Domino's (NASDAQ:DPZ) Posts Q2 Sales In Line With Estimates

Fast-food pizza chain Domino’s (NYSE: DPZ) met Wall Street’s revenue expectations in Q2 CY2025, with sales up 4.3% year on year to $1.15 billion. Its GAAP profit of $3.81 per share was 3.6% below analysts’ consensus estimates.

Is now the time to buy Domino's? Find out by accessing our full research report, it’s free.

Domino's (DPZ) Q2 CY2025 Highlights:

- Revenue: $1.15 billion vs analyst estimates of $1.15 billion (4.3% year-on-year growth, in line)

- EPS (GAAP): $3.81 vs analyst expectations of $3.95 (3.6% miss)

- Adjusted EBITDA: $256.4 million vs analyst estimates of $237.5 million (22.4% margin, 7.9% beat)

- Operating Margin: 19.7%, up from 17.9% in the same quarter last year

- Free Cash Flow Margin: 14.6%, up from 11.6% in the same quarter last year

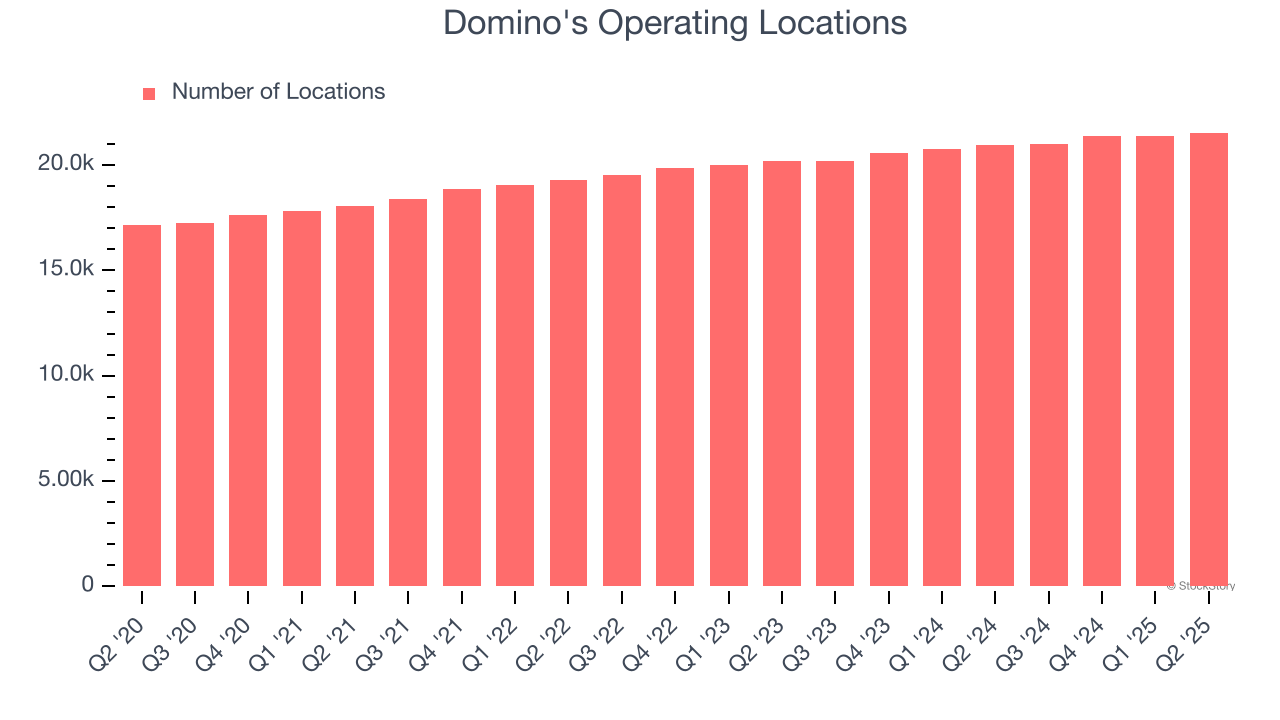

- Locations: 21,536 at quarter end, up from 20,930 in the same quarter last year

