Q1 Earnings Roundup: ON24 (NYSE:ONTF) And The Rest Of The Sales And Marketing Software Segment

Let’s dig into the relative performance of ON24 (NYSE: ONTF) and its peers as we unravel the now-completed Q1 sales and marketing software earnings season.

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 23 sales and marketing software stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 2.5% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 4.8% on average since the latest earnings results.

ON24 (NYSE: ONTF)

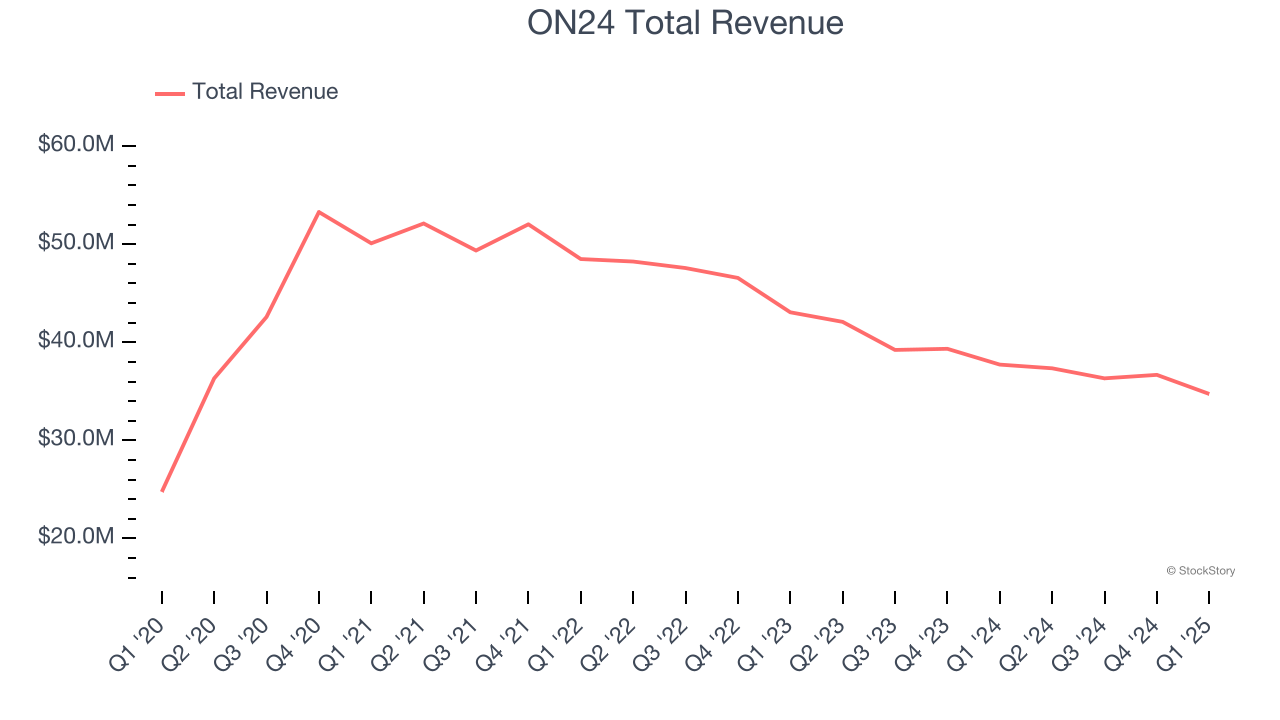

Started in 1998 as a platform to broadcast press conferences, ON24’s (NYSE: ONTF) software helps organizations organize online webinars and other virtual events and convert prospects into customers.

ON24 reported revenues of $34.73 million, down 7.9% year on year. This print exceeded analysts’ expectations by 1.5%. Despite the top-line beat, it was still a slower quarter for the company with full-year EPS guidance missing analysts’ expectations.

The stock is up 17.4% since reporting and currently trades at $5.53.

Read our full report on ON24 here, it’s free.

Best Q1: Yext (NYSE: YEXT)

