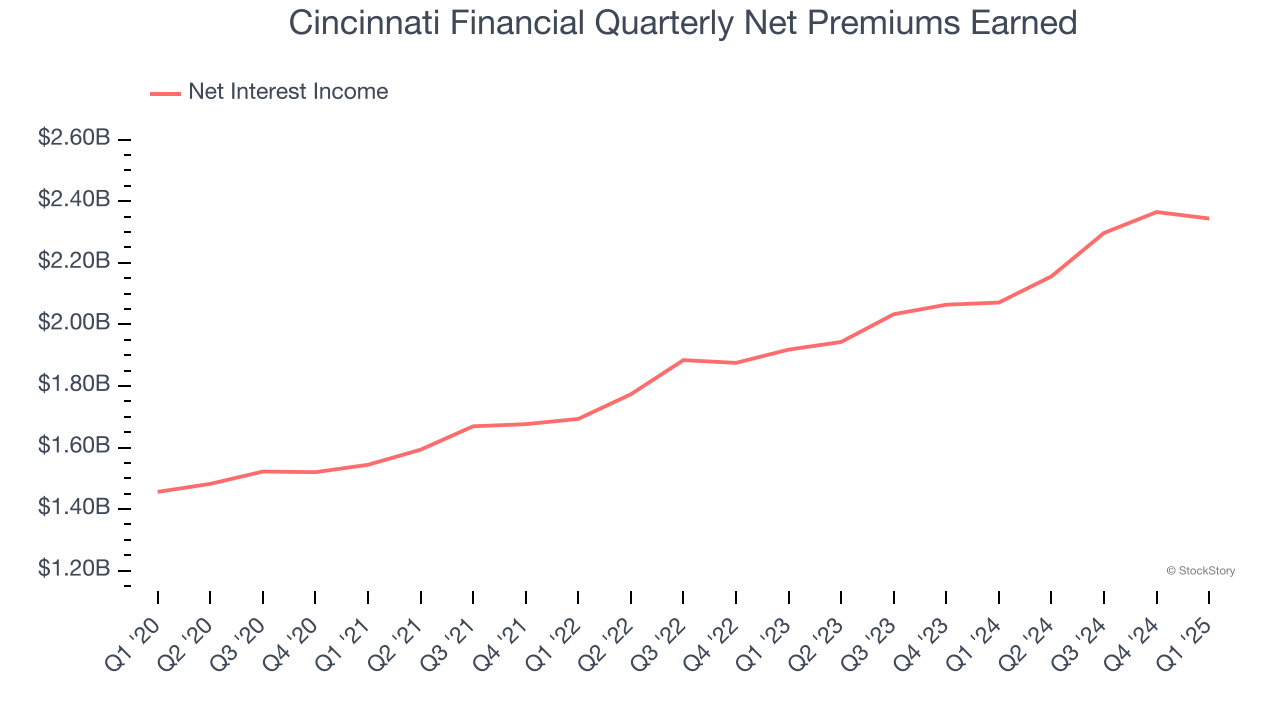

Our experience and research show the market cares primarily about an insurer’s net premiums earned growth as investment and fee income are considered more susceptible to market volatility and economic cycles.

Cincinnati Financial’s net premiums earned has grown at a 10.9% annualized rate over the last two years, better than the broader insurance industry.

2. BVPS Growth Demonstrates Strong Asset Foundation

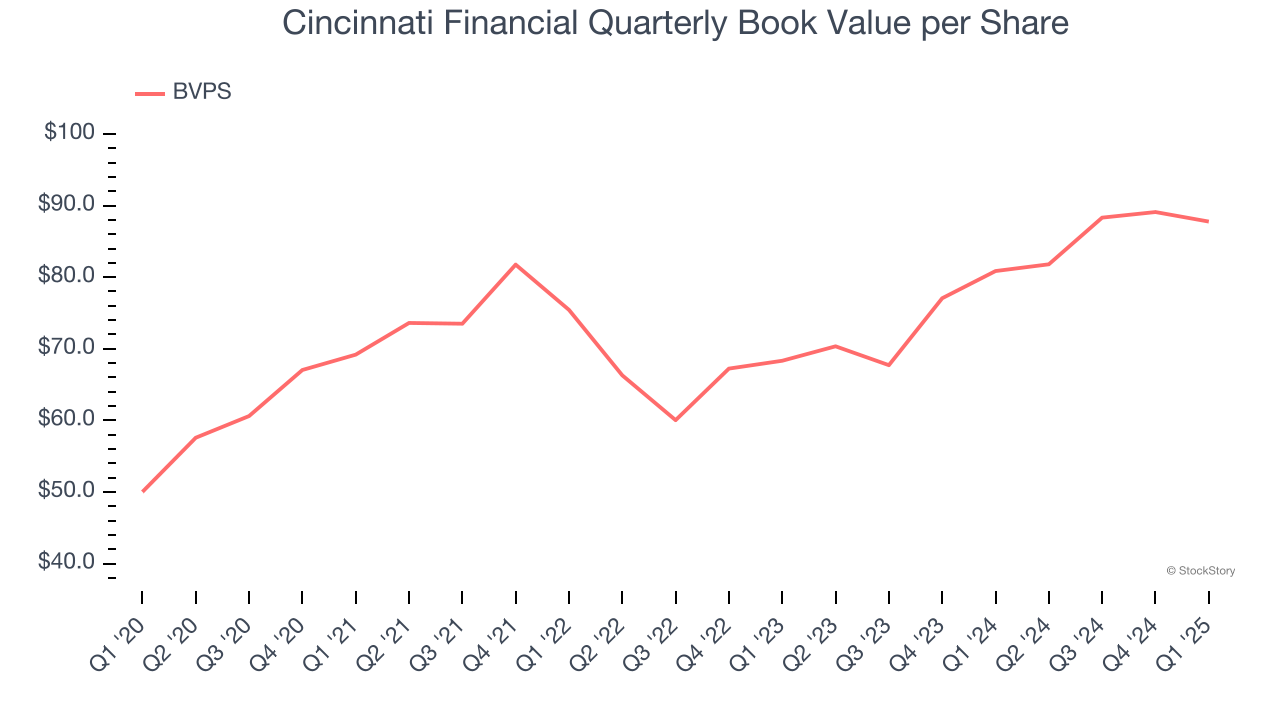

In the insurance industry, book value per share (BVPS) provides a clear picture of shareholder value, as it represents the total equity backing a company’s insurance operations and growth initiatives.

Cincinnati Financial’s BVPS increased by 11.9% annually over the last five years, and growth has recently accelerated as BVPS grew at a decent 13.3% annual clip over the past two years (from $68.33 to $87.77 per share).

One Reason to be Careful:

Projected BVPS Growth Is Slim

Book value per share (BVPS) growth comes from an insurer’s ability to price risk appropriately and invest premiums profitably.

Over the next 12 months, Consensus estimates call for Cincinnati Financial’s BVPS to grow by 6.5% to $89.20, paltry growth rate.

Final Judgment

Cincinnati Financial’s positive characteristics outweigh the negatives, but at $146.26 per share (or 1.6× forward P/B), is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.