Veeva Systems (NYSE:VEEV): Strongest Q1 Results from the Vertical Software Group

As the Q1 earnings season wraps, let’s dig into this quarter’s best and worst performers in the vertical software industry, including Veeva Systems (NYSE: VEEV) and its peers.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 14 vertical software stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 2.8% while next quarter’s revenue guidance was in line.

Luckily, vertical software stocks have performed well with share prices up 16.8% on average since the latest earnings results.

Best Q1: Veeva Systems (NYSE: VEEV)

Built on top of Salesforce as one of the first vertical-focused cloud platforms, Veeva (NYSE: VEEV) provides data and customer relationship management (CRM) software for organizations in the life sciences industry.

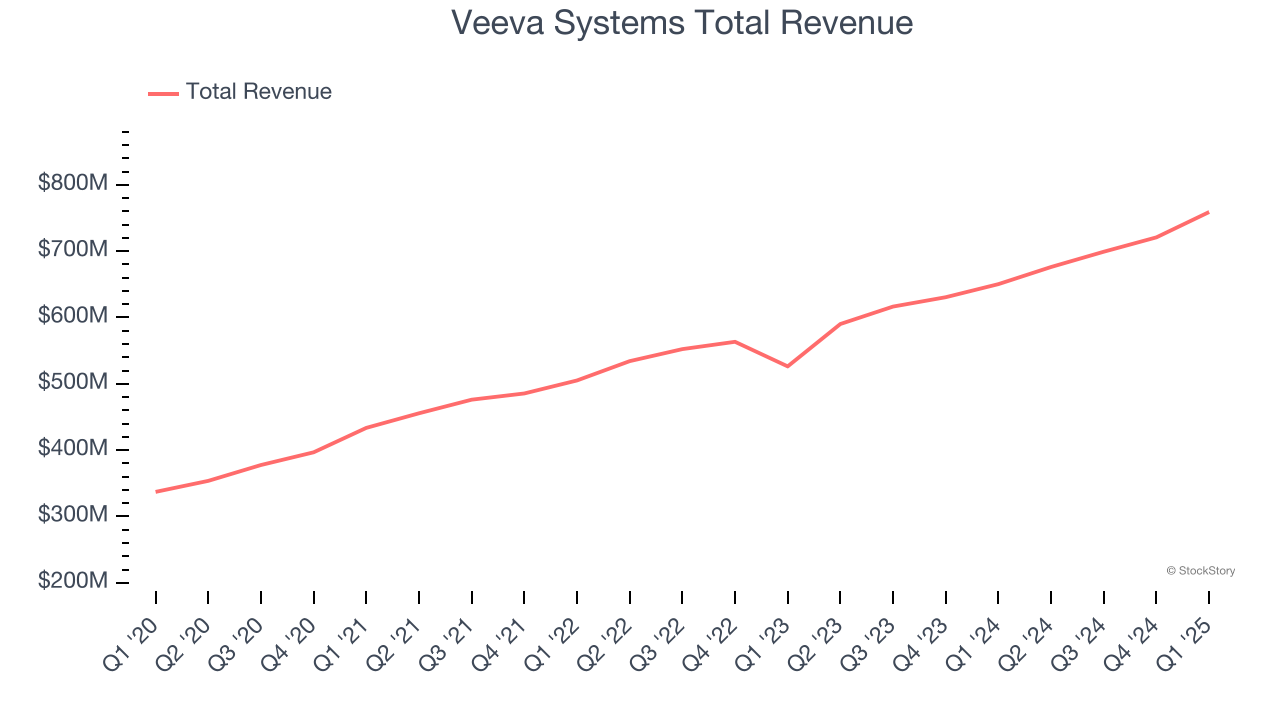

Veeva Systems reported revenues of $759 million, up 16.7% year on year. This print exceeded analysts’ expectations by 4.2%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ billings estimates and EPS guidance for next quarter exceeding analysts’ expectations.

Veeva Systems achieved the highest full-year guidance raise of the whole group. Unsurprisingly, the stock is up 17% since reporting and currently trades at $275.

Is now the time to buy Veeva Systems? Access our full analysis of the earnings results here, it’s free.

Upstart (NASDAQ: UPST)

Founded by the former head of Google's enterprise business, Upstart (NASDAQ: UPST) is an AI-powered lending platform facilitating loans for banks and consumers.

