2 Reasons to Like GABC (and 1 Not So Much)

German American Bancorp has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 9.4% to $40.89 per share while the index has gained 7.5%.

Is now the time to buy GABC? Find out in our full research report, it’s free.

Why Does German American Bancorp Spark Debate?

Founded in 1910 during a wave of community banking expansion in the Midwest, German American Bancorp (NASDAQ: GABC) is a financial holding company that provides banking, wealth management, and insurance services across southern Indiana and Kentucky.

Two Positive Attributes:

1. Projected Net Interest Income Growth Is Remarkable

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect German American Bancorp’s net interest income to rise by 37.6%, an improvement versus its 2.3% annualized growth for the past two years.

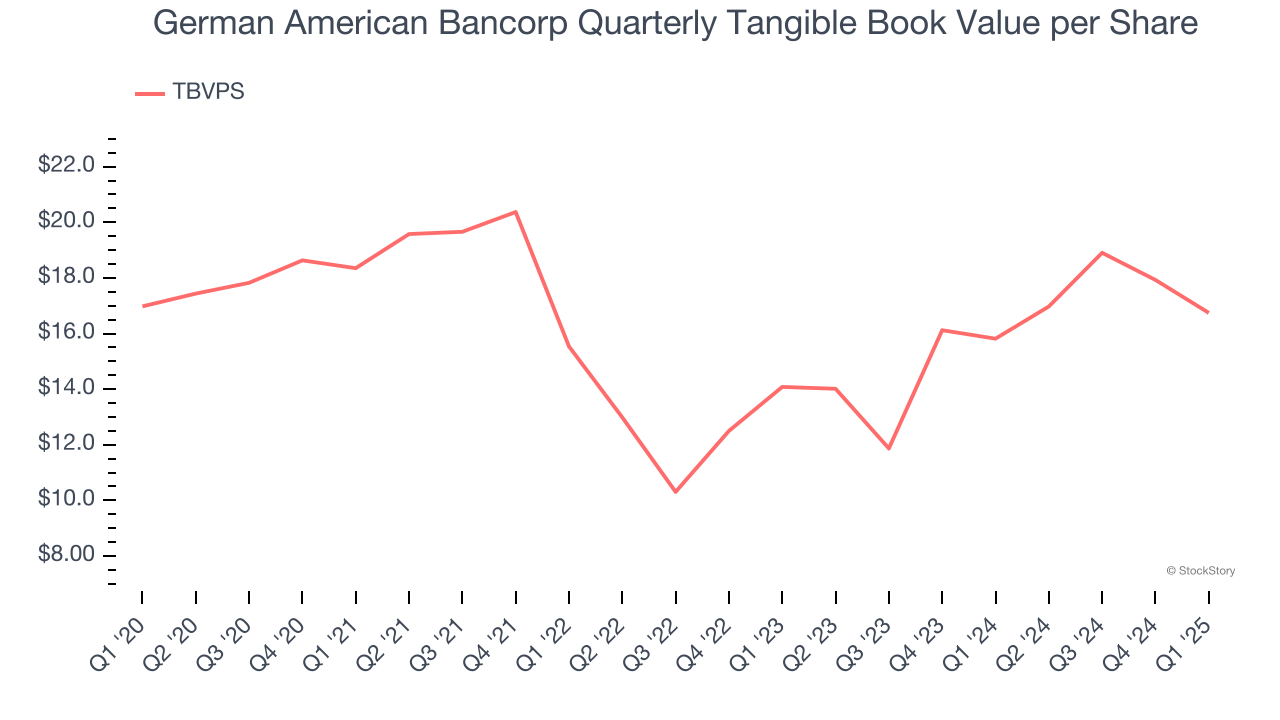

2. Projected TBVPS Growth Is Remarkable

The key to tangible book value per share (TBVPS) growth is a bank’s ability to earn consistent returns on its assets that exceed its funding costs and credit losses.

Over the next 12 months, Consensus estimates call for German American Bancorp’s TBVPS to grow by 14.6% to $19.18, top-notch growth rate.

One Reason to be Careful:

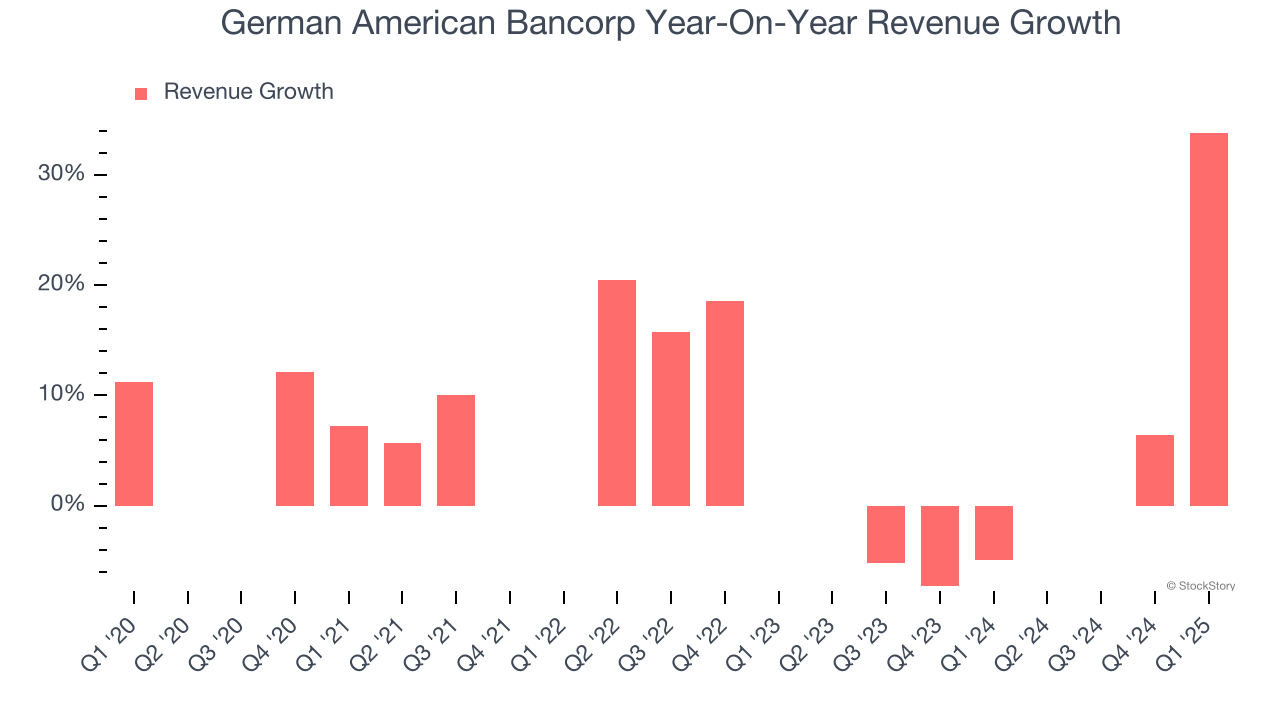

Lackluster Revenue Growth

Long-term growth is the most important, but within financials, a stretched historical view may miss recent interest rate changes and market returns. German American Bancorp’s recent performance shows its demand has slowed as its annualized revenue growth of 2.5% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Final Judgment

German American Bancorp’s positive characteristics outweigh the negatives, but at $40.89 per share (or 1.4× forward P/B), is now the right time to buy the stock? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.