3 Reasons PLAY is Risky and 1 Stock to Buy Instead

Over the past six months, Dave & Buster's has been a great trade, beating the S&P 500 by 20.8%. Its stock price has climbed to $30.14, representing a healthy 25.2% increase. This run-up might have investors contemplating their next move.

Is now the time to buy Dave & Buster's, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Dave & Buster's Not Exciting?

Despite the momentum, we're cautious about Dave & Buster's. Here are three reasons why you should be careful with PLAY and a stock we'd rather own.

1. Shrinking Same-Store Sales Indicate Waning Demand

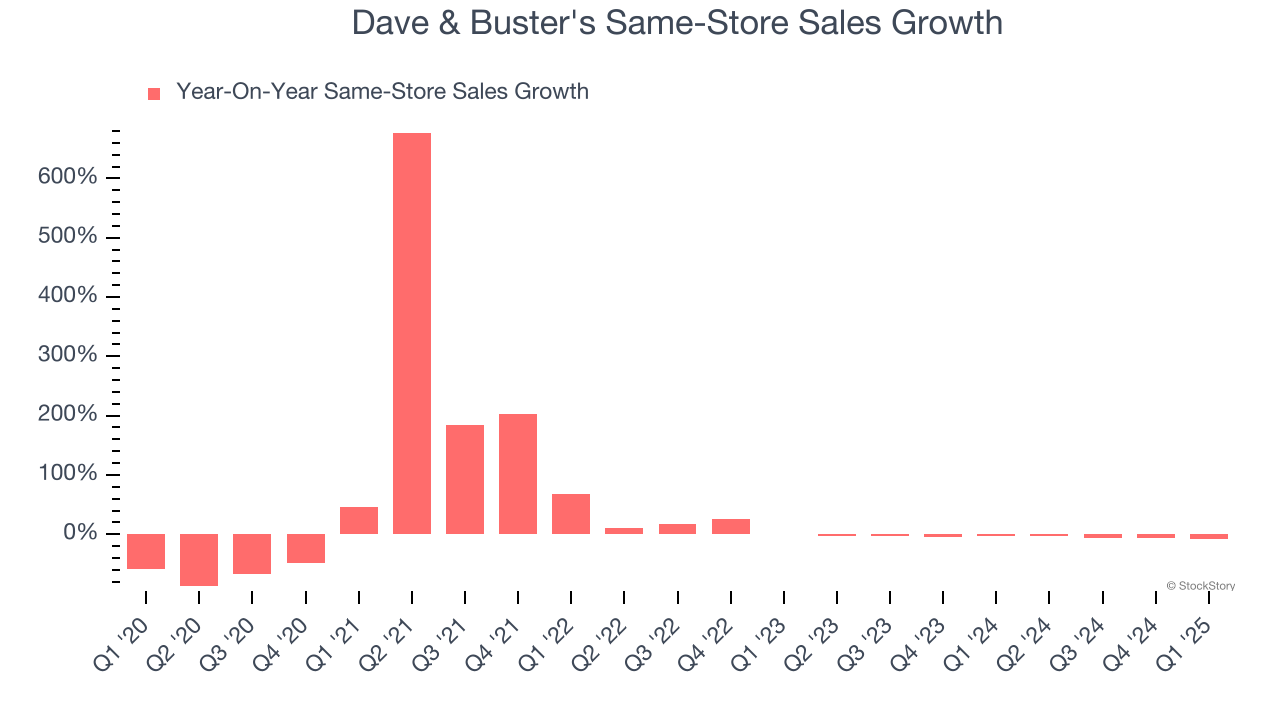

In addition to reported revenue, same-store sales are a useful data point for analyzing Leisure Facilities companies. This metric measures the change in sales at brick-and-mortar locations that have existed for at least a year, giving visibility into Dave & Buster’s underlying demand characteristics.

Over the last two years, Dave & Buster’s same-store sales averaged 4.8% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Dave & Buster's might have to close some locations or change its strategy and pricing, which can disrupt operations.