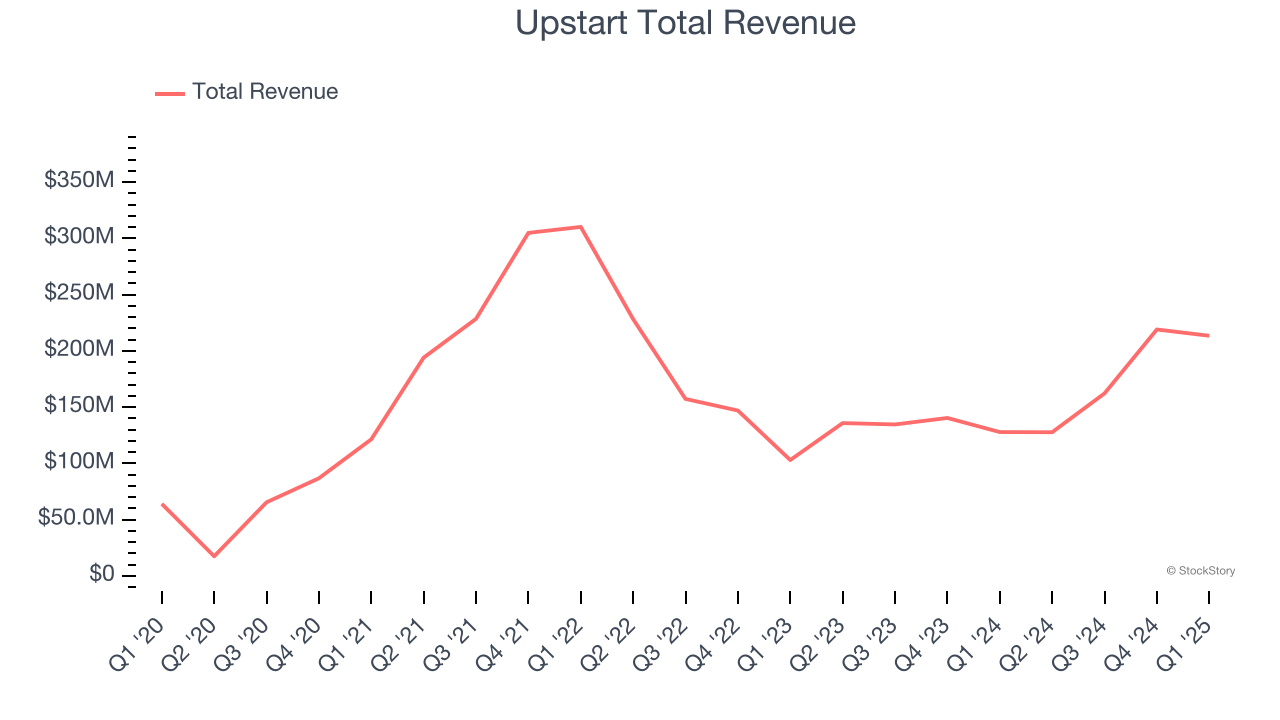

Upstart reported revenues of $213.4 million, up 67% year on year, outperforming analysts’ expectations by 5.2%. The business had a very strong quarter with EBITDA guidance for next quarter exceeding analysts’ expectations.

Upstart delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 45.2% since reporting. It currently trades at $74.65.

Is now the time to buy Upstart? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Doximity (NYSE: DOCS)

Founded in 2010 and named for a combination of “docs” and “proximity”, Doximity (NYSE: DOCS) is the leading social network for U.S. medical professionals.

Doximity reported revenues of $138.3 million, up 17.1% year on year, exceeding analysts’ expectations by 3.5%. Still, it was a weaker quarter as it posted full-year guidance of slowing revenue growth and EBITDA guidance for next quarter missing analysts’ expectations significantly.

Interestingly, the stock is up 2.9% since the results and currently trades at $60.13.

Read our full analysis of Doximity’s results here.

Cadence (NASDAQ: CDNS)

With the name chosen to reflect the idea of a repeating pattern or rhythm in electronic design, Cadence Design Systems (NASDAQ: CDNS) offers a software-as-a-service platform for semiconductor engineering and design.

Cadence reported revenues of $1.24 billion, up 23.1% year on year. This print met analysts’ expectations. Zooming out, it was a satisfactory quarter as it also logged an impressive beat of analysts’ EBITDA estimates but a slight miss of analysts’ billings estimates.

The stock is up 12.2% since reporting and currently trades at $320.60.

Read our full, actionable report on Cadence here, it’s free.

nCino (NASDAQ: NCNO)

Founded in 2011 in North Carolina, nCino (NASDAQ: NCNO) makes cloud-based operating systems for banks and provides that software-as-a-service.

nCino reported revenues of $144.1 million, up 12.5% year on year. This result surpassed analysts’ expectations by 2.7%. It was a strong quarter as it also produced an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ billings estimates.

The stock is up 9.1% since reporting and currently trades at $29.23.

Read our full, actionable report on nCino here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.