Concrete Pumping (NASDAQ:BBCP) Reports Sales Below Analyst Estimates In Q1 Earnings, Stock Drops 14%

Concrete and waste management company Concrete Pumping (NASDAQ: BBCP) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 12.2% year on year to $93.96 million. The company’s full-year revenue guidance of $385 million at the midpoint came in 5.8% below analysts’ estimates. Its GAAP loss of $0.01 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Concrete Pumping? Find out by accessing our full research report, it’s free.

Concrete Pumping (BBCP) Q1 CY2025 Highlights:

- Revenue: $93.96 million vs analyst estimates of $97.92 million (12.2% year-on-year decline, 4% miss)

- EPS (GAAP): -$0.01 vs analyst estimates of $0.04 (significant miss)

- Adjusted EBITDA: $22.5 million vs analyst estimates of $24.97 million (23.9% margin, 9.9% miss)

- The company dropped its revenue guidance for the full year to $385 million at the midpoint from $410 million, a 6.1% decrease

- EBITDA guidance for the full year is $97.5 million at the midpoint, below analyst estimates of $106.5 million

- Operating Margin: 8.8%, down from 11.3% in the same quarter last year

- Free Cash Flow was $11.09 million, up from -$1.91 million in the same quarter last year

- Market Capitalization: $376.7 million

Company Overview

Going public via SPAC in 2018, Concrete Pumping (NASDAQ: BBCP) is a provider of concrete pumping and waste management services in the United States and the United Kingdom.