2. Cash Burn Ignites Concerns

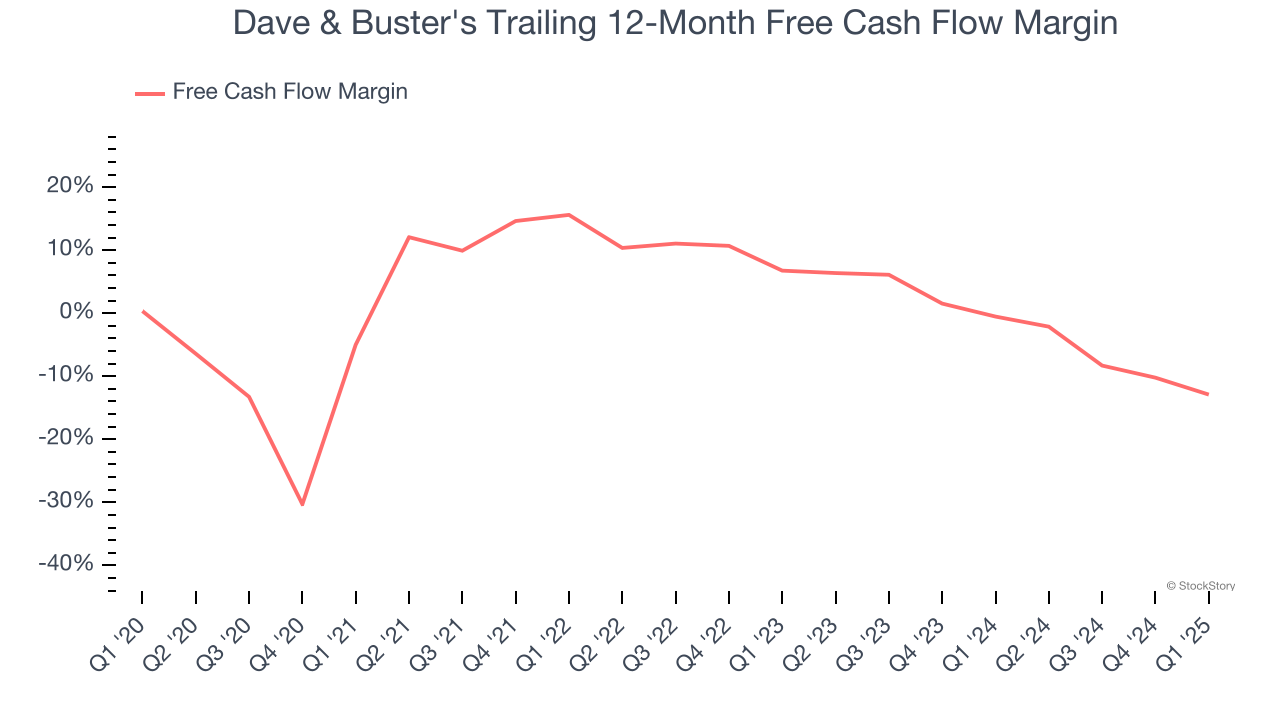

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Over the last two years, Dave & Buster’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 6.6%, meaning it lit $6.59 of cash on fire for every $100 in revenue.

3. Short Cash Runway Exposes Shareholders to Potential Dilution

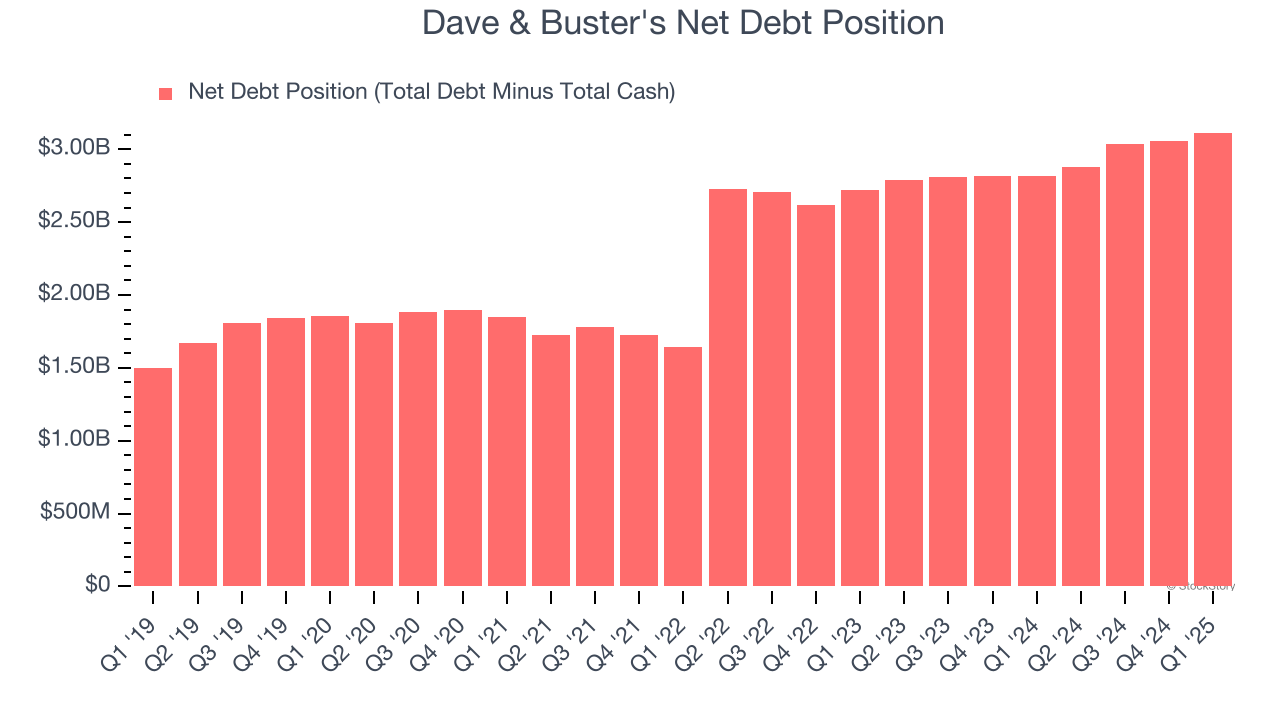

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Dave & Buster's burned through $272.5 million of cash over the last year, and its $3.13 billion of debt exceeds the $11.9 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Dave & Buster’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Dave & Buster's until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

Dave & Buster's isn’t a terrible business, but it doesn’t pass our bar. With its shares topping the market in recent months, the stock trades at 14.1× forward P/E (or $30.14 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are superior stocks to buy right now. Let us point you toward the most entrenched endpoint security platform on the market.

Stocks We Like More Than Dave & Buster's

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.