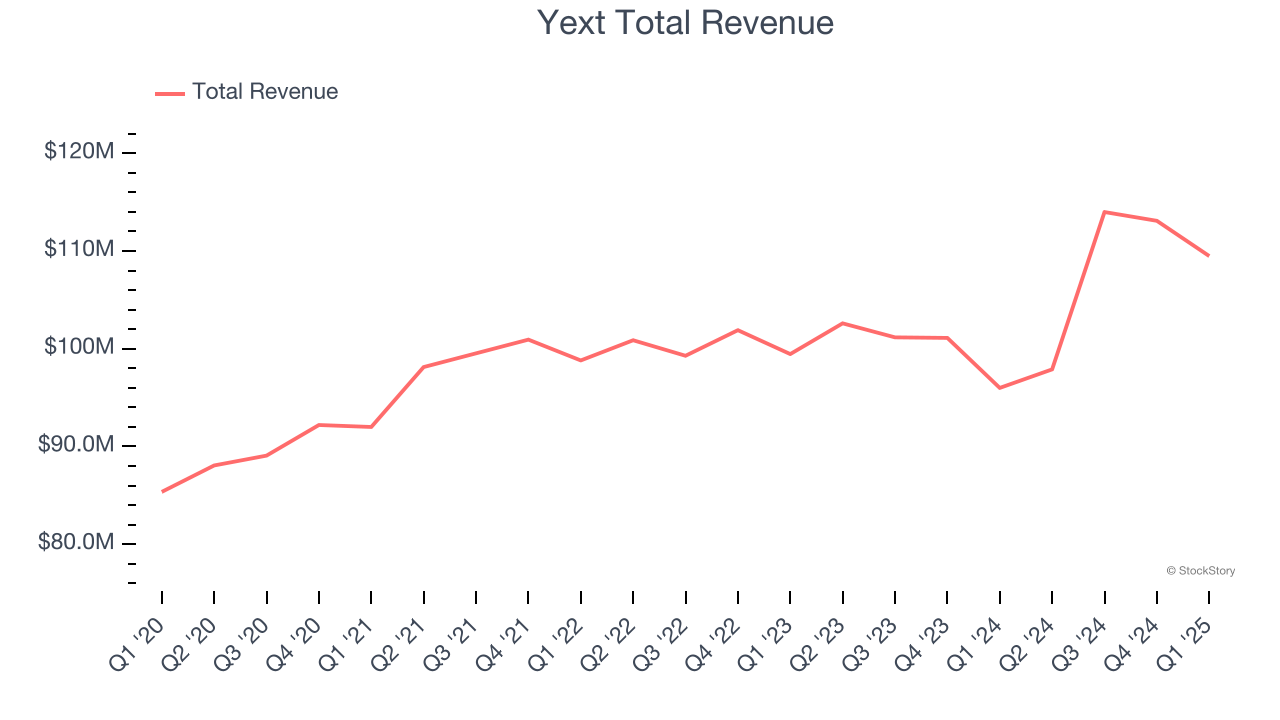

Founded in 2006 by Howard Lerman, Yext (NYSE: YEXT) offers software as a service that helps their clients manage and monitor their online listings and customer reviews across all relevant databases, from Google Maps to Alexa or Siri.

Yext reported revenues of $109.5 million, up 14.1% year on year, outperforming analysts’ expectations by 1.8%. The business had an exceptional quarter with a solid beat of analysts’ annual recurring revenue estimates and an impressive beat of analysts’ billings estimates.

The market seems happy with the results as the stock is up 30.4% since reporting. It currently trades at $8.88.

Is now the time to buy Yext? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Braze (NASDAQ: BRZE)

Founded in 2011 after the co-founders met at NYC Disrupt Hackathon, Braze (NASDAQ: BRZE) is a customer engagement software platform that allows brands to connect with customers through data-driven and contextual marketing campaigns.

Braze reported revenues of $162.1 million, up 19.6% year on year, exceeding analysts’ expectations by 2.2%. Still, it was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations.

As expected, the stock is down 17.1% since the results and currently trades at $29.96.

Read our full analysis of Braze’s results here.

VeriSign (NASDAQ: VRSN)

While the company is not a domain registrar and does not directly sell domain names to end users, Verisign (NASDAQ: VRSN) operates and maintains the infrastructure to support domain names such as .com and .net.

VeriSign reported revenues of $402.3 million, up 4.7% year on year. This result was in line with analysts’ expectations. Taking a step back, it was a mixed quarter as it failed to impress in some other areas of the business.

The stock is up 11.8% since reporting and currently trades at $282.30.

Read our full, actionable report on VeriSign here, it’s free.

Freshworks (NASDAQ: FRSH)

Founded in Chennai, India in 2010 with the idea of creating a “fresh” helpdesk product, Freshworks (NASDAQ: FRSH) offers a broad range of software targeted at small and medium-sized businesses.

Freshworks reported revenues of $196.3 million, up 18.9% year on year. This number beat analysts’ expectations by 2.1%. It was a strong quarter as it also put up accelerating growth in large customers and a solid beat of analysts’ EBITDA estimates.

The company added 717 enterprise customers paying more than $5,000 annually to reach a total of 23,275. The stock is up 8.4% since reporting and currently trades at $15.55.

Read our full, actionable report on Freshworks here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.