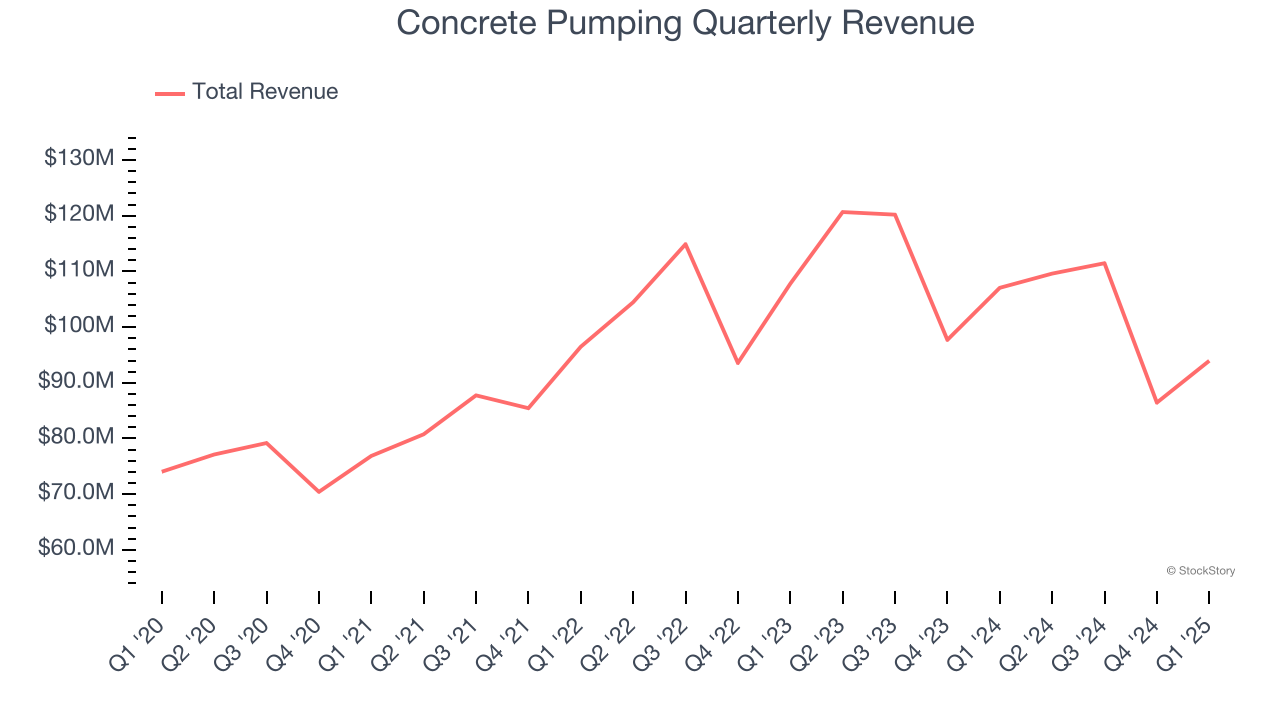

Sales Growth

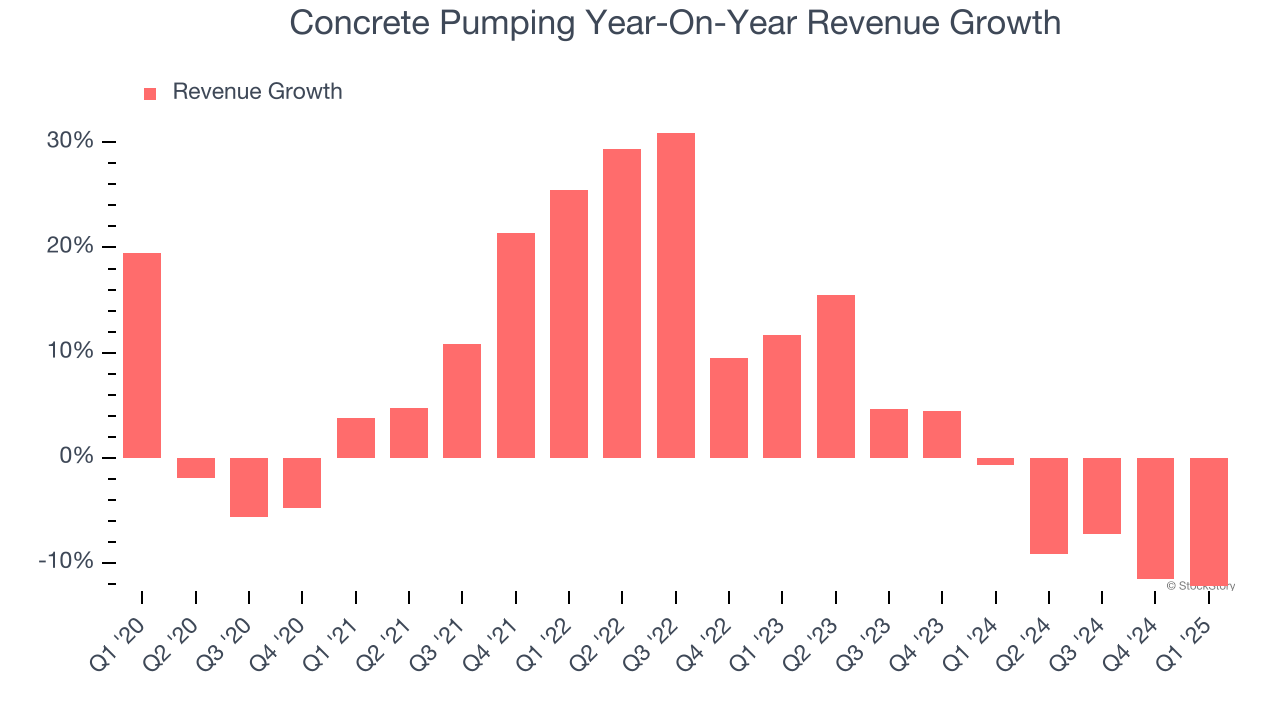

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Concrete Pumping grew its sales at a tepid 5.3% compounded annual growth rate. This was below our standard for the industrials sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Concrete Pumping’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.3% annually.

This quarter, Concrete Pumping missed Wall Street’s estimates and reported a rather uninspiring 12.2% year-on-year revenue decline, generating $93.96 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 5.2% over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