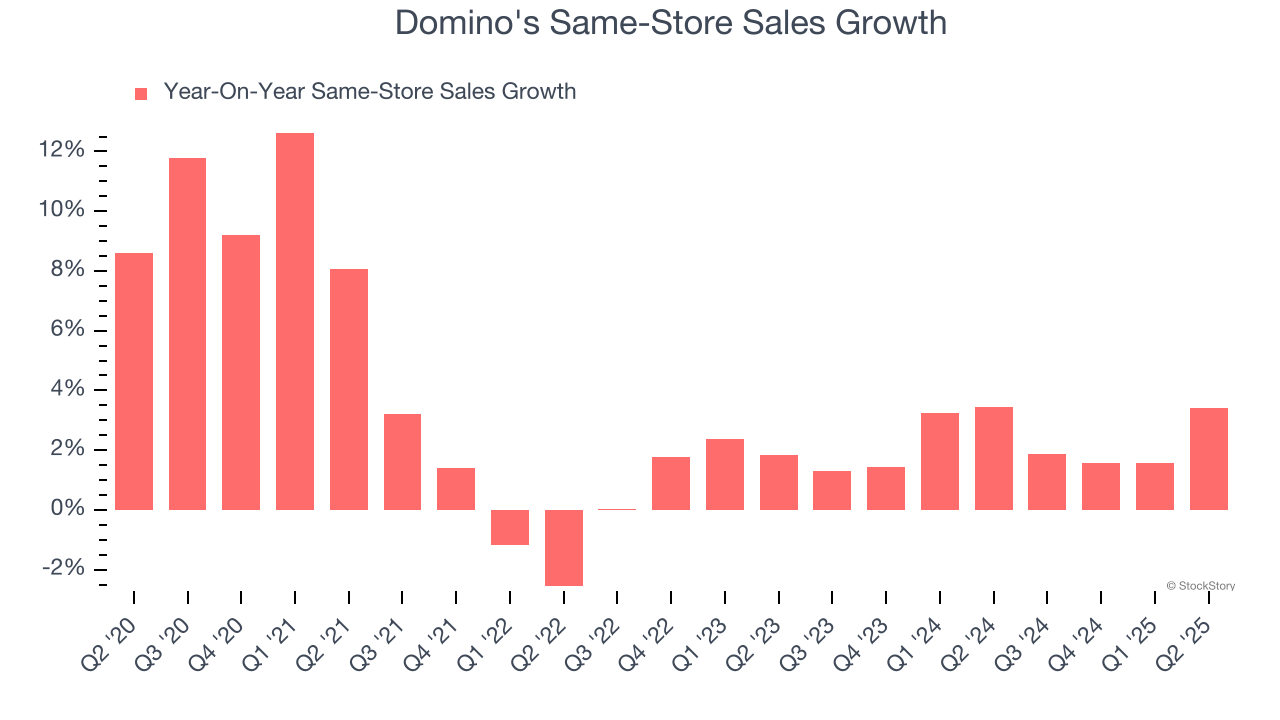

- Same-Store Sales rose 3.4% year on year, in line with the same quarter last year

- Market Capitalization: $15.95 billion

"Our team delivered strong Q2 results," said Russell Weiner, Domino's Chief Executive Officer.

Company Overview

Founded by two brothers in Michigan, Domino’s (NYSE: DPZ) is a globally recognized pizza chain known for its creative marketing and fast delivery.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $4.78 billion in revenue over the past 12 months, Domino's is one of the larger restaurant chains in the industry and benefits from a well-known brand that influences consumer purchasing decisions. However, its scale is a double-edged sword because there are only a finite of number places to build restaurants, making it harder to find incremental growth. For Domino's to boost its sales, it likely needs to adjust its prices, launch new chains, or lean into foreign markets.

