Q1 Earnings Outperformers: CarGurus (NASDAQ:CARG) And The Rest Of The Online Marketplace Stocks

Wrapping up Q1 earnings, we look at the numbers and key takeaways for the online marketplace stocks, including CarGurus (NASDAQ: CARG) and its peers.

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

The 13 online marketplace stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 2.2% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 7.3% on average since the latest earnings results.

CarGurus (NASDAQ: CARG)

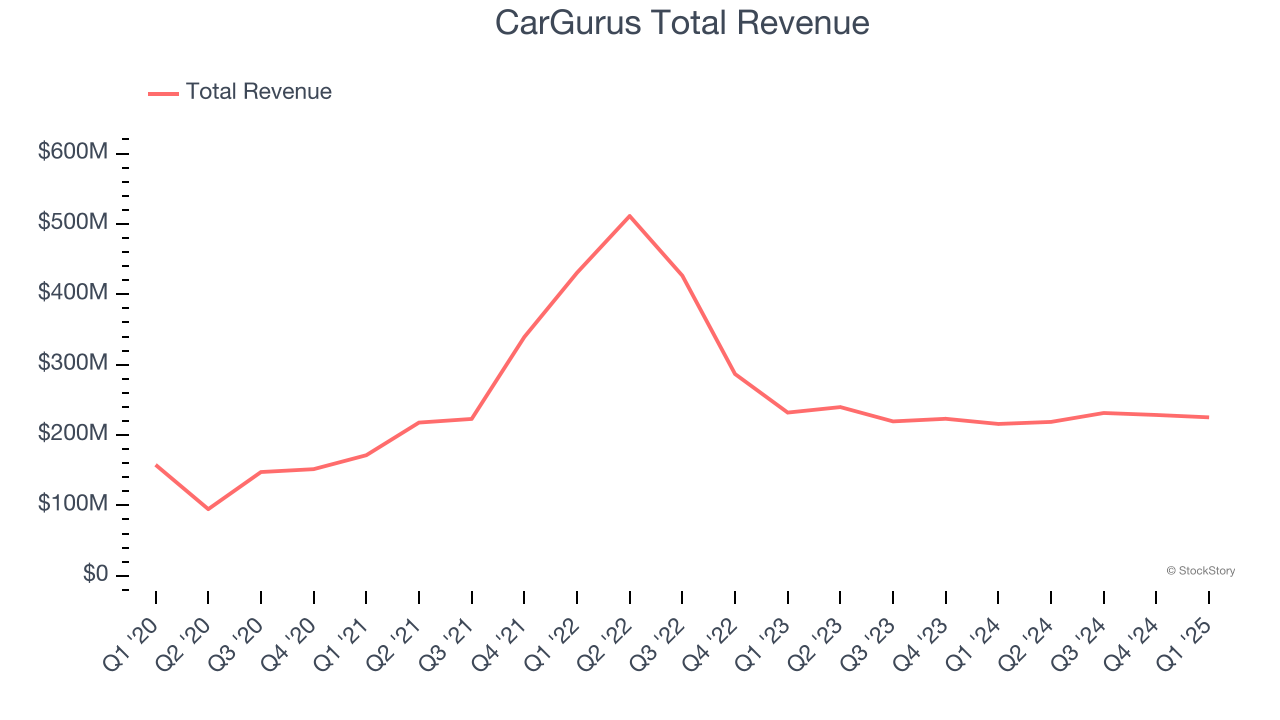

Bringing transparency to a sometimes opaque process, CarGurus (NASDAQ: CARG) is a digital marketplace where auto dealers can connect with potential customers and where car buyers can browse, purchase, and obtain financing.

CarGurus reported revenues of $225.2 million, up 4.3% year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with EBITDA guidance for next quarter exceeding analysts’ expectations.

"Our strong momentum in our Marketplace business continued into 2025, which grew 13% year-over-year,” said Jason Trevisan, Chief Executive Officer at CarGurus.

Interestingly, the stock is up 18.6% since reporting and currently trades at $33.16.

Is now the time to buy CarGurus? Access our full analysis of the earnings results here, it’s free.

Best Q1: eHealth (NASDAQ: EHTH)

Aiming to address a high-stakes and often confusing decision, eHealth (NASDAQ: EHTH) guides consumers through health insurance enrollment and related topics.

eHealth reported revenues of $113.1 million, up 21.7% year on year, outperforming analysts’ expectations by 13.4%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates and full-year EBITDA guidance exceeding analysts’ expectations.

eHealth delivered the biggest analyst estimates beat among its peers. On a dimmer note, the company reported 1.16 million users, down 1.8% year on year. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 21.5% since reporting. It currently trades at $3.67.

Is now the time to buy eHealth? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: The RealReal (NASDAQ: REAL)

Founded by consignment store aficionado Julie Wainwright, The RealReal (NASDAQ: REAL) is an online marketplace for buying and selling secondhand luxury goods.

The RealReal reported revenues of $160 million, up 11.3% year on year, in line with analysts’ expectations. It was a slower quarter as it posted full-year EBITDA guidance missing analysts’ expectations significantly and EBITDA guidance for next quarter missing analysts’ expectations significantly.

The RealReal delivered the weakest full-year guidance update in the group. The company reported 985,000 users, up 157% year on year. As expected, the stock is down 20% since the results and currently trades at $5.84.

Read our full analysis of The RealReal’s results here.

Cars.com (NYSE: CARS)

Originally started as a joint venture between several media companies including The Washington Post and The New York Times, Cars.com (NYSE: CARS) is a digital marketplace that connects new and used car buyers and sellers.

Cars.com reported revenues of $179 million, flat year on year. This print came in 0.6% below analysts' expectations. Aside from that, it was a mixed quarter as it also produced a solid beat of analysts’ EBITDA estimates but disappointing growth in its buyers.

The company reported 19,250 active buyers, down 0.7% year on year. The stock is up 13.7% since reporting and currently trades at $12.87.

Read our full, actionable report on Cars.com here, it’s free.

Sea (NYSE: SE)

Founded in 2009 and a publicly traded company since 2017, Sea (NYSE: SE) started as a gaming platform and has since expanded to offer a variety of services such as e-commerce, digital payments, and financial services across Southeast Asia.

Sea reported revenues of $4.84 billion, up 27.8% year on year. This result missed analysts’ expectations by 1.2%. Taking a step back, it was still a strong quarter as it recorded a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ number of paying users estimates.

The company reported 64.6 million users, up 32.1% year on year. The stock is up 18.3% since reporting and currently trades at $168.76.

Read our full, actionable report on Sea here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.