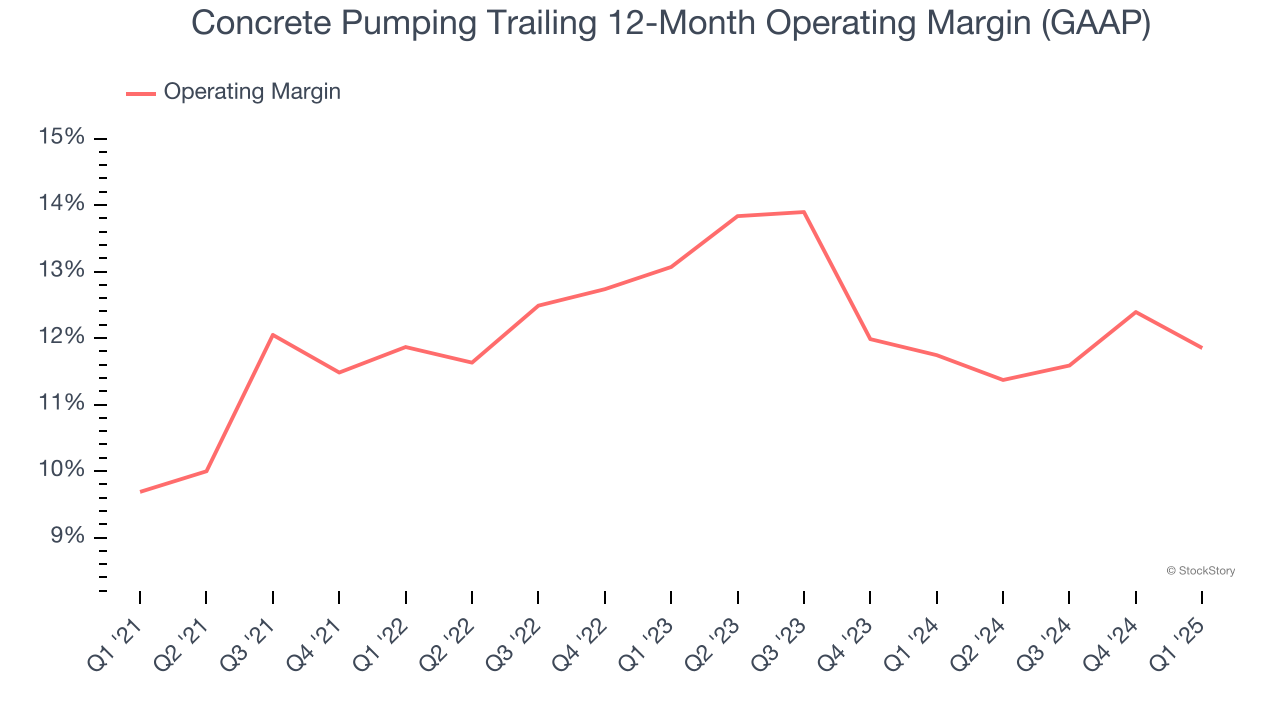

Operating Margin

Concrete Pumping has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 11.8%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Concrete Pumping’s operating margin rose by 2.2 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q1, Concrete Pumping generated an operating margin profit margin of 8.8%, down 2.5 percentage points year on year. Since Concrete Pumping’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

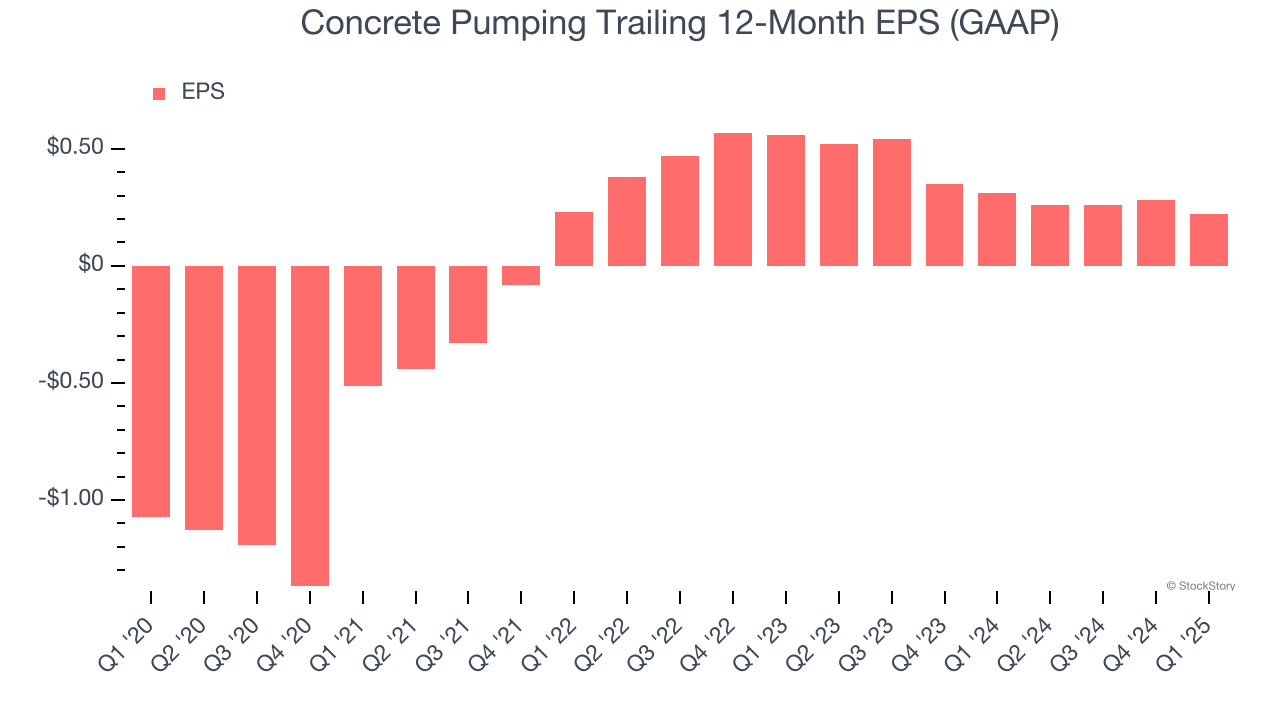

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Concrete Pumping’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Sadly for Concrete Pumping, its EPS declined by more than its revenue over the last two years, dropping 37.3%. This tells us the company struggled to adjust to shrinking demand.

We can take a deeper look into Concrete Pumping’s earnings to better understand the drivers of its performance. Concrete Pumping’s operating margin has declined by 3.5 percentage points over the last two years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, Concrete Pumping reported EPS at negative $0.01, down from $0.05 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Concrete Pumping to perform poorly. Analysts forecast its full-year EPS of $0.22 will hit $0.40.

Key Takeaways from Concrete Pumping’s Q1 Results

We struggled to find many positives in these results. Its full-year revenue guidance missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 14% to $6.08 immediately following the results.

Concrete Pumping’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.