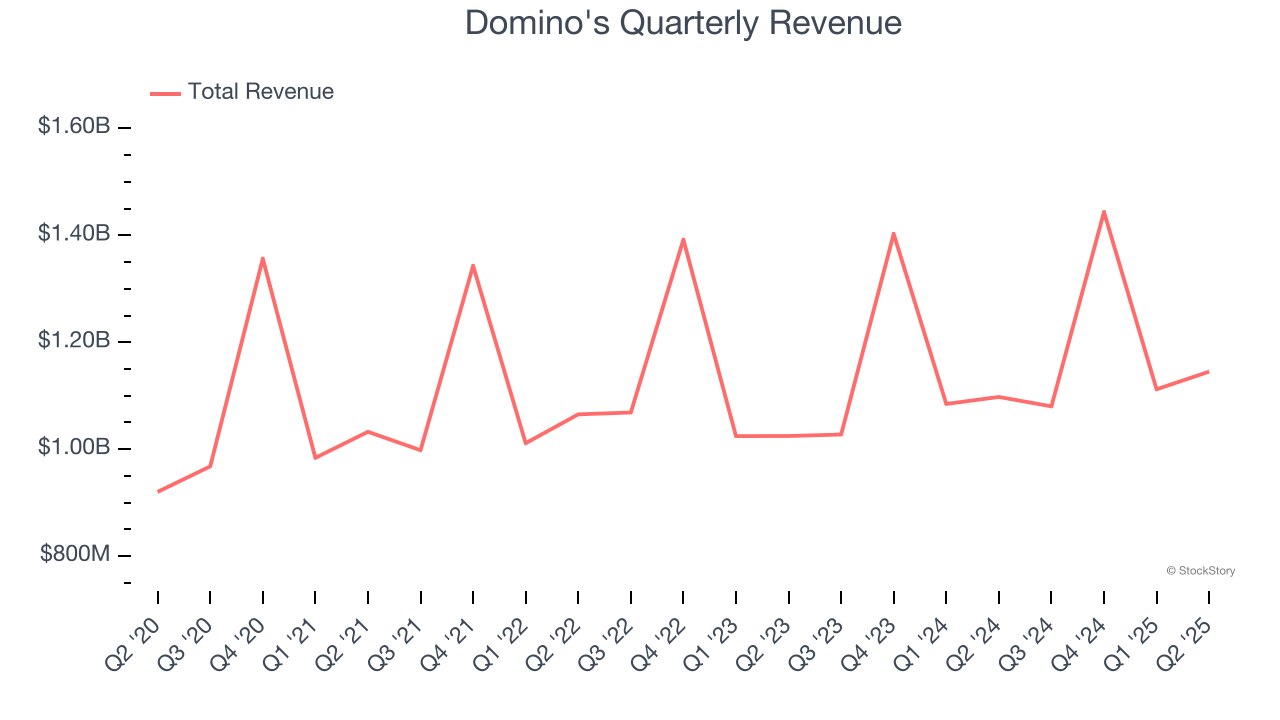

As you can see below, Domino’s sales grew at a tepid 5.3% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts), but to its credit, it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Domino's grew its revenue by 4.3% year on year, and its $1.15 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.4% over the next 12 months, similar to its six-year rate. Although this projection suggests its newer menu offerings will spur better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Restaurant Performance

Number of Restaurants

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Domino's sported 21,536 locations in the latest quarter. Over the last two years, it has opened new restaurants quickly, averaging 3.5% annual growth. This was faster than the broader restaurant sector. Furthermore, one dynamic making expansion more seamless is the company’s franchise model, where franchisees are primarily responsible for opening new restaurants while Domino's provides support.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing restaurants and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Domino’s demand rose over the last two years and slightly outpaced the industry. On average, the company’s same-store sales have grown by 2.2% per year. This performance suggests its rollout of new restaurants could be beneficial for shareholders. When a chain has demand, more locations should help it reach more customers and boost revenue growth.

In the latest quarter, Domino’s same-store sales rose 3.4% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

Key Takeaways from Domino’s Q2 Results

We were impressed by how Domino's exceeded analysts’ same-store sales estimates, leading to operating margin meaningfully higher than in the same quarter last year. On the other hand, its EPS missed. Overall, we think this was still a decent quarter. The stock traded up 2.4% to $478 immediately after reporting.

Domino's may have had a good quarter, but does that mean you should invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.